While banks generally prefer to reward discretionary expenditure like dining out and overseas holidays, grocery shopping is one area where they make an exception. This essential category is eligible to earn up to 4 mpd with the right credit cards, whether you shop for groceries in-store or from the comfort of home.

In this post, we’ll cover the best cards to use for supermarkets.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 💰 CardUp |

| 🚗 Car Rental | 💗 Charity |

🍽️ Dining |

| 🏫 Education | ⚡ EV Charging | 🥡 Food Delivery |

| 🏨 Hotels | ☂️ Insurance | 📱 Kris+ |

| ⚕️ Medical | 🏖️ Overseas | 💊 Pharmacies |

| ⛽ Petrol | 🚍 Public Transport | 🛒 Supermarkets |

| 🚰 Utilities | 💒 Weddings | |

How do supermarkets code?

All major supermarkets in Singapore will code as MCC 5411: Grocery Stores, Supermarkets, including:

- Cold Storage

- Don Don Donki

- Giant

- Hao Mart

- Jasons Deli

- Little Farms

- Market Place

- Meidi-Ya

- NTUC FairPrice (and subsidiary brands like FairPrice Finest, FairPrice Xtra)

- Prime Supermarket

- Ryan’s Grocery

- Sheng Siong

If in doubt, you can easily look up the MCC before making a purchase with the following tools:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Buying groceries online

If you do your grocery shopping online, then use the following cards to earn the most miles.

| 🛒 Best Cards for Groceries (Online) |

||

| Card | Earn Rate | Remarks |

DBS yuu Card DBS yuu CardApply |

10 mpd | Giant* and Cold Storage only. Min. spend and cap of S$600 per c. month Review |

Citi Rewards Citi RewardsApply |

4 mpd | Max S$1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1.5K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Family as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$2K per c. month. Must choose Family as bonus category Review |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | Max S$1.1K per c. month Review |

SC Journey Card SC Journey CardApply |

3 mpd | Max S$1K per s. month Review |

| *Giant does not have an online store in Singapore, but you can order groceries via Foodpanda which is also a yuu merchant |

||

| 💳 yuu x Cold Storage |

|

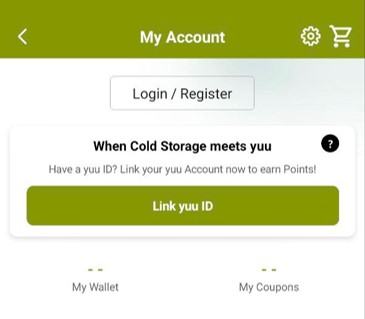

Transactions made via the Cold Storage app are eligible to earn up to 36 yuu Points per S$1 with the DBS yuu Card, provided you link your yuu ID.

To do this, tap on My Account > Link yuu ID. |

Buying groceries in-store

If you do your grocery shopping in-store, then use the following cards to earn the most miles.

| 🛒 Best Cards for Groceries (In-Store) |

||

| Card | Earn Rate | Remarks |

DBS yuu Card DBS yuu CardApply |

10 mpd | Giant and Cold Storage only. Min. spend and cap of S$600 per c. month Review |

Amaze + Citi Rewards Amaze + Citi RewardsApply |

4 mpd | 1% admin fee applies to all SGD transactions. Max S$1K per s. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Family as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$2K per c. month. Must choose Family as bonus category Review |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd^ | Max S$1.1K per c. month Review |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd* |

With min. S$1K spend per s. month, capped at S$2K Review |

| ^Must use mobile contactless (mobile payments) *Must use contactless (tap physical card or use mobile payments) |

||

Do note that the HSBC Revolution is no longer an option for this category, following its May 2024 nerf which removed MCC 5411, among others.

Earn 6 mpd on groceries via HeyMax

As you can see, there isn’t much competition when it comes to pure earn rates— at 10 mpd, the DBS yuu Card simply wipes the floor with the competition.

But the DBS yuu Card also forces you to limit your shopping to Cold Storage or Giant only, and requires a minimum spend of S$600 per calendar month. What if you can’t meet that minimum spend, or want to shop at NTUC FairPrice or Sheng Siong instead?

In that case, you should explore the HeyMax alternative.

|

| 👍 250 Max Miles joining bonus |

| Sign up for a Heymax account and get up to 250 Max Miles as a welcome bonus |

| 250 bonus Max Miles |

HeyMax sells vouchers in various denominations for FairPrice, Giant and Sheng Siong:

These purchases will code as MCC 5311 Department Stores, which earns 6 mpd with the OCBC Rewards Card till 30 June 2025, capped at S$1,000 per calendar month.

