I received a nice glossy mailer from Standard Chartered (getting snail mail makes me feel alive) advertising a new sign up offer for their Visa Infinite card.

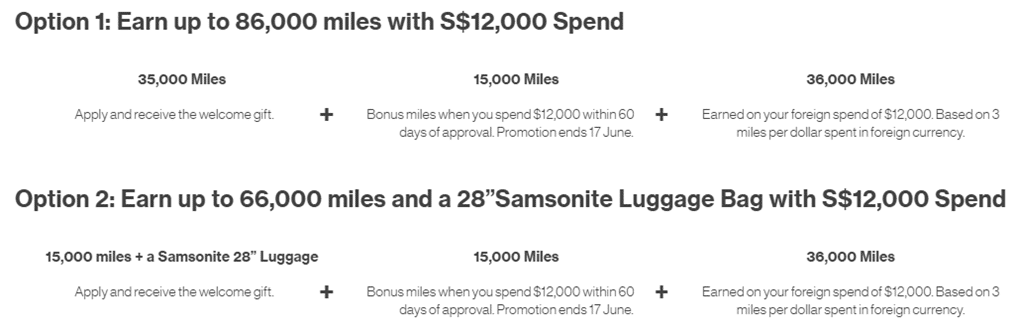

For successful applications approved before 17 June 2017, SCB is offering a choice of two promotions (T&C here)-

- 86,000 miles with S$12,000 spending within 60 days of approval OR

- 66,000 miles + 28 inch Samsonite bag with S$12,000 spending within 60 days of approval

The 35,000 mile welcome gift was always available with the payment of the $588.50 annual fee (SCB used to disclose the annual fee before GST but now includes it, as per their obligations under the income tax act. Sorry, but this always bugged the accountant in me), and the 36,000 base miles would have been yours anyway had you spent $12,000 overseas under the regular T&C of the card. Therefore, the real carrot they’re offering is the 15,000 miles you get when you spend S$12,000 within 60 days of approval.

I’ll have a fair amount of overseas spending on my upcoming RTW trip, and gave some serious thought as to whether I could make this work.

If I were to bring along my UOB Visa Signature card for my overseas spending, I’d be able to get 4 mpd on $2,000 a statement cycle for the 2 cycles I’ll be overseas for. That’s a total of 16,000 miles.

Assuming I spent the other $8,000 on my UOB PRVI Miles at 2.4 mpd, I’d end up with a total of 16,000 + 2.4 * 8,000=35,200 miles for $12,000 of overseas spending.

If I went with the SCB Visa Infinite, I’d end up with 86,000 miles but would be out of pocket $588.50 for the annual fee. So conceptually speaking, I’d be paying $588.50 for the ability to acquire 50,800 more miles than my best alternative. This is about 1.16 cpm, a fairly decent amount.

My actual outlay would be less than $588.50, however, given that SCB is running a rebate promotion with Uber until 30 Sept 2017 that gives you 20% cashback on your Uber (Eats + regular Uber) spending each month, up to $50. You need to spend at least $600 a month on your SCB card to qualify.

After this promotion ends, the SCB VI card still offers 10% cashback on Uber spending capped at $100 a calendar quarter and $400 a year.

I use Uber a lot for work, so assuming I could max out this promotion, I’d get $50*5 (May-Sept, 20% rebate promotion)+ $100 (Oct-Dec, 10% rebate regular) + $100 (Jan-Mar, 10% regular rebate) and a bit more for April to May before my annual fee is due again. That’s about $450 in value, which sounds so generous I’m starting to think I’ve not done this calculation properly*. And I’d need to spend upwards of $3,250 on Uber in under a year. Which means I’d need to order dinner for quite a few people in the office…

*The T&C of the 20% Uber rebate promotion doesn’t specify how it interacts with the usual 10% rebate granted to the SCB VI card, but I think it’s safe to assume they don’t stack. Likewise, I’m not sure if the bonus cashback earned on the 20% promotion will count towards the $400 annual cap on the SCB VI.

But assuming it does, and I max out at $400, that’s an actual outlay of just below $200 which makes the card more palatable.

Benefits of the SCB Visa Infinite Card

I’ve written about the perks of the Standard Chartered Visa Infinite before here, but I believe some additional benefits have been added since then. To recap, you get

- 1.4 mpd for local spending and 3 mpd for overseas spending, provided you spend a minimum of S$2,000 in a statement cycle. If you don’t, you get 1 mpd for both

- 6 free lounge visits a year via Priority Pass

- A free 4 hour yacht charter for 14 people if you spend $75,000 in a year (worryingly, blackout periods and 20% peak period surcharges apply)

- The Uber credits I mentioned above

But then I asked Jeriel what he thought and he reminded me of what I’ve told many a person- don’t acquire miles speculatively. Thanks to our good friend the HSBC Advance card, I have a sizable amount of unconverted points with no travel plans in the near future. So the more I think about it, the more I can’t really justify paying the annual fee.

What does this mean for your sign up bonus strategy?

