How much is a KrisFlyer mile worth?

This fundamental question underpins every decision you make in the miles and points game:

- Is it “worth it” to pay a 3.25% foreign currency transaction fee to earn miles overseas?

- Is it “worth it” to forgo 5% cashback with ShopBack for 3 mpd with KrisFlyer Spree?

- Is it “worth it” to pay a 2% admin fee to earn miles on your bills with Citi PayAll?

- Is it “worth it” to pay a S$192.60 annual fee in exchange for 10,000 miles?

You can’t answer any of these unless you know how much a mile is worth.

Unfortunately, there’s no black and white answer because the value of a mile is subjective. While there’s some math we can do to establish the upper and lower limits, where you fall on that continuum is entirely dependent on you, your philosophy and your travel patterns.

In light of the recent KrisFlyer devaluation, I think it’s time to revisit the value of a KrisFlyer mile once more.

| ✈️ KrisFlyer 2022 Devaluation |

| 🔺 Award Price Increases |

|

| 👎 Changes to Stopover Policy |

|

| 📚 Further Reading |

How my valuation has evolved

I last looked at the value of a KrisFlyer mile in mid-2019, and a lot has happened since then:

- COVID-19 made air travel practically impossible for 18 months, leading people to burn miles on things they’d never have dreamed of normally

- Singapore Airlines devalued the rate for mixing KrisFlyer miles + cash from 1.02 cents to 0.95 cents each

- KrisFlyer offered 15% transfer bonuses in 2020 and 2021, plus elite status for transferring credit card points, greatly increasing the number of miles in circulation

- Miles purchase facilities like Citi PayAll have lowered the price of buying miles to as little as 0.8 cents each

- KrisFlyer has further hiked Saver award prices by 8-16%

- The Stopover Trick has been nerfed, reducing the opportunities to stretch your miles

- While this is debatable (and I don’t have the data to back it up), it feels like premium cabin Saver awards have become much harder to find, especially in First Class

All this to say it’s high time to revisit the valuation, and in this post I’ll walk you through how I came to my new figure.

I can’t emphasise enough that this isn’t a purely mathematical exercise, because the value of a mile is as much art as it is science. Some people will disagree with my thought process, and that’s just fine. What’s more important is you come away with a figure that makes sense for you.

| 💰 tl;dr: The MileLion’s Mile Valuation |

| The maximum price I’d pay for KrisFlyer miles is 1.5 cents each, and the minimum value I’d accept for redemptions is 1.7 cents each |

How do we value a KrisFlyer mile?

There’s two things to consider when we value a KrisFlyer mile:

- Acquisition cost

- Redemption value

Acquisition Cost

Every day, you’re presented with opportunities to purchase miles, either implicitly or explicitly.

For example, you may choose to use your UOB PRVI Miles card for a USD transaction. A 3.25% FCY fee will be charged, for which you’ll earn 2.4 mpd, yielding an implicit cost of 1.35 cents per mile. Alternatively, you may choose to pay your income taxes through Citi PayAll. You’ll earn 2.5 mpd and pay a 2% admin fee, which works out to 0.8 cents per mile.

The acquisition cost gives you an idea of how much you should be paying to earn miles- for example, it’d be silly to pay 2 cents per mile if the vast majority of options cost less than 1.5 cents each.

Here’s a summary of the various options available on the market

| Options for Purchasing Miles |

|

| Option | Cost Per Mile |

| Citi PayAll | 0.8 cents1 |

| CardUp | From 1.07 cents2 |

| SCB Visa Infinite Tax Payment | From 1.14 cents3 |

| HSBC Tax Payment | From 1.2 cents4 |

| FCY spend on UOB PRVI Miles | 1.35 cents5 |

| SC EasyBill | From 1.36 cents6 |

| HSBC Visa Infinite Welcome Gift | From 1.39 cents7 |

| AXS Pay+Earn | From 1.52 cents8 |

| FCY spend on Citi PM, DBS Altitude, OCBC 90°N Visa | 1.63 cents9 |

| UOB Payment Facility | From 1.7 cents10 |

| Annual fee for Citi PM, DBS Altitude, KrisFlyer UOB and OCBC 90°N Visa | 1.93 cents11 |

