| ⚠️ Important Note |

|

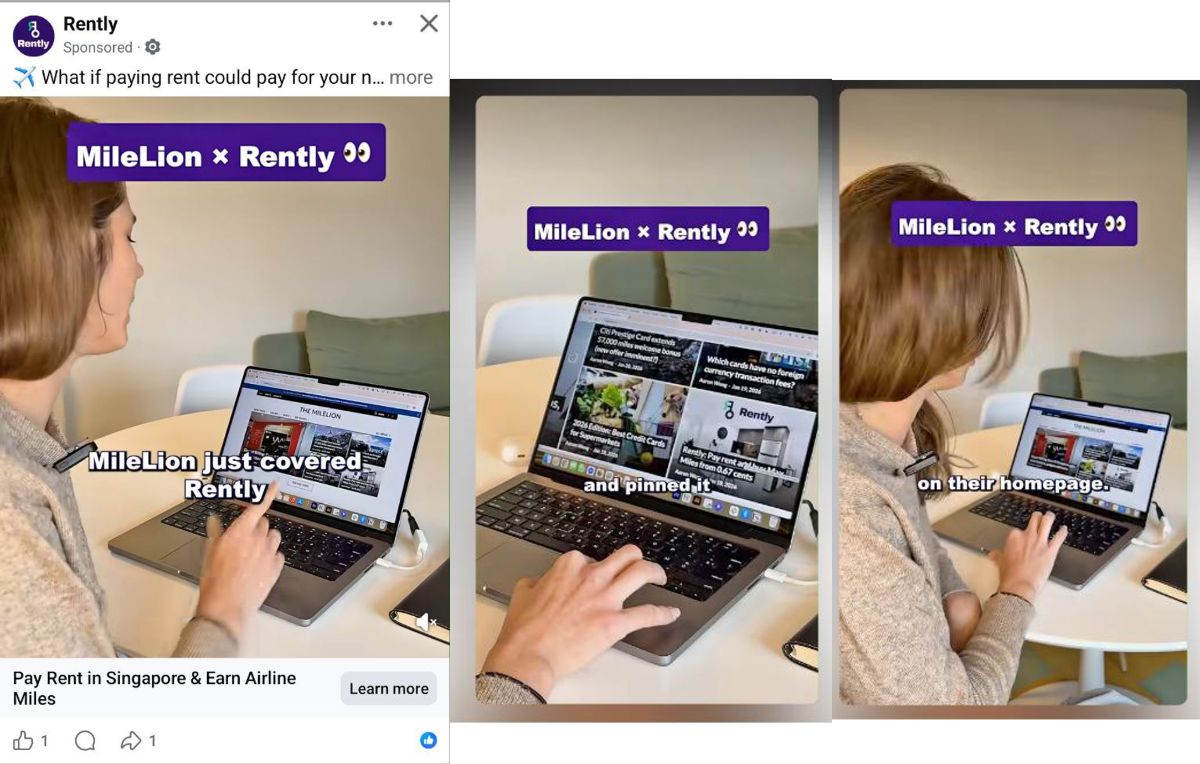

It’s been brought to my attention that Rently has been running ads labelled MileLion x Rently, referencing this article.

Because this may give the impression that we have some sort of partnership, let me be clear: we do not. I have not produced any sponsored posts for Rently (and if I did, they would be clearly labelled, as is my practice). I also do not earn any referrals from them. Rently previously approached me in December to enquire about paid collabovrations, but ultimately did not proceed. And no, despite what the ad says, this article was not “pinned” on the home page. At the time, it was simply the most recent post published. Once the next day’s posts went live, the article moved down the page accordingly. Rently did not approach me for permission before doing any of this, and I am annoyed, to put it mildly. I have asked them to remove the ads immediately (and yes, I know, Streisand effect, but I wanted to make it clear). I am leaving the original article up because I believe it could be genuinely helpful to people trying to learn more, but I also want them to be aware of Rently’s less-than-professional approach to marketing. |

