Another year has come and gone and it’s Christmas again! I’m currently working on a very long 2016 year in review piece but until then, I thought I’d share with you what I’d like for Christmas, from a miles collector point of view.

I think it’s safe to say that any unfulfilled items from my 2015 Christmas wish list still remain highly desired (although two of my wishes, Global Entry for Singaporeans and a credit card with no foreign transaction fees came true! It’s a Christmas miracle…) but because I’m greedy that way, here’s what I want for Christmas in 2016.

(1) Singapore Airlines to introduce a truly revolutionary new cabin product….

2017 is going to be a busy, busy year for Singapore Airlines. We know they’re going to introduce a new Suites and Business class product when they take delivery of their new A380s (but no showers, boo).

It’s highly likely the Business Class product will be some derivative of the 2013 product currently found on the refurbished 77Ws and A350s, but how do you improve on an already excellent product? Where do you go from there?

If I were to wear my speculating hat, I’d say they’re going to add doors to the Business Class seats, like what Delta plans to do with their A350 aircraft from fall 2017. Based on absolutely no hard evidence whatsoever, I declare this to be a cheap and easy way to add privacy to an existing seat.

We know from these rejected SQ cabin designs that business class seats with doors were, at one point in time, on SQ’s design radar. So did SQ decide against it completely? Or agree with the concept but wanted a different approach?

SQ is also going to be introducing a new regional business class product in 2017 as its A330s/772s sail into the sunset and A350s start to fill up the fleet.

SQ’s current regional business class product is one of its weakest areas. With a 2-2-2 angled flat configuration, you’ll frequently find this product deployed on short regional hops like Bangkok/KL (which is more than fine) and medium haul routes like Taipei (unacceptable considering EVA operates a 1-2-1 full flat product).

Even worse, although the seat is more suited to daytime flights, SQ still deploys them on overnight routes to places as far afield as Canberra and Seoul. Why? Because they can. There are no competing direct SIN-CBR flights, and Asiana is using its A330s with a similar angled flat product on the SIN-ICN route too.

At current count, about 43 SQ aircraft have the regional J product, and that’s 43 too many. So I’m going to be very interested in what SQ replaces this with. I know there are economics considerations, and a 1-2-1 configuration might not make financial sense on a short/medium haul route. Fair enough, but couldn’t SQ do a 2-2-2 full flat layout? I think that’d be an acceptable compromise. I’ve flown plenty of excellent 2-2-2 full flat hard products (TK comes to mind) and although I wouldn’t accept that on a long haul flight, for regional routes it’ll work.

Where First Class is concerned, I am absolutely intrigued by what SQ plans to do with its Suites product. When Suites was first announced it was something truly revolutionary. The idea of a double bed in the sky evoked thoughts of the golden age of travel, or something more akin to a luxury train/yacht cabin than an aircraft.

But since then competitors have come back with their even more over-the-top responses, most noticeably Etihad with its First Class Apartments (it of course wouldn’t be fair to compare SQ Suites with EY’s Residence given that there are 12 Suites on an A380 vs only 1 Residence). So SQ once again needs to raise its game.

The rejected DCA designs for First Class may again perhaps be illuminating insofar as they hint at the direction SQ is thinking. This double wide seat looks like they’re building the suite around a social concept perhaps, but beyond that there’s really nothing else I can speculate on.

Having a great new first and business class product is one thing, but the only way most of us are ever going to try that is on miles. Which brings me to my next wish…

(2) …AND actually allow redemptions on said product

Hey, no one said Christmas wishes had to be realistic.

When SQ first launched its new First and Business Class (fully flat) cabin products in 2006, it didn’t allow saver redemptions for SIX YEARS after the product was launched! Six years! Till this day I do not know how SQ got away with that (probably the same way they got away with launching Suites in 2008 but not making saver awards available until 2012).

So there is clearly precedent for SQ giving the middle finger to their frequent flyers (here’s our awesome new product but you can’t get it unless you pay. Oh and thanks for your loyalty in the pass btw) when it comes to new cabin products, and my biggest fear is that they will do this again. (yes, they didn’t have any such restriction when the 2013 cabin products came out but I’d argue that those were seen more as a mid-cycle refresh than truly the launch of something new)

Come on SQ, do the right thing…

(3) Krisflyer extends its discount redemption promotions to cover premium cabins

Krisflyer has recently started offering discounted redemptions on SQ/MI award tickets. This is some manner of progress for a program traditionally as tight-fisted as Krisflyer, and although I normally don’t advocate redeeming miles for economy class (based on poor value and the fact that you could always experience economy class anyway), a 30% discount brings the value into the more acceptable range.

