It seems like 100,000 miles is the new black, at least for high-end credit cards. After SCB got the ball rolling with the SCB X Card, Citi has decided to launch a 100,000 miles promotion of its own for the Citi Prestige.

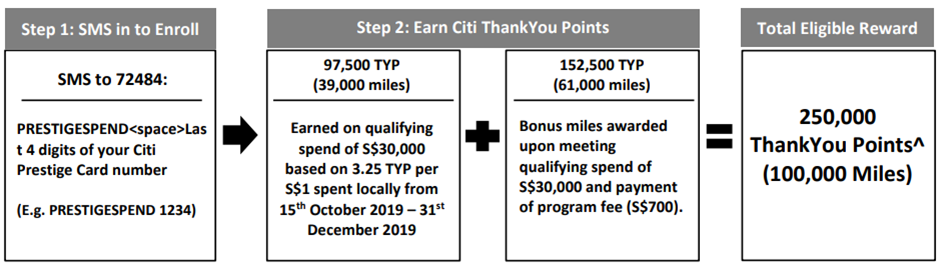

Citi Prestige customers should have received an eDM or SMS about an offer which runs from 15 October to 31 December 2019, where cardholders can earn up to 100,000 miles (250,000 Citi Thank You points) by spending on their Citi Prestige and paying a program fee.

Now, despite what the marketing materials say, it’s not really a 100,000 miles bonus. Citi’s figures include the base miles you’d earn, so it’d be more accurate to call it a “Buy up to 61,000 miles for $700 offer”- still good, but not quite as catchy.

The full T&Cs can be found here.

Citi is offering two variants of this promotion:

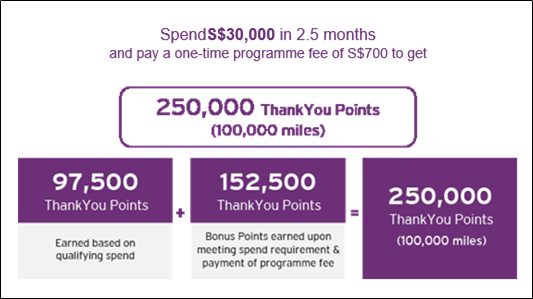

Offer 1: Spend S$30K and pay S$700 to get 61,000 bonus miles

Citi Prestige cardholders who spend S$30K in 2.5 months (an odd timeframe to be sure, but I’m guessing it’s to tie in with 31 December) and pay a fee of S$700 will receive 152.5K bonus ThankYou points (61K miles).

This is on top of the 97.5K base ThankYou points (39K miles, or S$30K @ 1.3 mpd), so your total haul is 100K miles.

In other words, you’re basically paying S$700 to buy 61K miles, or a cost of 1.15 cents per mile.

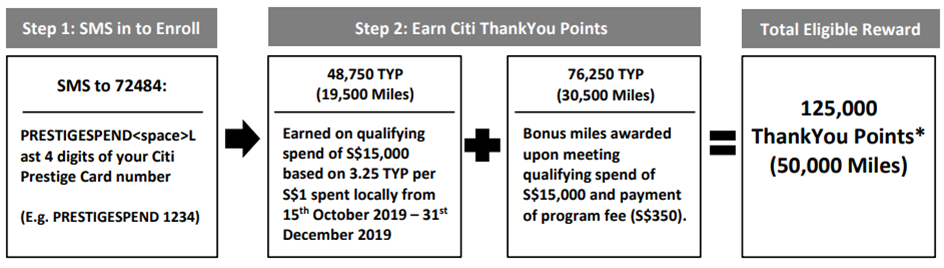

Offer 2: Spend S$15K and pay S$350 to get 30,500 bonus miles

If S$30K is too rich for you, Citi is offering half the miles with half the fee. Citi Prestige cardholders who spend S$15K by 31 December 2019 and pay a fee of S$350 will receive 76.25K bonus ThankYou points (30.5K miles).

This is on top of the 48.75K base ThankYou points (19.5K miles, or S$15K @ 1.3 mpd), so your total haul is 50K miles.

In this case, you’re paying S$300 to buy 30.5K miles, which is the same price of 1.15 cents per mile as above.

Registration required

Enrolment via SMS is required. Send the following to 72484 to register:

PRESTIGESPEND<space>Last 4 digits of your Citi Prestige Card number

(e.g PRESTIGESPEND 1234)

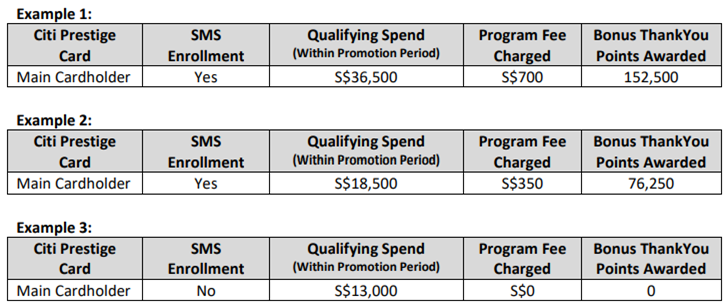

Note that you don’t actually need to pick an offer. If you register and spend at least S$30K, you’ll automatically be charged S$700 for 152,500 bonus points (it’s not possible to opt for the lower tier). If you register and spend S$15-30K, you’ll automatically be charged S$350 for 76,250 bonus points. And if you register but don’t meet S$15K, you won’t be charged anything.

