As someone who holds accounts and credit cards across multiple banks, I’ve often longed for the convenience of viewing all my balances in one place.

For a while, it looked like the Seedly app might be the answer to this, but it was always an inelegant solution.

Account updates were slow and had to be manually triggered, and the process involved entering your OTP on a third-party app (a security no-no). The app was glitchy and hung often, and the feature eventually fell apart when banks started blocking access.

But the underlying idea was solid- why shouldn’t Singaporeans be able to access all their financial information in one place? It seems awfully antiquated that in 2020, I still have to download and consolidate my balances in a manual spreadsheet each month.

That’s all set to change, thanks to SGFinDex.

What is SGFinDex?

SGFinDex is an initiative by the MAS that allows customers to view all their consolidated financial information in one place online. The idea stems from Open Banking in Europe, where third-party financial service providers can access consumer banking, transaction and other financial data from banks and non-bank financial institutions.

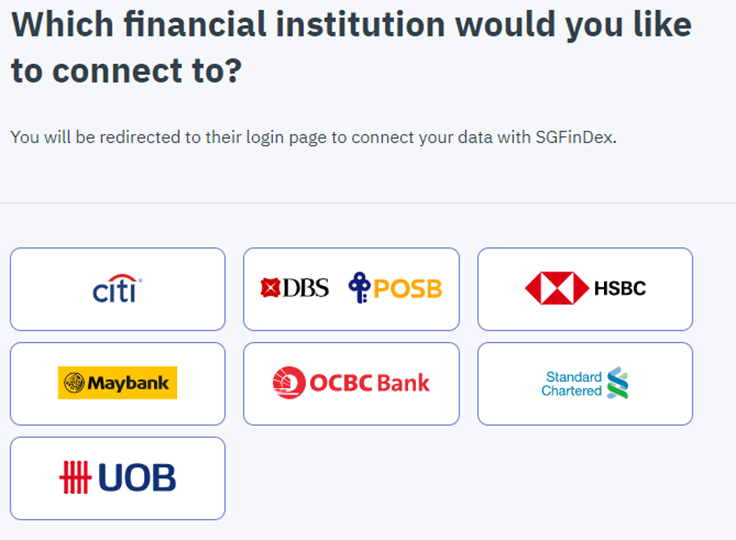

The following banks and government agencies currently support SGFinDex.

| Banks | Government Agencies |

|

|

To my complete shock, the cutting-edge-and-in-no-way-primitive Bank of China does not participate, so those of you with SmartSaver accounts will have to continue doing things the old-fashioned way. It’s also unfortunate that American Express is not yet present; while they don’t take deposits, it’d be useful to see their credit card balances reflected in the overall dashboard. There’s also no support for roboinvestors like Stashaway or Endowus, or pseudo bank accounts like Singlife and GIGANTIQ.

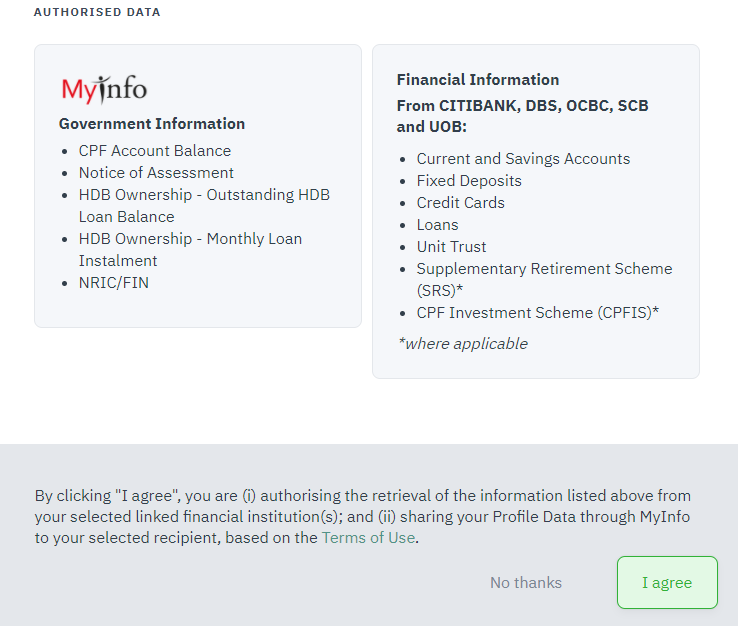

As it stands, the following information can currently be viewed though SGFinDex:

