From 1 June 2020, the OCBC 90°N will be updating its T&Cs to introduce S$5 earning blocks and additional rewards exclusion categories.

In a nutshell, these changes are bad. Cardholders suffer an effective devaluation in the miles earn rate thanks to the S$5 earning blocks, and the new exclusions further limit the places you can earn rewards.

| ⚠️ OCBC has also unveiled changes to its VOYAGE card, which take effect from June 1. Read the analysis and how it affects you here |

The old T&Cs can be found here, while the new T&Cs can be found here. For ease of reference, I’ve created a comparison which you can view here.

Introduction of S$5 earning blocks

Here’s how earning points on the OCBC 90°N Card will change from 1 June 2020.

| Before 1 June 2020 | From 1 June 2020 | |

| Local Spend | S$1= 1.2 Travel$ | S$5= 6 Travel$ |

| Overseas Spend | S$1= 2.1 Travel$ | S$5= 10.5 Travel$ |

| AXS Pay+Earn | S$1= 1 Travel$ | S$5= 5 Travel$ |

On first glance, it seems like the status quo’s been maintained. After all, S$1 currently earns you 1.2 Travel$. From 1 June 2020, S$5 earns you 6 Travel$. Some quick math shows they’re one and the same, right?

Not quite. The devil is in the details, or rather, the rounding.

| ❓ Learn how different banks round credit card points, and how that affects the points you earn |

Here’s how OCBC currently calculates points on the 90°N Card:

- Round transaction down to the nearest S$1

- Multiply by 1.2 (local) or 2.1 (FCY)

- Round figure to nearest whole number

From 1 June 2020, here’s how points will be calculated:

- Round transaction down to nearest S$5

- Divide transaction by 5

- Multiply by 6 (local) or 10.5 (FCY)

- Round figure to nearest whole number

If that’s too much math for you, perhaps this table will clarify things:

| Amount (local spending) |

Before 1 June 2020 | From 1 June 2020 |

| S$4.99 | 5 miles (1 mpd) |

0 miles (0 mpd) |

| S$5 | 6 miles (1.2 mpd) |

6 miles (1.2 mpd) |

| S$9.99 | 11 miles (1.1 mpd) |

6 miles (0.6 mpd) |

| S$10 | 12 miles (1.2 mpd) |

12 miles (1.2 mpd) |

| S$14.99 | 17 miles (1.1 mpd) |

12 miles (0.8 mpd) |

| S$15 | 18 miles (1.2 mpd) |

18 miles (1.2 mpd) |

| S$19.99 | 23 miles (1.15 mpd) |

18 miles (0.9 mpd) |

| S$20 | 24 miles (1.2 mpd) |

24 miles (1.2 mpd) |

The introduction of S$5 blocks effectively devalues the earn rate, because there is no scenario where 90°N cardholders come out better, and several where they come out worse.

Now, the effect of rounding obviously gets smaller as your transaction size increases, and the most miles you’d lose on any transaction is 5. At the same time, however, it just doesn’t seem equitable that someone who spends S$14.99 is rewarded the same as someone who spends S$10. After all, the merchant fees a bank earns from a S$14.99 transaction will be more than on a S$10 transaction- why should they pocket all of the extra?

New exclusion categories

From 1 June 2020, the following transactions will no longer earn points:

- MCC 7349: Cleaning, Maintenance and Janitorial Services

- MCC 4784: Tolls and Bridge Fees

- MCC 5993: Cigars, Stores and Stands

- MCC 8675: Automobile Associations

- MCC 8699: Labour Union

- Transactions to Singapore Government Public Hospitals including Non-Profit Hospitals, Community Hospitals and Polyclinics under the MCC 8062

- Transactions under Transportation and Tolls MCC 4111/4121/4131 except for Grab Transport, Gojek and Comfort/Citycab transactions

There’s not much to say about cleaning services, automobile associations or labour unions, but here’s my thoughts on the rest.

