If you want to get a credit card in Singapore, the MAS requires you to have:

- Annual income of at least S$30,000, or

- Total net personal assets exceeding S$2 million, or

- Total net financial assets exceeding S$1 million

Since I’m guessing not many people fall into the latter two bullet points, the minimum income requirement of S$30K becomes the most relevant metric. If you can’t meet that, you’ll have to settle for either a S$500-limit credit card, or a secured credit card that’s backed up by a fixed deposit.

However, you’ll find many credit cards with income requirements well above S$30K. Some ask for S$80K, others S$120K, still others S$500K and more!

How strict are income requirements, anyway?

But here’s the thing: any income requirement above S$30K is essentially arbitrary. Although MAS makes a distinction in credit limits between those who earn S$30K-S$120K (4x monthly income) and S$120K and above (no limit), it’s entirely the bank’s prerogative to approve someone earning at least S$30K for any card they wish.

This means that income requirements are more of a way for a bank to segment its offerings, in the sense that a S$120K card will come with more benefits than a S$30K card (but not always!).

This also means that when it comes to applications, “it doesn’t hurt to try” should be the operative rule. Obviously, you’re not going to get approved for a S$500K credit card with a S$30K income, but if you’re just short of the mark, banks can and do exercise discretion with income requirements.

Which cards don’t enforce income requirements?

UOB Visa Signature

UOB Visa Signature UOB Visa Signature |

|

| Apply |

|

| Official Income Requirement | S$50,000 p.a. |

| Unofficial Income Requirement | S$30,000 p.a. |

When the UOB Visa Signature launched in 2006, it was positioned as the card for the mass affluent, which at the time required a minimum income of S$60K, versus S$120K today (that’s inflation for you).

These days, the official income requirement has been cut to S$50K, and even that’s more of a serving suggestion, since there’s plenty of data points of approvals at the S$30K mark. In fact, in a sure sign that UOB isn’t paying much attention to this, the minimum income for foreigners is set at S$40K, when the default practice is to set this higher than the requirement for locals due to the greater flight risk involved.

I consider this to be one of the most useful cards on the market, so it’s great that pretty much anyone can get it.

DBS Woman’s World Card

DBS Woman’s World Card DBS Woman’s World Card |

|

| Apply | |

| Official Income Requirement | S$80,000 p.a. |

| Unofficial Income Requirement | S$30,000 p.a. |

The DBS Woman’s World Card needs little introduction, since it’s a must-have for anyone (male and female) who buys things online. With 4 mpd on the first S$1,500 of online transactions each month, it’s one of the fastest ways to rack up miles on air tickets, movie tickets, Amazon, RedMart, Lazada, Grab rides, Deliveroo orders etc.

On paper, the DBS Woman’s World Card has an S$80K income requirement, but in practice, you can easily get approved so long as you’ve above S$30K.

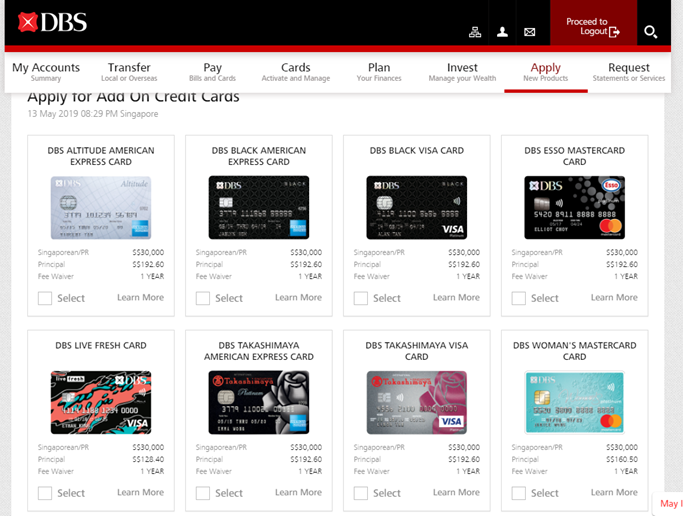

The easiest way of going about this is if you already hold a DBS or POSB credit card. Log on to ibanking, then look for Apply > Credit Cards at the top of your screen.

You’ll see a whole list of DBS/POSB cards. Select the DBS Woman’s World Mastercard and click Apply (you don’t see it in my menu because I already have it). You should receive an instant decision.

StanChart Visa Infinite

StanChart Visa Infinite StanChart Visa Infinite |

|

| Apply | |

| Official Income Requirement | S$150,000 p.a. |

| Unofficial Income Requirement | S$80,000 p.a. |

The StanChart Visa Infinite, frankly speaking, doesn’t have a lot going for it. At most it’s a vehicle for buying miles, given its 35,000 miles welcome gift and tax payment facility (though nowhere as good as before).

