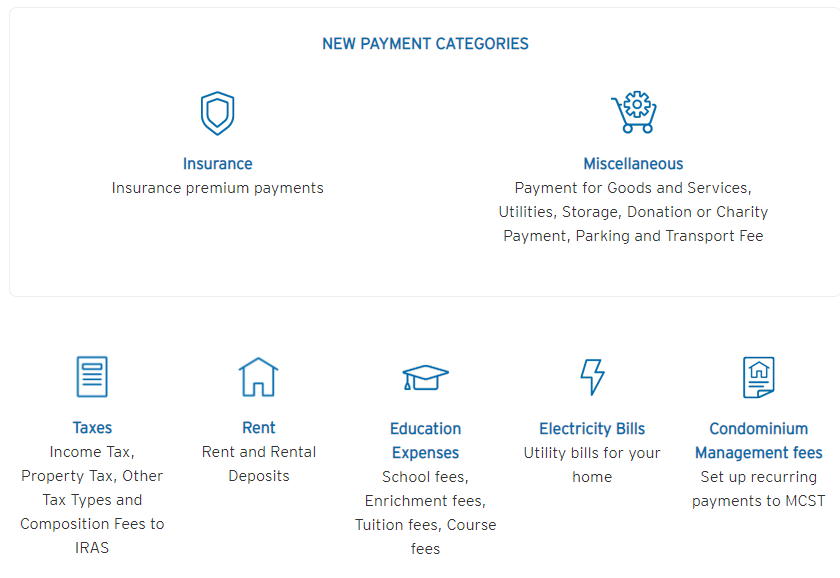

Citibank has made some major enhancements to Citi PayAll, adding support for insurance, goods and services invoices, utilities, storage bills, charitable donations, parking and transport fees.

These join the existing options for paying taxes, rent, education expenses, electricity bills and condo management fees.

In addition to this, Citibank is also offering up to S$250 of CapitaVouchers for Citi PayAll transactions made by 30 November 2020.

Citi PayAll’s new categories

Insurance premium payments to the following insurers are now supported by Citi PayAll:

|

|

Sadly, the days of earning free points on insurance transactions are long gone. Ever since HSBC nerfed insurance payments in its latest T&Cs update, and points for GrabPay top-ups went bye bye, there have been virtually no (free) options for earning credit card rewards on insurance premiums.

Under “miscellaneous payments” we can expect to see support for:

- Goods and services invoice payments

- Utilities

- Storage bills

- Donations

- Season parking

- Transport bills

All of these are open-ended fields, i.e you can enter the bank details of any recipient. This, coupled with the fact that Citi PayAll doesn’t request supporting documentation (at least during the setup phase; they may ask for it later), might give people some creative ideas of generating miles by “donating” to a friend or family member. Presumably they’ll have some checks on the back end to prevent that from happening.

More options are always a good thing, but do note that it’s still possible to earn miles for free on utilities and donations provided you have the right card.

| ❓ How do you setup a Citi PayAll payment? |

|

Citi PayAll transactions do count towards minimum spending for both sign-up bonuses, as well as other promotions like the Citi Prestige’s airport limo benefit. |

Get up to S$250 of CapitaVouchers for using Citi PayAll

From now till 30 November 2020, Citibank is offering Citi PayAll users additional CapitaVouchers for scheduling payments:

- Pay S$5,000-10,000 and get a S$25 voucher

- Pay S$10,000-25,000 and get a S$75 voucher

- Pay S$25,000+ and get a S$250 voucher

All payments must be set up and charged by 30 November 2020 to be eligible. No enrollment is required, and vouchers will be mailed to eligible customers within 12 weeks of the end of the promotion period.

Each cardmember is entitled to receive only one gift for fulfilling the relevant qualifying spending. Do note that payments to IRAS made with the Citi PremierMiles Card up till 31 August will not qualify for this promotion, presumably because Citibank is already offering an upsized 1.5 mpd during this period.

