Here’s The MileLion’s review of the OCBC VOYAGE Card, which launched in 2015 as OCBC’s first-ever miles card.

That’s right- it might surprise you to know that the upmarket VOYAGE predates the mass market 90°N by nearly six years. While most banks go broad before going niche, OCBC did things the other way round. It’s an interesting approach to say the least, but that’s another discussion for another time.

As the bank’s flagship card, the VOYAGE has a lot resting on its shoulders. So is this a journey worth enjoying, or just a bad trip?

OCBC VOYAGE Card OCBC VOYAGE Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The OCBC VOYAGE offers a unique proposition with its “any seat, any flight” redemptions, but it’s hard to shake the feeling that most perks come with caveats attached. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Review Changelog

|

Date: 18 September 2023

|

Overview: OCBC VOYAGE Card

Let’s start this review by looking at the key features of the OCBC VOYAGE Card.

|

|||

| Apply Here | |||

| Income Req. | S$120,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$492.50 |

Min. Transfer |

1 VOYAGE Mile (1 mile) |

| Miles with Annual Fee |

15,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 1.3 mpd | Points Pool? | No |

| FCY Earn | 2.2 mpd |

Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

The OCBC VOYAGE comes in metal card stock, duralumin to be precise. Duralumin is a strong, hard and lightweight aluminium alloy that contains copper, manganese, iron, and silicon, and is resistant to acid and seawater corrosion. I suppose that means you can go swimming with your VOYAGE Card (because why wouldn’t you?).

The latest version of the VOYAGE Card weighs in between 8-20g.

Why the range of weights? Because there’s actually four versions of the VOYAGE. In addition to the basic OCBC VOYAGE, you have:

- OCBC Premier VOYAGE, for clients of OCBC Premier (min. AUM S$200K)

- OCBC PPC VOYAGE, for clients of OCBC Premier Private Client (min. AUM S$1M)

- BOS VOYAGE, for clients of Bank of Singapore (min. AUM S$3M)

The main difference between the cards is the earn rate, as summarised in the table below:

| 💳 OCBC VOYAGE Cards |

|||

| Card | Annual Fee | Local | FCY |

OCBC VOYAGE OCBC VOYAGE |

S$492.50 | 1.3 mpd | 2.2 mpd |

OCBC Premier VOYAGE OCBC Premier VOYAGE |

S$492.50 | 1.6 mpd | 2.3 mpd |

OCBC PPC VOYAGE OCBC PPC VOYAGE |

Waived | 1.6 mpd* | 2.3 mpd* |

BOS VOYAGE BOS VOYAGE |

S$492.50 | 1.6 mpd | 2.3 mpd |

| *2.3 mpd for local and overseas dining | |||

The OCBC PPC VOYAGE and BOS VOYAGE get Tower Club access (albeit as an associate member, with a 10% surcharge on all F&B consumption on top of the usual GST and service charge), but apart from that the (published) benefits are the same.

In this review, I’ll be focusing on the basic version of the OCBC VOYAGE Card.

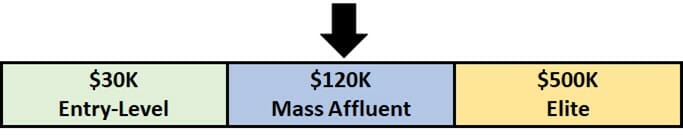

How much must I earn to qualify for an OCBC VOYAGE?

The OCBC VOYAGE has a minimum income requirement of S$120,000 p.a..

If you fall short of that mark but are otherwise asset rich, you can deposit S$200,000 with OCBC to get OCBC Premier status. This allows you to get the OCBC Premier VOYAGE with a minimum income of just S$30,000 p.a..

How much is the OCBC VOYAGE’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$492.50 | First 2 free 3rd onwards: S$189 |

| Subsequent | S$492.50 | S$189 |

The OCBC VOYAGE has an annual fee of S$492.50. Up to two supplementary cards are free for the first year, and S$189 per annum subsequently.

