| Update: This offer has now expired, but you can continue to enjoy a 1.99% fee on tax payments with the code TAX199 |

Income tax season is upon us, and if you’re thinking of earning some miles when paying, here’s an offer for you.

CardUp is offering Milelion readers a special rate of 1.99% (normally: 2.6%) on income tax payments scheduled by 31 May 2019 30 June 2019 with the promo code MILELIONTAX. This applies to payments made via Visa and Mastercard only.

| CardUp FAQ

Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

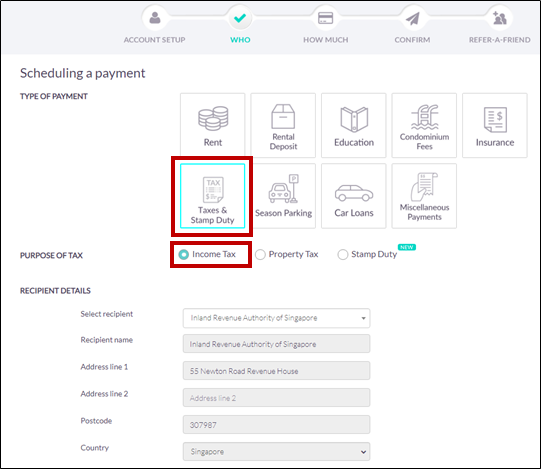

To use this code, simply click on Schedule Payment…

![]()

Select Tax & Stamp Duty –> Income Tax

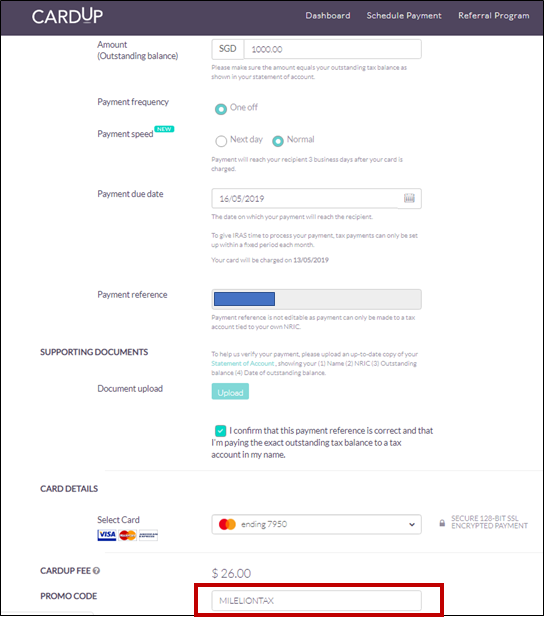

Enter your payment details, upload the supporting documentation and enter MILELIONTAX in the promo code field

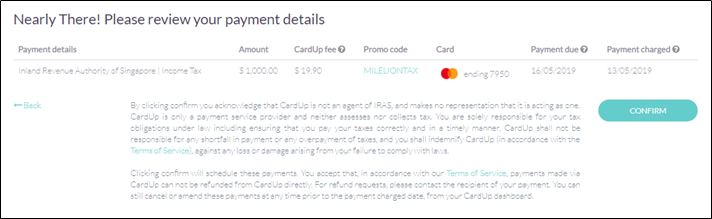

That’s it! You’ll see the discounted rate of 1.99% at the final screen.

The T&C for this promo code can be found here. This promo code can be used a maximum of once per user.

If this is your first ever payment with CardUp, you can opt to use the promo code MILELION instead and get $20 off a minimum payment of $1,000

- If your tax amount is less than $1,000, you can only use MILELIONTAX

- If your tax amount is $1,000 to $3,278, MILELION is a better deal if you’re eligible

- If your tax amount is >$3,278, MILELIONTAX is a better deal

CardUp has teased that anyone who uses the MILELION or MILELIONTAX codes will receive a surprise promo code in June for their next payment. I don’t know what that is, but look out for it in your inbox.

