If you’ve been following this site for a while, you’ll have come to realise that when UOB says “promotion”, whatever follows needs to be followed with a hefty pinch of salt.

UOB is in the habit of running what I call “blind promotions”, or promotions where you do not know before participating whether the quota has already been exhausted. I find this very consumer unfriendly, because it’s essentially asking you to take a gamble. The headline screams “Earn up to XX miles per dollar!” –> You put the spending on your card –> “Sorry, the promotion has been exhausted” you get told at the end of the month.

There’s no way you can verify if this is true, and that means all the risk lies with you (of the promotion being exhausted) and all the benefit lies with UOB (of earning the merchant fees on the expenditure you diverted to their card in hope of participating in the promo).

Other banks do not generally do not follow this practice- they may place caps on what you can earn, but they don’t place quotas on how many can take part. For example, when DBS does a bonus miles promotion with its Altitude cards, there is no quota on number of people who can participate.

So it should be no surprise that UOB’s latest PRVI miles promotion follows a similar theme:

From now till 31 December 2017, UOB is offering 3 mpd on overseas shopping and dining paid for with the UOB PRVI Miles card. That’s the headline, at least. Dig deeper into the T&C and you’ll find that

- It’s for the first 3,000 registered cardmembers (you can register here)

- You need to spend a minimum of S$1,000 on “eligible transactions”, eg overseas shopping and dining

- 3 mpd is capped at S$2,000 of eligible transactions

The maximum miles you can earn from this promotion is 6,000. When you consider that 4,800 of these miles are base ($2,000 @ 2.4 mpd) and only 1,200 ($2000 @ 0.6 mpd) are bonus, that doesn’t sound like a really compelling promotion at all.

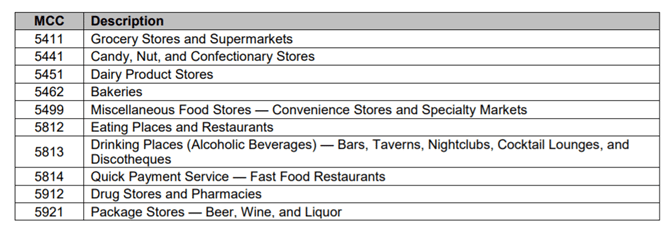

UOB defines the following MCCs as dining:

What’s interesting is that they’ve included things like supermarkets, drug stores, liquor stores and convenience stores in their definition of dining, which is a generous interpretation by any means so credit where it’s due.

Note that hotel dining will not be covered under this definition (hotel dining is a confusing one for me- I know that there are times when a restaurant may be in a hotel but still retains its own MCC (eg Imperial Treasure at Crowne Plaza Changi Airport), but given that there’s no way to ascertain this ex-ante I never take the risk). I personally don’t see much value in this insofar as I have my UOB Preferred Platinum AMEX card which gives me 4 mpd on local and overseas dining (it’s recently been capped though).

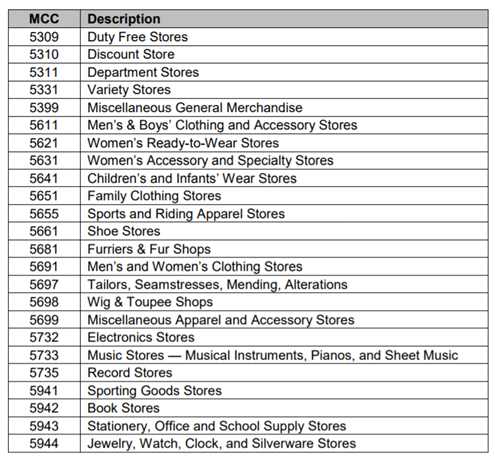

The following categories are considered by UOB to be shopping for the purposes of this promotion:

Where shopping is concerned, I’d much sooner use the Citibank Rewards card, which gives me 4 mpd on local and overseas shopping and doesn’t run the risk of me diverting spend for a promotion that’s already been exhausted.

Remember that UOB has a rather unusual way of defining overseas transactions. While other banks define an overseas transaction as any transaction carried out in foreign currency, UOB adds the additional requirement that the payment gateway must be outside of Singapore.