| KrisFlyer top-up | 5.6 cents12 |

| 1. Valid till 31 Jul 22, min. S$5K spend, capped at S$120K 2. Valid till 31 Aug 22 for income tax payments with code MLTAX22, Visa only 3. With min. S$2K spend per statement month 4. 1.5% fee with 1.25 mpd (HSBC Visa Infinite) 5. 3.25% fee with 2.4 mpd 6. 1.9% admin fee with 1.4 mpd (SC Visa infinite) 7. S$488 annual fee (HSBC Premier) gives 35,000 miles 8. 2.5% fee with 1.6 mpd card 9. 3.25% fee with 2 mpd 10. Valid till 30 Jun 22 11. S$192.60 annual fee gives 10,000 miles 12. Available during redemption process, at US$40 per 1,000 miles |

|

| ⚠️ Buy miles legitimately! |

|

You may have seen ads on Carousell, Facebook or Instagram for mileage brokers who offer KrisFlyer miles for sale. You’d best avoid them, because purchasing from such sources violates the KrisFlyer programme’s T&Cs. If caught, your account can be shut down and all your miles confiscated. It’s just not worth it. Only buy miles from legitimate sources like banks and official partners. For a better understanding of how mileage brokers guys operate, refer to this post. |

There’s two things I’d like to highlight.

First, the cost per mile floor was 1.07 cents when I did my last update in mid-2019. Now, it’s fallen by about 20% to 0.8 cents.

Second, access to cheaper miles have been democratised. At the time of the last update, the cheapest miles purchase options were only available to those with high-end cards like the SC Visa Infinite, HSBC Visa Infinite, DBS Insignia or Citi ULTIMA.

Now Citi PayAll has thrown the door wide open with its 2.5 mpd offer, which is valid across all miles & points earning cards. Even holders of the entry-level Citi Rewards and Citi PremierMiles cards can now buy miles at 0.8 cents each!

Citi PayAll requires that you have an actual bill to pay, but given how wide the scope is, most people could probably find something (hint: the miscellaneous payments category is surprisingly broad).

| 💰 Citi PayAll: Supported Payments | |

|

|

In light of these developments and given the options at my disposal, I’d be unwilling to pay more than 1.5 cents per mile.

Redemption value

The redemption value gives you an idea of what value you should get when redeeming miles.

KrisFlyer offers the following options:

| Options for Spending KrisFlyer Miles | ||

| Redemption Option | Value per mile | |

| ✈️ | Award flights | 2-8 cents |

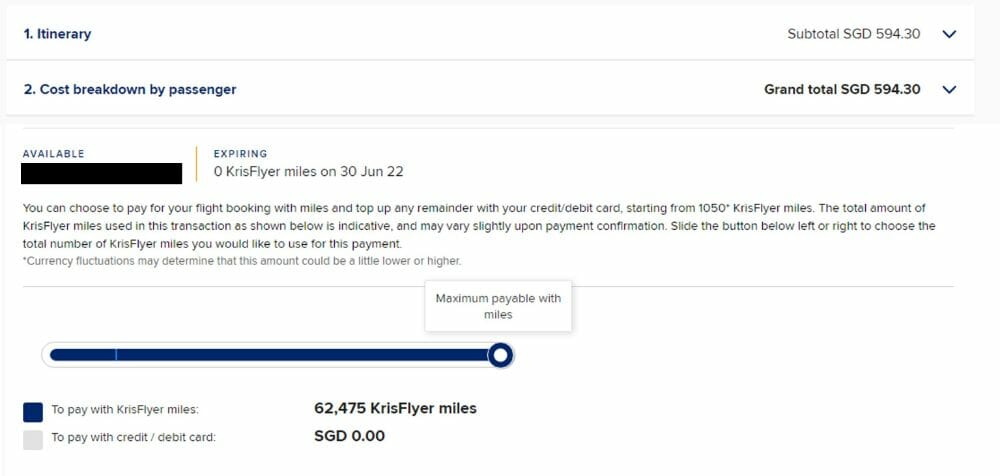

| ✈️ | Pay for flights with miles | 0.95 cents |

| 🚘 | KrisFlyer vRooms | 0.8 cents |

| 🛍️ | KrisShop | 0.8 cents |

| 🏨 | Shangri-La Golden Circle conversion | 0.77 cents |

| 🏬 | CapitaStar conversion | 0.7 cents |

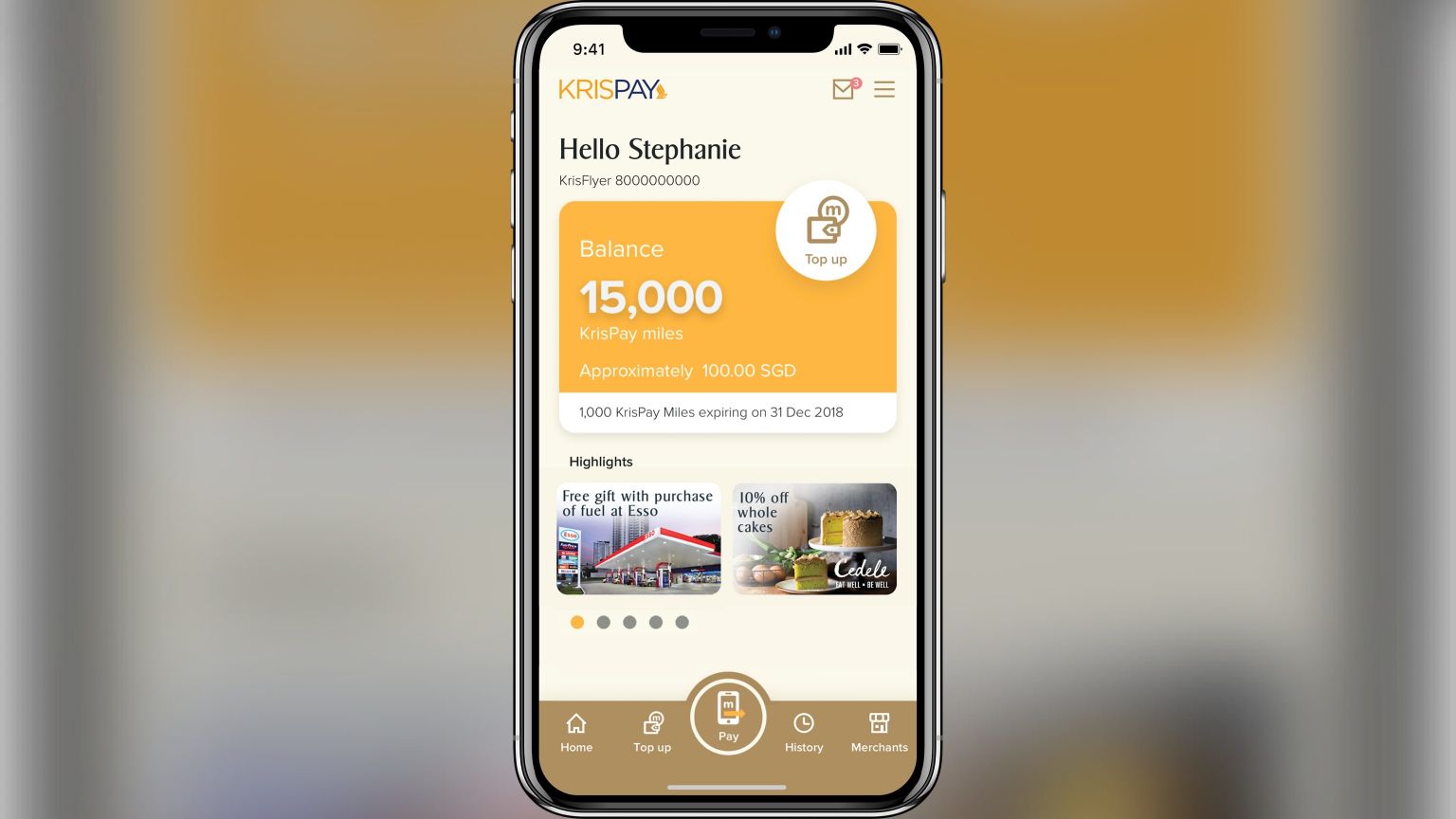

| 📱 | Kris+ | 0.67 cents |

| 🎡 | Pelago | 0.67 cents |

| ⛽ | Esso Smiles conversion | 0.33- 0.67 cents |

While the extremes are more theoretical than anything else they can help set the floor and ceiling value for redemptions- I shouldn’t be valuing my KrisFlyer miles at 0.1 cents or 10 cents each, for example.

Where you fall between those depends on your own redemption patterns. I can safely ignore most of the on-ground redemptions because I’d never redeem my miles for Esso petrol, or on Kris+/KrisShop (well, this one time aside). I might use SIA’s Pay with Miles feature in an emergency, but such cases are likely to be exceedingly rare.

