Student credit cards are pretty unattractive to anyone looking to kick start their miles journey. The majority of them earn at most 1% cashback, making them little better than debit cards.

It used to be that the DBS Live Fresh Student card was the only student card in the market to have a decent miles earn rate of 1.2 mpd. Sadly, DBS nerfed the card so hard over the years that it has just become an all show and no substance card with a paltry 0.3% cashback on all spending. Although it does get you complimentary access to Zouk. (yay?)

I personally would not apply for a student credit card as this puts me in danger of not being a new-to-bank applicant when I’m looking to apply for a normal credit card in the future. Being classified as a new-to-bank customer is crucial when you are applying for your first credit card as you generally receive higher sign-up bonuses (and other good stuff) when applying for a credit card and this will greatly accelerate your pool of miles or heck, even cashback.

With little to no side benefits, you can pretty much live without a student card. However, there is one particular student card that might prove useful, thanks to a very unique perk.

Diners Club: one lounge pass per year, first-year annual fee waived

Diners Club may be a forgotten credit card company which has slowly faded into the background (back in its heyday, I still remember my parents using this card to get dining discounts at restaurants), but students may want to take note of its offerings.

There are several Diners Cards that come in student versions:

As with all student cards, these come with a S$500 credit limit per month. These are all ostensibly cashback cards, but Diners Club cards can double dip on cashback and Diners Club Rewards points. These points are earned at a S$1= 1 point rate, and can be converted to KrisFlyer Miles or Delta SkyMiles.

Before you get all excited, the conversion rate from Rewards Points to Miles is 4,500 Rewards Points to 1,000 miles with no conversion fee. That translates to a paltry earn rate of just 0.22 miles per dollar.

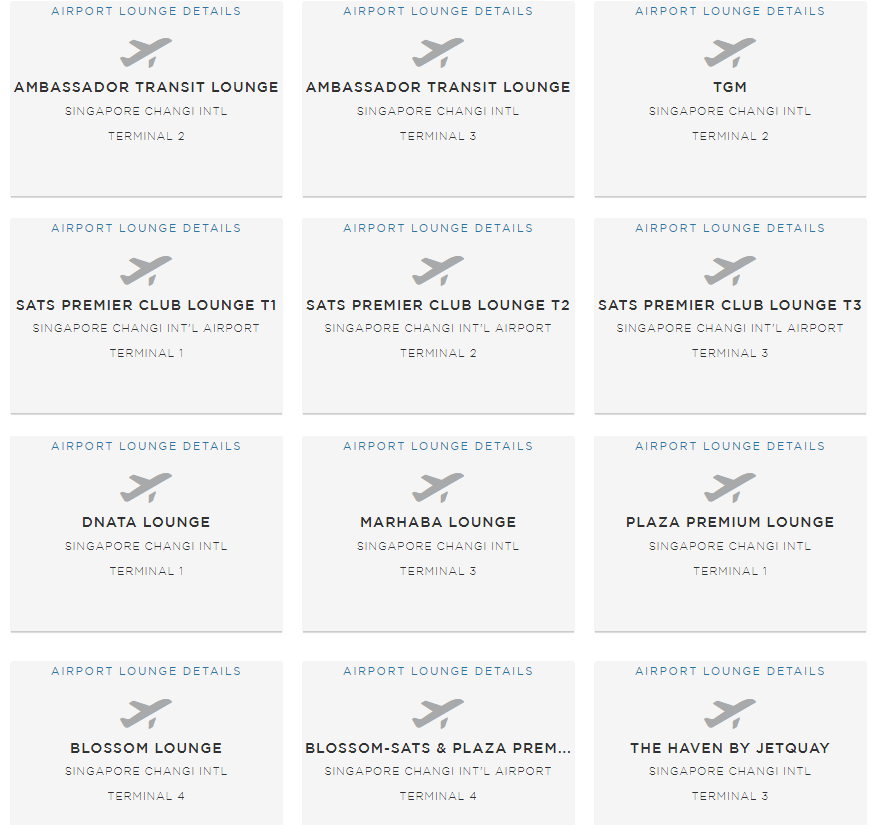

The real attraction is that Diners Club cards (including student versions) get access to participating Diners Club airport lounge located around the world.

If you hold a Diners Club card issued in Singapore, you are able to get complimentary lounge access once per year from April to March (i.e. April 2019- March 2020 counts as a year). This benefit applies once per Diners Club account, so even if you hold 10 cards, it’s still 1 access per year only. For subsequent visits consumed after the complimentary visit, you will be charged S$34 (before taxes).

Compared to other student credit cards currently in the market like the DBS Live Fresh Student Card, Maybank eVibes, and the CIMB AWSM, the Diners Club student cards definitely stand out in the with this unique perk.

In Singapore Changi Airport, the lounges which are available are pretty similar to those being offered through Priority Pass/Lounge Key:

If you’re already a working adult thinking of applying for a Diners Club card just to get the 1 complimentary entry per year, my suggestion is to look at other cards which are available which offer more complimentary lounge access visits.

Concluding Thoughts

For a first-year free card with lounge access thrown in plus complimentary shopping/dining vouchers on approval, the Diners Club cards are a pretty tempting option. Just remember to cancel it before your annual fee in the next year is due, once you’ve consumed your lounge benefit.

Just to add on to this article. I managed to get a supp card for my 17 year old daughter on the amex plat debit card. So she can use that card to access the amex lounges. Amex give approval if your child is studying overseas.

Yeah that’s a much better option, I’d do that too…if I had a plat charge xD. and it’s a plat charge, not a plat debit haha. Amex does not have debit cards.

Here’s another nugget of trivia, assuming I was given correct info from Amex CSO.. that one cannot set a Charge Limit on supplementary cards…?

To me, that’s kinda dangerous.. both in terms of temptation and/or in event the card gets lost/stolen.. I’d rather be safe and give a Visa or Mastercard and set a limit, just in case..

Diner’s Club? Their website looks like it’s stuck in 2001 and I’ve heard horror stories about their customer service. (Their customer service is only open during office hours. Seriously?? What happens if you want to report a card loss?)

That being said, I guess it makes sense to apply for a Diner’s Club student card since it makes zero sense to get a Diner’s Club card as an adult…