Cardholders who spend at least S$60,000 in a membership year (S$30,000 for the OCBC Premier VOYAGE) will receive an annual fee waiver.

15,000 VOYAGE Miles will be awarded for paying the annual fee each year, which works out to about 3.28 cents per mile. Alternatively, cardholders can opt to pay a $3,240 annual fee to receive 150,000 KrisFlyer miles, or 2.16 cents per mile.

Note that if you pick this option, you will receive KrisFlyer miles and not VOYAGE Miles (VOYAGE Miles can be converted into KrisFlyer miles, but not the other way round). As we’ll see later in this post, 1 VOYAGE Mile is more valuable than 1 KrisFlyer mile, though it’s hard to pin down an exact valuation.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.3 mpd | 2.2 mpd | N/A |

SGD/FCY Spend

OCBC VOYAGE cardholders earn:

- 1.3 VOYAGE Miles for every S$1 spent in Singapore Dollars

- 2.2 VOYAGE Miles for every S$1 spent in foreign currency (FCY)

1 VOYAGE Mile is worth 1 KrisFlyer mile, so that’s an equivalent earn rate of 1.3 mpd for local spend and 2.2 mpd for FCY spend.

These are fairly competitive rates compared to other cards in the $120K segment, although OCBC’s punitive rounding policy (discussed later in this article) will result in a lower average mpd on smaller transactions.

| 💳 Earn Rates for General Spending Cards (income req.: S$120K) |

||

| Card | Local Spend | FCY Spend |

StanChart Visa Infinite StanChart Visa Infinite |

1.4 mpd* |

3 mpd* |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd |

2.2 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

1.25 mpd^ |

2.25 mpd^ |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.4 mpd |

Citi Prestige Citi Prestige |

1.3 mpd | 2 mpd |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| *Min. S$2,000 spend per statement month, otherwise 1 mpd for both SGD and FCY ^From second year onwards, with min S$50,000 spend in the previous membership year, otherwise (or if first year) 1 mpd (SGD) and 2 mpd (FCY) |

||

Bonus Spend

The OCBC VOYAGE does not have a bonus spend category (though the OCBC PPC VOYAGE does earn 2.3 mpd on local and overseas dining).

That’s kind of a bummer, because it makes it really hard to rack up VOYAGE Miles in any significant quantity- unless perhaps you use the VOYAGE Payment Facility, which we’ll talk about in more detail below.

When are VOYAGE Miles credited?

VOYAGE Miles are credited when your transaction posts, which generally takes 1-3 working days.

How are VOYAGE Miles calculated?

Here’s how you can work out the VOYAGE Miles earned on your OCBC VOYAGE.

| Local Spend | Round down transaction to nearest S$5, divide by 5, multiply by 6.5. Round to the nearest whole number |

| FCY Spend |

Round down transaction to nearest S$5, divide by 5, multiply by 11. Round to the nearest whole number |

One annoying thing about the VOYAGE (and all OCBC cards for that matter) is that transactions are rounded down to the nearest S$5. That means a S$14.90 transaction earns the same number of miles as a S$10 transaction, and a S$4.99 transaction earns no miles at all!

This rounding policy means that even though the OCBC VOYAGE may have the same headline earn rate as a competitor, the actual number of miles earned will be smaller. Below is a comparison with the Citi Prestige, which also offers 1.3 mpd on local spending.

OCBC VOYAGE OCBC VOYAGE(1.3 mpd) |

Citi Prestige Citi Prestige(1.3 mpd) |

|

| S$5 | 7 miles | 6.4 miles |

| S$9.99 | 7 miles | 11.6 miles |

| S$15 | 20 miles | 19.6 miles |

| S$19.99 | 20 miles | 24.8 miles |

| S$25 | 33 miles | 32.4 miles |

| S$29.99 | 33 miles | 37.6 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (ROUNDDOWN(X/5,0)*6.5,0) |

| FCY Spend |

=ROUND (ROUNDDOWN(X/5,0)*11,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for VOYAGE Miles?