I have some (vain) hope here that future award sales may include Business or (gasp) First class awards because in Krisflyer’s latest award sale, Premium Economy tickets were covered for the first time.

On the other hand, given that SQ is notoriously protective of its premium cabins (see point 2 on them not opening up saver awards in their premium cabins for 6 years) I see absolutely no reason why they’d do this. They’re already so grudging to let people redeem their miles for premium cabins, much less at a discount…

(4) Marriott continues to keep the best parts of the SPG program post 2017

In 2016, Marriott bought Starwood and caused much weeping and gnashing of teeth among Starwood loyalists (myself included). Why? Because Marriott are like a reverse Midas, in that everything they touch turns to crap.

So far there have been positive steps, such as Marriott adding guaranteed 4pm checkout for Gold and Platinum members. But there is still a lack of clarify regarding what will happen to some of the better SPG Platinum benefits like upgrades to suites or lifetime status.

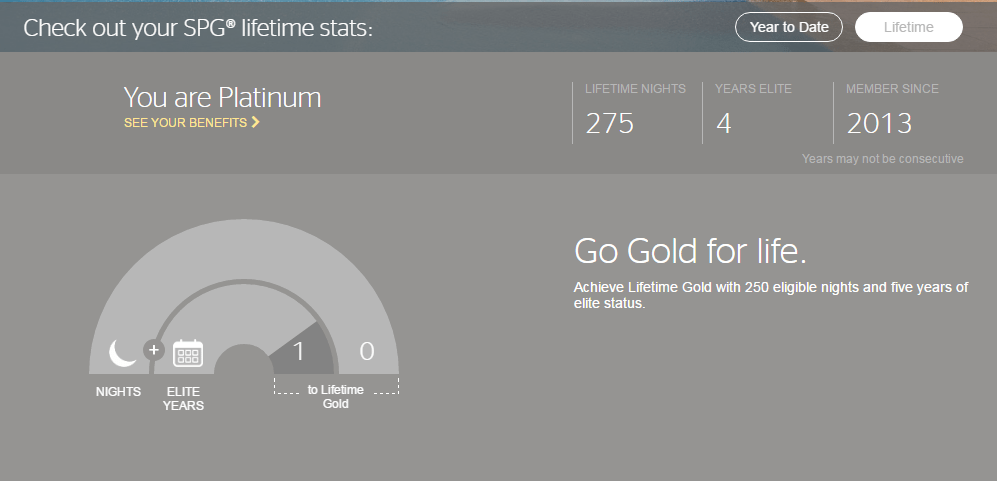

All I need to do to attain Lifetime Gold is requalify for Gold/Platinum status one more time this year.

Marriott is already matching SPG Gold to Marriott Gold and SPG Platinum to Marriott Platinum (despite the fact that Marriott Gold and Platinum require 50 nights (SPG- 25) and 75 nights (SPG-50) respectively), but no word yet on whether Lifetime status will be matched in a similar manner.

Other issues still up in the air include-

- What will happen to Starwood’s generous transfer ratios with airline partners (1:1 with most airlines, or 1:1.25 when you transfer a minimum of 20,000 points)?

- What will the new threshold for Elite status be under the combined program? (75 nights to Elite with Marriott vs 50 with SPG)

- Will Ambassador service be retained for 100+ night members?

Maybe it’s time to start looking at Hyatt…

(5) Uber starts a loyalty program

Why does Uber need a loyalty program? Because they’re not the only game in town anymore. As I mentioned in my getting around New York guide, there are an increasing number of Uber alternatives, all offering fundamentally the same product.

In Singapore, Grab is making a strong play for the market, and I suspect their practice of offering a weekly promotion has forced Uber to respond in kind.

A loyalty program would certainly increase the substitution cost of Uber vs Grab. Indeed, in 2016 Uber started testing a loyalty program, albeit in a very limited way. Perhaps this is a sign of something to come in 2017?

