CNA reported today that Singapore Airlines is planning to introduce a “blockchain-based digital wallet” for its Krisflyer program. The press release reads like a buzzword-obsessed publicist’s wet dream:

Singapore Airlines’ (SIA) Krisflyer frequent flyer miles will be “digitalised” and can be used for purchases at retail outlets in the near future, the airline announced on Monday (Feb 5).

A new Krisflyer “digital wallet app” employing “world-first blockchain-based” technology is expected to be rolled out in the next six months, SIA said in a media release.

“It will allow the extensive KrisFlyer membership base to use ‘digital KrisFlyer miles’ for point-of-sale transactions at participating retail merchants,” SIA said.

I’ll be the first to say that I don’t know enough about blockchain technology to hodl an opinion (see what I did there) about whether this is indeed a good use case (the consensus on Reddit seems to be yes, although there are many other ways you could have gone about achieving the same end). I did find this amusing though:

So I’m not going to debate the merits of using blockchain technology for the proposed Krisflyer digital wallet. What I am going to highlight is why I’m slightly concerned about the direction this is heading. To understand why I’m worried, it’s first necessary to delve a bit into the idea of “revenue based” frequent flyer programs, both on the earning and spending side.

Revenue-based frequent flyer programs, accruals side

Frequent flyer programs can either accrue miles on a distance-based or revenue-based model.

Traditional FFPs used distance-based accruals to award frequent flyer miles. In its purest form, this meant that if you flew 1,000 miles from A to B, you’d earn 1,000 miles regardless of how much you actually paid for your ticket. I can’t think of any airline that still has this model (edit: Alaska Airlines still awards 100% for all economy tickets), but US airlines used to award 100% of miles flown on all economy tickets years ago regardless of price.

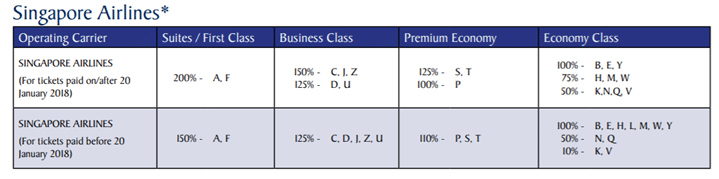

Obviously that didn’t provide much incentive for people to buy more expensive fare classes, so we started seeing hybrid systems which took into account how far you flew and how much you paid for your ticket. Singapore Airlines currently operates a hybrid system, where the most expensive buckets of economy class tickets earn 100% of miles flown, while the cheapest earn 50%.

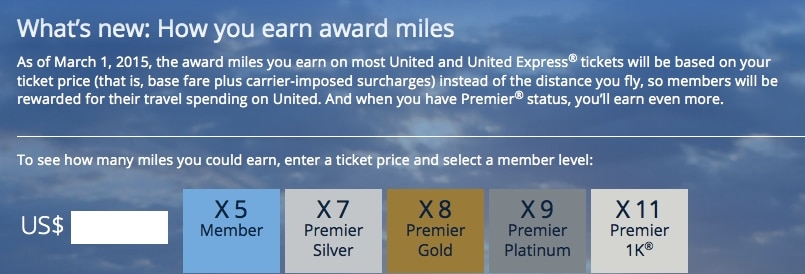

On the other extreme, you have revenue-based frequent flyer programs where miles accrued are completely divorced from distance flown. In a revenue-based program that awards members, say, 5 miles per $1 spent, someone paying $900 for a last-minute 700 mile short haul flight would earn 4,500 miles, while someone paying a highly-discounted advance purchase fare of $850 for a 3,000 mile flight would earn 4,250 miles.

The idea behind revenue-based programs is twofold: to provide people with an incentive to choose more expensive tickets, and to close loopholes that encourage passengers to do “mileage runs” where the value of the miles earned under a distance-based program is more than the actual cost of the ticket.

