With the current restrictions on travel and dining out, many premium cardholders have started to question the logic of continuing to pay annual fees for benefits that can’t be used. This is especially the case for AMEX Platinum Charge members, who pay a hefty S$1,712 annual fee.

It seems like American Express is trying to pre-empt those questions, because they’ve just launched a rather large promotion. From now till 20 July 2020, all Platinum Charge cardholders will enjoy double points on all spending, and double the value when redeeming points for statement credit.

No registration is required, and both principal and supplementary cards are automatically enrolled.

Double Points

| Regular Earn Rate | Enhanced Earn Rate (until 20-Jul-20) |

|

| General Spending | 0.78 mpd | 1.56 mpd |

| Singapore Airlines, SilkAir, Scoot tickets | 1.95 mpd | 3.9 mpd |

| Platinum EXTRA Merchants | 7.8 mpd | 15.6 mpd |

From now till 20 July 2020, AMEX Platinum Charge cardholders will earn double the usual points on all transactions, with no minimum spending or caps (except for Platinum EXTRA merchants).

This means a general spending earn rate of 1.56 mpd, which would make the AMEX Platinum Charge the second best general spending card in the market, slightly behind the UOB Reserve, DBS Insignia, Citi ULTIMA and OCBC Premier & Private Banking VOYAGE cards at 1.6 mpd.

A 1.56 mpd rate also makes the AMEX Platinum Charge a potential candidate for paying your income taxes, rent, insurance, or other bills via CardUp. CardUp charges a 2.6% admin fee for AMEX cards, which means a 1.62 cents per mile figure

| If you’re new to CardUp, use the promo code MILELION and get S$20 off your first payment |

Likewise, the usual 1.95 mpd earn rate on Singapore Airlines, SilkAir, and Scoot tickets is doubled to 3.9 mpd, and the 7.8 mpd earn rate on Platinum EXTRA merchants is doubled to an incredible 15.6 mpd. Revenge spending, anyone?

Do remember that the bonus points on Platinum EXTRA merchants are capped at S$16,000 per calendar year. Any spending after that will earn 20X points until 20 July 2020, and 10X after that.

| Who are Platinum EXTRA merchants? | |

|

|

Double Value

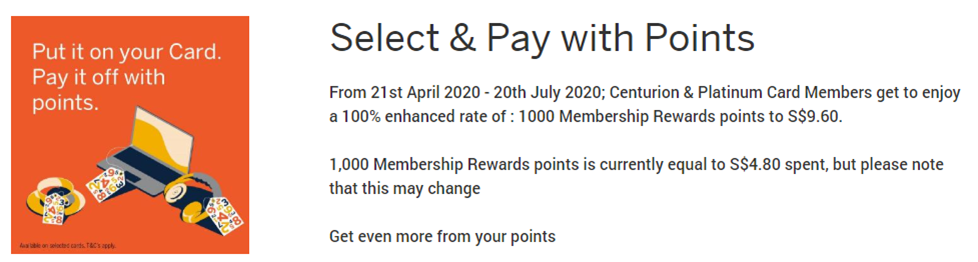

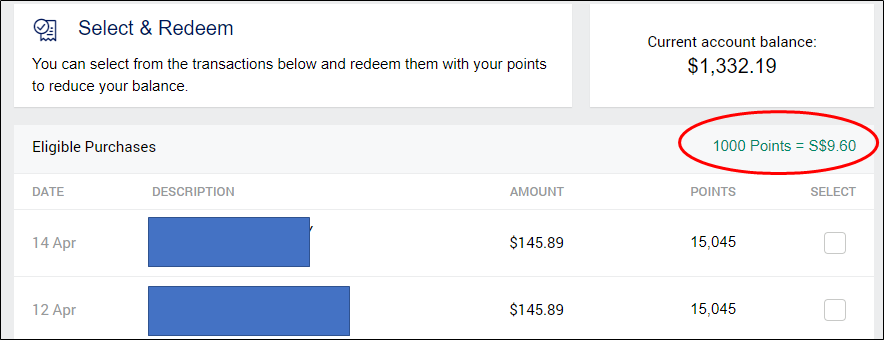

Charges on your AMEX statement can normally be offset with Membership Rewards points, at a rate of 1,000 points= S$4.80.

The regular rate is a very poor deal. 1,000 points are worth 625 miles, so it’s like you’re implicitly cashing in your miles for 0.77 cents each.

From now till 20 July 2020, this rate will be doubled to 1,000 points = S$9.60. That’s like taking 1.54 cents per mile, less than what you’d get when redeeming premium cabin tickets, but still equivalent to earning 2.4% cashback on everything (other general spending cashback cards max out at 1.6%).

If you’re spending at Platinum EXTRA merchants, AMEX Platinum Charge cardholders would effectively get 24% off on the first S$16,000 spent. Put that way, it doesn’t sound so bad forgoing miles for cashback.

