One major reason why people are hesitant to use credit cards overseas is the fear of “hidden” fees (they’re all there in the T&Cs — hence the scare quotes — but the average person doesn’t have the time nor inclination to dig through them). Between bank charges, card network fees, FX markups, and the scourge of the Dynamic Currency Conversion (DCC) scam, cash can feel like the simpler and safer option.

But in recent times, numerous cards have been advertising “0% FX fees”, or claiming to offer FX rates “comparable to Google’s”.

How do these cards work, what options are available, and are they better options than miles cards?

What does “zero FX fees” actually mean?

Let’s clear up a common misconception: just because a card offers zero FX fees — also known as foreign currency (FCY) transaction fees — does not mean you’ll enjoy mid-market rates.

When you make an FCY transaction on your card, the amount is first converted into SGD based on the prevailing rates offered by the card network (American Express, Mastercard or Visa).

- Transactions in USD are converted into SGD

- Transactions in currencies other than USD are converted into USD, before being converted into SGD

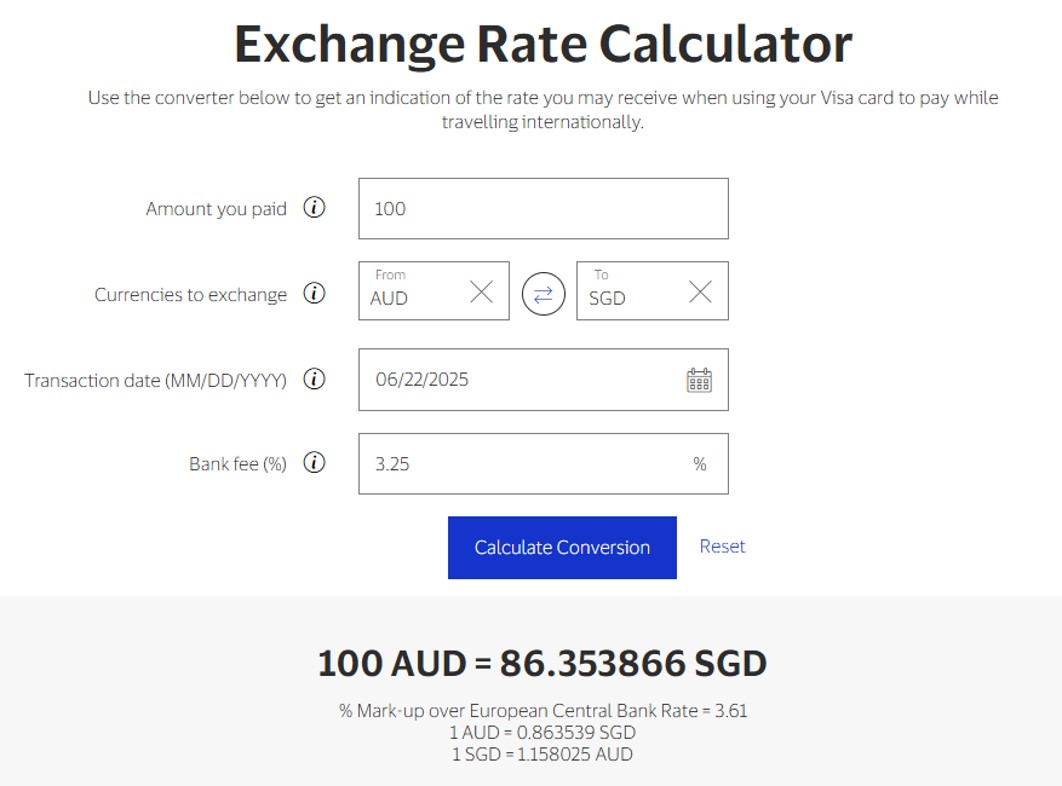

The bank then adds an FCY transaction fee to the converted amount to derive the final figure posted to your card statement. Both Mastercard and Visa offer online tools that let you work this out for yourself.

Therefore, there are two potential fees here:

- The FX spread that the card network charges

- The bank’s FCY transaction fee, which ranges from 2.5-3.5%

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

| ICBC | 2.5% | |

If your card claims to have “zero FX/FCY fees,” it simply means the bank does not impose (2). You will still be subject to (1), though it’s usually rather modest.