A full list of ineligible transactions to earn VOYAGE Miles can be found in the OCBC VOYAGE T&Cs under section 1.4.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- Hospitals

- Insurance Premiums

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real Estate Agents & Managers

- SimplyGo (Bus/MRT transactions)

- Utilities

For avoidance of doubt, OCBC VOYAGE Cards will earn miles with CardUp. There have even been special tie-ups in the past that give VOYAGE Cardholders a discount on the admin fee.

What do I need to know about VOYAGE Miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | No | S$25 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 9 | Varies |

Expiry

VOYAGE Miles earned on the OCBC VOYAGE do not expire, so long as the card remains active.

Pooling

VOYAGE Miles are a unique currency earned only on the OCBC VOYAGE, and since you can only hold one VOYAGE Card at a time, there’s no pooling to be done. You must redeem all your VOYAGE Miles before cancelling the OCBC VOYAGE, or else forfeit them.

VOYAGE Miles cannot be combined with 90°N Miles or OCBC$ for redemptions.

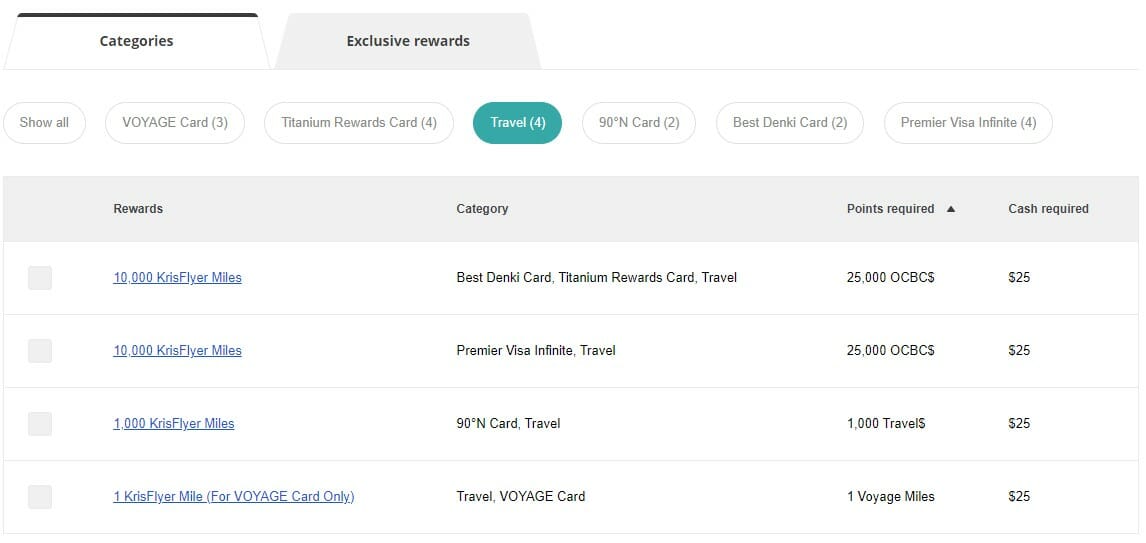

Transfer Fees, Partners & Times

Back in September 2022, OCBC announced that it was would add seven new airline and hotel transfer partners by the end of 2022. That deadline ended up slipping all the way till July 2023, but the upshot is that cardholders can now choose from nine airline and hotel partners.

| Frequent Flyer Programme | Conversion Ratio (VOYAGE Miles: Partner) |

| 1:1 | |

| 1,000 : 1,000 | |

| 1,000 : 1,000 | |

| 1,000 : 1,000 | |

| 1,000 : 900 | |

| 1,000 : 900 | |

| 1,000 : 750 | |

| 1,000 : 700 | |

| 1,000 : 500 |

The minimum transfer, transfer ratio and conversion time depends on partner.

KrisFlyer

Transfers to KrisFlyer miles are done via the OCBC Rewards portal.