In reality though as Gary Leff at View from the Wing has pointed out, revenue-based programs don’t make sense because they don’t reward marginal business. Someone who buys a $900 last minute ticket is probably doing so because they don’t have a choice, and they’d have gone with your airline whether you offered 1 mile per dollar or 10. Someone who buys tickets way in advance, however, does have options and is more likely to shop around.

Singapore Airlines has made PPS qualification revenue-based, but still uses distance-based accruals for the purposes of awarding Krisflyer Elite Gold and Silver status. There’s no suggestion that Krisflyer intends to go revenue-based just yet, at least on the accruals side. Which brings me to the redemption side…

Revenue-based frequent flyer programs, redemption side

Most airlines use either distance-based (Cathay Pacific) or zone-based (Singapore Airlines) charts for redeeming miles. That’s to say, a one-way SQ business class flight from Singapore to Los Angeles costs the same as a one-way SQ business class flight from Singapore to San Francisco, notwithstanding the fact the distance flown is different. One of the implications of this is that the value of a mile differs depending on what you redeem it for.

Being revenue-based on the redemption side is a whole different kettle of fish. It means that 1 mile= X cents, regardless of what route or cabin class you redeem it for.

In reality, budget carriers have been revenue-based on the redemption side since day one. At JetBlue and Southwest Airlines, for example, one point gets you a fixed 1.3 and 1.5 cents of value respectively (if you want to be super technical it fluctuates ever so slightly).

I can’t remember a single instance of an airline that was distance-based on the redemption side switching to revenue-based (although a few have started dynamic pricing, see below), and that’s a good thing because the more astute among you will have realised that doing so means premium cabin awards immediately become unattainable.

Currently, a round trip business class ticket from Singapore to San Francisco on SQ costs 176,000 miles, give or take some taxes. That ticket costs about S$7.5K, which is how we get our value of ~4 cents per mile when you redeem a business class ticket. Now imagine that SQ adopted a revenue-based redemption program which valued each mile at 1 cent*. That same ticket skyrockets to 750,000 miles. Of course customers would be up in arms. (*SQ does offer a Pay with Miles feature that values miles at 1 cent each, but that’s for purchasing revenue tickets, not award tickets. Award redemptions on SQ are still zone-based)

So airlines, as much as they’d love to do that, can’t do so without having a riot on their hands. What’s the next best alternative? Promote miles as currency, which is what Singapore Airlines is now trying to do.

“Miles as currency”

Airlines in the States have been doing this for a while already. United lets you redeem your Mileageplus miles for food and merchandise on-site at EWR airport at around 0.7 cents each (in addition to the numerous options available for spending them online like on hotels, car rentals, magazine subscriptions, merchandise, broadway tickets, dining vouchers, inflight Wi-Fi…).

Delta lets you buy alcohol with your Skymiles at their Skyclubs at approximately 1 cent each, including champagne. Their President has gone on record saying that “we want people to be able to use those miles not to fly for free but to control your experience”. In other words, Delta’s approach is to get people to see “miles as currency”- not something you save up for a once-in-a-lifetime trip, but something you use on a daily basis for. This is the trend we see with Western airlines, and it’s telling that British Airways now talks about “spending” Avios rather than “redeeming” them.

So what is Singapore Airlines doing?

And that brings me to Singapore Airlines and their blockchain initiative. It’s clear that one of the purposes behind this (other than to see if the stock price gets a bump ala Kodak for doing some initiative remotely related to blockchain) is to encourage Krisflyer members to start seeing miles as currency and burning them more frequently.