In the table below, I’ve compared the rates that Visa uses to mid-market rates (as shown on XE.com) for five major currencies.

| XE.com | Visa | Spread | |

| 1 USD | S$1.289 | S$1.290 | 0.08% |

| 1 GBP | S$1.721 | S$1.731 | 0.58% |

| 1 EUR | S$1.492 | S$1.500 | 0.54% |

| 1 AUD | S$0.860 | S$0.864 | 0.47% |

| 10,000 JPY | S$81.63 | S$81.76 | 0.16% |

| Do note that spreads can differ from day to day |

|||

| ❓ Should we be comparing to mid-market rates? |

|

Mid-market rates are only the right basis for comparison if you could have realistically obtained them in the first place.

|

So even though you’ll certainly be paying less with a zero FCY fee card, it won’t quite match the rate you see on Google.

Do note that multi-currency debit cards like YouTrip or Revolut work slightly differently when you’re paying with a wallet-supported currency— I’ll address this later on.

Credit cards

For credit cards, we need to draw a distinction between:

- cards which do not have FCY fees

- cards which have FCY fees, but rebate them in cashback.

This may seem like splitting hairs, but the distinction is crucial because of rewards exclusions.

To illustrate, suppose you charged a US$1,000 education expense to a card which does not have FCY fees. The amount charged to your card will be the SGD equivalent based on the Visa/Mastercard rate, simple as that.

Then suppose you charged the same US$1,000 education expense to a card which has a 3.25% FCY fee, but also offers 3.25% cashback on FCY spending. The amount charged to your card will be the SGD equivalent based on the Visa/Mastercard rate, plus a 3.25% FCY transaction fee. But if education is an exclusion category for that card (and it almost certainly is), then you won’t be getting the 3.25% cash rebate. It’s as if you paid an FCY fee after all!

In other words:

- the benefit of zero FCY fees applies to any type of transaction

- a rebate on FCY spending may only apply to transactions which aren’t on the exclusion list

Of course, if you’re making a non-excluded transaction, then you’d be indifferent between the two. However, because of this possibility, zero FCY fee cards are the safer choice.

Zero FCY fees

| Card | FCY Earn Rate | Remarks |

Apply |

N/A No fee |

Up to 113 interest-free days |

GXS FlexiCard GXS FlexiCardApply |

Random cashback No fee |

Min. spend S$10 to earn random cashback |

Mari Credit Card Mari Credit CardApply |

1.5% cashback No fee |

No min. spend or cap. |

Trust Cashback Card Trust Cashback CardApply |

1% cashback No fee |

No min. spend or cap. For non-bonus category spend only |

Apply |

0.22% LinkPoints rebate No fee |

No min. spend or cap. |

UOB EVOL Card UOB EVOL CardApply |

3% cashback No fee |

Min. spend S$800, capped at S$40 per s. month. Ends 31 Jan 26 |

CIMB Founders Card

The CIMB Founders Card has no FCY fee, but it also doesn’t offer any rewards for spending.

What it does offer is up to 113 interest-free days on all retail purchases, compared to 50-55 with regular credit cards. If you’re spending on a category that doesn’t earn rewards anyway, or if cash flow is your primary concern rather than rewards, then this would be an option to look at.

GXS FlexiCard

The GXS FlexiCard has no FCY fee, but also offers close to negligible rewards.

You’ll need to spend at least S$10 to earn a randomised instant cashback reward. This can be as much as S$3 in theory, but in practice most people report getting a few cents.

Mari Credit Card

The Mari Credit Card removed its 3% FCY fee on 1 January 2026, and now offers a flat 1.5% cashback on all FCY spending, with no minimum spend.

This is capped at S$22.50 of cashback, or S$1,500 of FCY spending in a month, and is currently set to lapse on 31 December 2026.

Trust Cashback Card

The Trust Cashback Card has no FCY fee, and earns 1% cashback on all FCY spending. No minimum spend is required, and no cap applies.