- Current and savings accounts balances

- Fixed deposits balances

- Unit trust holdings

- SRS accounts and holdings

- CPFIS accounts and holdings

- Unsecured loan outstanding balances (credit cards, personal loans etc.)

- Secured loan outstanding balances (home loan, car loan etc.)

- CPF Account Balance

- Notice of Assessment

- Outstanding HDB Loan Balance and Monthly Loan Instalment

Getting started with SGFinDex

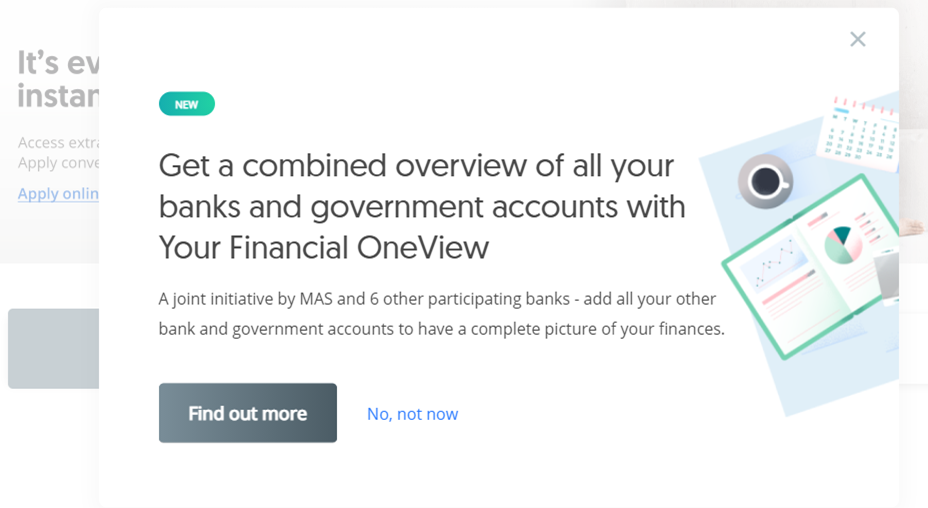

I first became aware that SGFinDex was live when I logged into my OCBC internet banking and saw this pop-up notice.