You will need to submit a copy of your NOA to CardUp as supporting documentation, and you can only pay off your entire tax due amount. You won’t be able to pay in installments; IRAS doesn’t allow that through CardUp.

Also note that unlike the tax payment facilities offered by banks where funds are transferred to your account and you make the payment, CardUp makes payment directly to IRAS on your behalf.

How does this compare to other payment options?

Back in March, I wrote about the various methods of earning miles on your income tax payments. Since then, we’ve had some new developments so I’ve updated the table accordingly:

[table id=20 /]

A quick word about the CardUp calculations: you may be wondering why the math to derive cents per mile is not Fee/MPD. That’s because the CardUp fee itself also earns miles. For example, if I pay $1,000 with my Citi Ultima card:

- The total amount charged by CardUp is $1,000 + $19.90= $1,019.90

- I earn $1,019.90*1.6≈ 1,632 miles

- Cost per mile= 19.90/1,632=1.22 cents each

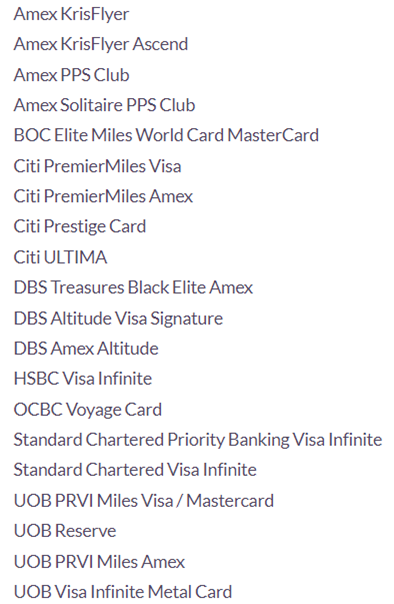

There are no 10X opportunities with CardUp, so there’s no point using cards like the DBS Woman’s World and Citi Rewards. All general spending cards should earn points for income tax payments with CardUp, so stick to these and you’ll be fine.

Have a read of this post for the full list of options available when paying income tax.

Conclusion

A 1.99% fee represents a great opportunity to pick up miles for less, so be sure to schedule your payments before 31 May 2019. 30 June 2019.

You can also refer your friends to CardUp and get $20 for every new user who makes a payment, plus a bonus $30 (till 30 June) when three friends make an income tax payment with your code.

Wonder if this will work with the new uob krisflyer card…

It will, you’ll just earn 1.2mpd that’s all

Ah OK. Was wondering cos thought mainlymiles.com mentioned the 4816 code being recognised by uob…

Cardup no longer uses 4816

Can we get 3 miles per dollar spent with UOB Krisflier if we meet the min SGD 500 annual spend on SQ group?

no

Which other card should we use with cardup? Thanks!

General spend card

does ocbc voyage get points with cardup?

if so then ocbc premier/BOS voyage will get 1.6mpd?

Would like to know if anyone knows this .. thanks!

Hi boo and Lena, yes OCBC voyage cards earn points on your CardUp spend. Anytime you have questions on any cards, do check with us at hello@cardup.co.

Cheers,

The CardUp Team

Hi Aaron,

Can we have this extended please? Will get by NOA earliest first week of June…

Hi Talan, we heard you! Promo has been extended to end June 🙂

Cheers,

The CardUp Team

log in iras and check for the past few years, the NOA dated on JUN or JUL.

Hi NewBie, we’ve extended the promo til end Jun! 🙂

A disadvantage of CardUp is the inability to pay by smaller amounts – for those who don’t wish to pay off their entire tax amount. Ipaymy however allows that.

Also not sure why CardUp has limited period each month for payment to IRAS, whereas ipaymy doesn’t.

I was under the impression this was an IRAS restriction, not cardup specific. Apparently there was a problem with people overpaying their bills and demanding a manual refund from IRAS in order to ms

No Amex card for this promo. Got my eyes blink blink for awhile.

But none of the Amex cards offer great miles anyway, they’d be 1.3 at most (Citi pm Amex)

looking at reducing the 20K for the plats 🙂 but cant use in this

Will this work for IRAS property tax? Or isit limited to just income tax?