👍 Cleaning services rendered through Helpling don’t code as MCC 7349. Instead, they code as MCC 5734 Computer Software Stores. I know, right?  |

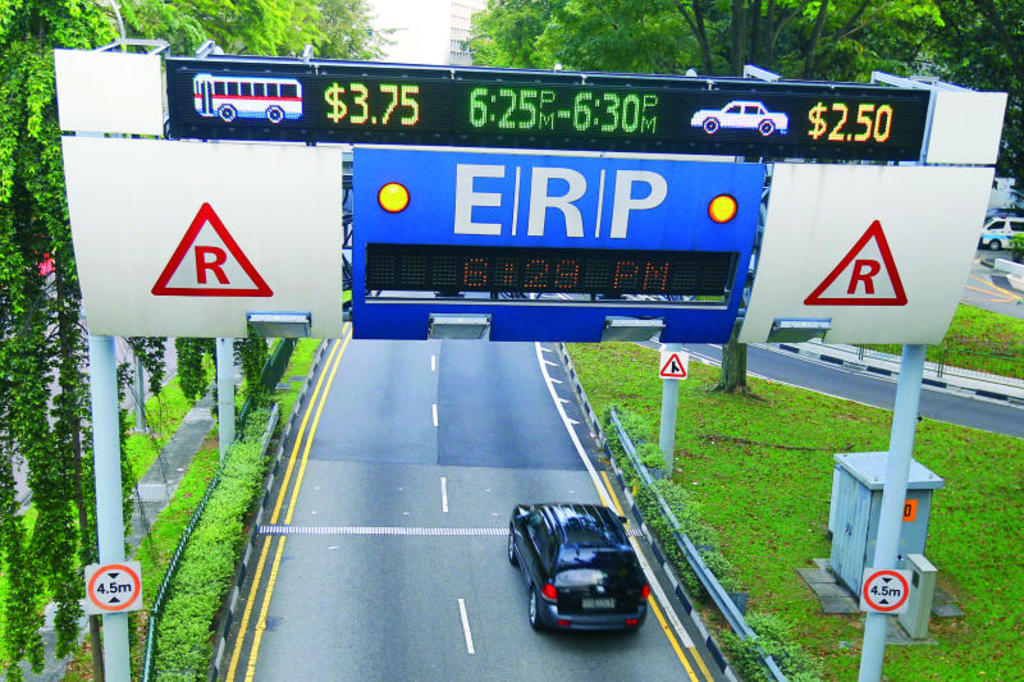

MCC 4784

We don’t have bridge fees in Singapore, but my guess is MCC 4784 covers MotorPay transactions. MotorPay, for the uninitiated, is a service which lets you pass through ERP gantries without a cashcard in your IU. Your tolls are billed to your credit card on a periodic basis.

MCC 5993

The loss of cigar stores is…puzzling, but this isn’t the first time a bank’s taken a stand on clean lungs. A while back I wrote about the weirdest things I’ve found in credit card T&Cs, and smack in the middle of DBS Reward’s T&Cs was this gem:

4.5 The use of Redemption Voucher for any tobacco or tobacco related product purchases are not allowed.

So yeah. Don’t smoke, kids.

MCC 8062

It’s important to note that OCBC has not done a blanket exclusion of MCC 8062. Rather, they’re excluding public, non-profit, and community hospitals, as well as polyclinics. These entities presumably enjoy a discounted MDR (merchant discount rate) which makes rewards uneconomical.

OCBC has told me that you will continue to earn points at private hospitals under MCC 8062, such as Gleneagles, Mount Alvernia, Farrer Park Hospital etc. I’ve requested for the full list of private hospitals where points will still be earned, and will update this article when I receive it.

| ⚠️ Update: OCBC has provided me with the following list of public hospitals and facilities where points will not be earned. | |

| Alexandra Hospital Changi General Hospital Khoo Teck Puat Hospital KK Womens’ and Children’s Hospital National Cancer Centre National Heart Centre Singapore National Neuroscience Institute National Skin Centre National University Hospital Ng Teng Fong General Hospital Sengkang General Hospital Singapore General Hospital Singapore National Eye Centre Tan Tock Seng Hospital Institute of Mental Health Bright Vision Hospital Jurong Community Hospital Outram Community Hospital Sengkang Community Hospital Yishun Community Hospital Mount Alvernia Hospital Ang Mo Kio – Thye Hua Kwan Hospital Ren Ci Community Hospital St. Andrew’s Community Hospital St Luke’s Hospital |

