| This article was written in collaboration with Standard Chartered Bank (Singapore) Limited. All views expressed in this article are the independent opinion of The Milelion based on my research. The Milelion is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. |

I’d like to believe that my stance on cashback cards is pretty well known by now. Even amidst the biggest crisis in aviation history, I’m still keeping the faith with miles. After all, I firmly believe it’s only a matter of time before COVID-19 is subdued, international travel returns, and miles once again take you places – we just have to wait it out.

Which is why it was so surprising when Standard Chartered Bank approached me about writing a piece on the Unlimited Cashback Card. “You sure you didn’t confuse me with Budget Babe?” I said incredulously, surreptitiously checking also for hidden cameras.

But serious they were, and come to think of it, even if I’m personally not about to hop onboard the cashback train, the miles vs cashback equation is still an important topic to revisit, in light of the new normal we find ourselves in.

The arguments for switching to cashback

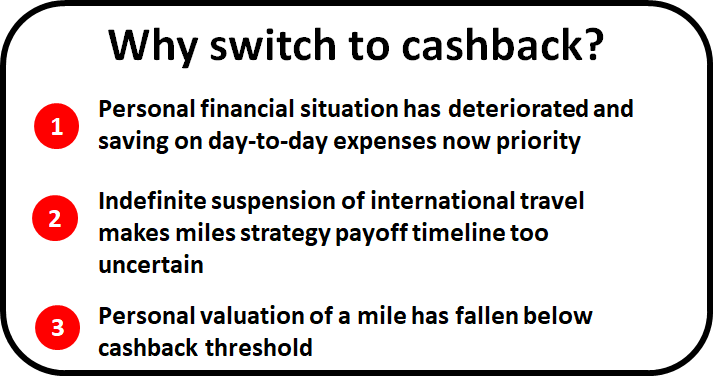

The way I see it, there are three main reasons why someone might switch from miles to cashback during this time.

The first (and most important) is that your financial situation may have changed for the worse, due to the impact that COVID-19 has had on the economy. Even if you’ve been relatively unscathed up till now, all the ongoing retrenchments and salary cuts mean it’s never a good idea to get complacent. Cashback cards offer direct savings on all your expenses, and as much as I enjoy collecting miles, I’ll be the first to admit they can be gateways to additional spending (e.g use miles to book a holiday ⟶ spend money on holiday).

It’s all good and well to daydream about holidays when times are good, but nothing jolts you back to reality like a recession. If the current economic climate necessitates some belt-tightening, then every dollar saved helps, and cashback may be the better option at the moment.

Second, the indefinite hiatus on international leisure travel may make the miles game payoff too uncertain for some. It could be 6, 12, 18 months before leisure travel resumes, and even then, your preferred destinations or attractions may take longer to reopen. There could be additional health and quarantine restrictions that make leisure travel technically possible but practically infeasible, and not everyone will be comfortable with flying straight away.

Miles collectors always knew they were in it for the long game, but an indefinite timeline wasn’t part of the deal. If this bothers you, then cashback at least has a very immediate payoff.

Third, you may still be into miles per se, but your personal valuation of a mile has fallen to the point where cashback cards start to become the superior option. I personally value miles at 1.8 cents each, but within the current climate, that’s come down to 1.5 cents (don’t ask me how I derive the figures, it’s extremely unscientific).

Here’s the decision process for miles versus cashback on general spending, depending on what miles card you use and where your valuation falls:

| If you earn this on your miles card… | Switch to 1.5% cashback if valuation of mile falls below… |

| 1 mpd | 1.5 |

| 1.1 mpd | 1.36 |

| 1.2 mpd | 1.25 |

| 1.3 mpd | 1.15 |

| 1.4 mpd | 1.07 |

If any of the statements above describe you, then you might be better off making a switch.

| 📉 What about potential mileage devaluations? |

| While there are valid reasons to switch from miles to cashback during this time, I don’t think the fear of potential devaluations is one of them. We’ve covered the topic extensively during this webinar, but to reiterate: devaluations happen when there are too many miles chasing too few seats. With load factors at record lows, the opportunity cost of a redemption seat is practically zero. Devaluing now would simply threaten an airline’s revenue stream (banks may be less willing to purchase miles if their customers don’t want them), with little tangible benefit in return. |

Standard Chartered Unlimited Cashback Card promotion

Assuming you’ve decided to make the switch, let’s look at what the Standard Chartered Unlimited Cashback Card has to offer.

