One great development we’ve seen in recent times is the introduction of services like Cardup and PayAll that allow you to earn points when paying bills with credit cards. There’s a fee involved, obviously, but it still represents an opportunity to buy miles at a much cheaper price.

RentHero is a new platform that facilitates rental payments between landlords and tenants. There’s normally an admin fee of 2.25% per transaction, but they’re now offering Milelion readers a special discounted fee of 1.9% for all transactions made within 12 months of signing up.

Sign up for RentHero via this link to enjoy the 1.9% transaction fee

*sign ups via this link earn The Milelion a referral bonus*

Note that it’s not “12 months from now“, it’s “12 months from signing up“, so if you signed up in, say, June 2019, your discounted fee would be valid till June 2020.

All RentHero transactions are secured by AES-256 bit encryption, and the platform is PCI-DSS compliant. Rental payments made to RentHero are held in a separate bank account from operational funds.

For comparison’s sake, here’s how RentHero’s fees measure up to other options in the market:

| Platform | Admin Fee | Remarks |

| Cardup | 2.6% | Occasional 2.2% discounted fee offered via eDM |

| ipaymy | 2.25% | Targeted 1.99% offers periodically sent out via eDM |

| Citi PayAll | 2% | Certain customers have been targeted for 1.5% |

| RentHero | 1.9% | Available for all payments for 12 months |

The limitation with RentHero is that it only supports rental payments, so you can’t use this for education, insurance, condo, income or property tax payments. That said, if you’ve got rent payments to make, this is the lowest publicly-available fee in the market.

RentHero currently only accepts Singapore-issued Visa and Mastercards, although AMEX will be offered soon. There is no need for your landlord to register with RentHero- they’ll receive their payments through a bank transfer.

How much does it cost to buy miles through RentHero?

Milelion readers can get a discounted 1.9% admin fee through RentHero for a 12 month period from when they sign up, and earn miles on a number of general spending cards. Unfortunately, no 10X opportunities are available for RentHero payments, but the low 1.9% fee can offer good value even with general spending rates.

Here’s a summary of the cost per mile for various cards:

| Card | MPD | Cents Per Mile |

DBS Altitude Visa |

1.2 | 1.55 |

|

|

1.25 | 1.49 |

UOB PRVI Miles  SCB Visa Infinite (>$2K per month)  UOB Visa Infinite Metal Card |

1.4 | 1.33 |

BOC Elite Miles World Mastercard |

1.5 | 1.24 |

UOB Reserve  DBS Insignia |

1.6 | 1.17 |

*Citi and OCBC do not award points for rental payments, therefore their cards have not been included here

