IHG is currently running a points sale where members will be able to get up to a 100% bonus on all purchased points. This new sale from IHG Rewards Club will run from now until 11:59 am 1 November 2018 Singapore Time.

Check your IHG Rewards Club account to view your targeted bonus

In this points sale, the bonus that each IHG Rewards Club member will receive is unique to their account. My IHG Rewards Club account got targeted for an 80% bonus on all purchased points but Ben from OMAAT got targeted for a 100% bonus. So be sure to check your IHG Rewards Club account to view your bonus.

You are allowed to purchase 100,000 IHG Rewards Club points per calendar year pre-bonus on your account. In this promotion, the bonus amount is tiered to how many miles you purchase. Here’s the bonus you will receive on purchased points if you were targeted with an 80% bonus:

- 5,000 – 14,000 IHG Rewards Club Points – 40% bonus

- 15,000 – 19,000 IHG Rewards Club Points – 60% bonus

- 20,000 IHG Rewards Club Points and above – 80% bonus

Purchasing IHG Rewards Club points at an 80% bonus will lead to a cost per point of US 0.55 cents per point. Which isn’t that bad given that the lowest publicly available price you can purchase IHG Rewards Club points for is US 0.5 cents per point.

Should I be buying IHG Rewards Club points?

If my account had been targeted with a 100% bonus, I would most definitely consider purchasing IHG Rewards Club points. Especially so with the ongoing PointBreaks promotion where if you put your purchased points in redeeming a PointBreaks hotel, you can possibly get a night for as low as USD25 per night at some properties.

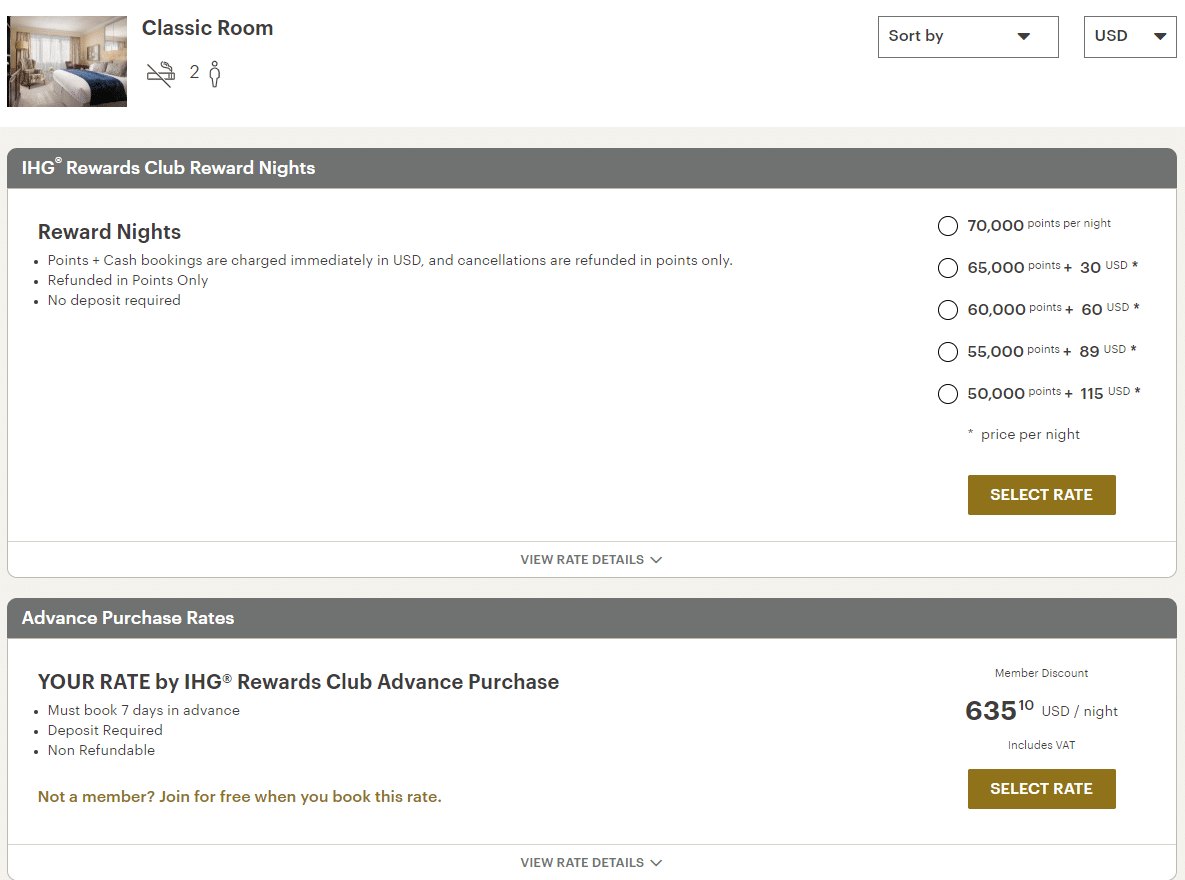

Purchasing IHG Rewards Club points is a great way to experience properties you would not have normally paid cash for. Take for instance the InterContinental London Park Lane, a paid night goes for about USD635 after taxes which is frankly not a price I’d normally pay. While a night on points goes for 70,000 IHG Rewards Club points per night. If you had purchased points at an 80% bonus, you are only paying an effective rate of USD385 which is much more palatable, that is about 40% cheaper than paying the cash rate. If you have purchased points at a 100% bonus, this will lower the cost of a night to USD350.

What’s more, rooms booked using IHG Rewards Club points enjoy more flexibility as they can be canceled at up to 24 hours before arrival at no charge as compared to the Your Rate rate which is generally a non-refundable rate. However, cancelation policies of rooms booked with IHG Rewards Club points might vary from hotel to hotel so it’s best that you check the cancelation policies before making your points booking.

Concluding Thoughts

IHG Rewards Club frequently holds sales on purchased points so you don’t have to worry if you are thinking of giving this sale a miss. However, if your account was targeted for a 100% bonus I would suggest that you might want to purchase some points for yourself if you have an upcoming hotel stay in mind at IHG properties. That is if you have not purchased IHG Rewards Club points previously.

If you are unsure of which cards to use to maximize your points returns from purchasing IHG Rewards Club points, you can refer to the table below. IHG Rewards Club points purchases are processed by points.com in USD.

| Credit Card | Miles Per Dollar (mpd) | Bonus Spend Criteria/Cap |

| BOC Elite Miles | 5.0 | 5.0 mpd earn rate is valid until 31 Dec 2018. |

| DBS Woman’s World Card

Citibank Rewards Card |

4.0 | DBS Woman’s World: capped at S$2,000 per calendar month. ‘Points.com’ transactions do not earn 10X automatically, you must call in for a manual adjustment of points for all transactions made on ‘points.com’Citibank Rewards: capped at S$1,000 per statement month for 10X transactionsUOB Visa Signature: minimum spend of S$1,000 in equivalent Foreign Currency Transactions (FCY), capped at S$2,000 equivalent spend in FCY |

| Standard Chartered Visa Infinite | 3.0 | Minimum spend requirement of S$2,000 is required per statement cycle. |

| Standard Chartered Rewards+ | 2.9 | Capped at 20,000 bonus points per card anniversary year. i.e S$2,222 in FCY equivalent |

| HSBC Revolution | 2.0 | No cap/minimum spend criteria |

Hi Matthew, I plan to book the London Parklane as mentioned above for 3 nights. But it means I need 210,000 points. But the max I can buy at this promo is 200,000. Any advice on how I can make up the difference? Would my wife be able to create an account to make a booking?