What this means is that if you were to pay US$100 through Paypal, that US$100 would be converted to its SGD equivalent and earn miles at a rate of S$1=1.4 miles and not 2.4 miles because Paypal will carry out that transaction through its Singapore-based processing gateway. Again, I find this really consumer unfriendly, because how on earth are you supposed to know where a company hosts its payment gateway?

TL;DR: I really hope UOB stops doing blind promotions, because these undermine its otherwise strong credit card portfolio (and I do like the PRVI Miles card- it’s my go-to for local and overseas general spending). I mean, people have written to the ST Forum about UOB’s promotions . And we all know that the ST Forum is reserved for only the most serious of grievances that require immediate and high profile public discourse.

Thanks to Kenneth for this tip

UOB Visa Signature – spend at least $1000 overseas and in foreign currency (same condition as above), get 4mpd (better than 3mpd) on any spend (better than this selective spend) and without registration.

This is an additional alternative to the above cards with the added extras that VS will also work on hotels and hotel dining and there are some MCCs in the shopping list above that are no included for Citi Rewards (electronics store (although can use OCBC Titanium), duty free stores, etc.).

aye. but is uob visa signature even taking new applications now?

I did like to share my experience for the UOB Visa Signature application I had two years back. They do not allow me to apply at the branch, indicating the card was de-market. But the card was still posted on their site. http://www.uob.com.sg/personal/cards/index.page. So I got home and was successful to apply it on their site, so it may still work as long as the card was listed there.

You know, I received the ‘promotion’, and dropped it in the trash after a cursory look. And I don’t regret it after reading this..

Just out of curiosity, instead of laughing and saying “This is SO UOB!” why don’t you call your MP and ask him/her to bring the matter up in Parliament? Consistently withholding information about promotions is misleading and should be made illegal. In other jurisdictions this bank would have been fined already…

“Call your MP”? You’re not Singaporean, are you?

I know what the situation is, but still they are MPs and they work for you… 😉

my MP expressly told me that any further calls would result in a restraining order.

Just to share on my experience with UOB’s “blind” promotion: I have been regularly taking part in UOB’s blind promotions but I had my doubts after an unfortunate incident this year. Somewhere in April, UOB had a “Spend S$8,000 and get $200 Ding Tai Feng vouchers” promo (limited to the first 2k or 3k customers). I had made the spending within 1 week of the promotion but after the promotion period ended, which was a few months later, I did not receive any sms or redemption voucher. I called up the call centre and the officer checked with the product… Read more »

My experience is rather similar to that of Edmund. Earlier this year, UOB had a promotion “Spend S$2,500 and get a buffet voucher at Aquamarine; spend S$8,000 and get 4 buffet vouchers at Aquamarine.” After spending the required amount, I did not get any voucher. I did not make any headway after speaking to the CSO. On another occasion, when I first receive my Privi Miles Amex, I swiped about $40k for a car. Again, I did not get a single UNI$ on a spend promotion running at that time. My personal view of such blind promotions are nothing but… Read more »

Same for me.. Clap clap.. should tag scam promotion to this. Uob and ocbc our wonderfully backward local banks..

Wow I didn’t know about the payment gateway requirement on paypal. So sneaky! So that means any Paypal account registered in Singapore should not use UOB for overseas spending? I just spend EUR 2000 on a tripadvisor booking with paypal but feel silly now.

How about Uber, Grab, Singapore Airlines, Tripadvisor Singapore for bookings made outside Singapore (e.g., Uber trip in Hong Kong or SQ flight originating in Hong Kong but booked via Singaporeair.com)? Will I only get 1.4mpd for all of these when using UOB PRVI Amex?

@Tai – if all those bookings are online you should be using dbs woman’s world mastercard, 4mpd subject to cap at 2k monthly. Gender is not a criteria for applying. After 2k switch to dbs altitude visa – 3 mpd for travel bookings up to 5k cap.

if you buy singapore airlines tickets originating in hong kong but book them from singapore, i’m pretty sure it will be processed via SG payment processor. like what tabea said, you should look at dbs woman’s world card as your first choice and altitude as second choice anyway for air tickets

“What’s interesting is that they’ve included things like supermarkets, drug stores, liquor stores and convenience stores in their definition of dining, which is a generous interpretation by any means so credit where it’s due.”

Does this apply to UOB PP AMEX as well?

