| The Milelion has partnered with Seedly to launch The Milelion’s Community, an online space for miles chasers to ask and answer questions. In this series, I’ll pick out a few interesting ones for deeper analysis. |

An anonymous user asked the following question on The Milelion’s Community:

“Is it still worth getting a miles card if I don’t want to travel in first/business class?”

First, let me shed a little tear, because redeeming miles for Economy Class means settling for a fraction of their potential. After all, the beauty of miles is that they let us enjoy experiences we wouldn’t have been willing or able to spend money on.

I can’t think of too many people who would pay for Business Class, much less First. On the other hand, most of us could buy Economy Class tickets if we had to. So by redeeming your miles for Economy, you’re really not getting anything you wouldn’t otherwise have had.

To put it another way, the golden rule of redeeming miles is:

Miles are worth more the higher the cabin you redeem

To illustrate this, consider the following-

| Round Trip to San Francisco | Economy | Business | First |

| Cash Price | S$1,450 | S$6,780 | S$11,540 |

| Miles (Saver) | 76,000 miles + S$139 | 190,000 miles + S$139 | 260,000 miles + S$196 |

| Value per mile | 1.7 cents | 3.5 cents | 4.4 cents |

| Quotes for Economy and Business are on the non-stop SQ31/32, First Class is on the one-stop SQ1/2 | |||

Now, I’m hesitant to put it in such simplistic terms, because it’s wrong to say you get 4.4 cents per mile by redeeming First Class unless you’d have been willing to pay S$11,540 out of pocket otherwise.

Moreover, you need to consider the value of miles earned on a cash ticket, the likelihood of getting a Saver award, and a whole lot of other non-quantifiable variables that can throw your calculation out of whack.

All that said, however, the general trend still holds: miles are more valuable when redeemed for Business or First Class. But I suppose that if you’re redeeming for a family, or just trying to minimize the cost of travel, then Economy Class redemptions can look attractive. In fact, I’ve laid out a few scenarios where Economy Class awards can make sense.

So back to our question: does it make sense to get a miles card if you want to fly in Economy Class?

Most of the respondents on the Seedly thread have said “no”, with some suggesting that it’s more efficient to use a cashback card and pay for an air ticket with the money saved.

But is that true, though?

| tl;dr |

| If you only want to fly on Singapore Airlines, then it’s worth collecting miles even for Economy Class. However, if you’re open to budget carriers or other airlines, then you’re better off earning cashback and keeping the flexibility to chose carriers, dates and times |

Miles vs cashback, Economy Class edition

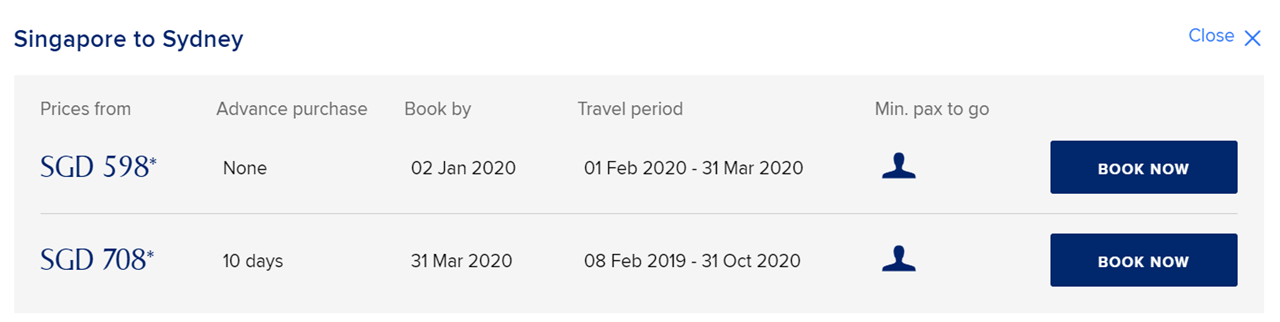

Suppose I want to fly to Sydney in Economy Class. The cheapest fare I can find on Singapore Airlines is S$598, versus 39,200 miles for a Spontaneous Escapes award.

Let’s see how much spending this award will require with a cashback card, versus a miles card.

AMEX True Cashback AMEX True Cashback |

BOC Elite Miles BOC Elite Miles |

|

| Earn rate per S$1 | 1.5% cashback | 1.5 mpd |

| Return Economy Class ticket to Sydney | S$598 | 39,200 miles + S$173 taxes |

| Spending required | ~S$40,000 | ~S$26,000 + S$173 |

That’s…interesting. We see that the miles card requires 35% less spending to earn the same Economy Class award!

