The Citibank PremierMiles Visa card hasn’t had a sign up offer for a while now, but Citibank has just launched a new sign up promotion for customers who apply from now till 31 October 2018.

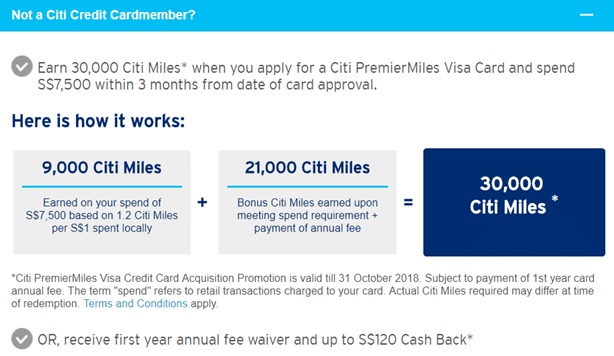

Here’s a breakdown of the offer:

Here’s a breakdown of the offer:

To summarize- if you get the Citibank PremierMiles Visa card, pay the $192.60 annual fee and spend $7,500 within 3 months of acquiring the card, you’ll receive 30,000 miles in total. That’s broken down as follows

- 9,000 base miles from spending $7,500 @ 1.2 mpd

- 10,000 miles for paying the $192.60 annual fee

- 11,000 bonus miles for meeting the spending conditions

As you can see, the “real” bonus is 11,000 miles, as you could earn 20,000 miles anyway simply by making the spend and paying the annual fee.

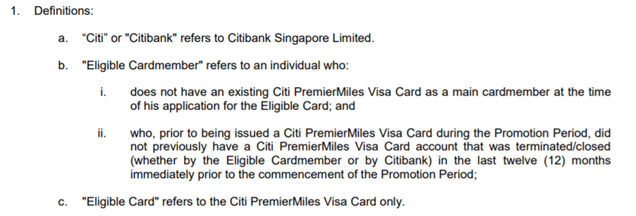

Confusingly, the T&C seem to suggest that this offer still applies to you if you held any card other than a PremierMiles Visa in the past 12 months, but based on the phrasing of the website (Not a Citi Credit Cardmember?) my interpretation would be that this offer is only for new to bank Citibank cardholders.

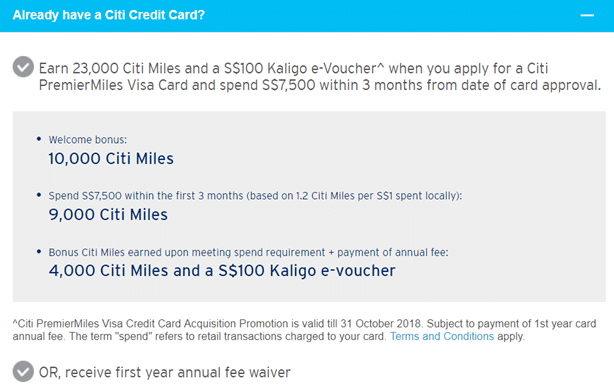

If you’re an existing Citibank cardholder, you qualify for the second offer:

When you pay the annual fee of S$192.60, you get the 10,000 miles as per normal, with the same 9,000 base miles upon spending $7,500. The true bonus you earn is 4,000 miles and a $100 Kaligo e-voucher. Kaligo can be a great way of earning more miles on hotel stays, but you need to be very careful here as rates may be higher than those you’d find on OTAs, negating any benefit from additional miles. You can find the T&C for this promotion here.

How does this compare to Citibank’s past sign up offers? Earlier this year, Citibank ran a sign up bonus for the PremierMiles Visa card which had a “spend $10,000 get 42,000 miles” headline.

Here’s how that promotion was broken down:

- 12,000 base miles from spending $10,000 @ 1.2mpd

- 10,000 miles from paying the $192.60 annual fee

- 5,000 bonus miles from making a first spend of any amount

- 15,000 bonus miles for meeting the spending conditions

In other words, the “true bonus” was 20,000 miles, but remember you had to spend $10,000 to get this. In contrast, the bonus is now 11,000 miles, but requires $7,500 spending.

Your $7,500 of spending does not include the following types of expenses. I’ve highlighted a few I think you should be aware of:

(i) annual fees, interest charges, late payment charges, GST, cash advances, instalment/easy/extended/equal payment plans, preferred payment plans, balance transfers, cash advances, quasi-cash transactions, all fees charged by Citibank or third party, miscellaneous charges imposed by Citibank

(ii) funds transfers using the card as source of funds;

(iii) bill payments (including via Citibank Online or via any other channel or agent);

(iv) payments to educational institutions;

(v) payments to government institutions and services (including but not limited to court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases);

(vi) payments to insurance companies (sales, underwriting, and premiums);

(vii) payments to financial institutions (including banks and brokerages);

(viii) payments to non-profit organizations;

(ix) betting or gambling (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel;

(x) any top-ups or payment of funds to payment service providers, prepaid cards and any prepaid accounts;

(xi) transit-related transactions; and

(xii) transactions performed at establishments/businesses/merchants that fall within an excluded Merchant Category or a merchant that has been excluded by the bank

Citibank points do not pool, which is to say that if you’ve accumulated a large chunk of points from the just concluded Citibank Apple Pay 20X promotion on your Citi Prestige or Citi Rewards card, those points won’t be pooled with your PremierMiles. On the plus side, Citibank has the widest selection of partner airlines available to any bank in Singapore, which includes some pretty useful FFPs like Etihad Guest, as well as British Airways Avios.

Finally, Citibank has cut the income requirement of the PremierMiles Visa from $50,000 to $30,000 earlier this year, making the card accessible to anyone who is eligible for a credit card.

[credit_card_shortcode cc_id=”21823″]

(x) any top-ups or payment of funds to payment service providers, prepaid cards and any prepaid accounts.

– Would this mean that using the card for ipaymy / cardup will not count as qualifying spend?

I hope they get back the offer they had for Citi Prestige last year – 80k miles for $10,000 spend in 3 months

Agree. Miss that one too

Wasn‘t it 20k spend?

Would paying SP bills count towards the $7500?

[…] the current offer from Citibank, this sign-up bonus offer from DBS does not require the payment of the annual fee when you first get […]

[…] in August, Citibank launched a new sign up offer for the PremierMiles Visa card which awarded customers 30,000 miles for signing up, paying the […]