The card has an official income requirement of $150K, but in reality approval will be given to anyone earning upwards of S$80K.

A better question is: do you even want this card in the first place? Its features are extremely limited, with six lounge visits the only real highlight.

Citi Prestige Card

Citi Prestige Citi Prestige |

|

| Official Income Requirement | S$120,000 p.a. |

| Alternative | Place S$10,000 fixed deposit |

The Citi Prestige Card officially has a S$120K income requirement, but if you can’t meet that then a fixed deposit of S$10,000 can be placed with the bank instead.

However, you cannot hold both secured and unsecured Citi cards at the same time, so if you wish to open a secured Citi Prestige, you must:

- Close all your existing unsecured Citi credit cards, or

- Convert your existing Citi credit cards to secured ones

Based on previous data points, secured Citi Prestige Cards are eligible for the welcome offer as well, which at the time of writing is 50,000 bonus miles.

HSBC Visa Infinite

HSBC Visa Infinite HSBC Visa Infinite |

|

| Official Income Requirement | S$120,000 p.a. |

| Alternative | Place S$30,000 fixed deposit |

The HSBC Visa Infinite has a minimum income of S$120,000, but you can also place a fixed deposit of S$30,000 with the bank instead. The credit limit will be up to 100% of the approved deposit amount.

Secured cardholders enjoy all the standard benefits of HSBC Visa Infinite membership, including an unlimited-visit LoungeKey for the principal and up to five supplementary cardholders.

American Express Cards

I want to include a special section on AMEX cards, because there’s a bit of a strange case.

In late 2022, all American Express cards removed their published income requirements, simply stating “card application is subjected to customers meeting the regulatory minimum income requirement and internal assessment.”

What this means is that so long as you earn above S$30K , you have a chance of being approved for any AMEX card.

| Card | Annual Fee | Last Published Income Requirement |

AMEX Platinum Charge AMEX Platinum Charge |

S$1,744 | S$200,000 |

AMEX Platinum Reserve AMEX Platinum Reserve |

S$545 | S$150,000 |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

S$327 | S$80,000 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

S$343.35 | S$50,000 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

S$179.85 | S$30,000 |

Yes, that includes the AMEX Platinum Charge too! I’ve heard some grumbling about this product being “devalued” because it launched with a S$200K income requirement that later dropped to S$150K and then S$120K, but I think it’s a strange complaint because the filter has never been the income requirement- it’s the annual fee. If you earn S$30K a year and think it’s OK to drop S$1,744 on a credit card, well, that’s not going to win any awards for fiscal prudence.

Which cards strictly enforce income requirements?

While some income requirements are just for show, there’s other cards which strictly enforce their minimum income requirements.

Here’s a few that we know of.

UOB Lady’s Solitaire Card

In the not-too-distant past, the UOB Lady’s Solitaire Card’s S$120K income requirement was widely known to be a bluff, with many people getting approved at incomes much lower than this. However, UOB started enforcing the S$120K requirement a lot more strictly shortly after card membership was opened to men.

Today, if you try to apply with an income below S$120K, you’re likely to get the following:

Dear customer, your UOB Lady’s Solitaire Card application is unsuccessful as your income on our records does not meet the min S$120K p.a income requirement. If applicable, please visit our official UOB webpage > Cards > Card Services > Credit Limit Review to update your income and submit a new application.

If you really want to get the card, but don’t meet the minimum income, you’ll need to place a fixed deposit of at least S$30,000 with UOB. Visit your nearest UOB branch for more information.

DBS Vantage Card

While DBS doesn’t enforce the income requirement for the DBS Woman’s World Card, it certainly does for the DBS Vantage. In fact, you won’t even see the option to apply for a DBS Vantage Card on the digibank portal if your income records with the bank don’t reflect at least S$120K.

DBS has a whole document on how to update your income records for a Vantage application, so it’s safe to say they take this seriously.

Conclusion

So long as an applicant meets the MAS-mandated minimum requirements, then banks have the discretion to approve them for any sort of credit card, be it an entry-level plastic card with no annual fee, or a top-of-the-line invite-only metal card.

In practice, however, banks use income requirements to segment their products, and unless you have significant sources of wealth other than salary, it’s unlikely someone earning S$30,000 a year will be approved for a super premium card.

Still, it’s good to know that income requirements above S$30,000 aren’t hard and fast rules, so when in doubt, try sending in an application- the worst they can say is no!

Any other cards you know of which aren’t strict on the income requirements?

