It seems that bill payment facilities are very much in vogue among banks these days, because hot off the heels of Citi PayAll comes Standard Chartered’s trial of SC EasyBill, a competing service.

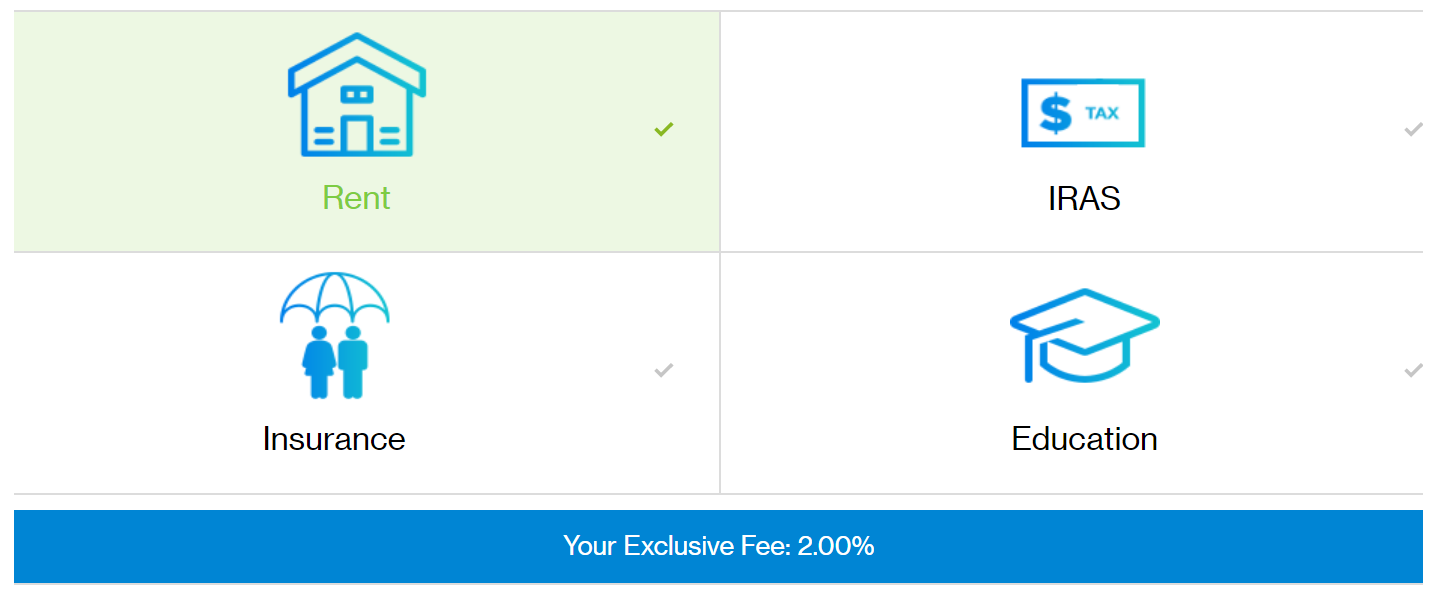

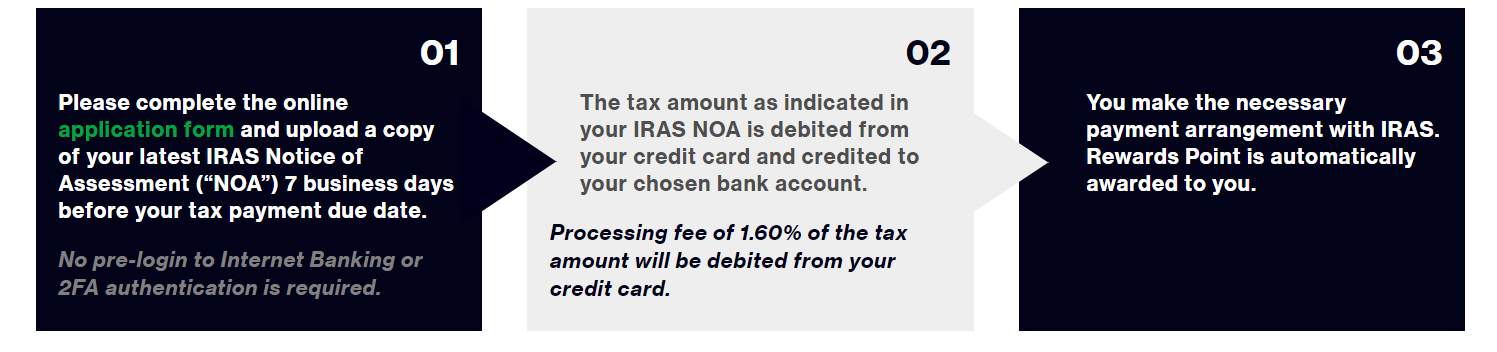

SC EasyBill does not appear to be open to everyone yet; you’ll need to have received an eDM from the bank to participate. It works much the same as Citi PayAll- you charge your bills to your credit card, pay an admin fee, and earn points. The bank then pays the billing organization on your behalf.