The full T&C of this promotion can be found here.

Citi PayAll: Cost per mile

Citi PayAll charges a standard fee of 2% (although customers may sometimes receive targeted offers for discounted rates), which yields a cost per mile (CPM) of 1.25-5 cents each, depending on which card you use.

| Card | Miles per S$1 with Citi PayAll |

CPM @ 2% |

Citi Rewards Citi Rewards |

0.4 | 5 |

| 1.2 | 1.67 | |

Citi Prestige Citi Prestige |

1.3 | 1.54 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.25 |

Needless to say, it doesn’t make sense using the Citi Rewards card with Citi PayAll (occasional promotions aside), but the Citi PremierMiles, Citi Prestige and Citi ULTIMA can all be viable options, depending on your personal valuation of a mile.

If you’re making a payment under the CapitaVoucher promotion, your cost per mile is further reduced, assuming you take those vouchers at face value. To illustrate:

| Payment | Voucher | CPM with Citi PremierMiles Card |

| $5,000 | $25 | 1.25 |

| $10,000 | $75 | 1.04 |

| $25,000 | $250 | 0.83 |

Conclusion

Citi PayAll’s new payment categories expand its use cases and provide more ways to earn miles on bill payments. The CapitaVoucher promotion also allows you to further reduce your cost per mile, at least for a limited period.

Citi PayAll’s headline rate of 2% makes it generally cheaper than competitors like CardUp (2.25%), but note that the latter periodically runs promotions for payments like rent (1.9%) and income tax (1.75%).

If you haven’t made your income tax payment yet, be sure to check out The Milelion’s Income Tax Guide for the cheapest ways to earn miles while doing so.