Breakdown: OCBC Rewards 6 mpd Promo Breakdown: OCBC Rewards 6 mpd Promo |

||

| Component | Monthly Cap (OCBC$) |

Monthly Cap (S$) |

| Base: 5 OCBC$ per S$5 (0.4 mpd) |

N/A | N/A |

| Regular Bonus: 45 OCBC$ per S$5 (3.6 mpd) |

10,000 OCBC$ | S$1,110* |

| Special Bonus: 25 OCBC$ per S$5 (2 mpd) |

5,000 OCBC$ | S$1,000 |

| *Really S$1,111, but remember that OCBC only awards points in blocks of S$5 |

||

In other words, HeyMax lets you change the MCC of your grocery shopping from 5411 to 5311, making it eligible for rewards with cards that earn bonuses on that category.

Don’t forget that your voucher purchases are also eligible to earn Max Miles, which can be converted at a 1:1 ratio to 27 airline and hotel partners, without any fees.

| ✅ HeyMax Transfer Partners | |

| ✈️ Airlines | |

|

|

| 🏨 Hotels | |

|

|

For more on the sweet spots you can redeem with Max Miles, refer to this post.

Conclusion

When I last updated this article in 2024, the most you could earn for grocery shopping was a “mere” 4 mpd.

But thanks to enhancements to the DBS yuu Card, it’s now possible to earn a whopping 10 mpd on this category. And even if you don’t want to limit yourself to Cold Storage and Giant, buying vouchers via HeyMax with the OCBC Rewards Card lets you earn 6 mpd with NTUC FairPrice and Sheng Siong as well.

How about the trust card used in NTUC?

Are payments made through the Fairprice app (scan QR at supermarket and kopitiam) considered online spend for the DBS WWMC?

yes.

So can I also assume paying via the Fairprice group app in the store (scan QR) will earn 3mpd for SC Journey card right? Thanks

Trust Fairprice not there

Doesn’t the (Amaze +) Citibank Rewards card also belong under online grocery options?

if the transaction is already online, what do you need the amaze for?

Trust card easily beats the competition for grocery shopping with its 21% rebate. The only drawback is that you need to clock $350 (NTUC member) of non Fairprice transactions per month which pays very low rebates.

obviously that is not 21%

If I chose family and food categories for Ladies card, and I made groceries purchases at NTUC and food purchases at Kopitiam but use the Fairprice app to scan QR code for payment linked to Ladies card. Do I get 6mpd?

i have the same question, does an in-app purchase clock under the same categories for UOB lady’s?

Does paying at cashier via the Fairprice app linked to Citi Cashback qualify for the 8% cashback for groceries?

if your favorite grocery is Cold Storage, you have to reserve Citi Rewards + Amaze for this because of the Revolution nerf. If you hit the cap, you need to use Visa Signature and make sure you are hitting the contactless minimum spend. The UOB Krisflyer or general spend card.

Is this right?

For me nothing beats Yuu at CS. It’s not just the 18% on $600. It’s the no-minimum uncapped 5% as well. Valuing a mile at 1.5 cents, 5% cashback is just 1 cent less than a 4mpd card. And unlike miles, Yuu points: can be spent straight away without waiting for award space, are awarded in fractions (!!), can be spent on any small purchase, and are valid for 2 years. I don’t even bother to tally my excess spend > $600 at CS since I just pull out Yuu for convenience. Even when I exceed $600pm, the bonus 13%… Read more »

Groceries – 8% @ Maybank Family & Friends MC

Groceries (Online Only) – 5% @ Citi SMRT VISA

Groceries (Overseas) – Near No FCY Fee – 8% @ Instarem + Maybank Family & Friends MC

This is a miles-centric page hence these cashback cards are unlikely ever going to get a shoutout at MileLion

well, yuu aside…

Also covered HSBC Live+ which makes me think you jumped on the bandwagon cos it’s new to direct more traffic to your webpage

don’t forget Trust, uob evol, uob absolute, AMEX True Cashback, SC Simply Cash and many more!

Does buying supermarkets vouchers earn still earn miles?

If I clock >$1000 FCY spend using UOB Visa Signature stored in Apple Pay does tapping the physical card in Singapore earn 4mpd? Have I’ve reached the $1000 min spend for both FCY and contactless mobile? Or only one category? Guess I should try on a small local contactless payment and see if I get the bonus.

Aaron, you mentioned “If you’re spending with a UOB credit card at Cold Storage, Giant, Jasons Deli or Market Place, then some special caveats apply.”

What about supermarkets with the same MCC as the abovementioned (e.g. Fairprice, Sheng Siong, etc) – will they earn UNI$ as opposed to UOB$ if you use a UOB card there?

Do we get miles for purchase of NTUC voucher?

Sheng Shiong vouchers seems to have been removed from HeyMax

was about to comment the same, had a panic attack at the self checkout line yesterday

Concurred, I could find FairPrice, Giant vouchers but not Sheng Siong

Same here. Couldn’t find sheng siong on heymax

Any thoughts on Cold Storage and Giant leaving DFI? How will that impact the 10 mpd?

Best card for Amazon Fresh?

Are in-store payments made through the Fairprice app (scan QR at supermarket and kopitiam) considered online spend for the CITI Rewards?