I am quite curious about how strict is PremierMiles AMEX with the salary requirement.

Hi Aaron, sorry if this is a dumb question, but does one have to be female to qualify for the DBS Woman cards?

No, I got it and I am a guy.

Unless there’s something Aaron isn’t telling us… 😏

what i wear in my own personal time is my own business.

nice one 😁

There you go, missing out on the monetisation opportunity from your OnlyFans user base.

Do they take into consideration bonuses for income requirements?

From my experience, the more prestigious cards do accept the bonus printed on my payslip. Otherwise, not so easy to find so many earning $150k or $200k or $300k, etc……….

But what if you changed jobs and it promises a higher bonus?

Well, if the cash is not credited to your bank account, how do you proof that you received the bonus?

Business owners and senior managements that has 90% variable income will need some kind of evidence and not just verbal.

NOA, payslip, company certified employment letter and bank statements should work.

I think they take your CPF into account… so just need to check your contribution for that 12 months.

CPF contribution has a cap of $1,200 per month, so it’s not a useful gauge.

Retirees (55 or older) can qualify for credit cards if they have income >$15K, net personal assets >$750K or a guarantor with income >$30K, but their maximum credit limit is 2X monthly income instead of the usual 4X.

So means just by me having an income of > $30K & being the guarantor, my parents with < $15K annual income can apply for a cc? Does this apply for all banks & AMEX?

these are MAS minimum guidelines. banks still retain the discretion to impose stricter criteria if they see fit.

but yes, if you have income >$30k and act as guarantor, your parents can get a CC.

Here is my “retirement case”. A few years ago, I had American Express chasing me pretty much every week to sign-up for their card. I was busy at work at the time, and didn’t do anything. Later, after I completed that contract and chose to retire, I replied to Amex. “Suddenly” they were not longer interested in offering me the card as I did not fit the “mould” of being a wage-slave. So I wrote to them and explained that the reason I could choose not to work was because I had enough net wealth that it was not necessary,… Read more »

Oh, and to add here. The 4* salary limit is a myth. When I was working, I had banks give me credit limits without even asking more than 8 times my monthly salary. What is more, they never asked what other cards I already had, and what were the limits on those cards. When I added all my card limits (across banks) together I could have gone on a $500k spending spree! It was just ridiculous how easy amassing huge amounts of credit limit was. Until, as I found out with Amex, that you don’t fit the “mould” of earning… Read more »

What’s the criteria for the Centurion card? Would Siva be able to share? Platinum is now Pedestrain

@Curious.. “Pedestrian”..? What do you mean by Pedestrian and what’s your purpose of getting any specific card? For the perks? or to show off?

I agree with Curious. What with Amex handing out Platinum card freely without any consideration for the annual salary limit. (see HWZ forum, people bragging how they got platinum with incomes not even close to 100K) I don’t blame him

Err.. Actually, my point is, who cares who has or does not have any given card.. most times I don’t even take the card out of the wallet (if at all possible) cos I can use Apple Pay so no one even sees what card I’m using.. Use the card that benefits you most, should be the priority, instead of what income is required in order to get what card, no? Else why come to Milelion and the likes?

https://milelion.com/2018/03/04/singapore-version-amex-centurion-card-come/

if you have to ask…

Hi Aaron, you’re right about the SCB VI, tried applying for it this morning and got my card instantly approved even though I didnt meet the income requirement. gonna use the SCB VI now for my tax payments

Were you close to the income requirement?

@Tim… You.. and more… need to change your mindset… or else Milelion… and the likes… may have to give up, cut their wrists… and go back what they did before what’ve done… Stop being pawns of banks and or the pawns of “3rd Party” Service Providers… or… continue to be… but don’t come crying when the proverbial s**t hits the fan… Who is richer..? Someone who makes a million a year, but spends two..? Or someone who makes 20k a year, and spends 10…? It’s not the color (or material) of your card you whip out at dinner that counts…… Read more »

What are you on about? Clearly the article is about income requirement. Have a seat.

I was seated… you’re not worth getting up for… hahahahahaha…

Aiyah. I have been on aircraft where I had seat 1a and still had to turn right!

🤦🏻♂️ I meant BEFORE one gets onboard.. on a two bridge setup… but it’s ok… I understand that you didn’t get that… friends of Tim… 👌🏻

😊

you could say i’m between the 60-80k bracket

Omg what’s with all the …

Might be off topic but does repeated Cancel of card and reapply for sign bonus affect chances of getting the card again?