ANG MO KIO POLYCLINIC BEDOK POLYCLINIC BUKIT BATOK POLYCLINIC BUKIT MERAH POLYCLINIC CHOA CHU KANG POLYCLINIC CLEMENTI POLYCLINIC GEYLANG POLYCLINIC JURONG POLYCLINIC MARINE PARADE POLYCLINIC OUTRAM POLYCLINIC PASIR RIS POLYCLINIC PIONEER POLYCLINIC PUNGGOL POLYCLINIC SENGKANG POLYCLINIC TAMPINES POLYCLINIC YISHUN POLYCLINIC COMMUNITY EYE CLINIC COMMUNITY HEARING CLINIC HEART CENTRE SINGAPORE |

MCC 4111/4121/4131

This one’s particularly confusing. OCBC will cease to award points on transactions under MCC 4111/4121/4131, except for transactions with Grab Transport, Gojek and licensed taxi operators (including, without limitation, Comfort/Citycab/ Transcab/ SMRT Taxi/ Premier Taxi/ Prime Taxi/ HDT Taxi).

This would rule out other private car hire services.

Conclusion

The OCBC 90°N still retains its no-fee conversions, a transfer block of just 1,000 Travel$, and non-expiring points.

However, it’s disheartening to see them join UOB in the “S$5 block” club, and I really hope this doesn’t entice other banks to do likewise.

| ⚠️ DBS also awards points in blocks of S$5, but their method of calculating is somewhat less harsh towards customers |

So much for being transparent and not hiding being tncs.

There’s really no point in having this card post 29 Feb 2020.

And this is why I really give kudos to the serious miles collectors out there. I tried by starting with UOB Prvi Card (my first cc ever btw at the grand age of 40!) and then swapped to OCBC 90N due to its initial rewards rates and also cuz I *CANNOT* handle UOB’s UI with their app and overall banking service. But just doing that one swap, I had to jump through so many hoops changing out all my saved cc details on accts, etc. OCBC is by easier to handle since I already am a banking customer with them…but… Read more »

Agreed! Probably, u can save in your mobile browser https://www.whatcard.sg/ for subsequent miles collection planning 🙂

OCBC 2017: sTaYy TrUe~

Also OCBC:

can tell them to shove the card

Card has been in the drawer since March 1 anyway- just set a reminder to cancel it now before annual fee

Exactly. They must have seen the huge drop in usage post 29 Feb, and some bright sparks got together and thought, gee, let’s make this card even less competitive by following UOB’s dreadful practice.

So, if one does not want to use BOC system, the best general spend card now is UOB PRVI (1.4mpd in $5 blocks), Next is DBS Altitude (1.2 in $1.67 blocks) and last is this OCBC N90 now?

Not that simple- must account for the fact 90n has no transfer fees and only 1k min conversion. Uob prvi has 2 year expiry. Prvi + altitude got $25 conversion fee

I disagree that the no transfer fee and low min conversion is that significant of a benefit. For one, most of us would have another UOB card (PPV, VS, maybe Lady’s depending on gender) and DBS card (WWMC), and the points earned there would pool together with our PRVI and Alt cards respectively upon redemption, negating any additional free conversion. The low min conversion is somewhat useful, but then again if I was spending in $5 blocks I’d just go with the PRVI for the superior earn rate. It might make sense for some people, but it’s a deal breaker… Read more »

Pretty sad about this, i signed up only in the beginning of the year.

Would like to check what would be the next best entry level card.

DBS Altitude VISA / Citi Premier Miles Mastercard

For me I would personally go for DBS Altitude because of 3 mpd on online flight + hotel bookings where Citi PM doesn’t have.

PRVI for 1.4 mpd (beware $5 blocks, but higher earn rate) / Altitude for 1.2 mpd ($1.67 blocks) as Zezima mentioned. The benefit is that PRVI pools with other UOB cards (PPV, VS, Lady’s (sorry you probably can’t get this one)), Alt pools with WWMC.

If you’re feeling brave can even go for BOC Elite Miles for 1.5 mpd plus no annoying blocks to worry about.

Although the introduction of the $5 block look bad but im already used to it due to im holding UOB CC.. but its still a very important card in my miles game…The reason being is that it will award miles for FCY even though the payment gateway is in SG. Basically this card i will use if im not sure whether the payment gateway is in sg or not…