If you think that’s just because I’ve chosen Sydney, consider the following table, with a few other destinations thrown in:

| Destination | Lowest Fare | SE Miles | Spend @ 1.5% | Spend @ 1.5 mpd |

| Bali | S$248 | 10.5K | S$16.5K | S$7K |

| Bangkok | S$238 | 17.5K | S$15.9K | S$11.7K |

| Taipei | S$448 | 21K | S$29.9K | S$14.0K |

| Shanghai | S$428 | 28K | S$28.5K | S$18.7K |

| Mumbai | S$478 | 25.9K | S$31.9K | S$17.3K |

| Tokyo | S$648 | 35K | S$43.2K | S$23.3K |

| Perth | S$458 | 28K | S$30.5K | S$18.7K |

| Sydney | S$598 | 39.2K | S$39.9K | S$26.1K |

| Dubai | S$538 | 35K | S$35.9K | S$23.3K |

| Frankfurt | S$978 | 53.2K | S$65.2K | S$35.5K |

| San Francisco | S$1,208 | 53.2K | S$80.5K | S$35.5K |

| New York JFK | S$1,298 | 56K | S$86.5K | S$37.3K |

| Green= Better option. Cashback option is “better” if the spending required is <115% of miles option. The 15% buffer is arbitrary, but it’s meant to account for the ability to confirm flights immediately. Additional taxes of ~S$70-180 apply for the miles option, which are “pure cost” as they can’t be covered through incidental spending. | ||||

Let me pre-empt a few objections to this analysis:

(1) You’re using Spontaneous Escapes pricing for the award- if we take the regular award price, the picture changes

Yes, I’ve used Spontaneous Escapes pricing, but my line of thinking is that if we’re looking at the absolute cheapest cash fares can go, it’s only fair we do the same for awards.

In the same way that Spontaneous Escapes have restrictions on travel (they’re only released one month in advance, no cancellations), the cheapest cash fares will also have restrictions (e.g. limited travel periods, advance booking requirements, minimum passengers to travel, no cancellations).

So I know it’s not exactly like-to-like, but if you want to compare regular price redemptions, you should look at regular price Economy Class tickets, not promo fares.

But fine, I’m feeling generous. Perhaps you don’t fancy making your travel plans a month in advance, or the destination you want doesn’t frequently feature in Spontaneous Escapes. Here’s the table again, redone with regular award prices:

| Destination | Lowest Fare | Reg. Miles | Spend @ 1.5% | Spend @ 1.5 mpd |

| Bali | S$248 | 15K | S$16.5K | S$10.0K |

| Bangkok | S$238 | 25K | S$15.9K | S$16.7K |

| Taipei | S$448 | 30K | S$29.9K | S$20.0K |

| Shanghai | S$428 | 40K | S$28.5K | S$26.7K |

| Mumbai | S$478 | 37K | S$31.9K | S$24.7K |

| Tokyo | S$648 | 50K | S$43.2K | S$33.3K |

| Perth | S$458 | 40K | S$30.5K | S$26.7K |

| Sydney | S$598 | 56K | S$39.9K | S$37.3K |

| Dubai | S$538 | 50K | S$35.9K | S$33.3K |

| Frankfurt | S$978 | 76K | S$65.2K | S$50.7K |

| San Francisco | S$1,208 | 76K | S$80.5K | S$50.7K |

| New York JFK | S$1,298 | 80K | S$86.5K | S$53.3K |

| Green= Better option. Cashback option is “better” if the spending required is <115% of miles option. The 15% buffer is arbitrary, but it’s meant to account for the ability to confirm flights immediately. Additional taxes of ~S$70-180 apply for the miles option, which are “pure cost” as they can’t be covered through incidental spending. | ||||

The picture changes, but the story largely doesn’t. Although there are some situations where a cashback card may require less spending, if you want to travel medium or long haul, you’re mostly better off with a miles card.

(2) You’re comparing revenue space to award space. It’s always easier to book a ticket with cash than miles

True. If there’s even one seat left on the plane, you should be able to buy it for cash; it’s unlikely you’ll be able to redeem it with miles. However, deep discount fares are capacity restricted too. If there are only a few seats left on the plane, you can forget about getting one.

So if we’re going to bring in the award availability argument, then we shouldn’t be looking at the cheapest cash fares either.

(3) You’re not taking into account the fact that the cash ticket earns miles, but the award ticket does not

Again, valid point. But remember, if you’re booking the cheapest cash fare, you’ll earn 50% of the miles flown. Even on the longest route in our sample set (New York JFK), you’ll earn 9,534 miles, worth ~S$170 at a 1.8 cents per mile valuation. It doesn’t dramatically change our workings, especially when we consider that a miles strategy requires up to S$49K less spending.