Hi kevwong83, you can definitely pay your property tax through CardUp and use promo code MILELION if it’s your first payment for $20 off the fee. Let us know if you have questions at hello@CardUp.co

Hello I noticed u haven’t mentioned pairing the Amex plat charge card with the Cardup service, do you know if that is possible and if so is it “worth it”? Thanks !!

Hi Will, yes you can definitely use your Amex plat charge card with CardUp and you’ll earn points. Let us know if you need help at hello@CardUp.co

Will there be a promotional rate for Amex cards too?

Ipaymy is also holding similar promotion.

Can we use BOC EM card for this? Just concern that it will be crawl back?

Boc has told me that cardup will earn points. That said, you have to decide if you’re comfortable with their somewhat arbitrary clawbacks

Hi Kelvin, we can confirm what Aaron said – we’ve been partnering closely with BOC since 2017 and CardUp spend definitely earns points. Anytime you have any issues, please feel free to reach out to hello@cardup.co, we’ll be glad to reach out to BOC to contact you directly to clarify as part of our partnership with them.

Cheers,

The CardUp Team

Is CardUp a good platform for insurance premiums too?

Ipaymy is back accepting personal sign ups. Is it better than CardUp?

Hi, your article states that scheduling payments through the bank will allow for them to credit your account with the funds. But I called Citibank to ask if that was the case for Payall and was informed that the funds are credited directly to the organization? Would be grateful for a clarification as this would affect my decision on which service to use

Payall is different. PayAll goes straight to the billing organization. This has been mentioned in the main PayAll post, please have a read

Ah ok thanks for the clarification!

Just paid my tax with the UOB KF card, wonder what would the teased promo code be.

Is citi premiermiles visa supported on cardup? To get the 1.2miles/dollar

read the FAQ. it’s mentioned yes.

Thanks a bunch Aaron, this is absolutely brilliant! Miles credited so I’ve got enough for a return flight on SQ, or upgrades again to first! 😉

delighted to hear that. but upgrades aren’t the best use of your miles (unless maybe your employer is paying for the ticket), save them for full redemptions!

Update to last post; Unfortunately, just confirmed there wan’t any points credited to my DBS Altitude for income tax spend. Called up DBS hotline and they referred me to T&C point 2.6 of the reward card, which state that card services (i.e. all CardUp transactions) don’t qualify for points. Asked them when this was put into place/updated and the CS said it was July 2017. So there we go, absolutely no points gained from charging my full year income tax via CardUp! :/

So here’s the T&C they’re referring to, what a bummer. 2.6 a) DBS Points will not be awarded for: • Bill payments and all transactions via AXS, SAM, eNETS; • Payments to educational institutions; • Payment to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); • Payment to insurance companies (sales, underwriting, and premiums); • Payments to financial institutions (including banks and brokerages); • Payment to non-profit organisations; • Betting (including lottery tickets, casino gaming chips, off-track betting, and wagers… Read more »

I’ll ask the cardup team to look at this

also- can you PM me your contact details? https://milelion.com/contact-us

Thanks a lot Aaron, just dropped you a note.

Hi Lady G, thanks for the feedback. We’re actually in close working relationship with the DBS team, and can confirm that CardUp spend is eligible for the points earned on the DBS Altitude Card. The points typically take some time to be rewarded back to your account – we’re checking in with the DBS team, and will drop you an update once we hear back from them on this matter. Thanks for your support on using our platform for your income tax payment. Anytime you have questions on any cards, do feel free to check with us at hello@cardup.co too.… Read more »

Hi,

Do we have an update? I’d like to use DBS Alt for Cardup, if it is eligible for points, and the spending counts toward the DBS Alt sign-up promo.

Hi HT, we can confirm that your spend through CardUp is eligible for the DBS Altitude points, and it will typically take a few days before these points are awarded to you.