And while we’re talking about Uber…

(6) Uber brings back some measure of transparency to their pricing

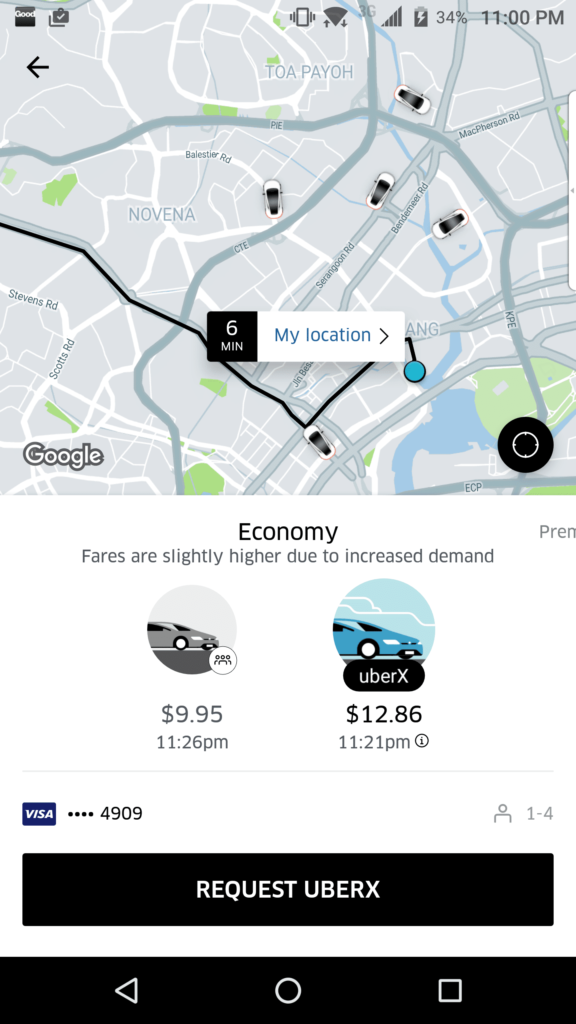

In 2016 Uber changed the way it discloses surge pricing in what was one of the most blatantly anti-consumer moves in recent memory. You can read my analysis here, but TL;DR, Uber no longer tells you about surge pricing, instead quoting you a fare upfront because math is hard and they have your best interests at heart.

Uber has walked back the change, very, very slightly, in that there is now a message in the app that makes a vague reference to fares being “slightly higher” due to increased demand. This is a mild improvement, insofar as the app originally made absolutely no reference to any surge pricing whatsoever even when there was.

The exact surge is still not revealed, which is completely unacceptable. And it’s obvious why they hide it. No one likes to get a raw deal. Even if i’m able to pay $17 for a ride that normally costs $10, I don’t like the idea that I’m paying 1.7X the cost. 1.1X? Sure I might take that, but 1.7X crosses some psychological barrier in my mind. And by removing the exact degree of the surge, Uber is trying to circumvent that.

So Uber, if you could go back to the old way of doing things, that’d be great.

(7) A bank breaks the 1.4 mpd barrier, once again

Once upon a time the gold standard for miles earning in Singapore was 1.6 mpd on general, local spend. UOB PRVI had it, and DBS Altitude gave it if your total monthly spend was >$2,000 (have a read of this 2012 BT article comparing miles cards to see what the landscape was like 4 years ago, and laugh at fact that they felt they needed to shoehorn in OCBC’s 0.4mpd card into the article too)

Then it went away. Now, the PRVI’s general earn rate is 1.4 and DBS Altitude 1.2 mpd. No bank has broken the 1.4 barrier ever since UOB took away the 1.6 miles earning in May 2015.

Is 1.6 mpd an unsustainable rate for banks to offer? If HSBC can offer unlimited 4 mpd (albeit on category spending), is 1.6 mpd on general spending that much of a stretch? Of course that raises the question whether consumers would be willing to pay a higher annual fee for a 1.6 mpd card, or accept higher finance charges on late payments.

I suspect that if 1.6 mpd does come back, it’s going to be offered by one of the banks trying to break into the general miles spending card space. This would exclude UOB, DBS and Citibank which already have strong offerings. Perhaps one of the dark horses like HSBC/SCB could introduce a mass market miles card, as their current miles card offerings are only for the affluent (Visa Infinite tier).

(8) Banks develop equitable ways of handling foreign currency refunds

We know that banks in Singapore earn some extra margin every time you use your credit cards overseas. I’ve done the analysis here (and updated it as of December 2016) which lays out the rates each bank charges.

