So it’s Chinese New Year. You’re at your relatives’ place. Everyone else is pigging out on pineapple tarts, comparing their children’s academic performance (“it’s been so hard for my daughter this year because she’s had to choose between Harvard, Stanford, and Yale. That’s too much pressure for someone her age!), and asserting that they and they alone know the one solution to all strife, foreign and domestic.

But not you, oh no. Because you, valued Milelion reader, have a sacred duty to do this CNY. You’re going to bring at least one relative who is walking in the abject darkness of cashback into the promised land of miles. Singsaver reports that most Singaporeans find cashback to be the “champion benefit” influencing card choice, so by golly we’ve got a lot of heathens to convert!

In the spirit of the season, here’s your guide to breaking down common objections to making the switch from cashback to miles.

“But cash is king!”

Well, yeah, sure.

Suppose you were walking down the road and saw a 50 cent coin and a gold bar. Would you go for the 50 cent coin? Of course not. It’s all about relative value. That’s the problem with sticking to the mantra “cash is king” and not thinking about whether the cashback earned through cashback cards is worth more than the miles foregone by not using miles cards.

Even if you take a very conservative valuation of 2 cents per mile, the best general spending cashback card (AMEX True Cashback/ SCB Unlimited Cashback @ 1.5% on everything) is inferior to the best general spending miles card (UOB PRVI Miles @ 1.4 mpd (2.8%) on everything). And when it comes to specialized spending, it’s hard to beat the effective rebates offered by 4 mpd (8%) points/miles earning cards (the best cashback cards max out at around 6-8%, but keep in mind that they have minimum spend requirements and caps on your upside, as we’ll see below).

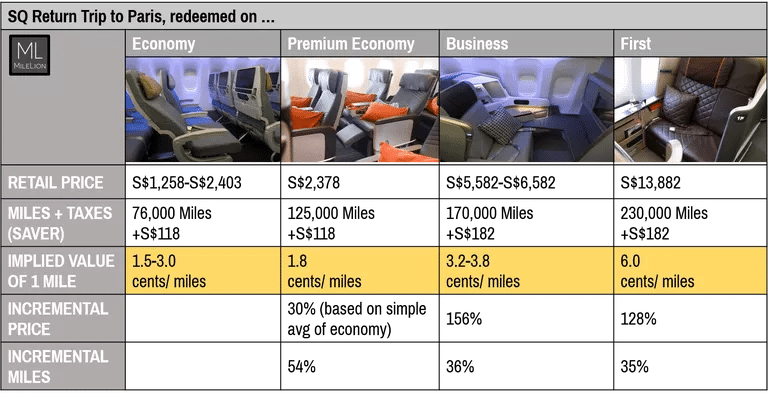

If your relatives ask you how you get 2 cents per mile, you could refer them to the table below:

If they still harp on about cashback cards being “better value”, ask them this: have they ever paid an annual fee on a cashback card? Have they stopped to think about how absurd it is, conceptually? Paying an annual fee on a cashback card puts you in a net negative position, and you spend the rest of the year just trying to work your way back to zero.

The best way to illustrate this is with the American Express True Cashback card- at a 1.5% cashback rate with a $171.20 annual fee, you’re looking at spending $11,413 just to get back to zero.

Yes, annual fees can be waived, but at least with miles cards, you’re hedged against either eventuality. Spend enough to get a fee waiver? Great. Don’t spend enough? Not to worry, your annual fee at least buys you miles, eg 10,000 miles for paying the $192.60 annual fee on the DBS Altitude Visa.

“But XYZ card earns up to (insert random high % here) cashback!”

