Member-get-Member (MGM) programs allow cardholders to earn rewards when referring family and friends for a credit card. Referees typically also enjoy an additional bonus beyond what they would have received if signing up through other channels.

American Express and Citibank have their own MGM programs, but this is the first I’ve seen from Standard Chartered.

Standard Chartered’s Member-Get-Member program

From now till 30 June 2020, existing Standard Chartered credit card or bank account holders can refer family and friends for credit cards. Both referrer and referee receive S$150 cashback each upon approval, with no minimum spending required.

| ⚠️ Only account holders of Bonus$aver Account, e$aver Account, Unlimited$aver Account, MyWay Savings Account, XtraSaver Account, JumpStart Account, SuperSalary Account, Preferred Current Account and Dash Easy Savings Account are eligible to make a referral |

Only referees who do not hold any principal Standard Chartered credit cards now or in the past 12 months are eligible for this offer. There’s no issue if they currently hold a supplementary Standard Chartered credit card, or a Standard Chartered bank account for that matter.

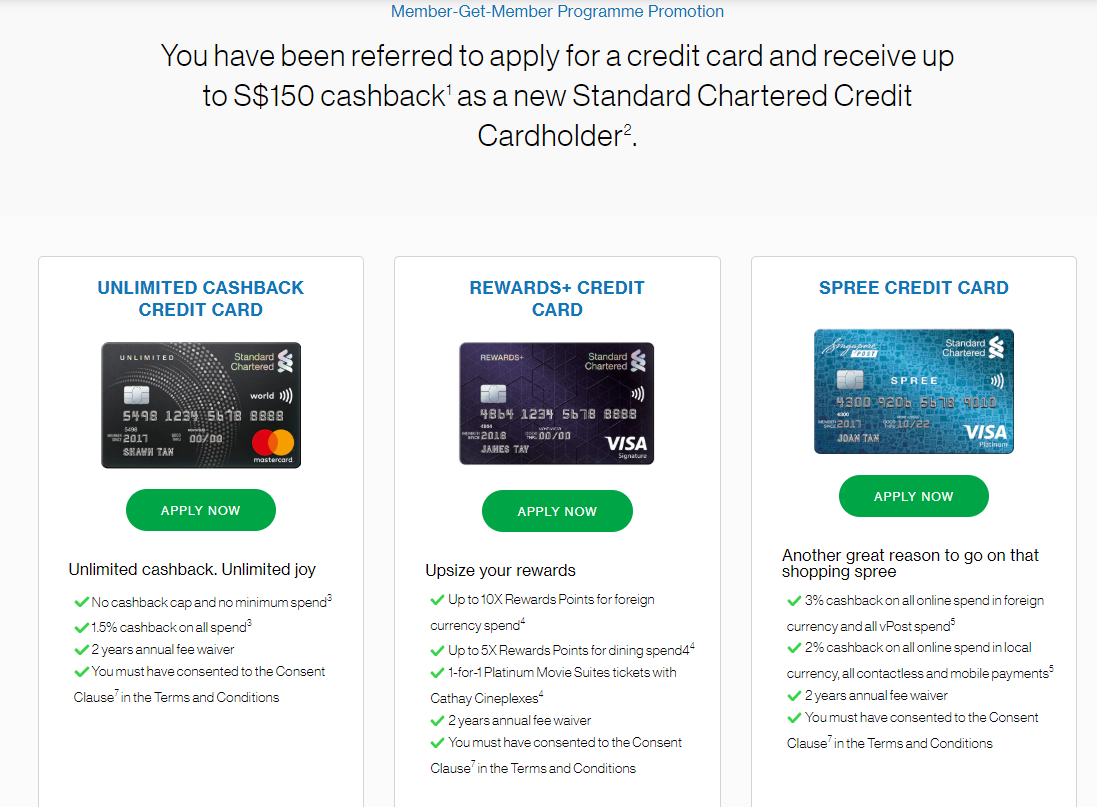

Referrals are available for the following cards:

| Annual Fee | Earns | |

SCB Unlimited SCB UnlimitedApply here |

S$192.60 (2 years waiver) |

1.5% cashback on everything |

SCB Spree SCB SpreeApply here |

S$192.60 (2 years waiver) |

3% cashback (capped at S$60) on selected categories |

SCB Rewards+ SCB Rewards+Apply here |

S$192.60 (2 years waiver) |

Up to 2.9 mpd on FCY spend (capped at S$2.2K per year) |

Applications must be received before 30 June 2020 to be eligible.