New Unlimited Cashback Cardholders who apply for a Standard Chartered Unlimited Cashback Card by 31 December 2020 will receive S$80 cashback^ when they activate the physical card within 30 days of approval. This cashback will be credited to your account within 30 working days of the date of activation, and must be used within six months.

| Income Req. | S$30,000 p.a | Cashback Rate | 1.5% (no cap) |

| Annual Fee | S$192.60 (first 2 years waived) |

Finance Charges | 26.9% p.a |

| Sign Up Gift | S$80 cashback^ | Bonus Offer | 5% bonus cashback+, min. spend S$500, capped at S$100 |

| Unlimited Cashback Credit Card Terms and Conditions | |||

| ❓ New Unlimited Cashback Cardholders are defined as those who do not currently hold a principal Standard Chartered credit card, and have not in the past 12 months before application |

Cardholders will earn a flat rate of 1.5% cashback on all expenses, whether in local or foreign currency.

However, new-to-bank cardholders who spend a minimum of S$500 on eligible transactions within the first 30 days of approval will receive 5% bonus cashback+, capped at S$100. Do note that this is capped at the first 400 eligible cardholders only, however, so there’s no guarantee you’ll receive it.

The bonus 5% cashback is in addition to the regular 1.5% cashback that Standard Chartered Unlimited Cashback cardholders normally receive, with no minimum spend or cashback cap. Here’s an illustration of how the base and bonus cashback work:

| Total Spend | Base Cashback @ 1.5% | Bonus Cashback @ 5% | Total Cashback |

| S$300 | S$4.50 | N/A- min. spend not met | S$4.50 |

| S$500 | S$7.50 | S$25 | S$32.50 |

| S$1,500 | S$22.50 | S$75 | S$97.50 |

| S$2,500 | S$37.50 | S$100- cap reached | S$137.50 |

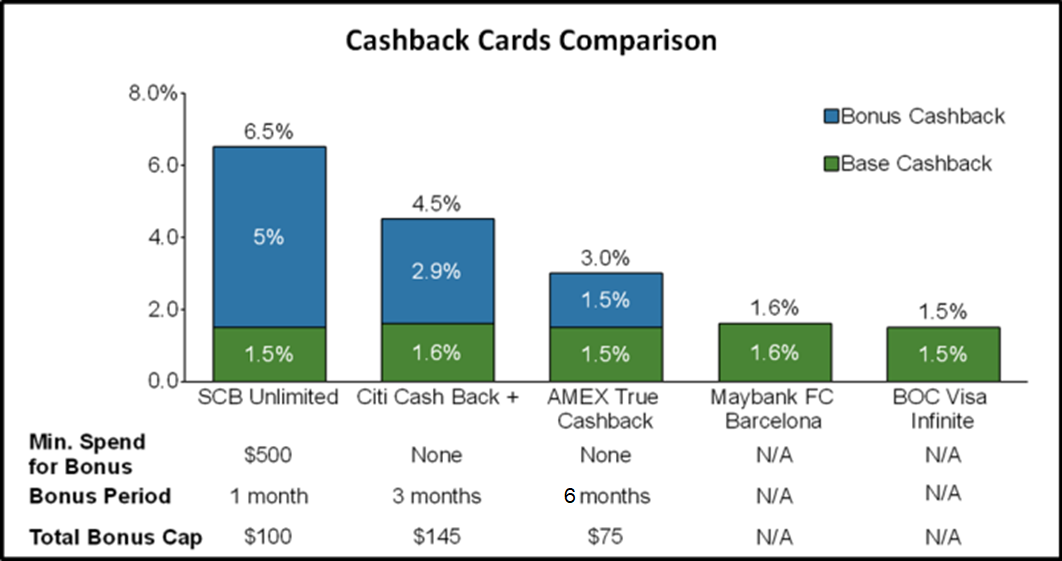

With this bonus, here’s how the Unlimited Cashback Card compares to similar cashback cards on the market (I’m looking at those which don’t have minimum spend requirements, and don’t cap the base cashback you can earn).

As my table shows, the Unlimited Cashback Card enjoys the highest welcome bonus rate, although unlike the Citi Cash Back+ or AMEX True Cashback cards, it does come with a minimum spend requirement.