99% of the time, I’ll redeem my KrisFlyer miles for their best possible use: Singapore Airlines flights.

When calculating the value derived from redeeming miles for flights, most people will take reference to the cost of a revenue ticket:

(Cost of revenue flight – Taxes and surcharges on award flight)/ Number of miles required= Value Per Mile

For example, if a Suites flight from Singapore to New York costs either S$21,202 or 264,000 miles + S$210, then the value per mile is:

(S$21,202-S$210)/(264,000 miles)= ~8 cents per mile

While this is mathematically sound, it’s important to highlight the limitations of this calculation.

Award tickets are flexible

Award tickets can be cancelled or changed for a small fee (except Spontaneous Escapes), while the cheapest revenue tickets are usually non-refundable. This added flexibility should increase the value of a mile, but there’s no way of modelling that objectively.

Revenue tickets earn miles, award flights don’t

Award tickets don’t earn miles, but revenue tickets do. These miles have a value, which would reduce your redemption value (because it effectively reduces the price of the revenue ticket).

Saver award availability assumption

Some of you might have scoffed the moment I brought up Suites to New York, because it’s notoriously difficult to redeem. While you could theoretically get a Suites Saver award for 264,000 miles, you’d have to be the luckiest person in the world to snag it.

It’s more realistic to take Advantage pricing (which is still far from a sure shot) at 474,000 miles, which would reduce the value per mile to 4.4 cents.

Here’s the thing though: your odds of scoring Saver vs Advantage pricing depends on routes, cabins, and seasonality. A truly robust valuation would work out a weighted average price, based on what percentage of the time you can redeem Saver awards, and what percentage of the time you’d have to pay Advantage prices.

It’d be impossible (or at least well beyond my abilities) to factor that in.

What are my realistic alternatives?

Even if we use the lower valuation of 4.4 cents, there’s an inherent flaw in my logic: I can’t say I value my miles at 4.4 cents each unless I’d have been willing to pay for that Suites ticket with cash.

To put it another way: suppose you’re walking down the street and someone gives you a coupon for 10% off at Tiffany. You go to Tiffany and buy a $10,000 diamond ring and say “wow, that coupon was worth $1,000!” That’s only correct if you were planning to buy the Tiffany ring anyway.

Similarly, if your alternative to redeeming a Suites flight to New York is to buy an Economy Class ticket, your redemption value is lower because, realistically speaking, the expense your miles are saving you from incurring is lower.

In my case:

- While I always look to redeem First or Business Class where possible, I’m certainly not in a position where I could pay for those out of pocket

- At the same time, I only redeem miles for Economy Class occasionally, when facing higher-than-usual fares (e.g. when it’s a one-way redemption, or a peak period)

- I’d never redeem miles for Premium Economy, because it offers marginal comfort over Economy Class for about 75-80% the cost of Business Class

- I’m able to travel on short notice, which makes Spontaneous Escapes redemptions (and their 30% savings) more feasible

- I redeem Saver awards 80-90% of the time, though there are situations where I bite the bullet and pay Advantage

Based on my historical travel destinations and redemption patterns, my gut feel is that I’d look for at least 1.7 cents per mile when redeeming miles.

Summary: Value of a KrisFlyer mile

To summarize what I’ve said so far: I won’t buy miles for more than 1.5 cents, and I won’t take less than 1.7 cents when redeeming them.

Why the gap? Because we need to account for so-called “non-cost” factors. There’s an unspoken cost involved in playing the miles game:

- the time spent formulating your strategy (e.g. spreadsheets, spreadsheets, spreadsheets!)

- the inconvenience of optimisation (e.g. traveling further to a different store because it accepts Paywave, having to manage multiple cards and bills)

- the sometimes constrained options (e.g. picking lunch based on which merchants are on Kris+, as opposed to where you’d really like to eat)

I simply have no way of putting a price on these, which is why I think it’s best practice that you set one figure for buying miles, and another, slightly higher one for redeeming them. Otherwise, it’s as if you implicitly understate your cost.

Conclusion

At the risk of sounding like a broken record, you shouldn’t take my valuations as the final word. The value of a KrisFlyer mile is inherently personal, and depends on your individual travel patterns and preferences.

Nonetheless, it’s an exercise you should frequently revisit as the market changes- the miles game isn’t static, and your valuations shouldn’t be either!

How much do you value a KrisFlyer mile, and what’s your methodology?