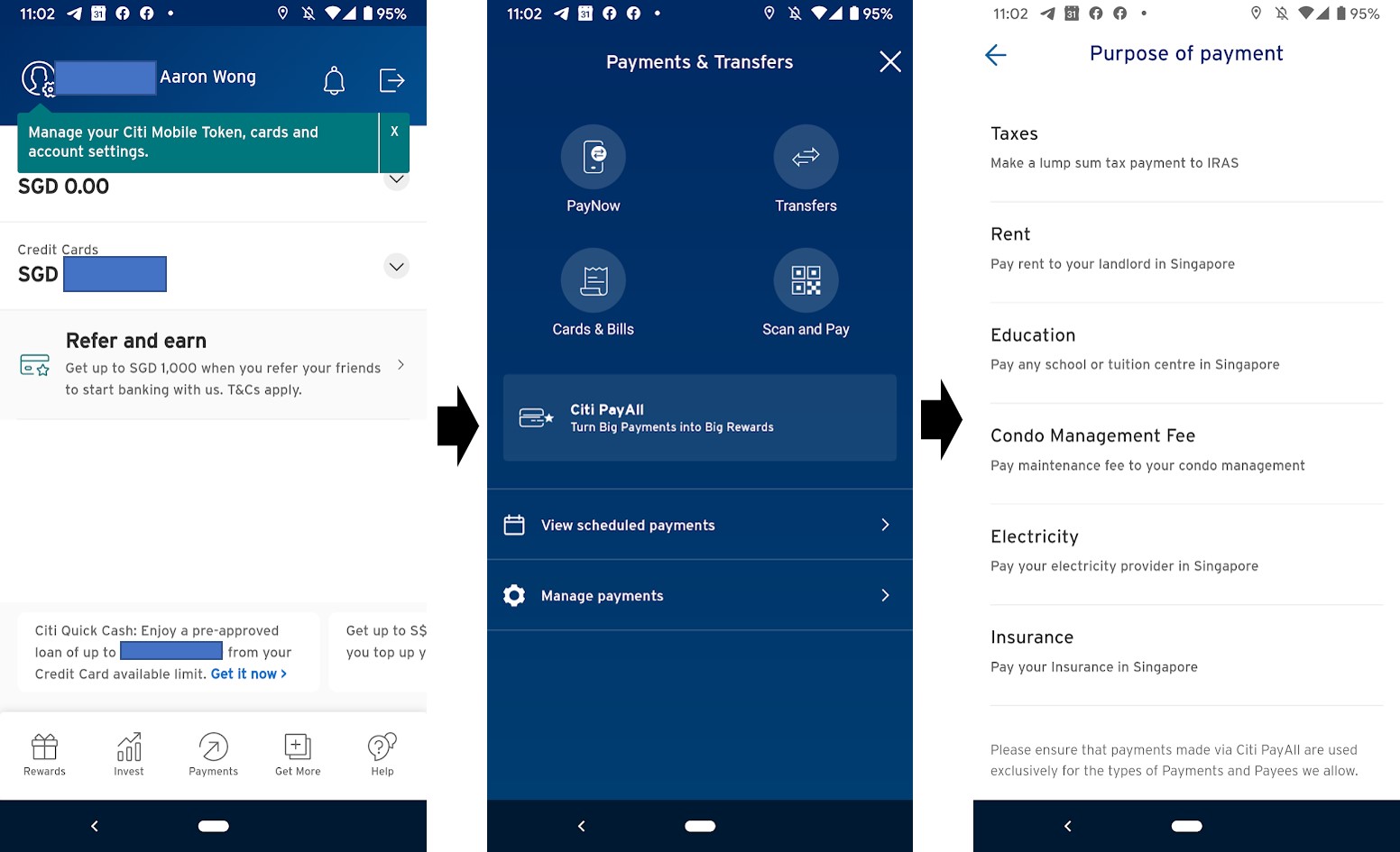

Open your Citi app and tap on the “Payments” button at the bottom. Select “Citi PayAll”, swipe past the instructions, then select your payment type. Follow the instructions to set up your payment, then select a Citi card to see how many rewards points you’ll earn.

Open your Citi app and tap on the “Payments” button at the bottom. Select “Citi PayAll”, swipe past the instructions, then select your payment type. Follow the instructions to set up your payment, then select a Citi card to see how many rewards points you’ll earn.

It says in the T&C that ” The Citi PayAll Payment Setup Date and Payment Charged Date must both fall within the Promotion Period in order to qualify as Eligible Transaction. ”

So if I have a current PayAll transaction set up in Mar 2020 to run monthly, I suppose it would not qualify as an Eligible Transaction?

You should probably set it up again.

So that means you can pay insurance bills but there wont be any points

Must the charge be in ONE transaction? If you scrutinise the T&Cs, everything seems to be defined the the singular:

Eligibility for S$250 CapitaVouchers: An Eligible Cardmember who charges at least S$25,000 in Qualifying Spend (not spends!) to his Eligible Card…

f. “Qualifying Spend” means a (not total) scheduled payment (not payments)…

The Citi PayAll Payment Setup Date (not dates) and Payment Charged Date (not dates) must both fall within the Promotion Period in order to qualify as Eligible Transaction (not transactions)…

Or is this the usual short-sighted copywriting deployed by Citibank again?

My guess is that multiple payments will qualify as there is a 15k monthly limit (at least on my payall) making it impossible to charge 25k in a single transaction.

Does anyone know if this limit can be changed and how?

how to check mthly limit? am able to put >25k thru as 3 separate payments for 1 same payment date.

Citi CSO confirms (after checking with some internal instructions) that Qualifying Spend refers to TOTAL transactions.

Have anyone tried setting up for AXA insurance premium? It’s says merchant account number not valid. Getting thru citi hotline has been a pain.

Same thing with me.

I have the same problem. How did you managed to solve it?

any idea what will be shown over at the recipient account?

Has anyone set up Prudential? I have existing arrangements on my Citibank card. Do I need to cancel those before setting up Citibank Payall so I do not pay twice.