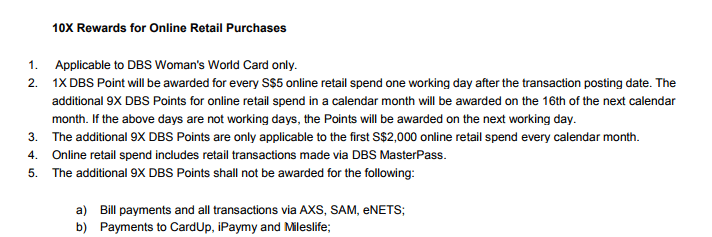

Well, that was fast. DBS has updated the T&C of its Woman’s card to state explicitly that payments made to Mileslife will not qualify for 10X points earning.

In some ways, this is a moot point because the Mileslife MCC is currently coded as professional services, which were always excluded under point i) of the Woman’s card T&C anyway. In fact, I’ve been saying from the start that you should not expect 10X spending bonuses on Mileslife, at least not just yet.

But I know from my discussions with the Mileslife team that they were working to get their MCC changed to a different category in order to enable users to leverage 10X card bonuses, so this definitely throws a spanner into the works.

I find this decision by DBS curious for 2 reasons. First, this has to be a new record in terms of time taken to change their T&C. iPayMy and Cardup were on the market for almost a year before DBS modified its T&C. Mileslife, on the other hand, has been around for just one month. So for DBS to take a pre-emptive move so quickly to shut it down, when Mileslife isn’t currently earning 10X with the woman’s card anyway, is certainly an aggressive step.

Second, it’s strange because of my whole discretionary spending argument, that I laid out here. It is not logically consistent to lump Mileslife together with iPayMy and Cardup, when iPayMy and Cardup are explicitly designed to facilitate non-discretionary spending on things like rent and insurance payments, whereas Mileslife is in the decidedly discretionary area of dining and lifestyle spend.

The recent changes by DBS to restrict your opportunities to earn bonus points on the Woman’s card are definitely concerning, and may point to an overall revamp of DBS’s strategy in light of the demise of the HSBC Advance. DBS has traditionally been very generous in its interpretation of what counts as online spend, but with one less competitor on the market there may be less of a need to compete in this space. The Citibank Rewards and UOB PPV both have a hefty list of exclusion categories, and the Titanium Rewards card is yet to gain significant traction.

I remain hopeful that there will be 10X opportunities with other banks, because those stacked with the ongoing Mileslife promotions make the proposition extremely attractive for dining out.

How about payment to FEVO cards? Does it still earn 10x ?

Not since Apr 9th.

“Tong tong Cheng”☠️?

I booked the Westin and Aloft hotels in Taipei through the SPG website using the DBS Woman’s MasterCard last month. Ended up that these were not considered online transactions by DBS. Did a check with SPG helpdesk and the CSO confirmed that it was the hotels that take the payment from the bank via the supplied credit card information and the payment was not performed ‘online’. Apparently all the hotels in the Starwood chain do it this way. Lesson learnt.

question: did you buy a prepaid rate? or did you use your card to secure the booking?

both were prepaid rates. I made sure I pay them upfront, which I did. I stayed at the Westin from 7-8 June but my DBSWMC statement showed the transaction as 29 May which was when I booked via online. What do you say, Aaron?

Call up DBS and forward them the email of your booking. I have got points retrospectively.

Thanks for the advice. I will try that.

what spk307 said is worth a try…but i think the issue is more to do with the MCC of starwood than anything else.

Glad to share that DBS will retroactively give the remaining 7x rewards points for my Starwood online hotel bookings.

“The department has checked and verified that 735 points were missing. This is 7X DBS points since we have already awarded 3X DBS points.

I’m pleased to confirm that 735 points have been credited to your credit card with immediate effect.”

awesome stuff, thanks for the update.

Some of these banks must be trawling the likes of this website and HWZ to figure out where they can stop the rot. DBS used to have one of the most relaxed points programme but has tightened up to be one of the more restrictive ones, in just a matter of 2 or 3 months.

But what does “stop the rot” mean? Unless it’s the case that certain merchants are really unprofitable for dbs to service, shouldn’t they be happy people are spending on their cards? Is the merchant fee someone like ipaymy pays really that different from, say, Expedia? If so, why should one category earn 10x and the other not?

banks lose money when they pay 4 miles per $1 of spend. the assumption is that most customers will use the same card to spend in lower miles earning categories as well, so at the portfolio level, the card is profitable. they don’t really want to have too many gamers who spend ONLY in the 4 miles/$1 category. MILESLIFE would effectively convert dining spend (a low miles earning category for DBS cards) into a 4 miles/$1 category, something DBS would wish to avoid.

On a lighter note, I would not consider dining as a discretionary spend in Singapore. Especially for lunch and weekends.

Sadly with effect of 2nd July, even EZ-link top-ups using DBS altitude at GTMs or Top-up kiosks doesn’t give any points anymore. Used to be able to get points from EZ-Link via FEVO and DBS altitude but now both are dead.

If you have an Android phone with NFC, can still get 4mpd with EZLink…

Eddie, can shed a little more light on which card to use?

How? HSBC?

Will UOB PPV net 4mpd for this app ?