The S$500 minimum spend is subject to Standard Chartered’s usual exclusion categories. The full list can be found here, but the key ones to take note of are:

- Insurance premiums

- Education payments

- Government payments

- Prepaid account top-ups

New Unlimited Cashback Cardholders will also be eligible to apply for a 6-month credit card funds transfer facility with 0% interest (EIR from 3.10% p.a), and receive 1% cashback on the approved amount*.

Who is this offer suitable for?

I’ve always said that the miles game is not for you if you’re unable to pay off your balance in full and on time each month. Nor is it if collecting miles entices you to spend more than you otherwise would have.

But all that said, if you’ve overextended yourself and now carry a revolving balance, the best option would be to cut up the miles cards and switch to a cashback card to directly save on your day to day expenses.

| ❓ What is a balance transfer? |

|

A balance transfer is a potential way out for those who have fallen behind on credit card payments. They essentially buy you time to pay off credit card debt, without worrying about high interest. With a balance transfer, you literally transfer your balance from Bank X to Bank Y. Bank Y gives you a lump sum of money to pay off what you owe to Bank X, and then you have a certain interest-free period to pay off Bank Y. Balance transfers are typically offered in 3, 6 or 12-month repayment plans, and require you to pay off a certain minimum amount each month. In the final month of the balance transfer loan period, you’re expected to pay off the remaining amount in full. You will typically pay a small processing fee upfront, but otherwise the 3, 6 or 12-month repayment period is interest-free for the approved tenure. This forces you to pay off your debts quicker, but on the other hand it’s more achievable since your interest stops compounding each month. Think of it as a second chance, with a fixed timeline. Do remember that a balance transfer only makes sense if you have a viable repayment plan in place and can stick to it. Once the interest-free period ends, your interest rates will revert to credit card levels, putting you back where you were before. |

Standard Chartered’s current balance transfer promotion for the Unlimited Cashback Card gives 1% cashback off the 1.5% processing fee, yielding one of the lowest nett fees in the market at just 0.5%*.

| Processing Fee | Interest After Grace Period | |

| Standard Chartered |

0.5% (after 1% cashback) |

26.9% |

| DBS | 2.5% | 26.8% |

| Citibank | 1.58% | 26.9% (Step down interest for good conduct: 20.9%) |

| OCBC | 2.5% | 26.88% |

| UOB | 2.5% | 26.9% |

| Processing Fees reflect prevailing discounts for 6 months tenure, and accurate as of 23 Sept 2020 | ||

Assuming you’re not an existing Standard Chartered customer, you could apply for a balance transfer (subject to eligibility criteria) to pay off your existing debt with the other credit card issuer, effectively “transferring your balance” to Standard Chartered.

For example, if you’re holding on to S$1,000 in credit card debt with Bank X, you can apply for a balance transfer with Standard Chartered and pay a fee of just S$5 (after the 1% cashback). You use the S$1,000 to pay off Bank X, and now have a 6-month interest-free period to get your financial house in order, while making payments of at least S$100 per month.

However, it’s vital that you don’t waste this breathing space, because after the 6th month, the interest rate reverts to 26.9% p.a. If you’re still carrying a balance by then, you’ll be back to square one.

I’m a firm believer that no one should be carrying a balance on a credit card in the first place (there are much cheaper ways to borrow money), but if you nonetheless find yourself in this position, this is definitely something to consider.

Other Standard Chartered Card Promotions

In addition to the acquisition and balance transfer offer, Standard Chartered customers have access to more than 3,000 dining, shopping, and lifestyle offers under The Good Life program.

Two particular offers worth highlighting are:

| Offer | Details | |

| Get a S$15 TANGS.com promo code with a min spend of S$200 on TANGS.com (T&Cs apply) |

For Friday, Saturday and Sunday shopping, till 31 Mar 2021 | |

|

Get S$7 off with a min spend of S$35 with code SCB7OFF (T&Cs apply) |

Valid till 30 Sept 2020, capped at 8,500 redemptions |

Conclusion

The COVID-19 pandemic and its unprecedented impact on the travel industry have no doubt changed the miles versus cashback equation, and there are certainly arguments to be made for switching camps.

With the prevailing financial uncertainty, there are some who will put an emphasis on conserving cash, and cashback cards obviously do more than miles cards to that end. Likewise, those who find the timeline for resuming travel to be too nebulous will find cashback cards offering more certainty in the short term. Finally, your valuation of a mile may have temporarily fallen to the extent that cashback cards make better near term options.

For those of you with credit card debt, your number one priority should be to resolve it, before you even think about travel. Standard Chartered’s funds transfer promotion* is a way to freeze interest for a 6-month term, but you need to use the interest-free period wisely.