A 1:1 ratio is used, with a minimum transfer of just 1 VOYAGE Mile. Transfers cost S$25, and are generally completed within 24 hours.

Other programmes

Transfers to the eight other programmes are done via the STACK Rewards portal, under the Points Exchange tab.

Transfer ratios for VOYAGE to partner miles range from 1:1 to 2:1, with a minimum transfer of 1,000 VOYAGE Miles and subsequent conversion blocks of 100.

The usual S$25 conversion fee is waived till 31 October 2023. Transfers are completed instantly for all partners except Accor Live Limitless (up to five working days).

Other card perks

Redeem VOYAGE Miles for any flight

One of the most unique features of the OCBC VOYAGE is the ability to redeem VOYAGE Miles for any seat, on any flight, to any destination. This is basically using VOYAGE Miles like cash.

To be clear, redeeming VOYAGE miles is not the same as redeeming KrisFlyer miles.

| Redeem VOYAGE Miles | Redeem KrisFlyer miles | |

| Airline | Any airline | Any KrisFlyer partner |

| Seat Availability | Any seat available for sale | Award inventory only |

| Miles Required | Depends on cost of ticket |

Fixed based on award chart |

| Taxes & Surcharges | Can be covered by miles | Paid in cash |

| Earn Miles & Status Credits | Yes | No |

VOYAGE Miles can be redeemed for any airline available through the VOYAGE Exchange (which would include every major carrier worldwide). KrisFlyer miles can be redeemed for Singapore Airlines or any of its Star Alliance/non-Star Alliance partners (which totals 30 at last count).

When you redeem VOYAGE Miles, you have access to any seat available for sale. When you redeem KrisFlyer miles, you’re limited to the space that airlines have set aside for awards.

The number of VOYAGE Miles required depends on the cost of the ticket. If the ticket is more expensive, you’ll need more VOYAGE Miles. If the ticket is cheaper, fewer VOYAGE Miles. With KrisFlyer, the number of miles is fixed according to the award chart.

VOYAGE Miles can be used to pay taxes and surcharges for tickets, but if you redeem KrisFlyer miles, you’ll need to pay for these with cash.

| ⚠️ You can, but shouldn’t! |

|

While you can use your VOYAGE Miles to pay for taxes and surcharges, you probably shouldn’t. OCBC uses a different valuation for VOYAGE Miles when used for fares, as compared to taxes and surcharges, and the rate used for the latter is very poor (presumably because they’re non-commissionable). Always opt to pay these in cash. |

Since tickets purchased through the VOYAGE Exchange are basically the same as a cash ticket, you’ll earn miles and elite status credits (e.g. PPS Value) as per the fare class. KrisFlyer redemption tickets do not earn miles or elite status credits.

Long story short, each route has their own advantages. If you use VOYAGE Miles, you enjoy better availability and miles/elite status accrual, but lower value on a per mile basis. If you use KrisFlyer miles, you have less availability and no miles/elite status accrual, but higher value on a per mile basis.

So the question then becomes: what’s the value of a VOYAGE Mile when redeemed through VOYAGE Exchange?

Unfortunately, less than before. At the time of the previous edition of this review, cardholders could enjoy a valuation of about 2.2-2.3 cents per VOYAGE Mile, when redeemed for Business Class flights. That value has now been cut to 1.72 cents, with even lower valuations for Economy Class.

| Cabin | Value per VM |

| First Class | 1.72 cents |

| Business Class | 1.72 cents |

| Premium Economy Class | 1.03 cents |

| Economy Class | 0.92 cents |

| The above figures are based on redeeming VMs via Travel with OCBC. It is also possible to redeem VM via the VOYAGE Exchange, but without holding the card I can’t tell you how those valuations differ, if at all | |

Complimentary Airport Limo

Principal OCBC VOYAGE Cardholders who spend at least S$12,000 per calendar quarter will receive two complimentary limo rides, capped at two rides per quarter and eight per calendar year.

