Bill payments made through AXS won’t earn you any credit or debit card rewards (with the brief exception of Chocolate for a few glorious weeks in 2025), and there’s no reason to expect that to change anytime soon.

However, that doesn’t mean you have to walk away empty-handed. Over the past few years, AXS has run various promotions and campaigns offering cash or KrisFlyer miles as incentives, and now it’s taking things a step further with the launch of its own loyalty programme called AXS Rewards.

How does AXS Rewards work?

|

| Use the referral code SQRZUZ5R and earn 50 bonus coins on your first bill payment |

AXS Rewards allows users to earn AXS coins when paying bills at over 800 billing organisations, including income tax, town councils, hospitals, membership fees, utilities, MCST fees, school fees, credit card bills, season parking and more.

To earn AXS coins, you must make payment through the AXS m-Station mobile app. You won’t earn any rewards if you pay through a desktop browser.

Earning AXS coins

AXS coins will be awarded at the following rates:

| Action | Reward |

| Pay one bill (non-recurring) | 10 coins |

| Pay one bill (recurring) | 15 coins |

| Every three bills paid | 30 coins |

For example, if I pay a total of 3x non-recurring bills, I will earn 60 coins (3 x 10 + 30).

Bill payments must be at least S$5 to earn AXS Coins, which also happens to be the minimum payment amount for most AXS transactions (some categories like utilities require at least S$10).

Now, I know what you’re thinking: why not split my bills into smaller denominations to earn more coins? Well, I really doubt it’s worth the effort, given how minor the rebate is (see below), but even if you were so inclined, it seems like AXS has built some anti-gaming guardrails.