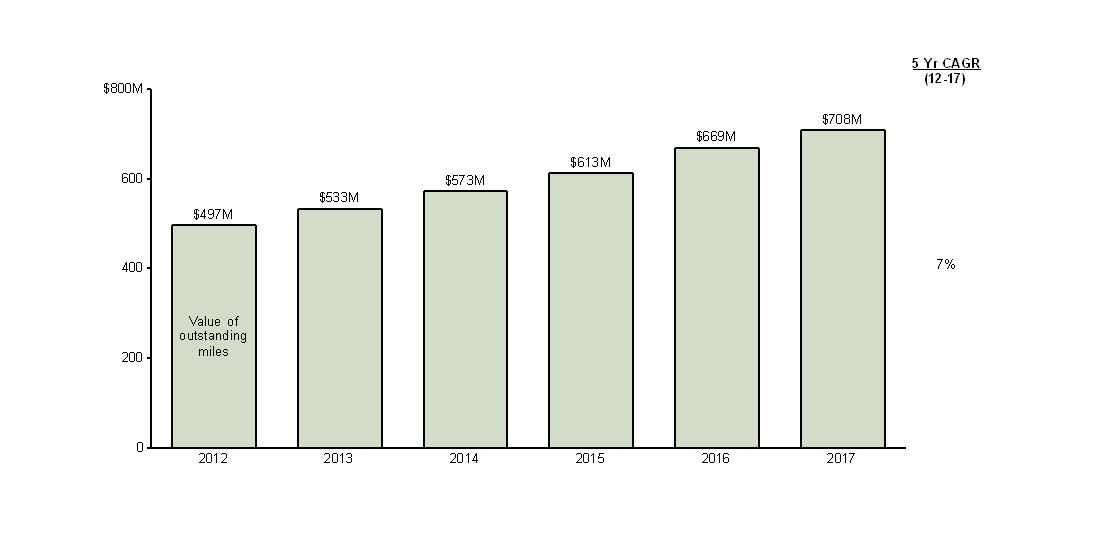

The monetary value of all outstanding Krisflyer miles to Singapore Airlines has been increasing steadily at ~7% over the past 5 years. This is all the more interesting when you consider that there have been several Krisflyer devaluations during this period which should have decreased the fair value of a mile outstanding. The fact that the outstanding liability increased means that the increase in quantity of miles issued more than offset the reduction in unit mile value.  Source: SIA annual reports

Source: SIA annual reports

That’s a lot of miles floating around the system and weighing down the balance sheet. SQ would, like every other airline, want to reduce this liability. But you can’t devalue miles too often, and flight award redemptions cost SQ money.

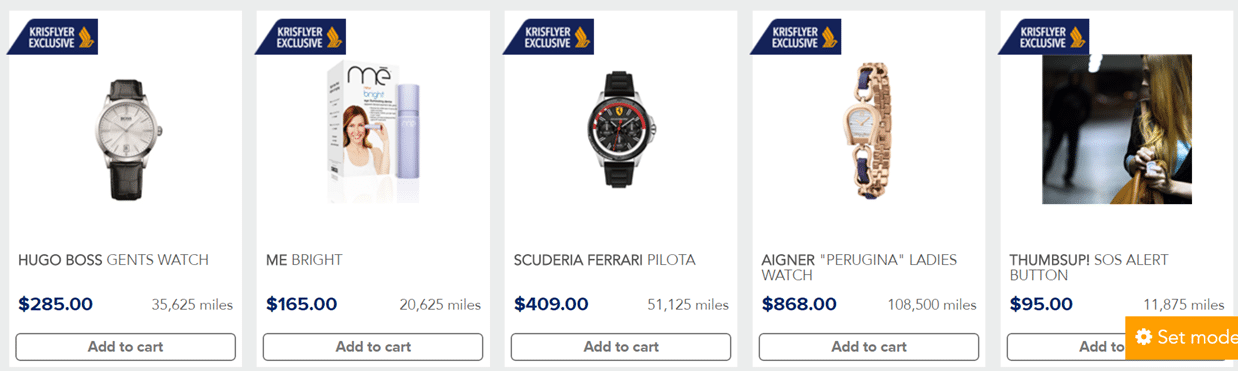

SQ could hope that the miles expire without being used, sure, but a much faster and more reliable way of reducing the liability is to create opportunities for miles to be redeemed more often, and at lower values.

