Since July 2017, UOB has been offering PRVI Miles cardholders a service called PRVI Pay. This “no questions asked” payment facility allows cardholders to generate as many miles as they want for a fee, subject only to their credit limit.

In mid-March 2019, UOB hiked the PRVI Pay fee by 5% from 2 to 2.1 cents per mile (cpm). But since then, they’ve sent some mixed messages about the fee hike:

- In July 2019, selected customers were targeted for a 1.8 cpm offer until 31 July 2019

- In August 2019, UOB temporarily restored the 2 cpm rate until 30 September 2019

- In September 2019, UOB extended the 2 cpm rate until 31 October 2019

And now, UOB has made the decision to extend the 2 cpm rate until 31 December 2019, which means that for the majority of this year, we haven’t actually had to pay 2.1 cents at all (apologies to anyone who actually did!)

How does PRVI Pay work?

A quick refresher for those who need it:

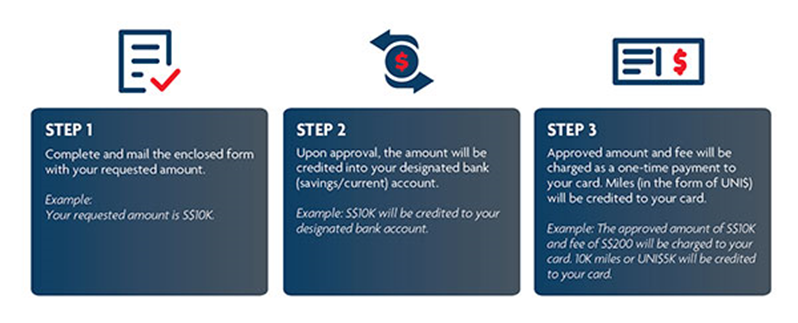

Cardholders will earn UNI$2.5 for every S$5 they charge to PRVI Pay, equivalent to 1 mile per S$1 charged. A fee of 2% applies, and hence your cost per mile is 2 cents each. Remember that the UNI$ you earn can be converted into either KrisFlyer or Asia Miles, so you have options to choose from.

Even though the number of miles you can buy is capped at your credit limit, there’s nothing stopping you from pre-paying your card account through ibanking, effectively “topping up” your credit limit.

How does this compare to other ways of buying miles?

The cost of buying miles in Singapore has fallen significantly over the past 12 months, so much so that I’ve revised my valuation of a KrisFlyer mile down from 2 cents to 1.8 cents each.

The table below summarizes your options for buying miles. Do keep in mind that not every method will be available to you, as some have income restrictions (e.g the SCB Visa Infinite’s tax payment facility requires a $150K p.a. SCB Visa Infinite card), and others require having particular types of payments (e.g. you can’t use RentHero unless you have a rental bill to pay).

[table id=4 /]

UOB PRVI Pay’s main advantage is that it’s a “no questions asked” facility- you don’t need an IRAS NOA, a tenancy agreement or anything of the sort to use it. So long as you have the credit limit, you can buy as many miles as you want.

However, there are cheaper “no questions asked” facilities out there, albeit with higher income requirements. OCBC VOYAGE cardholders (min income: $120K) can buy as many miles as they want for 1.9 or 1.95 cents each. UOB Reserve Visa Infinite cardholders (invitation only) can buy as many miles as they want for 1.9 cents each.

In that sense, UOB PRVI Pay (min income: $30K) provides the most accessible “no questions asked” facility on the market, but if you do indeed have a rental or tax bill to pay, you’re going to want to consider the following cheaper options instead:

| Rent | Tax |

|

|

| General note: Do not make the mistake of comparing admin fee % to determine which is the lowest cost option! For example, Citi PayAll has a fee of 2%, but when paired with the Citi Prestige card (1.3 mpd) can generate miles at 1.54 cents each. UOB PRVI Pay has a fee of 2%, but earns 1 mpd with the UOB PRVI Miles card for 2 cents each. Same fee, different cost. Always refer to the table above for the relevant workings |

Conclusion

At 2 cents per mile, PRVI Pay isn’t the deal of a century. However, if you’re just short of UOB’s transfer block of UNI$5,000 (10,000 miles), this could be a way of “topping up”.

I’d certainly explore the other options available before resorting to this, but if you need miles and need them quickly, PRVI Pay is still way cheaper than buying miles from Singapore Airlines at about 5 cents each.