So the news broke yesterday that BOC is well and truly nerfing the BOC Elite Miles card.

From 15 June 2020, the earn rates will be cut to a paltry 1 and 2 mpd for local and overseas spending respectively. That’s thanks to a 50% increase in the cost of redeeming KrisFlyer or Asia Miles, which applies to all points, existing or future.

| Current | From 15 June 2020 | |

| Earn Rate | Local: 1.5 mpd FCY: 3.0 mpd |

Local: 1.0 mpd FCY: 2.0 mpd |

|

30,000 points = 10,000 miles |

45,000 points = 10,000 miles |

| 18,000 points = 6,000 miles |

27,000 points= 6,000 miles |

|

| There will also be new exclusion categories for insurance, education, hospital transactions and more. Read this article for the full details. | ||

Looking at the watered-down version we’ll have from June, it’s hard to believe this was the same card that set the market alight when it debuted in July 2018 with 2 and 5 mpd for local and overseas spending.

In with a bang, out with a whimper. Something something die a hero something something.

How do you cash out your BOC points for miles?

Now, needless to say, you’re going to want to cash out all your points before 15 June 2020. Any points remaining that fateful Monday will lose 33% of their value, at least where conversions to miles are concerned.

You can check your points balance through online banking. Navigate to Credit Card → Account Information → Select your card on top → Click Inquiry. You’ll see the balance reflected under “Rewards Points”, right down to 2 decimal points.

| ☝️ Don’t have BOC online banking? You’ll need to go down to a physical branch to set it up. If you already have a BOC online banking account but got a credit card subsequently, you’ll again have to head down to a physical branch to link the card to the ibanking account. |

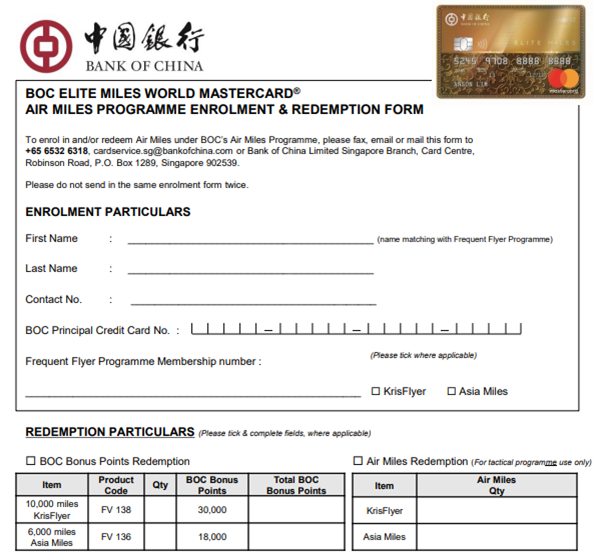

For those of you who haven’t transferred BOC points before, you’re in for a treat. The process involves filling up this form (hopefully you have a PDF editor, or else you’ll have to print, fill, and scan) and emailing it to cardservice.sg@bankofchina.com. A manual form, in 2020. This is truly the dawning of the Age of Aquarius.

Officially, BOC’s points transfer process can take up to 3 weeks. Fortunately, my two previous experiences were much faster than that, taking 3 and 11 days respectively. However, this is really a case of YMMV, so I wouldn’t leave it till too late.

| Form Submitted | Received |

| 30-Oct-19 | 2-Nov-19 |

| 13-Nov-19 | 24-Nov-19 |

If you’re lucky enough, your points balance will be at or almost at a nice multiple of 30,000 (KrisFlyer) or 18,000 (Asia Miles). This will allow you to cash out your balance with zero or close to zero orphan points.

| ⚠️ Remember that BOC, rather ludicrously, limits you to a maximum of 10 blocks of points per transfer. There’s no technical or logical reason for this, it’s simply because they can. 10 blocks means 100,000 KrisFlyer miles, or 60,000 Asia Miles. If you want to transfer more than this, you’ll need to submit a separate request and pay a second S$30 fee |

But some of you may be stuck in between- too many points to forfeit, too few to make it worthwhile spending up to the next block. What do you do then?

How do you burn orphan points?

Apart from miles, here are the other options you can redeem BOC points for:

| BOC Rewards Catalogue |

||

| Merchant (Code) | Item | Points |

| Bengawan Solo (FV 126) | $10 | 5,000 |

| AsiaMalls (FV 102) | $10 | 5,000 |

| The Clementi Mall (FV 104) | $10 | 5,000 |

| Isetan (FV 107) | $10 | 5,000 |

| Metro (FV 108) | $10 | 5,000 |

| Paragon (FV 110) | $10 | 5,000 |

| Popular Bookstore (FV 111) | $10 | 5,000 |

| The Seletar Mall (FV 114) | $10 | 5,000 |

| Takashimaya (FV 115) | $10 | 5,000 |

| UOL Malls (KINEX, United Square, Velocity) (FV 117) | $10 | 5,000 |

| GNC (FV 121) | $10 | 5,000 |

| Watsons (FV 125) | $10 | 5,000 |

| NTUC FairPrice (FV 119) | $10 | 5,000 |

| Sheng Siong (FV 120) | $10 | 5,000 |

| Golden Village (FV 130) | Movie voucher | 5,300 |

| WE Cinemas (FV 131) | 2D Movie voucher | 5,500 |

| Swensen’s (FV 128) | $20 | 10,000 |

| Crocodile (FV 105) | $20 | 10,000 |

| RISIS (FV 113) | $20 | 10,000 |

| TANGS (FV116) | $20 | 10,000 |

| Best Denki (FV 103) | $30 | 15,000 |

| Harvey Norman (FV 106) | $30 | 15,000 |

| Long Beach Seafood Restaurant (FV 127) | $50 | 25,000 |

| OSIM (FV 124) | $50 | 25,000 |

| $20 Statement Rebate (FV 146) | $20 | 30,000 |

| $50 Statement Rebate (FV 147) | $50 | 60,000 |

The first thing you’ll notice is that where vouchers are concerned, BOC points attract a fixed value of 0.2 cents each. That means there’s no “better” or “worse” deal here- it all depends on what tickles your fancy.

Given the BOC Elite Miles’ current earn rate of 4.5 points per S$1 on local spending and 9 points per S$1 on overseas spending, taking 0.2 cents per point is like earning a 0.9% and 1.8% rebate respectively. It’s not fantastic, but better than leaving value behind.

You also have the option to take a statement rebate, but the value per point drops to a dismal 0.07-0.08 cents. That’s a 0.3%-0.75% rebate, and you can flat out forget about it.

The redemption process is, you guessed it, manual. You’ll need to call up BOC customer service at 1 800 338 5335 and make the redemption over the phone. All vouchers issued are valid for 3 months (or the actual date stated on the voucher itself).

What am I doing with my BOC points?

As the previous screenshot showed, I’ve got 186,283 points left. 180,000 of those will go to Asia Miles (I’m warming up to them now that there’s no more fuel surcharges, plus I need some oneworld diversification), and of the 6,283 balance, I’ll take a S$10 NTUC voucher for 5,000 and consider the remaining 1,283 points a cost of doing business with BOC.

That represents ~S$285 of wasted spending, which as sheer coincidence would have it, is the exact annual fee I’d otherwise pay for my principal (S$190) and supplementary card (S$95). There’s something awfully poetic in that.

Conclusion

Please make it a point to tell everyone you know: cash out your BOC points before 15 June 2020. Get miles, get vouchers, get whatever, just don’t leave them there.

I wonder what BOC’s gameplan was with all this. It was very clear that the 2/5 mpd rates offered upon launch were not sustainable, but wasn’t the whole idea that this card would serve as a loss leader for customer acquisition? Get people on board, start cross selling them bank accounts and other products, turn them into lifelong customers and make the money back…

Well, as the bank’s going to find out over the next couple of weeks, that really hasn’t worked out. It’s going to be a full on rush for the lifeboats, and the BOC Elite Miles will be relegated to an interesting footnote in the history of the Singapore miles game.

Goodbye BOC Elite Miles!

I’m excited to being the king of General Spend for the mass market again :))

Welcome back. We’ve missed you**

**only for purchases in $5 round blocks or less than $30

More than $30. Argh. How did I miss that

when you hold a birthday party, do you tell people “the first 10 people to arrive will get cake?”

The customers probably have been acquired. I still see people using Citi Rewards Card as general spending card.

You cannot imagine the rage I feel reading this comment.

On the bright side, I guess they’re subsidizing the savvy miles chasers?

It’s the same rage i feel hearing “NETS” being given as an answer to a cashier’s “Visa or Nets” question 🙁

But surely if you send the form before 15 June by email, there’s a date stamp and BOC should recognise that as the date for authorising the points transfer to KF or AM – even if they “received” it on after 15 June?

Has this been clarified by BOC?

I feel compelled to point out that BOC is not the only bank that failed to successfully transition to 2020. I had to print, manually complete and snail mail a form to get 2FA approval for UOB. No option to email. For the record, I have PDF editor. The request took months to approve. I could not access my credit card statement for months and as they only allowed online statements to be accessed with 2FA. No paper statements (ironic). I would complain to their customer “service” but I know to pick my battles.

Called them today and was answered not by a CSO but by someone who was taking customer details for the CSOs to call back. Haha.

Oh boy.

I pity the call center CSOs and the admin people who have to process the mountain of paper and emailed forms coming in the next few days.

How do I claim the vouchers other than miles? Do I need to call and redeem?

“The redemption process is, you guessed it, manual. You’ll need to call up BOC customer service at 1 800 338 5335 and make the redemption over the phone. All vouchers issued are valid for 3 months (or the actual date stated on the voucher itself).”

Clearly stated in article.

Hi Arron,

For the form.. do i need to check the box at the “Air Miles Redemption” and type in the total miles quantity? or i leave it as blank?

I only check the “BOC Bonus Point Redemption” and key in Qty 10 and Total Boc Bonus point 300000.

Tks

I have about 4100 points available, is there no way to turn them into anything useful?

Edit: Sorry, misread

Spend up to 5k points then get out

1 dollar spend is 4.5 points. So your shortfall of 900 points means you need to spend $200 to reach $5,000.

Hope this helps!

If you have 300,000 BOC points instead of 180,000 would you redeem all on Krisflyer to avoid paying $30 twice? or do you still pay $30 twice as you would view Asian Miles a good currency as it has sweet spot to some of Europe and the Asian Miles do not have fix expiry like Krisflyer.

BOC no more supermarket vouchers left liao. just called today lei