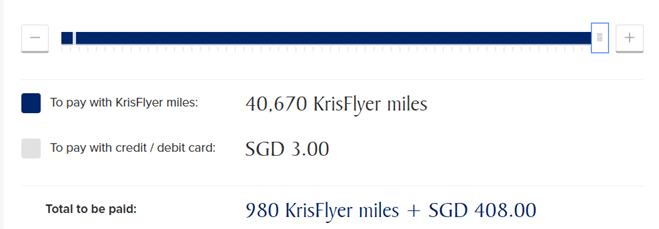

That’s why SQ started the “Pay with Miles” program that lets you redeem your miles at roughly 1 cent towards the cost of a revenue ticket. It’s why you can redeem your Krisflyer miles for merchandise at the KrisShop store (0.8 cents), or for Scoot vouchers (0.95 cents).

Krisshop Pay with Miles option: 0.8 cents per mile

Krisshop Pay with Miles option: 0.8 cents per mile

What do these options have in common? They’re all universally poor value for your miles. Even if you were to redeem economy awards, you’d get about 2 cents per mile, way more than what’s on offer through non-flight options. So while the value of Krisflyer miles spent through the Krisflyer digital wallet has not been announced yet, I can already tell you that it’ll be pretty poor, perhaps around 1 cent each at most.

Why am I worried?

You could rightly point out that no one is forcing me to use the Krisflyer digital wallet, nor redeem my miles for Scoot/Krisshop/Pay with miles options. If you believe that award tickets are the best use of miles, then it’s just the status quo for you no?

Yes and no. Although I’m all for having more ways to use Krisflyer miles, I don’t want it to be at the expense of the one thing I firmly believe miles should be used for: redemption for premium cabin award tickets.

The fact is that what we’ve seen from elsewhere in the world is a move towards “miles as currency” invariably means devaluations on the award ticket side too. In a worst case scenario, we get “dynamically-priced” awards which move in tandem with revenue ticket prices. Delta started this trend. United copied it somewhat. Malaysia Airlines has done it. Air France KLM has begun to price dynamically. British Airways plans to move in this direction from 2018. In some cases, this leads to just flat-out crazy award prices, as experiences with American Airlines over Thanksgiving showed.

I think we’re still (hopefully) a long way away from that with Singapore Airlines and Krisflyer, but moves towards “miles as currency” tend to be a harbinger of dynamic pricing down the road. And make no mistake- if SQ does start dynamically pricing awards in the future it will be very, very bad for frequent flyers.

Could this benefit any customers? Well, if you travel very, very infrequently (and don’t earn miles through credit cards because you like self-harm, My Chemical Romance, and cashback cards), then this might be good for you. You’ll have ways of cashing out smaller Krisflyer balances without having to accumulate enough miles for a flight, and some (inferior) value is better than letting the balance expire.

To sum it up, I believe that SQ is starting to explore “miles as currency” and we’re going to start seeing many more ways of using our Krisflyer miles for non-flight options at inferior valuations. Whether or not this will eventually lead to dynamic pricing, I don’t know, but in the meantime I’d strongly urge you to continue viewing your miles as a tool for accessing premium cabins you wouldn’t otherwise be able/willing to spend money on, and leave other options for the less informed.

for a start, KF miles should become harder to accrue for those not living in Singapore — because TY, UR, MR, & SPG points can all be converted to KF miles (the only airline that allows transfers from all four), SQ is basically giving them away to US residents; singapore credit card points are difficult to convert to UA, AA, DL, etc., miles, so it doesn’t work the other way around. i miss the good old days and wish SQ would stop being promiscuous — especially if the liability is as high as you say

My feeling is that they should increase the redemption rates from foreign sources like SPG transfer and other foreign cards especially America. Points just come by too easily for them and this weighs down on SQ and punishes those who really earn through flying.