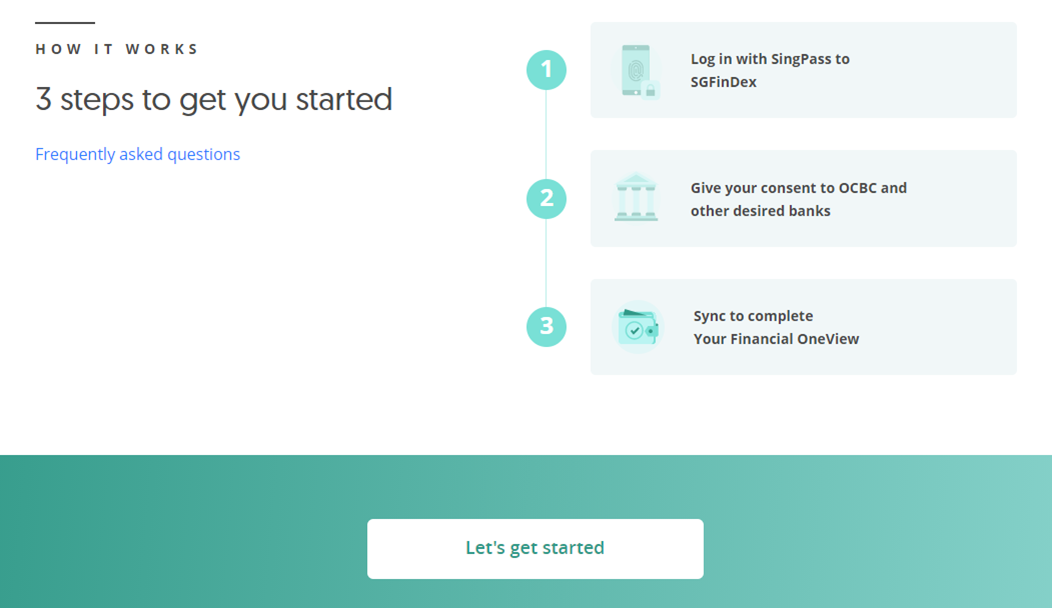

OCBC’s pop-up brings you to a page that explains briefly how SGFinDex works.

| Note: I did my SGFinDex setup through OCBC, so the screenshots below will reflect that. It’s also possible to setup via DBS or Standard Chartered ibanking, and the process will be largely the same (although menus may look different). |

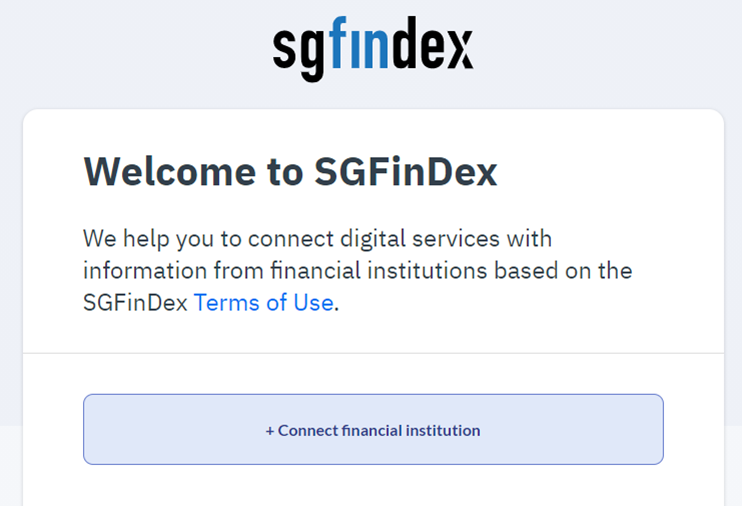

Clicking “Let’s get started” brings you to a SingPass login page, after which you’re presented with the SGFinDex main screen.

You’re given the option of connecting accounts from any of the seven participating financial institutions. Consent to data sharing will be valid for one year, and the setup process was straightforward and seamless (with the exception of HSBC, whose IT systems are a hot stinking mess).

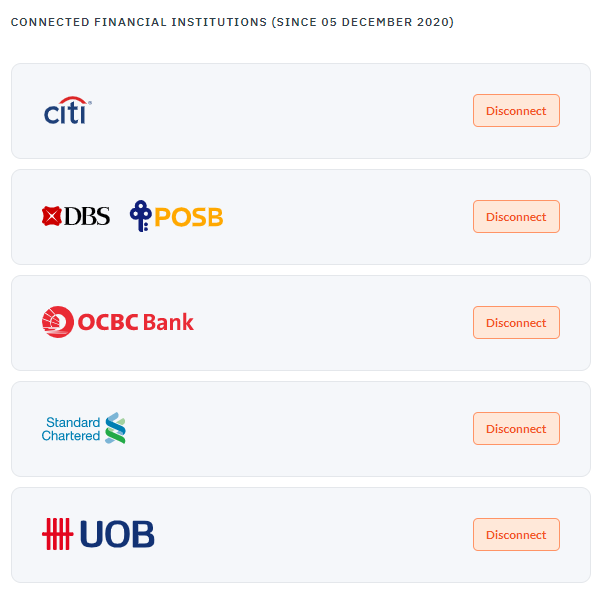

You can subsequently revoke permission at any time, should you wish to.