However — and here’s where it gets very confusing — this only applies to your non-bonus category. For your selected bonus category, you will earn 2.6-4.9% cashback (not the 5-15% they so deceptively advertise!) provided you spend between S$500 to S$2,000 per month for three consecutive months. If you do not meet this minimum spend, you earn nothing, not even the base 1% cashback!

It’s a very convoluted system, but not really the focus of this article. Refer to the post below for a more detailed discussion of the Trust Cashback Card’s misleading marketing claims.

Trust Link Card

The Trust Link Card has no FCY fee, and earns 0.22 LinkPoints per S$1 on FCY spending. No minimum spend is required, and no cap applies.

This is equivalent to a 0.22% cash rebate, though keep in mind that LinkPoints are a “captive cashback” that can only be spent at selected merchants (though one of those is NTUC, so to most people it’s as good as cash).

UOB EVOL Card

The UOB EVOL Card has no FCY fee, and earns up to 3% cashback on FCY spend, and 10% cashback on mobile contactless spend in MYR.

This is a promotional rate that is valid until 31 January 2026.

| Cashback | Cap |

| 3% cashback on FCY spend | S$40 per statement month |

| 7% cashback on MYR spend via mobile contactless | S$20 per statement month |

A minimum spend of S$800 per statement month is required.

Rebate of FCY fees

| Card | FCY Earn Rate | Remarks |

DBS Live Fresh Card DBS Live Fresh CardApply |

3.25%* 3.25% fee |

In-store spend for selected countries. Min. spend S$800 per c. month, capped at S$50 per c. month |

ICBC Global Travel Mastercard ICBC Global Travel MastercardApply |

3% 2.5% fee |

|

StanChart Visa Infinite StanChart Visa InfiniteApply |

3.5% + Up to 3 mpd^ 3.5% fee |

Till 15 Mar 26, capped at S$80. New or targeted existing cardholders only |

StanChart Priority Banking Visa Infinite StanChart Priority Banking Visa InfiniteApply |

3.5% + 1 mpd 3.5% fee |

|

| ^3 mpd with min. spend of S$2,000 per statement month, otherwise 1 mpd *3.25% for general overseas spending. Additional 6% cashback applies for shopping and transport spend in Singapore and overseas |

||

DBS Live Fresh Card

The DBS Live Fresh Card has a 3.25% FCY fee, but offers 3.25% cashback on selected overseas spend as an evergreen feature. This requires a minimum spend of S$800 in a calendar month, and is capped at S$50 per month.

However, I find the mechanics to be extremely finicky. This only applies to in-store FCY spend (i.e. not online transactions), and only in the following countries:

|

|

ICBC Global Travel Mastercard

The ICBC Global Travel Mastercard has a 2.5% FCY fee, but offers 3% cashback on overseas spend.

This nets you an effective reward of 0.5% cashback on overseas spending, subject to the usual rewards exclusions.

StanChart Visa Infinite & Priority Banking Visa Infinite

The StanChart Visa Infinite and Priority Banking Visa Infinite both have a 3.5% FCY fee, but selected cardholders will enjoy 3.5% cashback on overseas spend until 15 March 2026.

This is capped at S$80 for the entire promotion period, equivalent to S$2,286 of spending. Moreover, you must be a newly-approved cardholder, or an existing cardholder who received an invitation to participate.

More details can be found in the post below.

Standard Chartered Visa Infinite offering 3.5% cash rebate on FCY transactions

Debit cards

Zero FCY fees

| Card | FCY Earn Rate | Remarks |

Chocolate Visa Debit Card Chocolate Visa Debit Card |

1 mpd^ No fee |

Cap S$1K per c. month, 0.4 mpd afterwards |

GXS Debit Card GXS Debit Card |

Random cashback No fee |

Min. spend S$10 to earn random cashback |

|

0.22% rebate in LinkPoints No fee |

No min. spend or cap |

Chocolate Visa Debit Card

The Chocolate Visa Debit Card has no FCY fee, and awards 1 Max Mile per S$1 on the first S$1,000 spent per calendar month. Beyond that, the rate drops to 0.4 Max Miles per S$1 on all spend.

GXS Debit Card

The GXS Debit Card has no FCY fee, but like its FlexiCard cousin, offers a silly gacha mechanic that awards randomised cashback on every transaction of at least S$10.