| Regular Earn Rate | Enhanced Earn Rate (until 20-Jul-20) |

|

| MR Points Per S$1.60 | 2 | 4 |

| Value of 1,000 MR points | S$4.80 | S$9.60 |

| Effective Cashback | 1.2% | 2.4% |

Enhanced rate for paying annual fee with points

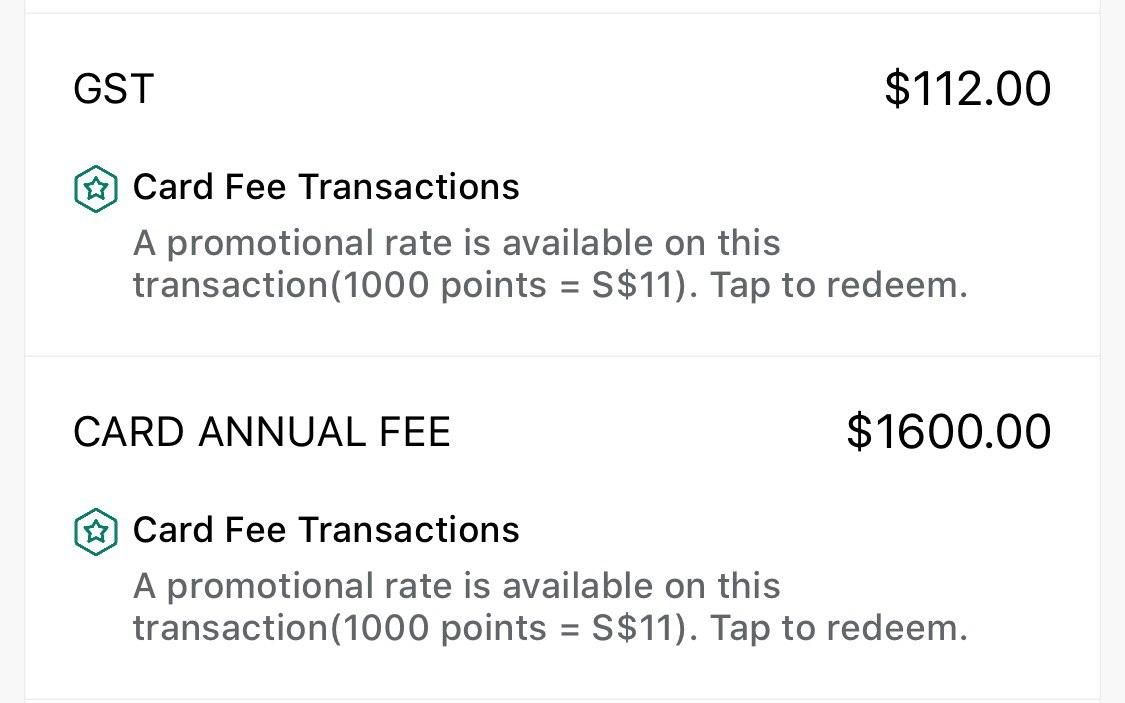

Perhaps realising that the annual fee will be a major pain point for customers with renewals due in the next couple of months, AMEX is offering a special rate of 1,000 points= S$11 when using points to offset the fee.

A full fee waiver would cost 155,636 points.

What programs can I transfer Membership Rewards points to?

MR points never expire, and members can transfer them to eight different frequent flyer programs and two hotel partners at the following ratios (no conversion fees apply):

| Transfer Ratio (MR Points: Partner Miles/Points) |

|

|

400: 250 |

| 400:250 | |

| 400:250 | |

| 400:250 | |

|

400:250 |

|

400:250 |

|

400:250 |

|

400:250 |

|

1000:1250 |

|

1000:1000 |

Conclusion

This is no doubt going to be an expensive promotion for American Express, but it’s also a necessary one. If the Covid-19 situation doesn’t improve, many of the Platinum Charge’s benefits can’t be used, and that’s not going to play well among customers with upcoming renewals.

My renewal isn’t due until September, so I don’t have that decision on my hands yet. I am, however, going to start using the AMEX Platinum Charge as my general spending card for the duration of the promotion.

“All eligible spend in excess of S$16,000, earn 2 Membership Rewards points and receive 8 additional Membership Rewards points for every full S$1.60 spent. ” from T&C

Do remember that the bonus points on Platinum EXTRA merchants are capped at S$16,000 per calendar year. Any spending after that will earn 1.56 mpd until 20 July 2020, and 0.78 mpd after that.

updated to 20x and 10x, thanks!

Hi Aaron, I think the bonus points is 20MR and 10MR rather than 20x and 10x.

I was calculating repeatedly as I’m planning some big ticket purchases and wanted to be sure, that’s why I spotted these little errors.

Thank you once again for your hard work and great tips!

2 of my friends were successful for a waiver of the annual fee, one in feb and one last week

lol joker

Were they big spenders or long-time (and good client) of AmEx?

If this sticks permanently it would be the only card in my wallet

Why are you using such a weird name “Platinum Charge”. This card is usually known as “The Platinum Card” and its well-known name is “The Platinum Card” in other countries like US and UK as well. It is a global logo card, should just follow the global naming rather than giving it a weird name to differentiate itself between “The Platinum Card” vs “Platinum Credit Card” and “Platinum Reserve Credit Card” in Singapore market.

Hey Aaron.. Any idea how this bonus would work if one had already hit the $16000 limit on EXTRA Partners in Q1 2020..?

Thanks!

Hey hoping that someone can help enlighten me about Aaron saying

“If you’re spending at Platinum EXTRA merchants, AMEX Platinum Charge cardholders would effectively get 24% off on the first S$16,000 spent”

Platinum Extra merchants will have an earn rate of $1.60 : 20 MR points

So if we spent $1600 that would amount to 20,000 MR points

Based on 1000MR to $9.60 conversion, 20,000 MR is $192

$192 is 12% of $1600.

How do we get at 24% cashback?

First $16000 gets a total of 40MR points per $1.60 at Platinum EXTRA merchants.

The math will work after that. 🙂

Hi, great article and sharing. However, may I point out that the effective cashback for regular earn rate is actually 0.6% rather than 1.2?

Thank you!