Is this a good deal?

If you’re going to spend S$15K or S$30K anyway, then the opportunity to buy miles at just 1.15 cents each is something that warrants serious consideration. After all, it’s one of the lowest prices to buy miles in Singapore:

[table id=4 /]

The other question is how this compares to the SCB X Card’s 100,000 miles offer. If you view the cards in their entirety (because the only way you can take advantage of the Citi Prestige offer is to pay the annual fee too), here’s what the math looks like:

| SCB X Card |

Citi Prestige | |||

| 60K offer | 100K offer | S$15K offer | S$30K offer | |

| Spend Requirement | S$6K in 60 days |

S$15K in 2.5 months | S$30K in 2.5 months | |

| Program Fee | N/A |

S$350 | S$700 | |

| Annual Fee | S$695.50 |

S$535 | S$535 | |

| Bonus Miles | 30,000 | 70,000 | 30,500 | 61,000 |

| Miles from Annual Fee | 30,000 | 30,000 | 25,000 | 25,000 |

| CPM | 1.16 | 0.7 | 1.59 | 1.44 |

The SCB X Card offers a lower CPM, but that’s about the only thing it has going for it- it certainly can’t match the Citi Prestige in terms of card-specific benefits.

What spending counts?

As per the T&C, the following transactions do not count towards the spending requirement:

| (i) any Equal Payment Plan (EPP) purchases, (ii) refunded/ disputed/ unauthorised/fraudulent retail purchases, (iii) Quick Cash/Ready Credit PayLite and other instalment loans, (iv) PayLite/ FlexiBill/cash advance/ quasi-cash transactions/ balance transfers/ annual card membership fees/interest/goods and services taxes, (v) bill payments made using the Eligible Card as a source of funds, (vi) late payment fees and (vii) any other form of service/ miscellaneous fees. |

Apart from the exclusions listed here, everything else should count, even if it doesn’t earn base points.For example, insurance and education payments would count towards the spending requirement, but you wouldn’t earn any points on these specific transactions.

PayAll spending will be included, and is probably the easiest way of hitting the spending requirement. Spending S$30K in 2.5 months is no mean feat, but I suppose Citi has high expectations of its Prestige customers (after all, it expects them to spend S$20K in 3 months to redeem a limo…)

Citi ThankYou points are one of the most valuable points currencies in Singapore

Citi points are one of the most useful points currencies in Singapore, thanks to the sheer number of transfer partners available. Most banks offer just KrisFlyer, or at most, Asia Miles. Citi has 11 different transfer partners, including some with great sweet spots like Etihad Guest, British Airways Avios and Turkish Airlines Miles & Smiles.

Thank You points earned on the Citi Prestige card do not expire.

Conclusion

S$30K is a lot of money to spend in 2.5 months, no doubt about it. I certainly wouldn’t go out of my way to hit this (not that I have a Citi Prestige card anymore anyway), but assuming you’ve got spending planned anyway, then this is worth taking a look at.

Am curious about the ability to use Payall. There is one exclusion to qualifying spend which seems broad enough to cover Payall:

(v) bill payments made using the Eligible Card as a source of funds,

Your bonus miles row for SCB X card is flipped for 60k and 100k offer I believe

fixed! do a refresh and you’ll see it.

Hi Aaron, I think your bonus miles columns for SCB 60K and 100K miles need to be swapped?

On another note, I think supplementary card holder spendings doesn’t accrue to the total spending also after going through the T&Cs… 🙁

thank you for spotting that! have updated it.

Same question around clause: (v) bill payments made using the Eligible Card as a source of funds, in the context of Card Up rent payments

CSO answers across 3 attempts were inconsistent so took the time to write in via secure email. The reply confirmed that Card Up, Rent Hero et al are excluded from the promotion. Pity but par for the course I think.

i wonder if grabpay topups can be included….

Grab wallet can only hold 5k max at any one time. Not enough to clock the 30k spending….

top up your wife grabpay…. haha

Can’t find it in the TnCs but they used the examples of “Main cardholder”. Sub card how?

Can you clarify if you heard that Payall counts from Citi itself – I couldn’t see this published anywhere. I’d be tempted if it does but not otherwise.

I am also keen to know if Cardup is eligible. I tried calling Citibank and the person kept asking for merchant code.

Hi Tom and Patrick,

We’ve confirmed with Citi that CardUp spend is eligible for this promo.

Feel free to drop any other questions you have to us at hello@cardup.co!

Cheers,

The CardUp Team