This represents a significant devaluation compared to before, where cardholders who spent S$5,000 received one ride, capped at two rides per month and 24 per calendar year. On a per ride basis, it’s also one of the most expensive on the market.

| 💳 Airport Limo Benefits (income req.: S$120K) |

||

| Card | Qualifying Spend | Cap |

HSBC Visa Infinite HSBC Visa Infinite |

S$2K per month for 1 ride* |

24 per year |

Maybank Visa Infinite Maybank Visa Infinite |

S$3K per month for 1 ride | 8 per year |

Citi Prestige Citi Prestige |

S$12K per quarter for 2 rides | 2 per quarter |

OCBC VOYAGE OCBC VOYAGE |

S$12K per quarter for 2 rides | 2 per quarter |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A |

DBS Vantage DBS Vantage |

N/A | N/A |

SCB Visa Infinite SCB Visa Infinite |

N/A | N/A |

UOB VI Metal Card UOB VI Metal Card |

N/A | N/A |

| *First 2 (Regular customer) or 4 (HSBC Premier) per year are free | ||

That said, we’re seeing quite a few credit cards nerf their limo benefits due to rising costs, so unfortunately this is par the course.

OCBC VOYAGE limo rides are valid for trips to:

- Changi Airport (Terminals 1-4)

- Seletar Airport

- Marina Bay Cruise Centre

- Singapore Cruise Centre

- Tanah Merah Ferry Terminal

- Queen Street Bus Terminal

- Woodlands & Tuas Checkpoints

Rides must be booked by contacting the VOYAGE Concierge at least 48 hours before the time of arrival at the airport

For avoidance of doubt, cardmembers can use the limo service before the minimum spend amount is met. At the end of the calendar quarter, charges will be waived based on the entitlements earned. If limo rides in excess of entitlements are used, a S$60 fee will be charged per transfer.

Unlimited Complimentary Lounge Visits

OCBC VOYAGE Cardholders (both principal and supplementary) enjoy unlimited visits to more than 100 Plaza Premium Lounges worldwide.

While Plaza Premium Lounges are normally a cut above your typical airport contract lounge, the footprint isn’t anywhere as big as Priority Pass or LoungeKey. Travellers to Phuket, Los Angeles, Manchester and Frankfurt won’t have any lounge options, to name a few.

VOYAGE Payment Facility

The VOYAGE Payment Facility is positioned as a way for VOYAGE Cardholders to pay their bills and earn miles in the process.

In reality, however, you don’t need a bill to pay. The VOYAGE Payment Facility is a “no questions asked” way of buying miles, with a price ranging from 1.9 to 1.95 cents apiece.

| Amount | Admin Fee |

| S$10,000 to S$150,000 | 1.95% |

| S$150,100 and above | 1.9% |

A minimum of S$10,000 must be charged, in increments of S$100. 1 VOYAGE mile will be awarded for every S$1 charged to the payment facility.

For example:

- A cardholder submits a form with a request for S$100,000

- OCBC charges S$101,950 to his OCBC VOYAGE Card (S$100,000 + 1.95% fee)

- OCBC credits S$100,000 to his designated bank account and awards 100,000 miles

- He uses the S$100,000 to pay off his VOYAGE card

- Nett cost= S$1,950 for 100,000 miles, cost per mile= 1.95 cents

Up to 90% of one’s credit limit can be requested through the VOYAGE Payment Facility.

While this is a useful feature to have, it’s possible to buy miles for less using alternatives like CardUp or Citi PayAll.

Do note that VOYAGE Payment Facility transactions do not count towards the minimum spend required for limo rides, or for an annual fee waiver.

1-for-1 dining offers

OCBC VOYAGE Cardholders receive periodic 1-for-1 offers and discounts at fine dining restaurants (such as Peach Blossom and Iggys), through the VOYAGE Gourmet Experiences platform.

The 1-for-1 offers are first-come-first-serve, and get sold out very quickly. To improve your chances of snagging a slot, subscribe to the OCBC VOYAGE Telegram Group, where news about these offers breaks first.