After all SQ is our national airline, we do not need fancy reviews from people who fly just using miles and points they didn’t earn.

I’d agree in the sense that SQ is now trying to “cheapen” the perception of KF miles. If you lower the bar for “redemption” then you loosen the balance sheet and let members use up their miles with reckless abandon. It makes me think that SQ has started to (if not long before) veer in the wrong direction. They might be taking this “digital initiative” the wrong way.

I know people here like to blame people in the US for their inability to redeem anything, but is that really the case? People in the US have a lot of choice as to who they fly with and where they want to go. SQ only flies to 4 cities in the US, which are well served by almost every other airline internationally. And I haven’t even considered the fact that most Americans try to remain loyal to one of their own crappy airlines not just because their network is more useful if you live in the US, but also… Read more »

to add insult to injury, SQ charges fewer miles than UA on several routes (e.g., US-Europe, F class domestic, mainland-Hawaii, maybe there are more) … so it’s not just the 4 cities you mention that are relevant for KF miles. by your logic, UA/AS/DL/AA miles should be harder to collect for those in the US than in other parts of the world — but that’s not so. looks to me as though SQ for some mysterious reason is favoring flyers who don’t live in singapore

My point is even if it is easier for Americans to collect miles doesn’t mean it results in Americans hogging award space, because they are so far away. So it shouldn’t matter if it’s easier for Americans to collect or redeem miles because there are so many alternatives and reasons not to fly SQ there.

I suppose there is a secondary point which is whether SQ owes it to us as our national airline to make their tickets easier to redeem. I’m not sure our constitutional rights extend quite so far.

Airlines introduced mileage programs in an era when most tickets were sold through TAs and systems were not wired to track revenues collected from a specific ticket. And we thrived on the arbitrage opportunities it accorded us. I would imagine if loyalty programs were introduced today, it would be entirely revenue based. 1 point per dollar spent (more if you’re more loyal), and it gets you x cents off on your next flight, with occasional promotions etc. They may still need to call it points/miles/bananas/chips rather than stating actual $ value credit, lest your employers who’re paying for your tickets… Read more »

Really like the way you’ve put this. Agree that if loyalty programs were conceived today they’d be very different. Off topic but I was surprised to read SQ’s annual report which said krisflyer started in 1999. That can’t be right, can it? Or maybe they mean some other ffp existed before that

The frequent flyer program was known as Passages.

Passages, Asia’s first frequent flyer program, was a joint venture FFP between Cathay Pacific, Malaysia Airlines and Singapore Airlines. It ended on Jan. 31, 1999.

Oh this is so cool! Didn’t know about it. Would love to do a retrospective article if I can find the info – https://www.flyertalk.com/forum/passages/78515-krisflyer.html

Mr Huang said the introduction of KrisFlyer means that SIA’s Economy Class has been completely upgraded in all respects. “Now, our Economy Class passengers are not only offered more comfortable seats and served champagne on board, but can enjoy these frequent flyer rewards as well,” he said.

Economy had champagne once upon a time?

If I remember correctly, Passages was a mileage program, but status was gained only in premium classes via the PPS program. When CX, SQ and MH decided to go their own ways, CX retained the same structure (mileage program separate from status program) with Asiamiles and Marco Polo Club (though you could earn status flying Y class). SQ on the other hand, ended up with a slightly more messy arrangement with PPS and KF, where you could earn status on both, but the former was restricted to premium classes only.

SQ is in a trajectory of sweating every cent out of whatever they can find albeit chicken out of the credit card charge and opt in insurance. They will lay their fingers on krisflyer because it is a cash cow and in their opinion, there are so much to sweat.

Changi handled 62 million passengers in 2017 and SQ barely got 1/3 of it. They are simply too myopic in trying to sweat the 1/3 while taking their eyes off the other 2/3.

[…] Wong over at Milelion does a great analysis of SIA’s move from the perspective of a frequent traveller, saying that the increasing the […]