Booking your air tickets with the right credit card can help rack up extra miles for your next trip, with up to 4 mpd on offer.

In this post, we’ll look at the best cards to use for this category, as well as the various permutations possible.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 💗 Charity |

| 🍽️ Dining |

🏫 Education | 🥡 Food Delivery |

| 🏨 Hotels | ☂️ Insurance |

📱 Kris+ |

| ⚕️ Medical | 🏖️ Overseas | ⛽ Petrol |

| 🚍 Public Transport | 🛒 Supermarkets | 🚰 Utilities |

How do airline tickets code?

The MCC for airline tickets depends on how you book them, but in general will be:

- For direct bookings: MCC 3000-3299 or MCC 4511

- For OTA bookings: MCC 4722

In case you’re uncertain about the MCC, there’s three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

Booked directly with airline

Most airlines will code in the MCC 3000-3299 range, and major carriers have their own unique MCCs. For example, Singapore Airlines codes as MCC 3075, British Airways codes as MCC 3005 and Qatar Airways codes as MCC 3136. However, some carriers like Scoot may fall under MCC 4511, the generic code for Airlines Not Elsewhere Classified. Those interested in seeing the full list of airline MCCs can consult this document.

Do note that the MCC will be the same whether you’re booking a commercial or award ticket. In other words, all the cards in this post will be equally applicable when you’re paying the taxes and surcharges component on an award ticket.

For tickets purchased directly with the airline, you can use any of the following cards.

| ✈️ For All Airlines | ||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$2K per c. month. Must choose Travel as bonus category Review |

DBS WWMC DBS WWMCApply |

4 mpd | Max S$1.5K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1K per c. month Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd FCY only |

Min S$1K max S$2K FCY spend per s. month Review |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd (till 31 Aug 24) |

No cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

3.2 mpd (till 30 Jun 24) |

Min. retail spend of S$800 per c. month. Capped at S$10K per c. month if SGD, no cap if FCY Review |

| ❓ Where’s the Citi Rewards Card? |

| The Citi Rewards Card earns 4 mpd on all online transactions, except travel (defined as airlines, cruises, hotels, rental cars, trains) Therefore, it wouldn’t be the right card to use here, as you’ll earn just 0.4 mpd. |

In addition to the cards mentioned above, here are some options if you’re travelling on Singapore Airlines and Scoot specifically.

| ✈️ For Singapore Airlines & Scoot |

||

| Card | Earn Rate | Remarks |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

3 mpd | SIA and Scoot Review |

AMEX HighFlyer Card AMEX HighFlyer CardApply |

2.5 mpd^ | SIA and Scoot Review |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

2 mpd* | SIA only Review |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

2 mpd* | SIA only Review |

AMEX Platinum Charge AMEX Platinum ChargeApply |

1.95 mpd | SIA and Scoot Review |

| *For travel originating in Singapore, billed in SGD ^Earn up to 6 mpd extra from HighFlyer account, depending on fare class |

||

Booked via OTA

If you’re booking your air tickets through an online travel agent (OTA) like Expedia, Trip.com or Skyscanner, the purchase will code as MCC 4722.

In that case you can use the following cards to maximise your miles.

| ✈️ For OTA bookings | ||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$2K per c. month. Must choose Travel as bonus category Review |

DBS WWMC DBS WWMCApply |

4 mpd | Max S$1.5K per c. month Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd FCY only |

Min S$1K max S$2K FCY spend per s. month Review |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd (till 31 Aug 24) FCY only |

No cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

3.2 mpd (till 30 Jun 24) FCY only |

Min. retail spend of S$800 per c. month. No cap Review |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