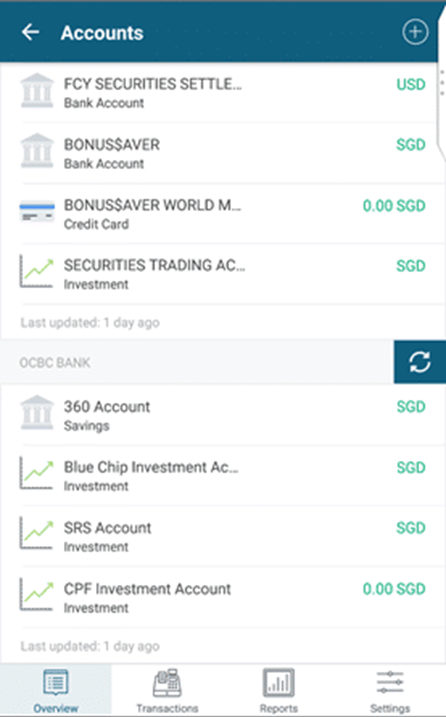

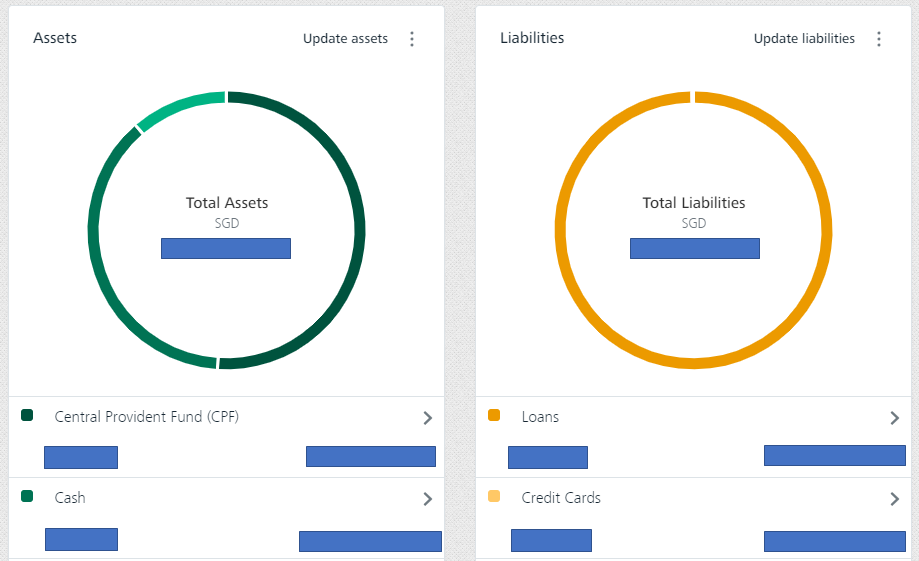

Once you’ve added your various accounts, you’ll be returned to the ibanking interface you came from, where a consolidated overview of assets and liabilities will now be presented.

To be clear, there’s no SGFinDex interface per se where you’ll see all your account information. You’ll still access this through the ibanking of one of the participating banks (or else create an account on MyMoneySense), and the presentation will be different depending on which bank you use.

For example, DBS integrates the SGFinDex data under its NAV Planner feature, providing additional tools for analysis and comparison. It does make it harder to drill down to view individual account balances, however, and if that’s what you’re after then OCBC/SCB provide cleaner interfaces.