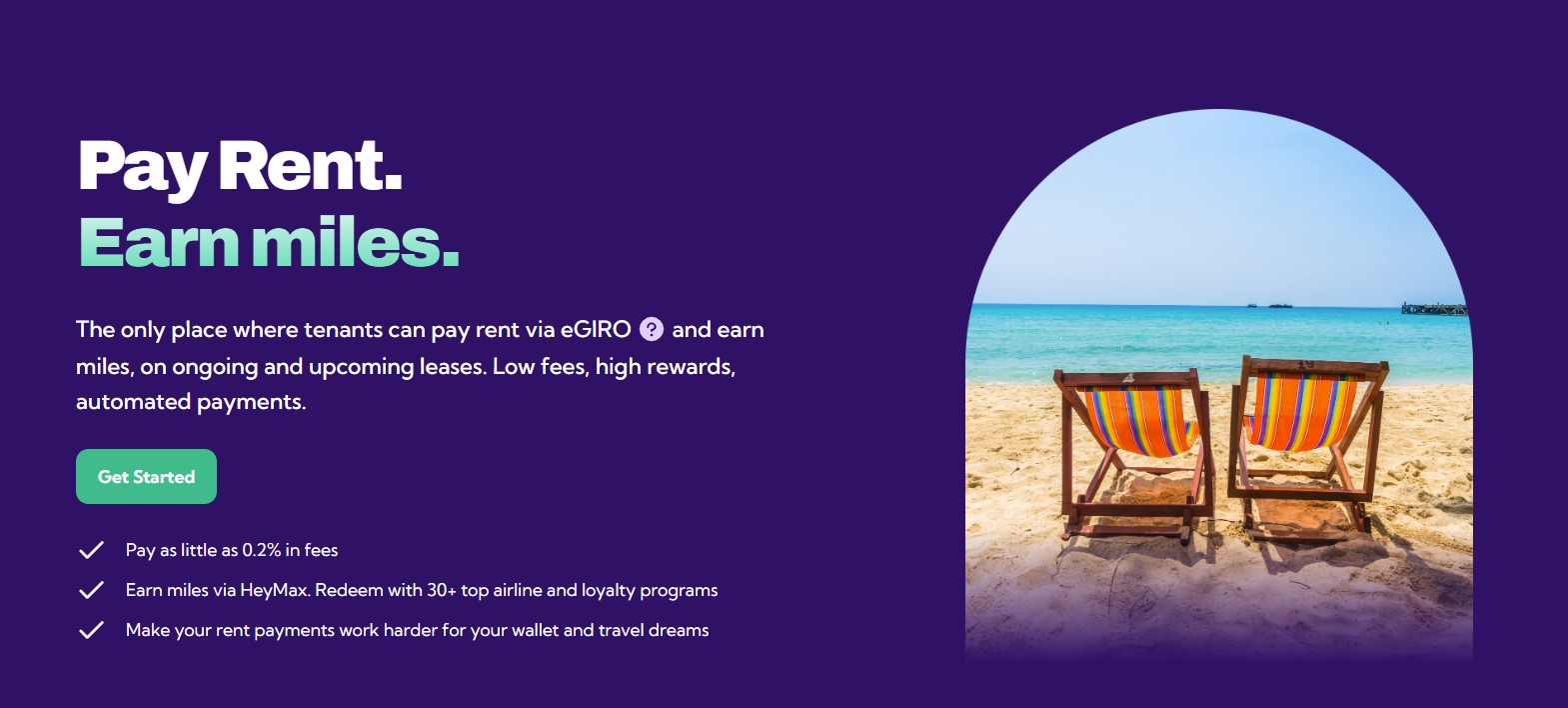

There are numerous ways of earning miles from paying rent in Singapore, with AXS, CardUp, Citi PayAll and SC EasyBill allowing tenants to pay landlords with credit cards, in exchange for a small administrative fee.

Rently is the latest player to join this already-crowded scene, though there’s a bit of a twist here. While you can earn credit card miles through this platform, the better deal is to keep them in your wallet and pay through eGIRO instead.

Why? Because Rently awards users with Max Miles, at a rate as low as 0.67 cents per mile. You can easily get many times that value when redeeming them for HeyMax’s 30+ airline and hotel transfer partners.

I want to caveat upfront that I’ve not used Rently before, so I can’t comment on their processes or customer service. However, the math looks very favourable, and here’s what I understand from their website.

How does Rently work?

|

| Rently |

If you’ve used Citi PayAll, CardUp or SC EasyBill for rental payments before, Rently will feel largely similar.

- Create an account

- Upload your tenancy agreement

- Select a payment method

- Rently pays your landlord via bank transfer on your behalf, and bills you the amount due plus an admin fee

There is no need for your landlord to complete any paperwork, or subscribe to any service.

At the moment, customers are limited to one active lease on Rently at any time, and can only pay residential tenancy agreements. Commercial leases are not accepted.