3 mpd | Agoda, Booking.com, Expedia, Traveloka, Trip.com, UOB Travel Review |

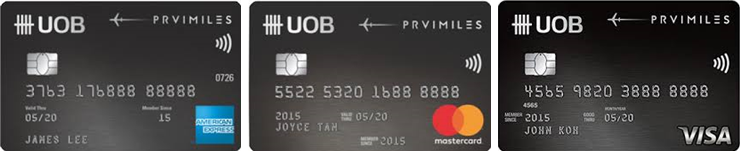

UOB PRVI Miles Offer

|

|||

| Apply (AMEX) | |||

| Apply (MC) | |||

| Apply (Visa) |

The UOB PRVI Miles Card offers up to 6 mpd with participating airlines booked via this Expedia link.

|

|

| The above list is subject to change, so be sure to confirm it with the latest T&Cs before booking. | |

To be clear, you must make your booking via the special Expedia link. You will not earn the bonus miles if you book your tickets on the official airline website.

In general, air tickets should price roughly as they do on the official website, but you should always make a point of comparison shopping. Unlike hotels, air tickets booked via third-party OTAs are still eligible to earn miles and status credits, subject to the fare class.

Bookings must be made by 31 December 2024. The full T&Cs of this offer can be found here.

What if I’m redeeming award tickets?

When it comes to earning miles, there’s no substantial difference whether you’re using your credit card to buy a commercial ticket outright, or paying for taxes and surcharges on an award redemption.

What if I’m buying airline miles?

Purchases of airlines miles from Points.com (which processes sales for Air France/KLM, Air Canada, Alaska Airlines, British Airways, LifeMiles [ad-hoc], Lufthansa, Qatar Airways, and United Airlines), do not code as airline transactions.

Instead, these code as foreign currency transactions under MCC 7399 (Business Services Not Elsewhere Classified), and you can use the following cards instead:

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Cap of S$1K per s. month |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | Min S$1K, max S$2K FCY spend per s. month |

SCB Visa Infinite SCB Visa InfiniteApply |

3 mpd | Min spend S$2K per s. month |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd (till 31 Aug 24) |

No cap |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

3.2 mpd (till 30 Jun 24) |

Min. retail spend of S$800 per c. month |

| S. Month= Statement Month | C. Month= Calendar Month |

||

If you’re buying airline miles directly from the airline (Singapore Airlines, LifeMiles [subscription]), then the purchase will code as an airline transaction, and you can use the cards mentioned earlier in this article.

Conclusion

Regardless of whether you’re booking a commercial ticket or redeeming miles, using the right card can earn you up to 4 mpd towards your next trip.

If a purchase is likely to bust the bonus cap on a given card, you may want to see if the airline offers gift cards, because this is basically a way of splitting up a transaction over multiple cards. Alternatively, consider using the Maybank Horizon Visa Signature, which lets you earn 2.8 mpd (temporarily upsized to 3.2 mpd) on up to S$10,000 of air tickets per month.

Thanks for this article. I often book flights through Online Travel Agencies like Agoda, as this is sometimes cheaper than going directly through the airline. Which credit card would you currently recommend in those cases?

Is doing an upgrade after purchasing the ticket coded differently? I recall that the description of the transaction for Singapore airlines mySQUpgrade was not the usual “Singapore air”

Hi Aaron, slightly tangential, but what would be the best credit card for pairing with Alipay and WeChat for use in China?

hi, Can you also list the travel insurance offered by each card in the same article, especially the amount of medical coverage and whether pre trip registration is required.

I might be lost in the loop, I thought HSBC Revolution card does not give 4 mpd for travel but I see it for booking airtickets in the above table? I am curious as I can consider using it for airtickets.

OTA is not under hsbc revo whitelist, removed as of 1 jan 2024

Hsbc revo more bonuses for hotels under 7011

OCBC Frank VISA – 8% Online (incl flights), Realistic Cashback = 6.25%

UOB EVOL VISA – 8% Online (incl flights), Realistic Cashback = 6.67% (revising ard 7 Aug 2024)

DCS CashBack Diners Card – 5%

KrisFlyer UOB Credit Card also has uncapped 3mpd with major OTA upon hitting annual spending of 800$ with SIA

good spot. will add that one.

Hi, understand this page is for airline, what about tour agency that require offline payment?

For foreign airlines eg ryanair, can use amaze+uob lady?