One of the great trends we’ve seen over the past five years is what I call the “democratization of the miles card”. When cards like the DBS Altitude, UOB PRVI Miles and Citibank PremierMiles launched years ago, they all required a minimum income of $80,000 to qualify. That put them out of the reach of many fresh university grads, who then fell prey to the evil armies of cashback.

But where credit cards are concerned, any income requirement above $30,000 is purely arbitrary. And over time the banks decided that the faux exclusivity of an artificially high income requirement was outweighed by the benefits of signing up more customers.

The DBS Altitude card went from $80,000 to $50,000 to $30,000 in March 2016. UOB PRVI Miles followed suit, with all three versions of its card adopting a $30,000 income requirement in April 2018. This left Citibank as the odd man out, as its Premiermiles Visa card had a $50,000 income requirement, and the Premiermiles AMEX a $80,000 income requirement.

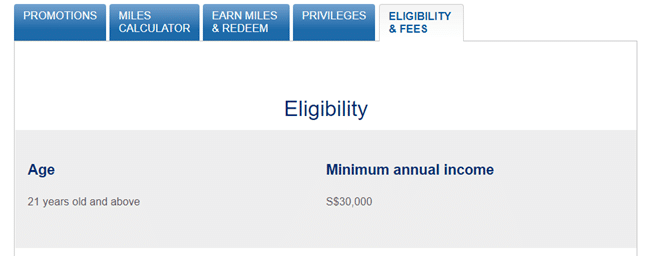

Well, Citibank has finally blinked, and as of today, the Citibank PremierMiles Visa card’s income requirement has been reduced to $30,000. That’s great news for people who want to earn something other than KrisFlyer or Asia Miles, given that Citibank partners with those plus:

- British Airways

- Etihad

- EVA

- Flying Blue

- Garuda

- MAS

- Qantas

- Qatar Airways

- Thai Airways

- Turkish Airlines

If you are signing up for a PremierMiles Visa card, do note that Citibank points do not pool. That’s to say, if you already hold a Citibank Rewards card or a Citibank Ultima card, your points will remain in separate silos. Do keep that in mind, as it means having to pay multiple conversion fees when cashing out.

Also remember that spending with Apple Pay on the Citibank Premiermiles Visa will net you 4 mpd up till 31 July 2018, with no cap. It’s not the best option (just using the Citibank Rewards card would get you 8 mpd, with no cap), but it’s good to know anyway.

The Citibank PremierMiles Visa earns 1.2 mpd on local spending and 2.0 mpd on overseas spending. You can earn 7 mpd at Agoda, 3 mpd at Expedia and 10 mpd at Kaligo. Paying the annual fee of S$192.60 (which is waived for the first year) nets you 10,000 miles. Citi Miles do not expire (although once you transfer them to your preferred FFP then the expiry policy of that FFP becomes applicable).

If you’re curious about how the Citibank PremierMiles card can fit into your overall miles accumulation strategy, do consider attending our upcoming workshop that lays out the basics of miles earning and burning in a structured and easy-to-understand format!

[credit_card_shortcode cc_id=”21823″]

f*** I just got rejected when I tried to apply a month ago, due to not meeting the 50k requirement

Second time’s the charm?

I’ve gotten myself an amex KF since then, thanks to a referral from a friend and somewhat generous welcome offers.