Rently has four different payment plans. The only difference between plans is the number of Max Miles awarded and, in the case of Tier 4, the ability to pay with credit card.

| Fee | Earn Rate | CPM | |

| Tier 1 eGIRO |

0.2% | 0.3 Max Miles per S$1 | 0.67¢ |

| Tier 2 eGIRO |

1.1% | 1 Max Mile per S$1 | 1.10¢ |

| Tier 3 eGIRO |

2.1% | 1.7 Max Miles per S$1 | 1.24¢ |

| Tier 4* Credit Card |

2.8% | 0.5 Max Miles per S$1 (+ credit card miles) |

Varies |

| *Rently doesn’t mention this plan on its website, but you can find it once you create an account and try to set up a payment |

|||

Customers will earn 0.3-1.7 Max Miles per S$1, credited automatically within seven business days of payment. Rently refers to this pricing structure as “early adopter pricing”, but guarantees it for the duration of your lease.

It’s also worth noting that while Rently does not have a specified minimum amount, it will “prioritise” leases of S$1,500 or more for faster approval. According to its FAQs, applications for “significantly lower” amounts may not be approved.

| ❓ Rently Care |

| Rently also offers a Rently Care service for tenants that removes the need for security deposits, and includes regular air conditioning servicing and insurance for home contents. That is separate from the Rently Pay service discussed here, and requires a monthly subscription. |

What credit card should you use with Rently?

Tiers 1-3 are processed via eGIRO, so there is no further opportunity to stack credit card miles.

However, Tier 4 is paid via credit card, and you can stack the 0.5 Max Mile per S$1 rate with further credit card rewards.

Rently says that payments code as MCC 5817 Digital Goods: Applications (Excludes Games). This is not a whitelisted MCC for any particular credit card, nor is it excluded. Therefore, you should use the highest-earning general spending card you have.

| Card | Earn Rate |

CPM* (2.8% fee) |

StanChart Beyond Card StanChart Beyond Card(PB/PP) Apply |

2 mpd +0.5 MMpd |

1.1¢ |

HSBC Premier Mastercard HSBC Premier MastercardApply |

1.68 mpd +0.5 MMpd |

1.26¢ |

DBS Insignia Card DBS Insignia CardApply |

1.6 mpd +0.5 MMpd |

1.31¢ |

UOB Reserve Card UOB Reserve CardApply |

1.6 mpd +0.5 MMpd |

1.31¢ |

OCBC VOYAGE Card OCBC VOYAGE Card(Premier, PPC, BOS) Apply |

1.6 mpd +0.5 MMpd |

1.31¢ |

Citi ULTIMA Card Citi ULTIMA CardApply |

1.6 mpd +0.5 MMpd |

1.31¢ |

Citi ULTIMA MC Citi ULTIMA MCApply |

1.6 mpd +0.5 MMpd |

1.31¢ |

StanChart Beyond Card StanChart Beyond Card(Regular) Apply |

1.5 mpd +0.5 MMpd |

1.37¢ |

DBS Vantage Card DBS Vantage CardApply |

1.5 mpd +0.5 MMpd |

1.37¢ |

UOB PRVI Miles MC UOB PRVI Miles MCApply |

1.4 mpd +0.5 MMpd |

1.44¢ |

StanChart Visa Infinite Card StanChart Visa Infinite CardApply |

1.4 mpd^ +0.5 MMpd |

1.44¢ |

UOB PRVI Miles Visa Card UOB PRVI Miles Visa CardApply |

1.4 mpd +0.5 MMpd |

1.44¢ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

1.4 mpd +0.5 MMpd |

1.44¢ |

| *CPM takes into account both credit card miles and Max Miles ^With min. spend of S$2,000 per statement month, otherwise 1 mpd |

||

I’ve not shown any cards earning less than 1.4 mpd, but feel free to use them if you think the math works out.

A little note regarding the calculations: Rently will award Max Miles based on the pre-fee amount, while your bank will award miles based on the post-fee amount. For example, if you pay rent of S$1,000 on a Tier 4 plan using a DBS Vantage Card (1.5 mpd), you will receive:

- 500 Max Miles from Rently (0.5 mpd x S$1,000)

- 1,542 miles from DBS (1.5 mpd x S$1,028, ignoring rounding)

Now, I know what you’re thinking: since this is an online transaction, can you earn 4 mpd with the Citi Rewards Card or DBS Woman’s World Card? Honest answer: I don’t know.

I don’t see any reason why it wouldn’t, but again, I’ve not had the opportunity to test it myself. If it does, it’d be a fantastic opportunity to generate miles from as little as 0.61 cents each, though keep in mind the 4 mpd is capped at just S$1,000 per month. Rently does not allow you to split payments across multiple cards, so the remainder of your payment will earn just 0.4 mpd, dragging down the average earn rate significantly.