Generally, all spend made through CardUp is also eligible for signup and promotional bonuses. We’re also in the midst of confirming this with the DBS team, and will drop you an update once we hear back. If you have any further questions, feel free to drop us an email at hello@cardup.co too!

Cheers,

The CardUp Team

Hi, I’m planning to use my DBS Altitude card for my tax payment. Wanted to confirm if you’ve heard back from DBS regarding whether tax payment via Cardup would qualify for the sign up bonus with minimum spend? Also would it earn miles as normal? Thanks!

Hi AG,

Thanks for checking – your CardUp spend on your DBS Altitude card will be eligible for the points as per normal. Just note that these points will take typically a few days before they are awarded.

As for the sign up bonus, we’re pending some updates from the DBS team. Could you drop us an email at hello@cardup.co? Our customer success team can let you know once we hear back.

Thanks.

The CardUp Team

Hi CardUp team,

Thanks for your reply. Would appreciate if you could please get back regarding the sign up bonus soon if possible, since I’m planning to pay my tax before your 30th June deadline. I’ll drop an email too.

Thanks!

Hello CardUp team, First of all, excellent customer service. It has been seamless using your service and this prompt follow up is outstanding. Thanks for confirming the eligibility for Altitude card and that it takes time to process (just wish the DBS CS rep had his facts right vs stating outright it’s not eligible after asking to re-confirm.) Initially was disappointed as I had shared this on social media and in person, recommending CardUp for Income Tax and more. I’ll drop you a separate note via email so you can identify my account and help support DBS team with this.… Read more »

Hello Aaron & CardUp Team,

Thanks a lot for your excellent customer service and prompt follow up on this, and checking in to make sure DBS had also followed up. Really appreciate such rare and outstanding service in this day and age. Happy to confirm my points were awarded as per your summary and I’m using CardUp’s other payment services too which is smooth and worth transacting via especially for recurring payments. 🙂

What if I have already made partial repayment via GIRO? if I want to pay the reminder via CardUp, is it possible? Or if I pay full NOA, will I get a refund?

my understanding is that cardup only lets you pay the amount stated on your NOA, so you’ll get a refund from IRAS

Hi CL, thanks for the question! You’ll be required to pay off the current outstanding balance amount as shown in your statement of account. If you have already made a partial repayment via GIRO, you can still pay off the remaining balance amount, and supported by an up-to-date document showing your updated statement Hope this helps!

Cheers,

The CardUp Team

Hi CardUp Team,

At this point in time, IRAS has scheduled to do a GIRO deduction on 6th of this month. i was trying to schedule a payment on Cardup, but even the earliest date is 7th of July (which is later than the GIRO deduction). Anyway I can get around this?

Hello, I’ve tried using the MILELIONTAX promo code but it says ‘Sorry, that promo code has been fully redeemed.’ 🙁 Didn’t know there was a limit for redemption….only just received my NOA on 21 June.

Any chance of a top-up for redemption? If not, guess will just use my bank tax payment facility…

I don’t think there’s a limit, but let me check with them

Hi AT, thanks for letting us know. Apologies for the confusion – you can try setting your payment up again with the promo code, it should be able to work now! Thanks for choosing to pay your income tax through our platform as well.

Cheers,

The CardUp Team

Hi Aaron and the Cardup team,

Thanks for the fast response! Just managed to schedule a payment successfully with the promo code 🙂 Will check back in a few days for the payment to go through and the rewards points to come in.

Hi Cardup Team, 30 June is nearly here and I still haven’t received my NOA. Any chance of extending this promo?

Hi Pamela,

You can drop us an email at hello@cardup.co and my customer success team will be happy to take this conversation forward. Happy to hear any other questions you might have too!

Cheers,

The CardUp Team

oh no, could you just check if cardup if it can be extended by 1 more month? i just miss the deadline by 1 day as the last 5 days of the month cannot schedule tax payment! =(

Hey Chris,

Feel free to drop us an email at hello@cardup.co and my customer success team will be happy to get back to you. Happy to hear any other questions you might have as well.

Cheers,

The CardUp Team