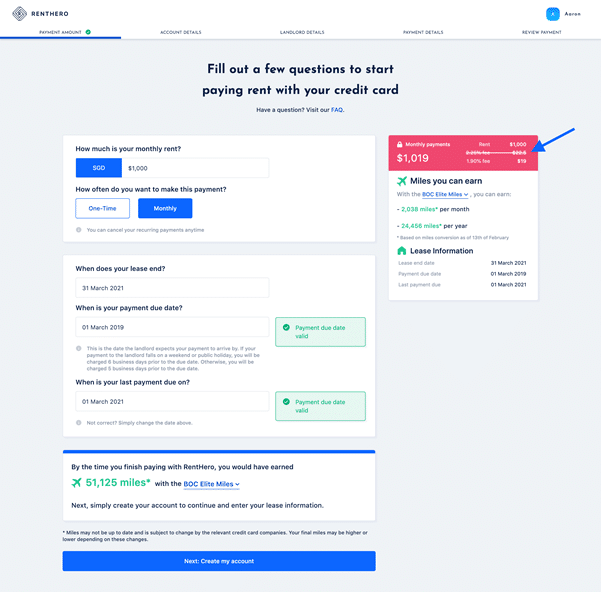

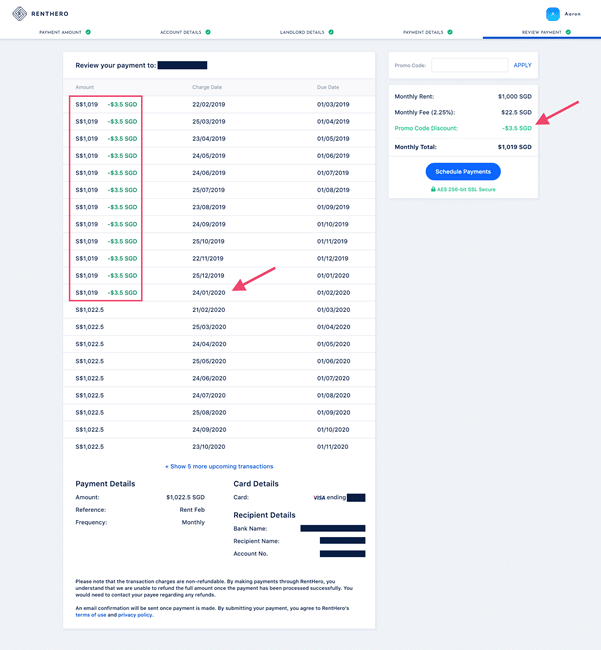

If you made a $1,000 payment with a card like the BOC Elite Miles World Mastercard, for example, your total transaction of $1,019 ($1,000 + 1.9% fee) would earn 1,529 miles. This represents a cost of 1.24 cents per mile, one of the lowest rates for buying miles in Singapore.

How to make a payment with RentHero

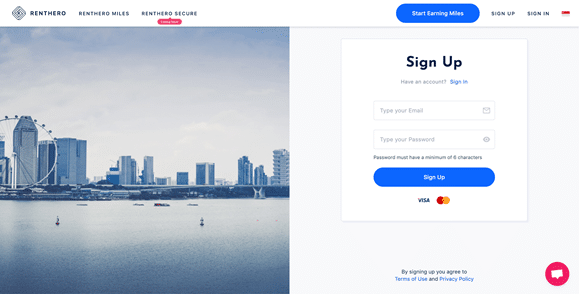

Here’s a quick guide to getting started with RentHero. You can only access the 1.9% admin fee by signing up through The Milelion’s link. Once done, you should be directed to this sign up page.

After signing up, you’ll receive an email with your 1.9% promo code. This is for future transactions- your first transaction will in any case reflect the discounted 1.9% rate already. There’s no limit to the number of transactions you can make with your 1.9% promo code.

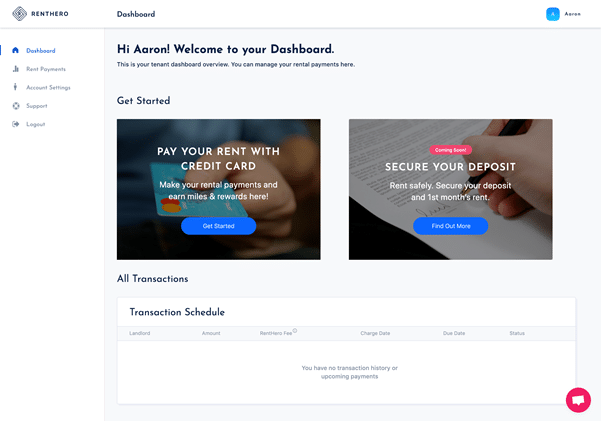

You’ll see your dashboard after that. Click on the “Get Started” box to pay rent with your credit card.

You’ll be prompted to enter your monthly rental amount, and whether you want to make a one-time or monthly payment. You should see the discounted service fee of 1.9% automatically on the top right of your screen.

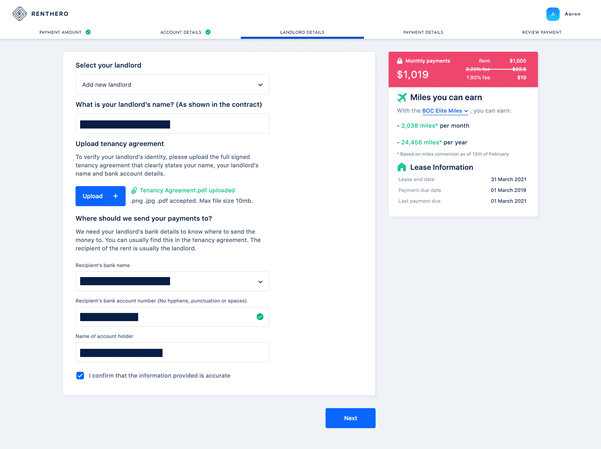

Follow the instructions to create and activate your account. Once done, you’ll be brought back to the RentHero platform where you’ll enter your landlord’s details and upload the tenancy agreement.