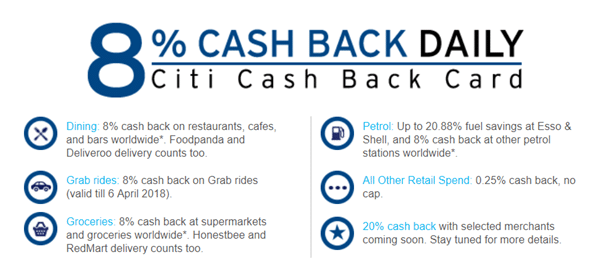

Cashback cards have big attention-grabbing earning rates. Like the Citibank Cashback card, which leads with an 8% cashback headline:

The response to this objection is to ask them about minimum spending. The Citibank Cashback card requires you to spend a minimum of S$888 each month. Spend S$887.99? You earn 0.25% cashback on everything. So unless they confirm plus chop will hit the minimum spend, they’re playing a dangerous game. With cashback, minimum spending requirements are the rule rather than the exception. With miles cards, it’s the other way round. For example, the UOB PRVI Miles card earns you 1.4/2.4 mpd on local/foreign spend regardless of how much you spend.

The minimum spending requirements with cashback cards also make it difficult to employ a best of breed strategy. Ask them about what they’ll use for spending on things other than dining, Grab rides, groceries and petrol. What about shopping? Taxis? Buying cinema tickets? Phone bills? If they say something like, “oh, I’ll use the OCBC 365 for 3% off online shopping and phone bills, the FRANK card for 5% off movie tickets, and the Maybank Family and Friends card for 8% off taxis” (they won’t), remind them that the minimum spending requirements on cashback cards means they can’t pick and choose like that. Miles cards? No such problem. Cherry pick the best card depending on the situation (don’t overdo it though, or you’ll end up with a situation like this).

Then ask them about caps. That bonus cashback on the Citibank Cashback card for dining, Grab rides, groceries and petrol? It’s capped at S$25 per category per month. General spending miles cards do not have caps. It’s true that some specialized miles cards do have caps, but the cap is a much, much higher rebate than cashback cards. For example, the DBS Woman’s World Card caps your 4 mpd on online spend at S$2,000 each month. That’s 8,000 miles, or S$160 of value- much higher than any cashback card I’ve ever heard of.

“But I don’t spend enough to earn miles!”

Many people unfortunately believe that miles cards are only for high spending experienced professionals with expense accounts who can funnel tens of thousands of dollars a month through their personal cards. That helps, of course, but it’s also a common misconception. You don’t need to spend big to chalk up a miles balance- you need to spend smart.

Show them how a monthly spending of $1,500, carefully placed on the right cards, could get them a round trip business class ticket to Shanghai within a year. For example-

- Online transactions (movie tickets, plane tickets, Uber, Lazada, Redmart): DBS Woman’s World Card @ 4 mpd

- Groceries: OCBC Titanium Rewards w. Mobile Payments @ 4 mpd

- Dining: OCBC Titanium Rewards w. Mobile Payments @ 4 mpd

- Everything else: DBS Altitude/UOB PRVI Miles @ 1.2/1.4 mpd

Or just show them this and in a Lion King-esque voice tell them “one day this will all be yours”:

Remind them that there are many other ways to turbo-charge their miles balances through double dipping opportunities. Introduce them to Mileslife, show them Kaligo, cue them in on Grab Rewards or Chope, or any of the other merchants that does transfers to Krisflyer.

If anything, given the minimum spend requirements on cashback cards, you might not spend enough to earn cashback in some cases!

“But redeeming miles is complicated and there’s never any space!”

The inability to secure an award ticket on SQ for a particular date and route is no doubt frustrating, and many people who switched from miles to cashback cite this as one of the key reasons.

But there’s big, big world beyond SQ. Now that Krisflyer partner awards can be redeemed online, it’s easier than ever to find alternatives to get from A to B. No award seats on SQ to Japan? Why not try ANA? Or a one stop through BKK/TPE with Thai/EVA? (that is, assuming that Krisflyer has finally worked out all the problems with their online partner awards redemption…)

And lest we forget, almost every bank in Singapore supports points transfers to both Krisflyer and Asiamiles at the same rate. Why not try out Cathay, or one of their oneworld partner airlines?