Trust Link Debit Card

The Trust Link Debit Card has no FCY fee, and rewards for general spending are similar to its credit card counterpart.

Multi-currency debit cards

Unlike traditional debit cards, which allow you to hold funds in SGD only, multi-currency debit cards allow users to convert and hold selected currencies in a wallet or bank account.

Some examples can be found in the table below (which is not meant to be exhaustive; there are other players out there too).

| Card | Supported Currencies | Network |

Wise Wise |

49 | Visa and Mastercard |

iChange iChange |

42 | Mastercard |

Revolut Revolut |

39 | Visa and Mastercard |

DBS MCY Debit Card DBS MCY Debit Card |

12 | Visa |

YouTrip YouTrip |

12 | Mastercard |

Amaze* Amaze* |

11 | Mastercard |

OCBC Debit Card OCBC Debit Card(linked to Global Savings Account) |

11 | Visa and Mastercard |

UOB FX+ Debit Card UOB FX+ Debit Card |

10 | Mastercard |

| *Amaze can be funded by either a credit/debit card or a wallet balance. In this context, we are referring to wallet-funded Amaze transactions |

||

When you spend on your multi-currency debit card in a supported currency, funds are first debited from that particular currency wallet. If there are insufficient funds, then conversions will be made from your SGD wallet at the prevailing rates offered by the card issuer (e.g. Revolut, YouTrip).

But when you spend in an unsupported currency, it works similar to a traditional debit card. The amount will be converted into SGD based on the prevailing rates offered by the card network (e.g. Visa, Mastercard), and debited from the SGD wallet accordingly.

The main advantage of multi-currency debit cards is that unlike credit or debit cards, they allow you to lock in today’s rates for tomorrow’s spending. This is not possible with credit or debit cards, which use the prevailing Visa or Mastercard rate on the day the transaction is made.

For example, if you feel that today’s JPY/SGD rate is good, you can buy JPY for your trip in six months. Assuming your instincts are correct and the JPY does indeed appreciate against the SGD, you win because you bought it for less (keep in mind there’s still opportunity cost, since your balance earns no interest). Of course, that can also work in reverse. If the JPY ends up depreciating against the SGD, you lose because you paid more for JPY than you had to.

Multi-currency debit cards also offer very competitive rates for supported currencies. During weekdays, they can be virtually on par with mid-market rates. However, during weekends, holidays, and times of high currency volatility, there may be a spread of ~1% or more.

Historically speaking, multi-currency debit cards were at a disadvantage because the MAS-imposed transaction limits restricted customers to keeping S$5,000 in a wallet at any time, and spending S$30,000 per year. These restrictions meant that customers wanting to make big ticket purchases would have to use a credit card instead.

But at the start of 2024, YouTrip became the first e-wallet to increase its stock limit (the amount that can be kept in the wallet) to S$20,000, and the flow limit (the amount that can be spent per 12-month period) to S$100,000. Revolut followed suit in the middle of 2024, and Amaze in 2025 (there have never been any spending or holding limits for multi-currency debit cards offered by banks).

| Wallet Cap | Annual Trxn Cap | |

| Amaze | S$15K | S$75K |

| Revolut | S$20K | S$100K |

| YouTrip | S$20K | S$100K |

| Wise | S$20K | S$100K |

Basically, unless you’re spending really big, these limits should not bother you.

Drawback of debit cards

Fraud risk

If you plan to use a debit card (whether traditional or multi-currency), one important thing to understand is how fraudulent transactions are handled.

Any transactions charged to your debit card, whether fraudulent or legitimate, are immediately deducted from your account.

While there are procedures to dispute fraudulent transactions and (hopefully) recover your funds, you will be out of pocket for the period of the investigation. Some time back, there was a feature in CNA covering the horror story of a customer who found her YouTrip wallet drained by 31 unauthorised transactions in quick succession, and had to wait months to recover her funds.

In contrast, if your credit card gets hit by a fraudulent transaction, there is no immediate deduction of funds. You can spot the fraudulent transaction on your statement and open a dispute with the bank, and in the majority of cases you should receive a temporary credit to offset the disputed amount while investigations are carried out.