(4) You haven’t considered the specialized spending scenario. There are cashback cards which earn much higher rates

For ease of comparison I’ve benchmarked a general spending cashback card to a general spending miles card- both of these earn the same flat rate regardless of spending category.

We can of course look at a specialized spending scenario too, but it gets a bit more complicated. Here’s a scenario comparing the Citi Cash Back Card (8% on dining, groceries and petrol) and the DBS Woman’s World Card (4 mpd on online spending)

The Citi Cash Back card requires less spending, but there are a few important caveats to note.

First, regardless of which specialized spending cashback card you’re looking at, you’ll run into a minimum spend requirement. In the case of the Citi Cash Back card, you’ll have to spend a minimum of S$888 each month to earn 8% cashback. In contrast, there’s no minimum spending required to earn 4 mpd on the DBS Woman’s World, or with most other 4 mpd cards.

Second, the minimum spending requirement means you’ll be a lot more restricted with a specialized spending cashback card. In some cases, you may need to spend on non-bonus categories just to hit the threshold (which earn 0.25% cashback on the Citi Cash Back card). The absence of a minimum spend requirement for the DBS Woman’s World means you’re free to spend what you need each month, switching to other 4 mpd cards for other categories.

Third, note the monthly cap and the implications for how fast you earn your reward. You earn a maximum of S$75 bonus cashback per month with the Citi Cash Back card, which means at least 8 months to get your Sydney ticket. The DBS Woman’s World Card lets you earn it in as little as 5 months. Whether that’s worth a 30% difference in spending efficiency (S$7,475 vs S$9,800) is another matter, but it’s still worth highlighting.

Fourth, a lot of miles cards have sign up bonuses, which are a shortcut to hitting your reward. Very few cashback cards offer sign up bonuses, and where they do, the quantum is a lot smaller.

(5) You haven’t considered budget options or other carriers. If I’m earning cashback, I could just as well buy these instead

I can’t refute this point, because budget tickets can be fantastically cheap if you get them on sale. The same thing goes with Economy fares on other carriers. If the goal is to get from A to B in the cheapest way possible, then you wouldn’t even be considering Singapore Airlines Economy Class as an alternative.

So in that sense, yes- if you’re not an “SQ or bust” kind of person, cashback is definitely a better option for Economy/budget travel. However, if you want to fly full service Economy on Singapore Airlines, then I think there’s a decent case to be made for accumulating miles.

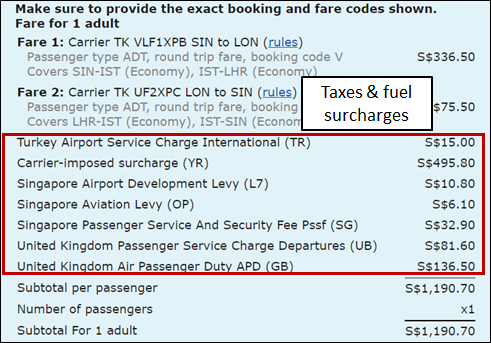

The “on Singapore Airlines” distinction is crucial, because Singapore Airlines no longer imposes fuel surcharges on award redemptions. It rarely makes sense to redeem miles for Economy on other airlines with fuel surcharges,because these can be a significant chunk of the overall cash ticket price.

Conclusion

A cashback strategy lets you keep the flexibility to choose carriers, dates and timings. If the concern is just to get the cheapest flight possible, then it doesn’t make sense to cumber yourself with a captive currency like miles. I suppose you could really say that cash is king, for people with this profile.

However, if you’re already “restricting” yourself to flying only on Singapore Airlines, then I’d argue it can still make sense to earn miles. Sign up bonuses, 4 mpd opportunities and discounts like Spontaneous Escapes can help you reach your free flight much faster than earning cashback.

At the end of the day, the best redemption is the one that makes you happy- and if that’s Singapore Airlines Economy Class, it’s still a pretty decent way to fly!

Another reason for people to use cashback to buy economy tickets or even redeem economy awards is so that there is more J and F award space available for me.

Award tickets can be changed or refunded much cheaper than a restricted cash ticket. That’s another consideration for miles.

second this, this feature has saved me countless times in the past due to last minute changes

It’s easy to get 4 mpd on most purchases with minimal spending requirements. This is a very good “rebate” even if the miles are used for economy class tickets.

Another thing is having some miles give you the option to redeem tickets when needed. When redemption tickets are “cheaper”, it will be advantageous to have these miles.

