This has been an utterly crappy year for FCY card charges:

- On 1 Apr 18, Maybank increased its FCY charge on Visa Diamante, Visa Infinite and World Mastercard from 2.5% to 2.75%

- On 4 Oct 18, Citibank increased its FCY charge from 2.8% to 3.0%

- On 1 Nov 18, HSBC increased its FCY charge from 2.5% to 2.8%

- On 1 Jan 19, CIMB will remove the admin fee waiver for FCY transactions on the Visa Signature and Platinum Mastercard, thereby increasing the fee from 1% to 3%

- On 15 Jan 19, BOC will increase its FCY charge on Mastercard transactions from 2.5% to 3% (Visa fees increased from 2.5% to 3% on 1 Dec 18)

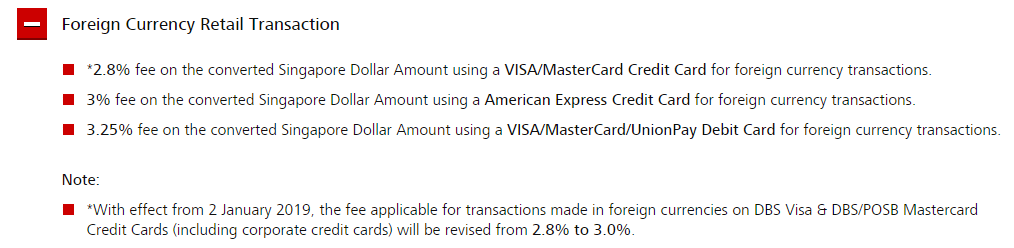

And because all that wasn’t bad enough, DBS will also be jumping on the FCY fee hike bandwagon from 2 January 2019:

In case you can’t see that clearly, it says that FCY charges on Visa/Mastercard credit card transactions will increase from 2.8% to 3.0% effective 2 January 2019. AMEX transactions remain at 3.0%.

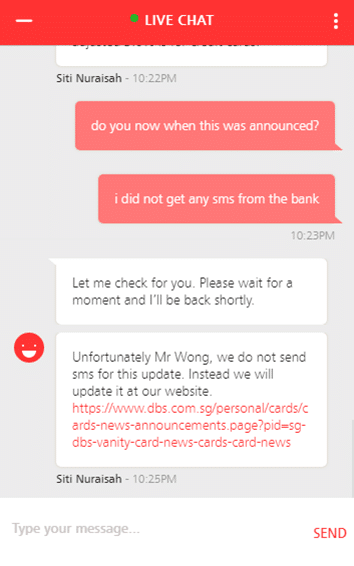

You might be wondering if you missed an SMS or letter from the bank about this. You didn’t- the change was made quietly (boo), and I stumbled upon it by accident while researching another article. Just to confirm my suspicions, I sent customer service a message, and got the following…

The link they provided is interesting, because it appears to be a running list of DBS card-related news stretching back to 2015. If you were so inclined, you could read off a history of changes that have happened to DBS cards since then (FYI: the last FCY fee hike was on 1 Dec 16, when Visa/Mastercard fees went from 2.5% to 2.8%).

What does this mean for the Altitude cards?

The DBS Altitude AMEX and Visa earn 2.0 mpd on FCY transactions. Here’s how they’ll stack up compared to other miles cards from 1 January 2019:

| Card | Overseas Earning Rate | FCY Charge | Cents/Mile |

| UOB Visa Signature (min $1K, max $2k FCY per statement period) | 4.0 | 2.8% | 0.7 |

| BOC Elite Miles World Mastercard | 3.0 | 3% (from 15 Jan) | 1.0 |

| SCB Visa Infinite(Spend >$2K per statement period) | 3.0 | 3.5% | 1.17 |

| SCB Rewards+ (capped at $2,222 per year) | 2.9 | 3.5% | 1.21 |

| AMEX KrisFlyer Blue and KrisFlyer Ascend (June and Dec) | 2.0 | 2.5% | 1.25 |

| UOB PRVI Miles (all cards) | 2.4 | 3.25% | 1.35 |

| DBS Altitude AMEX & Visa | 2.0 | 3.0% | 1.5 |

| Citibank PremierMiles Visa, Citi Prestige and Citi ULTIMA | 2.0 | 3.0% | 1.5 |

| AMEX KrisFlyer Ascend | 1.2 | 2.5% | 2.08 |

| AMEX KrisFlyer Blue | 1.1 | 2.5% | 2.27 |

| SCB Visa Infinite (Spend <$2K per statement period) | 1.0 | 3.5% | 3.5 |

1.5 cents per mile isn’t a bad fee to pay to earn miles on your overseas spending, but it isn’t the lowest, as the table above shows. You’re going to want to get a BOC Elite Miles World Mastercard or a UOB Visa Signature if you see yourself spending extensively overseas.

Conclusion

There was a time where it briefly looked like banks in Singapore might copy the idea of no-forex fee cards from the States, but that turned out to be a false dawn. FCY fees are on the up and up all across banks, and there’s no indication that anyone’s going to go against the market by introducing such a product.

These changes mean that American Express issued AMEX cards now have the lowest FCY fees in the market- fancy that! Let’s see how long that lasts…

Hi Aaron,

Can you help to include the following cards into the comparison

a) DBS Amex (Treasures)

b) Amex Platinum (Credit or Charge)

c) Citi Rewards

Thanks in advance

Bernard

+1 for Citi Rewards

there isn’t much to say about citi rewards because it’s 0.4 mpd with citi’s 3% fee…you can work out the math. of course, if you spend on qualifying overseas categories like bags, shoes and clothes you get 4 mpd in which case the deal is much better. amex platinum will be a very poor rate.

Aaron the DBS Amex Treasures Elite still gives 2.4mpd on overseas spend. I would wager that this would then be in the same league as UOB PRVI Miles? Or potentially better given the lower fees of 3.0%?

Aye, that’s right.

If you posted a comment here earlier it may have been lost in the site migration we just finished. My apologies- I hope you’ll consider reposting

i tot citi PM will give 2.4 mpd for FCY?

Hi Aaron,

is this mean that BOC Elite Miles World Mastercard still the best option if I spend less than $1 K in FCY Transaction?

yup

Maybe include citi prestige at 2.4mpd and breakdown the relationship bonus tiers?

I think that could sway the card to a more positive light

That said, I wonder if Citi will continue the promo rate…