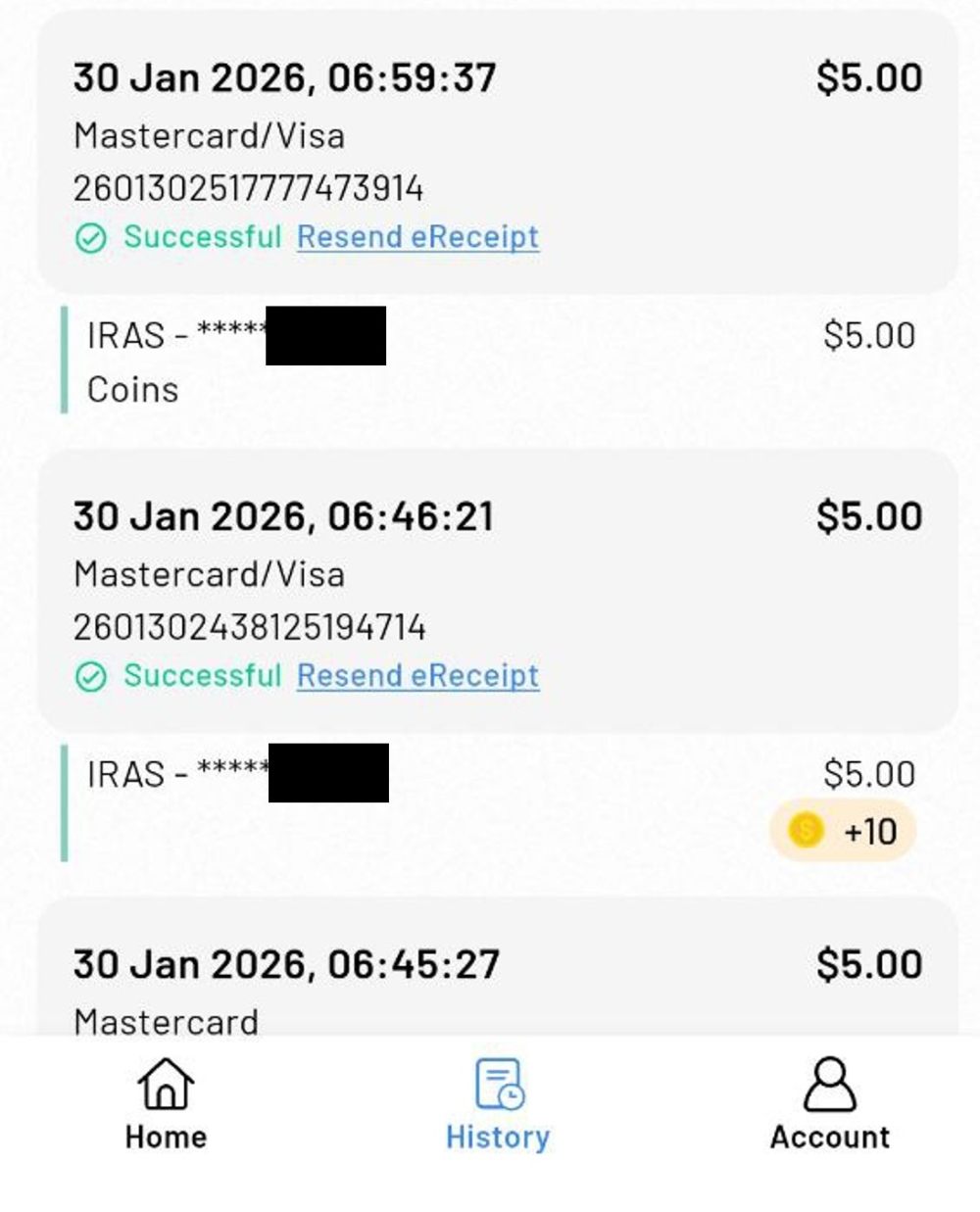

I made two identical transactions of S$5 each to IRAS for personal income tax; the first one earned coins, the second did not (I later tried a S$6 payment to IRAS for personal income tax, and it didn’t earn coins either).

That said, it also appears that AXS does make a distinction between bill sub-types to the same organisation. I made another transaction of S$5 to IRAS for corporate income tax, and earned coins on that payment.

AXS has clarified that AXS coins will only be earned on one unique bill payment per organisation per month. However, you can earn coins on multiple bills to the same organisation, under different accounts.

For example, I can make a payment to IRAS for my own personal income tax and earn coins, and then another payment to IRAS for my wife’s income tax and also earn coins (because it’s a different account).

Likewise, I can make a payment to Singtel for my broadband account and earn coins, and then another payment to Singtel for a family member’s mobile phone bill and also earn coins (again, different account).

Redeeming AXS coins

AXS coins can be redeemed for AXS vouchers at the following rates and denominations.

| Reward | Coins | Value Per Coin |

| S$2 AXS voucher | 400 | 0.5¢ |

| S$5 AXS voucher | 1,000 | |

| S$10 AXS voucher | 2,000 |

Based on the smallest possible bill payment of S$5, this works out to a maximum rebate of 1% (non-recurring) or 1.5% (recurring). It’s not spectacularly rewarding, but what do you expect? The margins are thin as it is.

Any AXS vouchers earned must be redeemed by 31 July 2026. The final transaction amount, net of vouchers, must be at least S$1 to complete payment (e.g. if you had a S$10.50 bill and a S$10 AXS voucher, you wouldn’t be able to complete the transaction).