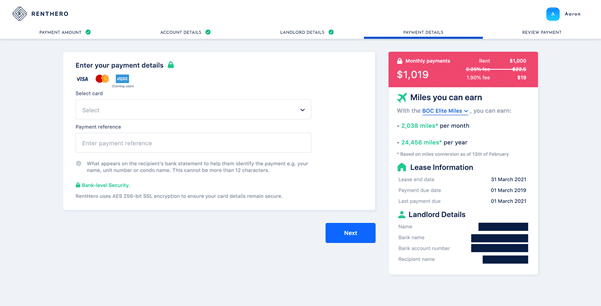

The final step is to enter your credit card details.

That’s it! You’ll see a summary of your scheduled rental payments. Be sure to double check that the 1.9% admin fee is properly reflected. If the first rental due date is the earliest possible date that can be chosen on RentHero, payment will be charged immediately. Otherwise, payments are charged at 2pm on the charge date.

You can subsequently edit transactions if you need to, but the service fee will revert to the default 2.25%. It’s better to delete the transaction and add it back again as a new payment to enjoy the 1.9% rate.

All payments should be made at least 6 business days in advance if the rental due date falls on a weekend/public holiday, or 5 business days in advance otherwise.

Conclusion

Assuming you weren’t targeted for the Citi PayAll 1.5% admin fee, then RentHero’s 1.9% fee is as good as it gets (actually, a BOC Elite Miles World Mastercard earning 1.5 mpd at a 1.9% admin fee would perform about the same as a Citi PremierMiles Visa earning 1.2 mpd at a 1.5% admin fee).

Any questions or tech support requests can be sent to the RentHero team at hello@renthero.com.sg

1.9% 😯

How do you derive at the CPM?

Using your example of a $1,019 transaction, earning 1,529 miles. Wouldn’t the equation be 1019/1529? Is there anything I’m missing out?

Your admin fee is 19 Dollars. This is cpm, not mpd

Tks for sharing. I’ll probably use the Amex Krisflyer blue card to hit the 3000 sgd spending goal once they start to accept Amex. (Very hard to use Amex outside of the US… On a different note, I set up PayAll for my rent back in Dec reoccurring 12 months when it was still beta testing with lower admin fee( I was getting 1.3cpm). It worked for Dec and Jan. Starting from Feb it stopped working and landlord had to chase me for late payment…perhaps they cancelled my existing setup once they rolled out the 2% charge for all in… Read more »

That will indeed put me in a position to hit the 20k miles bonus for a $50k 12-months spend on my UOB Privi AmEx. Can’t wait for AmExto be added as an option 🙂 That would be a 1.8 miles/$ for the card overall or 1.06c/mile for this promotion.

Keep us posted 🙂

BOC cards are out (hello clawback king!)

DBS cards are out (they shut down such payment provider very quickly, its similar to cardup and ipaymy in the past)

very good point on the BOC card. Whats your view on this?

What do you mean with “BOC cards are out”?

“Citi and OCBC do not award points for rental payment” – is this only for renthero or for cardup as well? (i am screwed if it is. Lost out on a few months of rental payments!) The cardup website explicitly excludes car loan payments using citibank cards but nothing is mentioned regarding rentals.

Hi Aaron,

12 months from signing up, mean i can get 1.9% use the code for every payment i made for 12 month ? or only for the first payment only ?

All

What’s the MCC for Renthero or any of the others? Does it fall under online shopping?

Can I use this method to pay for my friends rent??? Even I am not staying inside the rented house??

no, the person paying must be the person whose name is on the tenancy agreement