Where SC EasyBill differs from Citi PayAll is in terms of supported payments- most noticeably including insurance, which PayAll lacks.

| SC EasyBill | Citi PayAll | |

| Taxes | ✓ | ✓ |

| Rent | ✓ | ✓ |

| Education | ✓ | ✓ |

| Condo Mgmt Fee | ✗ | ✓ |

| Electricity | ✗ | ✓ |

| Insurance | ✓ | ✗ |

| Supports Recurring Payment? | ✗ | ✓ |

What’s also interesting is that SCB specifically defines each of these payment types in their T&C. Citi PayAll, on the other hand, does not.

|

The biggest grey area is probably (2), education payments. Citi describes these as payments to schools or tuition centres, but SCB’s definition seems much broader. I read this as saying you could even pay your personal trainer or yoga instructor via EasyBill. Or if you want an easy way of generating miles, ask your wife to teach you gardening? 😉

EasyBill payments cannot be made on behalf of family members or friends; you can only pay your own bills.

How much do miles cost with EasyBill?

EasyBill appears to charge a flat 2% fee, regardless of payment type.

That said, the T&C of EasyBill mention the fee is “exclusive to each customer, and is determined by the bank’s internal review processes”. This suggests that different customers receive different rates. If you were targeted for something lower, do let me know in the comments.

SCB has four points-earning cards in the SCB Visa Infinite, the SCB Priority Banking Visa Infinite, the SCB X Card and the SCB Rewards+. Here’s what a 2% fee means for the cost of miles

| Card | Earn Rate | Cost Per Mile @ 2% |

SCB Visa Infinite SCB Visa Infinite |

1.0 (spend <$2K p.m)/ 1.4 (spend ≥$2K p.m) |

2.0/ 1.43 |

SCB X Card SCB X Card |

1.2 | 1.67 |

SCB Priority Banking Visa Infinite SCB Priority Banking Visa Infinite |

1.0 | 2.0 |

SCB Rewards+ SCB Rewards+ |

0.29 | 6.9 |

Needless to say, you should absolutely not use the SCB Rewards+ with EasyBill.

The SCB Visa Infinite, on the other hand, looks attractive at a 1.4 mpd earn rate assuming you’re not paying IRAS. That’s because the SCB Visa Infinite’s tax facility costs 1.6%, which equates to a much lower cost of 1.6/1.14 cents per mile.

SCB Rewards points can be transferred to KrisFlyer only. Points earned on the SCB Visa Infinite do not expire, while points earned on other SCB cards expire after 3 years.

How does this compare to other ways of buying miles?

It says something about the miles and points landscape in Singapore that this list is growing all the time, but here’s how EasyBill measures up to other options.

[table id=4 /]

I wouldn’t use EasyBill at a 2 cent cost, but 1.43 cents can make sense if you have education or insurance payments. For rent, it’s still cheaper to use the BOC Elite Miles World Mastercard/UOB PRVI Miles/SCB Visa Infinite with the special 1.9% RentHero promotion for Milelion readers.

Conclusion

It’s good to see more and more options available to pick up miles for cheap, and this should definitely be on your radar if you’re an SCB Visa Infinite cardholder. Be sure to report in if you’re targeted for anything lower than 2%!

They must have made a mistake with me.

This morning at 11:36am I received an email titled Be rewarded with Cashback or earn 360‘ Rewards Points with SC EasyBill

I don’t have any credit card with SCB except for a SCB Mastercard. I ignored email when the example of Ted using Visa Infinite…….

Ted has $100K of payments to make.

Be like Ted.

Don’t have so much payments in a year. Since I’m not Ted, SCB must have made a mistake 😀

First time using EasyBill and the experience is bad, the transaction is posted in internet banking, but after 15 days, the insurance company has not received the $

I had a live chat with the officer, and the CS just said it had been paid and said to use the credit card statement as prove, until I keep pushing to escalate