We can complain about how we don’t have credit cards with 0 foreign transaction fees in Singapore (with the exception of this and this), but at the end of the day that’s just how things are. What is unfair, however, is how banks handle the refund of foreign transactions.

Here’s a scenario that happened to me some time back. I had a fraudulent transaction on my credit card to the tune of US$200. I filed a dispute, there was an investigation and I was found to be not liable. The bank refunded me US$200.

The issue was that due to the movements in the exchange rate since then, plus the differential rate the bank applies when refunding currency (I can’t find this anywhere in the T&C but I’m 99% sure that the bank applies a different currency conversion rate when refunding you forex vs charging you) I ended up being out of pocket. Which is ridiculous, given that the transaction was invalid to begin with. I had to make several calls before they finally refunded the difference too.

There are many other scenarios how this might impact you. At a B&B in Australia the innkeeper mistakenly charged AUD$154 instead of AUD$145. She refunded the first transaction and did the proper charge, but when I checked my statement I found that despite the fact the charge and refund were done literally minutes apart I received less on the AUD$154 refund than I was charged. Again, I had to make a series of phone calls to get that sorted out.

Here’s the thing- a refund is a refund. Whatever you paid should be whatever you get back. And banks should not be taking advantage of mistake/fraudulent forex transactions to line their pockets a bit more

So those are my 8 wishes for Christmas! Am I being overly optimistic? Probably. But hey, I can dream, can’t I?

Anything else you want to add to the list?

Wish to have a MPC credit card….

i hope you weren’t serious about jumping ship to hyatt … with only 700 hotels (vs. almost 6,000 for marriott/SPG) and an elite bar as high as SPG’s, that could prove a challenge :o) i status-matched to hyatt diamond this year, and with some difficulty/sacrifice of marriott stays managed to reach only 33 nights (versus 120 marriott). looking forward to hearing about the new SQ cabins.

sorry to hear / good to know about different credit card rates for charging and refunding … what a ripoff

Semi serious! I know their footprint isn’t as large but if you only travel to big cities then…

My wish is that singapore will finally have a co-branded hotel credit card.

Dont think the market here is big enough to support that sadly

Re (3), be careful what you wish for. Booking saver awards is tough enough as it is. Surely opening up further discounted premium class redemptions is just going to make that problem even worse?

And lets not even talk about first class… with 4 seats on the latest 77Ws, they can probably get away with dropping saver redemptions altogether…

haha yes that’s true. i was about to ask that SQ extend the Y–>PY bid to upgrade program to cover Y–>J but realised the implications that’d have for award space (plus i hear the Y–>PY upgrade program has been a flop so far with very few bids and people almost always getting min bid upgrades)

the new a380s will have 8 suites instead of 12 i believe. it looks like first class redemptions on SQ are going to get trickier…

Not completely on topic but I thought this was a pretty good article on what PY should be on an A350

https://www.runwaygirlnetwork.com/2016/09/04/new-a350-premium-economy-layouts-offer-7-not-8-seats-per-row/

SQ is just asking for too much for PY…. I played around with the PY upgrade program the other day for my Mom, and it seems you have to bid for both ways, which makes even the lowest bid pretty high all things considered.

Cool! Seems that Grab just launched a reward program. Wish almost granted!

thanks for pointing that out! i am intrigued. surely this will provoke some sort of uber response…

https://www.grab.com/sg/blog/hello_grabrewards/

My wish for Christmas is for HSBC to be less anal on Advance Visa applications…

I know Maybank cards have little (or no) cred around these parts but any thoughts on their Horizon Visa Signature accelerated miles programme? 3.2 miles for local dining, petrol and taxis is not too shabby and their T&Cs not OCBC-ishly outrageous.

http://info.maybank2u.com.sg/personal/cards/credit/credit-card-for-travel-horizon-signature-visa-card.aspx

yup I’ve covered this before. the main issue i see with the horizon card is that maybank does not have a good general spending card. so unless you spend a lot on the bonus categories you may face quite a long wait to cash out. contrast this to other banks which have good (if not decent) general spending cards to compliment their category spending cards eg hsbc advance / hsbc VI, dbs wwmc/ dbs altitude, uob ppv/ uob prvi, citibank rewards/premiermiles