Hi. Good comparison Aaron. I don’t spend much each month and pick up 15-25K miles a year on my regular spend. Tough to get enough for longhaul J trip by miles. Only way I can do J is to buy miles so I use my miles to fly economy on SQ when possible. I thought that is my best option? You think it is still possible to fly J with my kind of spending?

Without knowing your spending and categories it’s hard to say- however if you’re already maxing out your 4 mpd and only hitting 15-25k, then your annual spending must be very low. In that case I’d look for good opportunities to buy miles for j- can be as low as 1.14 cents with the right cards

Thks to attending your workshops, I use CRV for online shopping and PPV for paywave whenever possible for 4mpd. BOC Elite for general spend, PM or Elite when overseas. Have a few other cards but not used much. Have not tried purchase. Will check it out after re-reading your articles. So far I only fly star alliance – usually SQ but have used TR. Any particular site for miles purchase to recommend?

sounds like you’re already maximizing, if you have those cards. if the annual haul is 25k max then with it’s almost impossible to fly J without buying.

for buying miles- only do so from these sources: https://milelion.com/credit-cards/buy-miles-via-credit-cards/

Thks. Will check it out. May have some addition spending in 2020 too. So may have a chance to combine miles and some purchase to fly J!

one way/open jaw is cheaper w miles redemption

All the time and frustration taken to camp and book with miles should also be in the comparison. The 1-2 hours needed collectively for book for a family of 4 is easily worth $100-200 for many people.

I think your calculations overlook the taxes payable on awards. Instead of taking ~$40,000 spending as the basis for $598 cashback, shouldn’t it be $28,333 spending for $425 cashback, to equate the comparison only with the miles portion of the award? The $173 in taxes is then the same in both cases.

yup- someone raised this in the telegram group too. i’ve been thinking about this, and here’s my take: I don’t think it’s right to say that you need to spend $28,333 @ 1.5% to earn the sydney ticket with cashback, because that only gives you $425. You need a further $173 to buy the ticket. In the same way, it’s not correct to say you need to spend $26,000 @ 1.5% to earn the sydney ticket with miles, you need a further $173 to buy the ticket. That’s why I’ve broken out the figure into $26,000 of “incidental” spending +… Read more »

it sounds like the argument is completely out of whack if you would have excluded the $173 taxes in both cases. Disappointed that u have to resort to this to justify your article. You’re subjecting the taxes to spends in the case of cashback, and for the case of miles the extra out of pocket taxes seems like falling from the sky.

Although mile cards have no minimum spending to earn reward points, they do require a minimum spending in order to cash out their reward points. Another point for consideration.

My leisure travel is always in economy given: 1) the whole family of 4 travels together, and we don’t travel/spend enough to accumulate enough points to redeem 4 premium class tickets 2) the adults travel regularly enough in premium class for work, so can slum it out in the back for the occasional leisure travel 3) it is not a good idea to let the young ones in premium cabins before they start earning some money and understand its value 4) other than the hardware (nothing beats a flat bed to sleep on on an overnight flight), I don’t derive… Read more »

Can’t agree more especially point #4. I normally try to sleep as much as possible in premium class and frequently decline/postpone meals on board as they disrupt my rest – because you normally have a full day of work before you fly or will have a full day of work/meetings when you land and besides I am normally full from having meals at the lounge before boarding. Aspirational miles chasing very often leads to overspending. People end up buying vouchers to hit minimums, spending more than necessary because aspirations somehow blend into living it up by dining out more frequently… Read more »

Someone make this person the president of something. Maybe the internet. A lot of sensible thinking jammed into one short comment.

these are some excellent points you’ve raised. thanks for sharing!

Saw this great idea to get cheap miles at HWZ: https://forums.hardwarezone.com.sg/124219515-post5673.html I called DBS hotline and ask the CSO to check with the rewards dept for the cost the points are being charged to the card if they found out you redeemed the points from reversed transactions. It is S$0.0291 per DBS point. Works out to be S$0.01455 a mile because 1 DBS Point = 2 miles for Asia Miles, KrisFlyer & Qantas Points. So each 10,000 miles block will cost S$145.50. Very worth it!! Imagine flying 1 way First Class Saver on Star Alliance airlines from SIN to Europe… Read more »

What about taking additional leave just to secure redemption tickets? Let say redemption is only available Thursday or Monday(and not possible over weekends) that means you would have to take additional 1-2 days of paid leave just to make the redemption happen. For a couple attempting to redeem that could be equivalent of 2-4 paid days and is not insignificant.

You have not taken into account on the return on cash. You can take a long time before you are able to redeem your first flight on economy while cashback is given back to you on monthly basis. There is a opportunity cost and having cash upfront is always best.