Some of your more annoying relatives may ask questions like “I’ve never flown on (insert name here) airline before, is it safe?” You could be really passive aggressive and tell them there’s a higher risk of them dying from the bak kwa they’re shoveling down, or you could point them to the vast body of evidence and statistics that flying is one of the safest things you can do. A much more valid question is “what is the inflight experience on (insert name here) airline like?” to which you can point them here.

Conclusion

Are there some insurmountable objections? I suppose if someone says “but I barely travel and when I do I only fly budget airlines”, that’s a pretty tough wall to climb. I might try to remind them that miles and points cards don’t necessarily mean you have to fly (because your DBS Points/UNI$ etc can be redeemed for shopping vouchers etc), but this is a generally weak argument because the conversion rate to non-mile things is pretty bad. Fortunately, the vast majority of Singaporeans love to travel, and even if you’re only an occasional long haul flyer then miles can still work for you.

So go forth this CNY armed with this guide, and save your loved ones from a fate worse than death! 50 Milecoin (it’ll be worth more than gold one day y’know) to whoever shares the best “convert a heathen” story below.

But why on earth would I want more competition for limited award space?

BECAUSE YOU LOVE THEM.

On the argument there’s never enough space… it doesn’t really address the issue of NOT being able to book premium cabins with SQ. I mean, you can only book premium cabins on long flights with KrisFlyer that’s why you aim to earn with their program in the first place.

I’ve been having the OCBC TR and Voyage for some time now. OCBC called me recently to have me take up a third card, a cashback one! I told them, I don’t want cashback, I want miles. Then there was this long awkward silence…

There we go again on the miles vs cashback argument. You make good points – many choose cashback cards without really understanding the miles cards – BUT: 1. Stop using the bogeyman of paying annual fees on cashback cards. That cheapens your argument. I’ve held cards (miles and cashback) from ALL card issuing banks in Singapore (except OUB, which got swallowed by UOB) over the last 17 years. That’s a lot of cards. I’ve not paid a single dollar in annual fees. It used to be harder – you needed to call and wait to speak to a CSO to… Read more »

these are excellent points. i think what i’m saying is that if you’re the sort who doesn’t actively seek to get annual fees waived (forget, paiseh, don’t know it’s possible <- you'd be surprised how many people fall into this category), then at least with a miles card you're hedged against either eventuality. i mean there must be a reason why banks still opt to put an annual fee on cashback cards- they're assuming at least some people will pay them, and if you do then you’re immediately in the position i described above.

Question is whether the number is higher than the number of people who let their miles expire (either when they were in the points stage with the bank or in the miles stage with the airline). Don’t get me wrong. I understand where you’re coming from but we need to put this miles vs cashback debate to rest as it’s not a proper debate. We need to ask ourselves a set of questions to arrive at our personalized “value per mile”. If it is greater than S$0.0125, then you should choose miles cards – and Aaron’s recommendations are spot on.… Read more »

Also, for cashback cards, a dollar is a dollar. For miles, it’s really only worth it for J class and above and frankly, the novelty or “value” of taking biz class wears off after x number of trips.

Tbh cashback calculation is way easier than miles calculation.

To present it in the reverse makes it a very hard buy to anyone not in the miles game.

Hey Aaron,

Love the website…..good to see the Asians are cashing in as miles bloggers as well…..Singapore is one of my favorite locations as short hop from Perth

I still prefer cashback actually as there are no orphan miles and a cashback is always “fully ” redeemed.

Having said that, cashback rates have been reducing across the board with increasing restrictions .

So as of now, I would be indifferent between the 2.

“But I don’t spend enough to earn miles!”

“Show them how a monthly spending of $1,500, carefully placed on the right cards, could get them a round trip business class ticket to Shanghai within a year. ”

I spend less than $500 a month on my cards – so I guess I’m outta the miles game then?

What type of cards should I be using?

well….it’ll just take you longer. have a read of this post to know what cards you should be using.