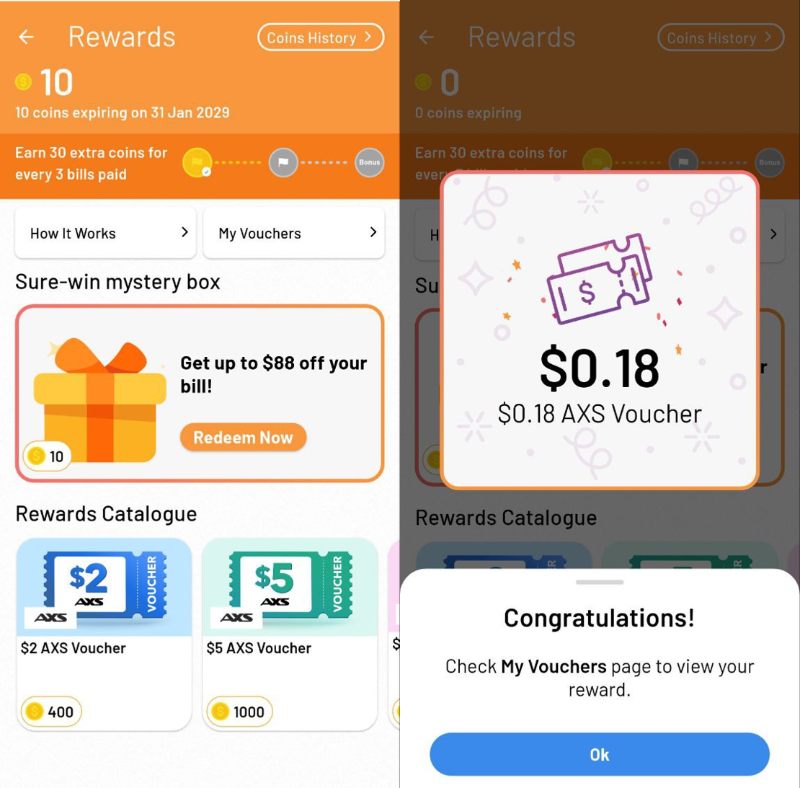

As an alternative to vouchers, customers can also redeem a mystery box for 10 coins, with the following possible outcomes.

| Reward | Probability |

|

>95% |

|

<5% |

For what it’s worth, I redeemed a total of seven mystery boxes, and got a S$0.18 AXS voucher each time. This means that mystery boxes are actually the superior reward, because you get, at the very least, 1.8 cents per coin. Based on the smallest possible bill payment of S$5, this works out to a maximum rebate of 3.6%.

AXS is positioning the 10 coins price as a limited-time discount, and says that mystery boxes will return to their “usual redemption price” from 1 March 2026, whatever that is. AXS mystery boxes will be offered until 30 April 2026.

More rewards will be coming soon, including the ability to offset your bill instantly with coins (instead of having to redeem fixed denomination vouchers).

The T&Cs for the AXS Rewards Mystery Box challenge can be found here.

Why pay bills via AXS?

To reiterate: you won’t earn any credit card rewards for paying bills via AXS, because AXS transactions fall under the rewards exclusion list for most card issuers in Singapore.

| 💳 Exception: Maybank F&F Card |

| If you want to be technical, the Maybank Family & Friends Card earns 0.3% cashback on all payments made via the AXS kiosk and AXS mobile app, capped at S$50 per transaction. |

However, most of the bills that AXS processes either can’t be paid with credit cards directly, or aren’t eligible to earn credit card rewards. If you wanted to get around these restrictions, you’d typically need to pay an admin fee through a platform like CardUp, Citi PayAll or SC EasyBill.

So what’s the appeal here? Cashflow.

Paying your AXS bills allows you to take advantage of the interest-free period on your credit card, delaying the outflow of funds from your account.

Suppose you have an insurance premium to pay, and your options are:

- Option 1: Pay the bill on AXS via eNETS or PayNow QR

- Option 2: Pay the bill on AXS via credit card

If you pick option 1, funds are deducted immediately from your account and used to pay the insurance premium.

If you pick option 2, your credit card is charged and the insurance premium is paid immediately. But your credit card bill isn’t due straight away.

For example, suppose your statement date falls on the 10th of each month, and you have a bill that’s due on 12 January 2025. You can make the payment via AXS with your credit card on 11 January 2025, which will become part of the statement balance that arrives on 10 February 2025.

Assuming your bank gives you 25 days to pay, cash only leaves your account on 7 March 2025. You have effectively enjoyed an interest-free period of 55 days!

So the general idea here is to make your payments at the very start of your credit card statement period, giving you additional time to pay at no additional cost (remember, you can call up the bank and ask them to switch your statement cycle to better suit the timing of your regular bills).

Of course, the timelines may not always line up so neatly, because you can’t dictate when certain bills need to be paid. But the general idea of stretching your cashflow by using the credit card’s interest-free period still holds.

Another convenience that AXS offers is the ability to set up recurring bill payments, backed by a credit card. This is conceptually similar to setting up a GIRO billing arrangement, only with the added benefit of instant processing, and the option to pause or skip a given month’s payment without having to cancel the entire arrangement.

Conclusion

|

| Use the referral code SQRZUZ5R and earn 50 bonus coins on your first bill payment |

The new AXS Rewards programme allows customers to earn AXS coins when making bill payments to more than 800 organisations. And even though you won’t earn any rewards from your credit card, you can still enjoy the benefit of extended cashflow (as compared to a bank transfer or GIRO deduction).

For the moment, I’d recommend going for the mystery boxes, since the minimum reward of a S$0.18 AXS voucher is superior to the regular voucher redemption route.

[…] H/T: Milelion […]