Is it worth it?

What’s interesting about Rently’s current pricing model is that the lower the fee you pay, the better the cost per mile. For example, Tier 1 customers (0.2% fee) just pay 0.67 cents per mile, while Tier 3 customers (2.1%) pay almost double at 1.24 cents.

So it makes sense to stick to the cheaper plan, though this also means accumulating Max Miles at a relatively slow rate. For example, if you had a S$4,000 monthly rental payment, you’d earn just 1,200 Max Miles each month.

Max Miles don’t expire, and can be transferred to 25 airline and 8 hotel loyalty programmes, mostly at a 1:1 ratio.

| HeyMax Transfer Partners | |

| ✈️ Airlines | |

|

|

| 🏨 Hotels | |

|

|

Whether it’s worth paying the fee depends on what you do with your Max Miles, but if you were to convert them to Accor Live Limitless (ALL) points, you’d get roughly 3 cents per Max Miles (based on the standard redemption rate of 2,000 ALL points = €40). Based on the Tier 1 pricing, you’re paying a 0.2% fee to earn back 0.9 cents in value — I’d certainly consider that.

Alternatively, you can cash out Max Miles via FlyAnywhere. All you need to do is submit a recent air ticket (award or commercial) on any airline to anywhere in the world, and HeyMax will reimburse you for the cash component at 1.8 cents per Max Mile. This is equivalent to paying a 0.2% fee to get 0.54 cents.

What about cashflow?

Another point worth highlighting is that if you use eGIRO with Rently, funds are deducted immediately from your account.

If you were to pay with a credit card, either with Rently or a competing platform like CardUp, you get up to 50-55 days of interest-free credit. That might be something you want to factor into your decision as well.

How does this compare to other alternatives?

CardUp

| CardUp | Rently | |

| Pay via | Credit card | Credit card or eGIRO |

| Admin Fee (Rent) | 1.83% | 0.3 – 2.8% |

| Cost Per Mile | From 1.12¢ | 0.67 – 1.24¢ eGIRO From 1.1¢ Credit Card |

CardUp’s 2026 rent payment promotion offers a 1.83% fee for Visa cards with the code RENT183. Depending on which credit card you use to pay, the cost per mile starts from 1.12 cents.

Citi PayAll

With the current Citi PayAll promotion, cardholders enjoy a 0.5% fee rebate when they spend a minimum of S$6,000 on rental and other payments between now and 28 February 2026.

Depending on which Citi card you use, this reduces the cost per mile to 1.31 to 1.75 cents per mile (I’m assuming you won’t use the Citi Rewards Card, where the cost per mile is a terrible 5.25 cents).

SC EasyBill

If you’re a StanChart Beyond Cardholder with Priority Banking or Priority Private status, you could opt to pay rent via SC EasyBill with a 1.9% fee and earn 2 mpd. This works out to 0.95 cents per mile.

Conclusion

Rently allows residential tenants to earn Max Miles when paying their rent, and while credit cards can be used for payment, eGIRO looks to be the better deal.

Given their pricing structure, my preference would be to stick with Tier 1, buy Max Miles at 0.67 cents each, and cash them out at 3 cents each via Accor.

Any experiences using Rently?

SC EasyBill Caps rent at SG$10,000 per month.

very impressed with the level of detail of this! thanks, great article

regarding the question that is raised in your article “since this is an online transaction, can you earn 4 mpd with the Citi Rewards Card or DBS Woman’s World Card?” Yes the Citi Rewards Card generally provides 10X points (equivalent to 4 miles per dollar or 4 mpd) on eligible online transactions. Merchant Category Code (MCC) 5817 is defined as “Digital Goods — Software Applications (Excludes Games)”. Key Takeaways for MCC 5817 with Citi Rewards: If the transaction with MCC 5817 is made online, it generally qualifies for the 10X points (4 mpd) rate, as it falls under online shopping/digital… Read more »

perhaps the bigger issue is whether anyone has rent that’s just $1k. not in this economy, I imagine! would it be possible to use rently to partially pay for rent, say just $1k, and then pay the balance some other way?

Thanks for this article! I’m quite new to collecting miles, and had a question –

when you say with Max Mile Rewards, for Accor, you get effective 0.9 cents and with Flyanywhere 0.54 cents, how is this calculated?

If (e.g. for Accor) you mentioned the mile I get roughly 3 cents per Max Mile, and the mile per dollar on Tier 1 is 0.67 cents?