However, if you’ve got upcoming big ticket purchases (and meet the minimum income requirement of $150K per annum) you may want to consider this card. Note that if you spent that $12,000 locally instead of overseas, you’d end up with 35,000 (joining gift) + 15,000 (bonus) + 16,800 (base miles @ 1.4 mpd)= 66,800 miles from $12,588.50 of spend.

What other options do you have?

- If you’re not already a Citibank credit card holder, you can get the Premiermiles card and spend $10,192.60 (including $192.60 annual fee) within 3 months of obtaining the card to get 42,000 miles

- You could get the AMEX Rewards card, spend $1,535.50 (including $53.50 annual fee) within 3 months to get 13,333 miles

- You could get the DBS Altitude Visa card, spend $2,000 ($1,000 a month for 2 months) to get 10,000 miles (for new DBS/POSB cardholders. Existing get 7,000)

- You could get the Krisflyer Ascend card, spend $6,337.50 (including $337.50 annual fee) in the first 3 months after approval and get 20,000 miles (but please, don’t use the card after that)

This means that in theory, someone with an upcoming spend of ~$31,500 (renovation, wedding, paternity suit) could get just over 170,000 miles if they time their sign up bonuses just right (and were willing to pay a total of $1,172.10 in annual fees).

So I’ll probably not go for this sign up offer, but anyone who has upcoming big spending might want to see if they can build a strategy around this.

Great analysis as usual!

I would just like to add that the SCB VI has quite a high foreign txn charge too (or at least that was what I last remember). $12,000 in foreign currency will be quite a hefty sum I would say. ?

thanks! I believe SCB is 3.5% vs 2.8% on the dbs altitude visa or citibank premiermiles visa. gotta cover the additional 1 mpd somewhere I suppose…

but then again, when you’re being reimbursed 🙂

Unfortunately for renovation, if you go the contractor route for your renovation, they don’t provide credit card services, so missed out a big chunk of miles there, especially since its suck a big ticket spending.

sorry, I meant the refurbishment that comes with renovating. you know, new couch, new lights, new sound system

The main problem I had with this card was that renewal miles are not given when you pay the annual fee from year 2 onwards.

Cancelled mine before renewal came. Was good while it lasted.

Damn. I guess this card is out for me.

Couldn’t get a fee waiver?

I don’t count the 20% uber promotion since it is obtainable from all the other StanChart credit cards that come with 2 year fee waiver. Yes it has a minimum monthly spend, but the creative should be able to find ways to meet the minimum (eg ipaymy rent with 7% cashback, which I think is good enough substitute for 4mpd).

Wow! So by virtue of you considering the card, you’re amongst the top income tiers! Cool! 😛

How I wish SCB’s IRAS facility could be leveraged for accounting for the initial spend.. One could potentially end up with 66800 miles* for $780`

Assuming a tax bill of $12,000,

* Sign up miles (35,000) + Bonus miles (15000) + Reward miles* (16800)

` Annual Fee ($588) + IRAS loan facility (1.6% of 12,000)

Infact, higher the IRAS bill, better is the potential

Too bad only retail transactions qualify. In case no big ticket purchases are in the offing, could rent payment through iPaymy / Cardup be an alternative? 66800 miles for $900!

Signing up for the card + paying 2.6% fee on the $12000 rent

Hi under clause 13, SCB didn’t specifically mention IRAS payment as a non-Qualifying Transactions. You sure IRAS payment can’t be used?

I’ve spoken to 2 CSOs and both of them confirmed that IRAS payments qualify as eligible spend for bonus miles. Unfortunately, haven’t been able to get a written confirmation. It’s an expensive gamble.. albeit a rewarding one.

20% and 10% Uber stack for this card. I know coz I max out this benefit across Uber and Ubereats.

ok now i’m tempted again.

Unrelated to the intent of this post but im assuming you will be bringing your fevo card along for the other $2k after you maxed out uob?

confession: don’t have a fevo. i was always able to max out dbs wwmc each month anyway so didnt see the need to get one

I am very impressed that a strapping young lad still only in his 20s can already make the income requirement….

My general experience is that it says minimum $XXXX but in reality, pretty loose. Don’t treat the banks’ stated minimums as a hard rule except for the $30,000 limit (that is a MAS-imposed limit for credit cards/unsecured credit so no flex there).

I know it is a different country but I just got an Amex Platinum Charge in Australia without any Australian income 🙂

Hi Aaron,

Can I please ask you to reconfirm that the “36,000 base miles would have been yours anyway had you spent $12,000 overseas under the regular T&C of the card” because I do not see this anywhere. I have the SCB Visa Infinite, and do not see this information online or in the info pack the bank sent to me.

At renewal (2nd year), there is fee payable but no miles. I confirmed this with customer service. So this is really a 1-year only card.

as per the SCB VI T&C, you earn 3 mpd on foreign spending provided you spend a minimum of $2,000 a month on your SCB VI card. in this example you spend $12k overseas, so you get 3 mpd* 12,000= 36,000 miles. this is with or without the promotion.