Other Visa Infinite benefits

OCBC VOYAGE Cardholders will enjoy the following benefits provided by Visa Infinite:

- Avis President’s Club status

- 50% off weekday golf at 50 participating golf clubs across Southeast Asia

- 50% off weekday golf at Sentosa Golf Club

- Visa Luxury Hotel Collection

Terms & Conditions

Summary Review: OCBC VOYAGE Card

|

|||

| Apply Here | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

The OCBC VOYAGE Card is not without its charm, but it just feels like every perk it offers comes with a caveat attached.

Yes, it has unlimited airport lounge visits for principal and supplementary cardholders, but it’s tapping the much smaller Plaza Premium network instead of Priority Pass.

Yes, it has complimentary airport limo transfers, but the minimum spend is a hefty S$12,000 per quarter- and unlike the Citi Prestige Card, there’s no Citi PayAll to help hit the threshold.

Yes, it offers the ability to redeem VOYAGE Miles for any seat on any flight on any date, but the value per mile has been cut significantly- a double whammy given the high airfares we’re currently seeing.

Yes, it has nine different transfer partners, but the conversion ratios for many make them not worthwhile considering (e.g. it’s criminal to me that garden variety Asia Miles involve a 25% haircut compared to KrisFlyer).

Yes, it has good earn rates for a $120K card, but it also has S$5 earning blocks.

Now granted, I don’t think it’s the weakest player in the $120K segment, but given the recent nerfs, it wouldn’t be the leader either. The most I’ll say is that if you sign up during a period with an attractive welcome offer, there could be enough in here to make the first year worthwhile. After that though?

Tricky.

Might be important to note that TravelwithOCBC is operated by Ascenda and different from Voyage Exchange.

This is a great point, thanks for sharing!

Hi – does Voyage Exchange (presumably the concierge) offer a better redemption rate than TravelwithOCBC?

Doesn’t seem so in my experience but that was back when we could get 2.3 cents/VM

So, a hard-to-earn dynamic pricing currency that is based on non-transparent rates, what’s not to like?

if you use voyage miles to redeem a business class ticket with SIA do you get PPS value?

Yes

Questions

1) Does VOYAGE Payment Facility transfers count towards the annual $60,000 spent?

2) Does it make sense to use the above (1) to get the annual fee waiver

3) Is it better to pay annual fees for the 15,000 miles since it has no expiry date

Am considering between OCBC VOYAGE for its 30,000 bonus miles or should I go for OCBC Premier VOYAGE straight?

Thank you in advance for your view 😉

Do note that OCBC deems a Toyota Alphard / Vellfire to be similar to a Toyota Noah… Surprised at the downgrade.

Minor correction: BOS minimum is USD3m not SGD5m

fixed, thank you!

This card has no paywave. What card in this era does not have paywave ?I know I can add to apple of Google pay but is really silly

The newer version has paywave. Can ask ocbc to replace it for you

Does the airport transfers , work for Sub card holders? As in they can take the transfers without the main cardholder?

Reading the T&Cs, it seem to indicate that you need to meet the minimum spend before taking the limo ride. 2.8.1 If a Cardmember charges at least S$12,000 (or its equivalent in foreign currency) on his/her Card within a quarter in the eligible spend categories detailed in section 1 of these Terms and Conditions, the Principal Cardmember will be awarded with two complimentary one-way Service. A maximum of two complimentary one-way Service may be awarded to a Principal Cardmember in a quarter . A “quarter” refers to each of the 4 quarters in a calendar year i.e. January to March,… Read more »

they nerfed me…

i have a 100k 365 card limit

i took the PREMIER version, and only got 10k on it

called them, they upped to 20k

i played along and deposited 30k inside to swipe a 50k bill..

it went back to 10k limit at statement date…

think they scared of giving MPD

I think we now need 8000 miles in addition to the 12k min spend per quarter for 1 limo booking. Absurd.