Back in August 2025, DBS announced that the DBS Vantage Card would be ending its automatic annual fee waiver for customers who spent S$60,000 per year.

This change will come into effect from 1 August 2026, which is fair enough— at least existing cardholders who were accumulating spend for a waiver when the announcement was made can’t complain about a rug pull.

However, two other changes were concurrently announced, which flew under my radar until now. From August 2026, both the DBS Altitude and DBS Woman’s World Card will also scrap their spend-based annual fee waivers.

While I don’t think it’s anything to panic over, it could suggest that the bank might be taking a stricter stance with regards to fee waivers going forward.

DBS Altitude and WWMC remove automatic annual fee waivers

| Card | Annual Fee | Waiver Criteria |

DBS Altitude Card DBS Altitude CardApply |

S$196.20 | Min. spend S$25K* |

DBS Woman’s World Card DBS Woman’s World CardApply |

S$196.20 | Min. spend S$25K |

| *Cardholders whose annual fee is waived will not receive the 5,000 DBS Points awarded for renewals |

||

For context, the DBS Altitude Card (both AMEX and Visa) and DBS Woman’s World Card both offer an automatic annual fee waiver when cardholders spend at least S$25,000 on retail transactions in a membership year.

Annual fee for subsequent years can be waived with a minimum of S$25,000 in retail spend each year to your Card.

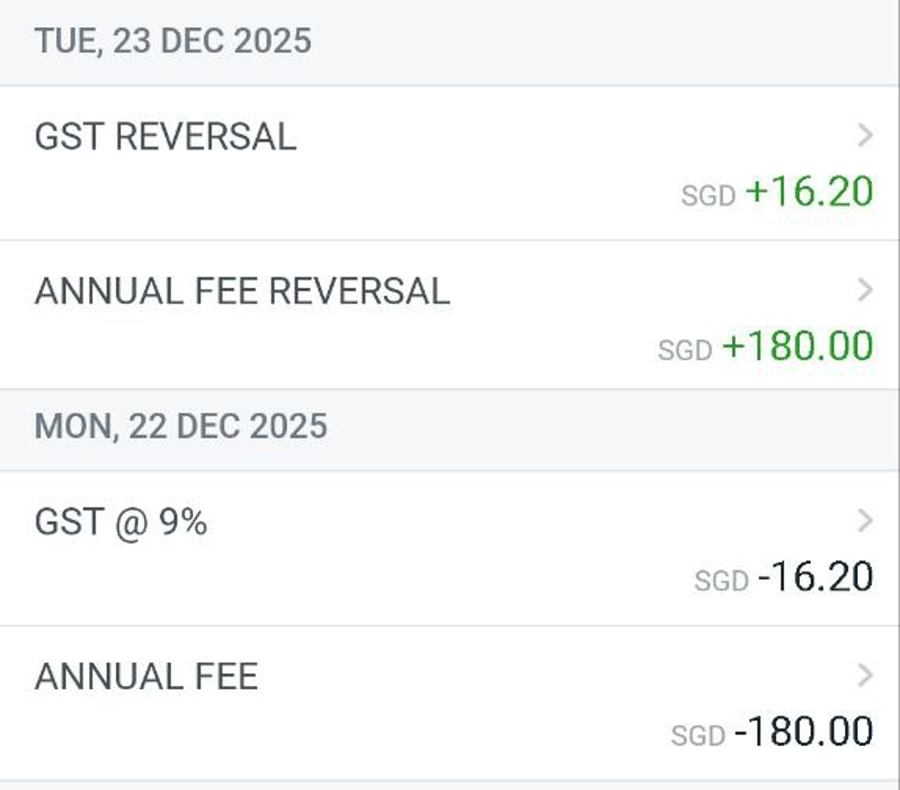

With effect from 1 Aug 2026, the annual fee waiver eligibility upon meeting the retail spend of S$25,000 in the previous card year will be ceased.

-DBS Bank

From 1 August 2026, this automatic fee waiver will no longer be available.