Therefore, if you plan to use a debit card, I’d highly advise you to lock it whenever it’s not in use.

Authorisation holds

Debit cards also do not support so-called “authorisation holds”, required when you rent a car or check in to a hotel. Instead, the hold amount is deducted from your available funds, leaving you with less money on hand.

For instance, if you have a US$1,000 balance on your YouTrip card and use it to guarantee a rental car, and the rental company has a US$400 hold, you only have US$600 left to spend. If you had used a credit card, a certain amount of your credit limit may be earmarked, but there’s no actual deduction of funds.

What’s the trade-off?

You may have noticed that all the cards with zero FCY transaction fees have mediocre rewards at best (the Chocolate Visa Debit Card is a notable exception at 1 mpd).

That’s not a coincidence. If the issuer isn’t making money from FCY fees, how are they going to have the margin to offer miles or cashback? In that sense, the reward is the savings.

If you’re looking for cards with better earn rates for overseas spending, you’ll need to accept that FCY transaction fees are part of the deal. It’s conceptually similar to buying miles, and everyone’s willingness to pay will vary (1.5-2 cents per KrisFlyer mile is a common benchmark).

Assuming a 3.25% FCY fee and an earn rate of 4 mpd, the cost per mile is 0.81 cents (ignoring the card network spread). I reckon that would be acceptable to most people, and you can read about the miles-earning options in the article below.

Conclusion

If your main concern is minimising the cost of your overseas transactions, then zero FCY fee cards offer a convenient and more secure alternative to cash.

But not all zero FCY cards work the same. Multi-currency debit cards will generally be cheaper than traditional debit or credit cards for transactions in supported currencies, though that assumes you don’t completely misread the market and lock in unfavourable rates!

The downside to zero FCY options is that the rewards will be mediocre at best— you can’t have your cake and eat it.

I personally feel that it’s acceptable to pay a 3.25% FCY fee if you can earn in the 3-4 mpd range, though everyone will have to come to their own conclusion based on their personal valuation of a mile.

Thanks, Aaron, for the helpful article. There seems to be a typo, as the XE.com and Visa GBPSGD rates are the same:

XE.com Visa Spread

1 GBP S$1.732 S$1.732 0.34%

thanks, that has been fixed

I am actually fine with the Trust Cashback card and Linkpoint cards. It is a challenge especially with Airlines constantly devaluing their programs. I understand the convoluted way Trust Cashback card works. Saving of 3.25 percent forex fee plus 1 per cent cash back. With many 4 MPD Credit cards are limited to just 1K per month or 2.4 MPD for UOB KF CC that has to wait almost a year to get the bonus miles, really for me not many choices. Comes the expected devaluation of the KF Miles that could drop to just maybe 1.5 cents per mile, the gap between cashback card and mileage card only gets smaller. At 2.4 miles per dollar, we get only about 3.6 cents value back per dollar expenditure and having to cough 3.25 percent in forex fees. So in this case Trust card trumps UOB KF CC for overseas expenditure. At least for earning miles, my stable of Credit cards do not perform so well for overseas expenses. I used my 4 MPD limited Credit card for SGD expenses.

For rebate of FCY fee, there’s also ICBC Global Travel Mastercard and ICBC Zodiac UnionPay Card (both 2.5% FX fee, 3% rebate, for a net 0.5% rebate, no min spend and uncapped)

>That’s not a coincidence. If the issuer isn’t making money from FCY fees, how are they going to have the margin to offer miles or cashback?

Banks still make on interchange and a pct of people carrying balances like any local transaction. If they can offer xx mpd for local, why not for fcy?

those hold amount aka deposits, with car rental and hotels, use credit cards. they normally dont cause you to have FX charges anyway. so for hotel payments, i will pay the hotel charges with my good fx card like trust or youtrip, and the deposit with another credit card (its ok, using 2 cards wont harm ego if you do not think about it that way.. lol)

If miles is not the goal, this year UOB beats Youtrip rates each time I check and they take in orders.

Revolut takes orders as well but higher market.

Of course other things to consider apart from just the rate itself.

As an aside – I found UOB does not charge FCY fees in Brunei (i.e., for BND transactions). Amaze, DBS, and Citi do.