Well, I am rather torn here; not entirely sure it is a good thing. Lenient requirements look good but risk diluting brand value and eventually benefits. The Centurion lounge benefit for AMEX Platinum Charge and 4th night free on Citi Prestige benefit restrictions (US) are 2 examples that immediately come to mind. This becomes very apparent with high end cards or worse private banking relationships that are not easy to walk away from despite program devaluation.

I was granted Amex Ascend with about 40k/annum salary. Listed requirement was 50k

can get with 30K income.

The platinum credit card also can get with 30K income even listed requirement is 80K

Do they look at your IRAS taxable income (applying via SingPass) which includes stocks or the monthly salary contributions?

Also does anyone know if AMEX is flexible if my income is a few hundred below the minimum?

Minimum as in a few hundred below $200K? That shouldn’t be an issue

Doesn’t the OCBC Premier Voyage card require you to be a OCBC Premier customer too? Are you saying that as long as I hit $120k I don’t need to be a OCBC Premier customer to get it?

no if you hit 120k and not premier customer you can get the regular one

I have the UOB Reserve and assure you I don’t meet the income requirements. The other side to credit card income requirements is historical spend and credit rating. The rest is a guideline 🙂

Is stipend strictly considered by banks as ‘not a source of income’? I’m in an traineeship with my yearly stipend >30000PA but my application never got through (Citibank/DBS)

My first ever credit card application was with SCB and back then my income was 36K but I got rejected. And somehow a random CSR was clumsy enough to reply my email that my application was approved while it was rejected. I complained the inconsistency and another CSR called me to apologize and then they gave me a card with 4K credit limit (like pity me or something lol). After 1 year I applied for an increase and they gave me 2X monthly pay. Then I think 2 years later I got 4X. But nowadays I don’t really use their… Read more »

I got the plat CC with 30k p.a. Shall try the Charge next year

There is, obviously and annoyingly, more than the income criterion to being approved for a certain credit card by a bank or financial institution. Case in point: My wife, who has a very healthy income well above the published minimum was still rejected for the DBS Woman’s World card despite us living in Singapore for >3 years at the time of application, her holding the SCB Visa Infinite, Citi Rewards, UOB Krisflyer and UOB Prvi Miles card, her working for a blue-chip PLC and her being able to provide salary slips for as long as DBS cared to ask for.… Read more »

yeah, some foreign colleagues at my previous job encountered the same issues too. banks do have additional criteria they apply beyond income, and sometimes it’s rather opaque too

Banks and financial institutions are private businesses and they have that right to their own criteria and opaqueness.

2 years ago i’d applied for the Amex Platinum Charge Card and the UOB PRVI Miles Visa at the same time (with 280k income). Amex said Yes and UOB said No. Go figure.

Some banks encountered unfortunate experience of foreign workers maxing out their cards, leave Singapore without paying the debt. Thus issue of commercial decision vs risk management.

Does anyone know how these income requirements apply to a PhD student? There is technically no income since stipend is not considered salary, but the school does pay CPF contributions for singaporean PhD students. When we submit that CPF payslip, I assume the banks work backwards and do a /0.37 to calculate your actual income since 20% employee + 17% employer? Does this apply to the CPF contributions in the PhD scenario?

TIA!

No the banks do not include the employer 17% CPF in any card/loan application. However, the 20% portion will be included as part of their consideration for your salary/stipend.

E.g $6000 salary with additional $1020 17% employer contribution is still counted as $6000.

They do not include the employer portion lol

Some more data points:

When my annual income was 92k, I was approved for the plain vanilla OCBC Voyage without any premium banking relationship.

When my annual income was 118k, I was rejected for CIMB Visa Infinite (with an official requirement was 120k).

At all times I had AA credit rating on CBS. Local and property owner. This happened about 2 and 1 year ago respectively.

I get SCB visa inf and Citi Pre with a 50000 annual income. Both apply as existing customers.

Is there any way to appeal a rejection? or resubmit again?

Resubmit again. I get rejected of SCB visa infinite twice and approved the third time.

Just keep re-submit until they approve

Does anyone have a recent data point for the annual income requirement for the UOB Lady’s Solitaire?

Just applied for DBS insignia. Keeping my fingers crossed

175k income. Rejected by amex charge =(

i know that citi is very strict on income requirement for prestige. got rejected before, just because my income was short by 3k

yes- try fixed deposit route if you really want one.

they offered the fd route but the limit will be pegged to the fd amount which will reduce my limit by 20k (which was nonsensical). i eventually managed to get the card via income requirement route when latest noa became available.

I got rejected a couple of times applying for Prestige.

My income is above 200k, I got AMEX Plat for years, but i got rejected twice by Citibank. Cant be bothered to apply anymore…

My credit rating is always AA

So i dont know anymore lol