When will the S$150 cashback be received?

The referrer will receive S$150 cashback in his card account within 60 days after the referee activates his/her credit card.

The referee will receive his/her S$150 cashback in two stages:

- S$80 received within 30 working days of card activation

- S$70 received within 60 working days of card activation

Do note that your referee must maintain the card for at least six months after the date of opening, or the cashback is liable to be clawed back.

The S$150 applies on a per customer basis. For example, if John refers James and he applies for 3 cards, John will get S$150. But if John refers James and Peter, and each of them applies for 1 card, John will get S$300.

The full T&Cs of the Standard Chartered MGM program can be found here.

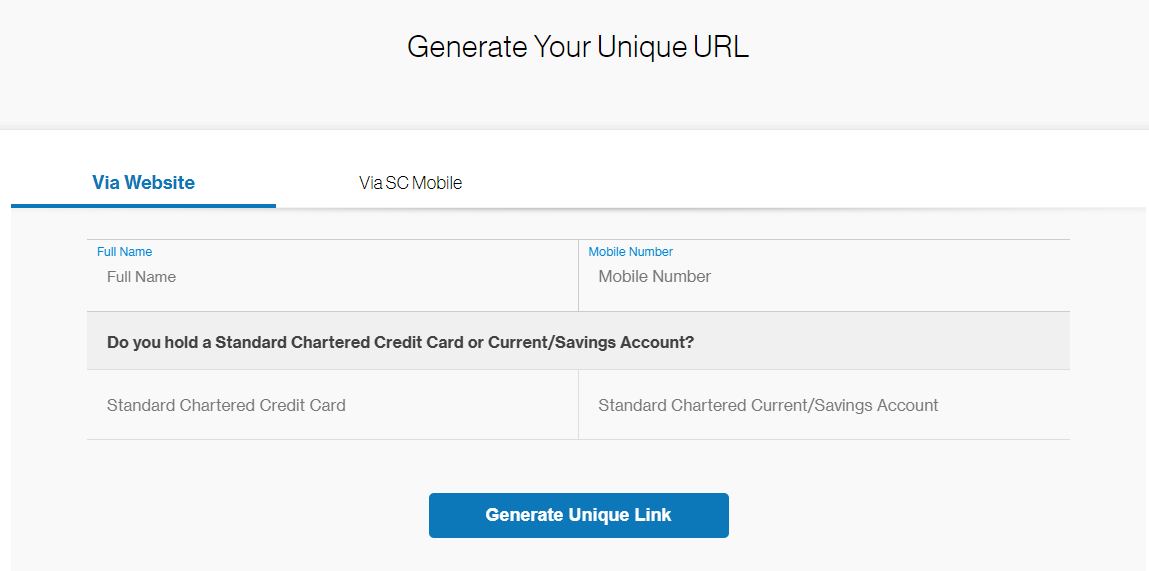

How to generate your Standard Chartered referral code

To generate your unique MGM code, navigate to this link. You’ll be prompted to enter your mobile number and last four digits of your existing card.

After that, you’ll receive a link you can share with your friends and family. You could even share it shamelessly on your blog.

Get S$150 when you apply for SCB credit cards here

If you’ve generated your link correctly, your referee should see the following landing page:

How does this compare to other alternatives?

From now till 31 May 2020, SingSaver is offering new-to-bank Standard Chartered cardholders a pair of Apple AirPods with wireless charging case, worth S$299.

If you and your referee are in a left-pocket-right-pocket kind of relationship, then it’d clearly make more sense to get a total of S$300 through the MGM program. Otherwise, do consider whether you’d value having the AirPods more.

Conclusion

If you know someone who doesn’t have a Standard Chartered credit card yet, here’s a chance to pocket S$150 for referring them.

This is a temporary promotion for now, but I suspect we may see it become a permanent feature if the take up is good.

(HT: Charismatic Chaos)

hihi, do u have a referral for SCB unlimited CC but for the balance transfer promo?

https://www.sc.com/sg/credit-cards/unlimited-cashback-credit-card/?instance=iboldpc3p12

applying via this link get you a free apple watch series 3 or $250 cash as a new to bank customer: https://pixel.ekosconnect.com/px?utm_source=c1x-49&utm_campaign=86-68-Standard+Chartered+Unlimited+Credit+Card&ev=affclk&k=b85a5a23c1d7d2de

this is unrelated to balance transfer though