Are you making the switch from miles to cashback during this time? Why or why not?

| ^Credit Card Sign-Up Promotion Terms & Conditions apply +5% Bonus Cashback Promotion Terms & Conditions apply *Standard Chartered Unlimited Cashback Credit Card Funds Transfer Promotion Terms & Conditions apply |

Cashback for me now as regular travel will not take place until 2024. Plus Business Class is now like Economy but at same redemption rates.

what you said reminds me of this recent article: https://www.straitstimes.com/world/how-covid-19-made-flying-business-class-feel-more-like-economy

the frills may be gone, but it’s still fundamentally a much better seat though. plus, there’s some built in social distancing with business class seats

I agree with Aaron here, in fact it’s mainly the wider seat and leg room that has me getting J&F fares. The food I only took sometimes as I would usually eat on the ground.

Agreed. Food is a bonus (and a lot of times, it is actually sodium-laden) but for me (at 1.9m) I cannot deal with economy or even premium economy legroom. The ability to sleep properly and the additional physical space is paramount.

Yep SQ business class now is dreadful. And if the CDC study posted below is to be believed then it’s not any better than economy when it comes to COVID-19. I redeemed for business because I thought it’d be better – should have saved some miles and just gone with economy – economy was empty and the business class service was woeful.

hey refreshing surprised to see you cover a cashback card! Having said that, been thinking about it though considering the circumstances as you mentioned. Thanks for comparing those within no min spending. That was the bane of my existence in the past with the UOB ONE card and tipped me over to the miles bandwagon. Cheers and keep up with the awesome articles!

glad you found it useful! well, as i said, i’m still racking up the miles, but given all that’s going on I figured some people might be on the fence. i mean, if you’re facing financial hardship, then definitely forget the miles game for now

Business class has no proven advantage vs infection especially when there are no seats kept empty. Interesting scmp article (also published elsewhere) discussing the CDC study of the LHR-HAN business passenger who infected 12 other business passengers and 3 economy passengers. Empty middle seats in economy may be better. The conclusion of the study from CDC: “The risk for on-board transmission of SARS-CoV-2 during long flights is real and has the potential to cause Covid-19 clusters of substantial size, even in business class-like settings with spacious seating arrangements well beyond the established distance used to define close contact on airplanes”… Read more »

cashback for now. With airlines potentially bleeding for years, i won’t be surprised there’s further miles devaluation next year

Don’t you guys think it’ll be an issue when the general public is able to travel – there will be so many people like us with so many miles – there will be less planes and seats available – it will be near impossible to book decent flight with miles.

well, if you believe the research, most people will actually take their time before flying again. not everyone is so eager to rush out and fly, what with fears of infection, xenophobia, travel disruptions etc.

also, airlines will be loathe to leave planes empty earning nothing. if there’s demand for travel, they’ll readily add back capacity.

Agree with your point. I foresee quite a number of redemption seats available when most leisure travel is allowed to resume. Demand will trickle back. Unlikely to be V shaped.

Exactly, and early research shows that it’s unlikely airlines are going to fill up J and F revenue fares like before, not in the midst of retrenchments and possibly a global recession.

Hi Aaron thanks for the article please do more cashback articles for cards more than 5%. You may creat a cashback zone for those too.

This is a miles website ……

1.5% if your generally spending 1000 a month, that’s 15 bucks. Miles card that’s give 4 miles a buck will give 4000miles for 1000 spending which we estimate each mile is worth 1.5cents is 60SGD. I think miles card is still more worth it! Unless you’re spending 100k a month 😬

I spend relatively larger amounts than most and find cashback cards an utter waste of time what with all the silly caps at $20,$60, etc.

I just use a 1.6 mpd card which even at 1.5 cents per mile is superior to 1.5% cashback. The reality is though when I’m redeeming flights I get at least 2.5 cpm. Cashback cards won’t make sense to me unless in the unlikely event flights will never happen again permanently, and rewards cards do not find something else for redemptions.

but if you’re going to look at 4 mpd miles cards, you’ll need to compare specialized spending cashback cards to be fair too. you’d earn much more than 1.5% with those (albeit with a cap and min spend requirement)

no snarky comments for “first xxx number of cardholders” promo? hahaha

my contention with “first X” campaigns is when they’re all or nothing. in this case, you’ll get at least $80 cashback when you sign up, with no spending required. that’s still a win in my book.