This would mean DairyFarm supermarkets (i.e. Cold Storage, Giant, etc.) can qualify for 4mpd? I always find myself sad that I am unable to use UOB PP Visa to paywave my way to 4mpd at these establishments.

Or do they also earn the Smart$ thing still?

no. ppa has a diff set of rules.

Slightly off tangent, but OCBC Voyage has been offering these promotions for a while now, and each time, there are no restrictions. Additionally, their benefits have only gotten better ever since I got the card a couple of years ago. Just thought it’s worth mentioning that as it’s the only card in my whole suite that has gotten better in privileges. Every other mileage card has gone backwards. They are also the only card to waive my annual fee uninitiated (often related to spend, but spending big on other mileage cards don’t reap the same reward)

i’ve been meaning to do a new article on the voyage card in light of the krisflyer devaluation to see whether the voyage card represents better value now (all things equal it will, assuming that the voyage team didn’t devalue VMs when krisflyer devalued). any example of benefits that have been added since you got the card? i know unlimited lounge access is one of them (albeit not in the form of a priority pass, sadly)

They’ve lowered the requirement for the Complimentary Airport Limo (2x) to $3k in a month, with 3 months validity. Much better than compared to Citi Prestige which is my daily SGD card. Plaza Premium Lounge (1+1 free) is very good for Asia. Outside Asia not so much, but that’s the whole point of chasing miles – for long haul business class redemptions. The latest promo, 3 miles per dollar for Foreign Currency Spend is wonderful. No registration and valid through 31 Dec. No limitations or minimum spending. If I don’t recall wrongly, this seems to happen approx. twice a year.… Read more »

re: limo- why is $3k in a month better than citi prestige? citi prestige is 1.5k in a quarter right?

Sorry I failed to explain.. it’s not actually better in value. But it’s better overall because…. given my spending pattern hitting $3k a month between some dining and foreign currency is easy (at 2.3 miles vs 2.0). So for me it’s easy to rack 12 limos a year from OCBC Voyage (up to 24). Prestige has a cap of 8. I travel a lot for leisure (lots of weekend trips). Also, once you earn it for Voyage, it’s valid for 3 months, and they regularly update with SMSes. With Prestige you gotta keep track yourself. And then you add the… Read more »

Just to quickly echo and support what Doug said above. I’ve been a very happy user of the OCBC Voyage for a year now. When I first got it I was a little hesitant because of he three articles Aaron posted, but decided to go for it because I wanted to buy miles at 2cpm ($3K for 150K Miles promotion) and because it fits into my spending pattern (large dining spends). Yes, I knew there were other cards with better miles earning from dining like UOB, but on principle, I refuse to support a bank that has taken a mentality… Read more »

After reading some of the posts here about not getting certain benefits due to various terms and conditions, i started to wonder why this was so. The following is a layman’s take on why such exclusions like “overseas spend doesn’t include online” or “you must be the first xxxx people to be eligible” exist. Because such practices are likely a substantial contributory factor towards a higher share price. Share price is a result of profitability and dividend attractiveness (amongst other things as well of course). To increase the card-related profitability sub-line of your quarterly/annual results to support paying higher dividends… Read more »

I’ve been thinking of getting a UOB card for miles (UOB PRVI Miles MasterCard or AMEX but undecided) but it seems rather uncertain whether I’m still eligible for the 12K miles for 1st 1200 with $4K spending. Any advice?

Hi, just checking.. can the UNI$ earned on Prvi Miles card be combined with Preferred Platinum visa? or are they considered as separate bucket, like Citibank?

Thanks!

combined

Thanks Aaron!

Hi Aaron , I am wondering why you are using UOB PRVI cards for overseas spending if there is no promotion when you are still holding OCBC Voyage card? UOB PRVI card gives 2.4miles for S$ vs OCBC Voyage 2.3miles but UOB PRVI card charges 3.25% for foreign transaction fee vs OCBC 2.8%. UOB PRVI card has minimum(S$1000) and maximum(S$2000) spending amount. OCBC Voyage has no minimum or maximum amount spent and give 2.3miles for every dollar spent on all transactions. Example 1: UOB: US$100 x 1.35 + 3.25% = S$139.38 (135 x 2.4 = 324 miles) * Round down… Read more »

i dont have an ocbc voyage

i use uob visa signature for first $2k of overseas spend as SOP