To be clear, cardholders whose membership year ends before this date will still be assessed under the current criteria, so in practical terms, the change only affects those whose membership year commenced from August 2025 onwards.

How serious are they about this?

Now, before you get too worried, it’s worth noting that DBS has never applied this criteria strictly, at least for these two specific cards. After all, expecting cardholders to spend S$25,000 a year on a card with a minimum income requirement of S$30,000 is quite an ask!

For what it’s worth, I’ve never spent anywhere close to the S$25,000 required for an annual fee waiver on either card, yet have always been able to get it waived anyway— sometimes even automatically.

Still, it’s a conscious decision to remove the automatic fee waiver, and that makes me wonder whether the bank will be taking a harder stance towards these going forward.

On the Telegram community, there are mixed reports regarding DBS fee waivers, but the general consensus is that they haven’t quite brought the hammer down— at least not for entry-level cards. Even if an automated fee waiver request via the digibot fails, talking to a human CSO often seems to do the trick (though YMMV, obviously).

Also, at the risk of sounding hopelessly naive, the removal might even be a positive development. An explicit minimum spend requirement could be pointed to as grounds for denying a fee waiver. With its removal, perhaps there’ll be more leeway?

While we’re on the subject of annual fee waivers, it’s also noteworthy that the ultra-premium DBS Insignia Card (min. income S$500K, annual fee S$3,270) will likewise be discontinuing its S$300,000 (!) spend-based waiver from August 2026, which might suggest the new leadership is taking a different approach to things.

Which DBS cards retain automatic annual fee waivers?

At the time of writing, the following DBS cards continue to offer automatic annual fee waivers, contingent upon meeting a minimum spend in the preceding membership year.

- DBS Takashimaya AMEX Card: Min. spend S$25,000

- DBS Mastercard Platinum Card: Min. spend S$25,000

- DBS Woman’s Mastercard (not to be confused with the Woman’s World Mastercard): Min. spend S$15,000

All other DBS cards continue to offer a waiver of the first year’s annual fee, except for the DBS Vantage and DBS Insignia (no waivers), and the DBS Live Fresh Student Card (5-year fee waiver).

Conclusion

From August 2026, the DBS Altitude and Woman’s World Card will join the Insignia and Vantage Cards in no longer offering an automatic spend-based annual fee waiver.

It remains to be seen whether this foreshadows a stricter approach towards fee waivers, though for what it’s worth, the spending requirement never seemed to be strictly enforced in the first place.

Elsewhere, it appears that Standard Chartered and HSBC have also started adopting a stricter approach towards annual fee waivers, even for entry-level cards. Hopefully, this doesn’t point towards a wider trend in the market.

Have you been able to get your DBS card annual fees waived recently?

I have been holding dbs cc since 2018 and last year (nov) was the first time my annual fee waiver got rejected. I cancelled my ww card after that. I still hold on to my dbs altitude (visa). but after utilising the priority pass, i might cancel it before the next annual fee charges.

This will be unpopular but if there are no discretional AF waivers then the case for having/issuing a card becomes clearer for both the cardholder as well as the issuer. I would prefer if cards have either no AF or a non-waiveable AF; nothing in between. The business of requesting waivers is a hassle for both parties. For myself I have some non-AF cards as well as some non-waiveable-AF cards. I have cancelled all the others, except for the Yuu card which is well worth it’s annual fee for my family.

Between :

– the race to the bottom regarding SUB offers which are getting very pricey to attract customers.

– the BNPL schemes which have captured the over-spenders (who used to pay the lucrative 25 to 28% CC interest rate fees)

I guess the average card is barely lucrative anymore over an even shorter tenure, hence waiving AF becomes even more complex industry-wise.

So nothing very special here from DBS.

I am finding UOB getting tough for fee waviers instead. I used to owe 3 Uob cards and fee waviers are getting hard to wavie…

Had to pay the fee for wwmc the previous month. 25k spending makes no sense since the miles bonus aren’t awarded above 1k anyway nowadays.

Just Churn. Cancel the card. Wait 12 months. Then get a sign up bonus as well as 1 year fee free.