My observations on SGFinDex

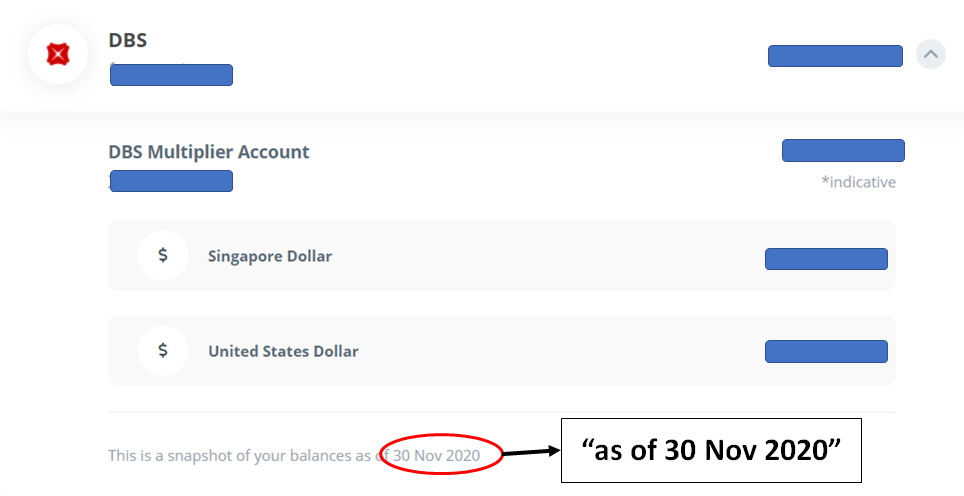

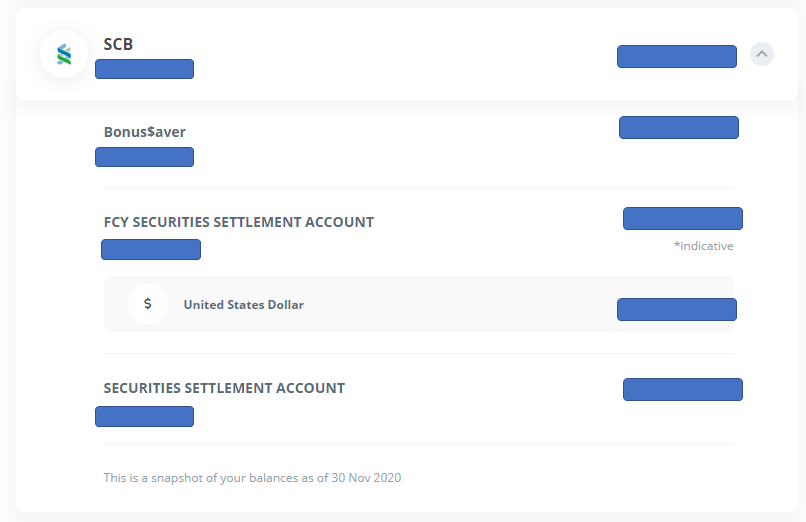

Banking data is not real-time

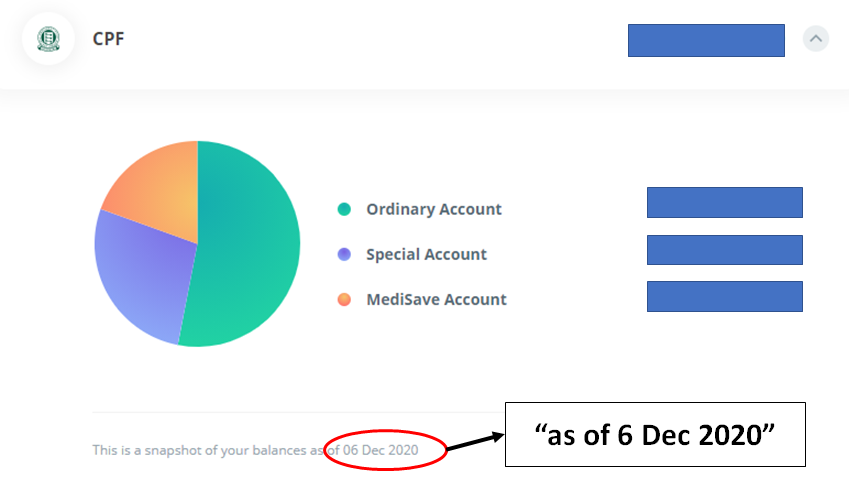

The first thing I want to point out is that banking data is not real-time. Account balances shown are as of the last day of the previous month, i.e 30 Nov 2020 in the screenshot below. If you want the most up to date information, you’ll still need to go through the individual ibanking portals as per normal.

However, information from government agencies like CPF/IRAS is provided in real-time, which makes me hopeful that banks will eventually transition to a similar implementation.

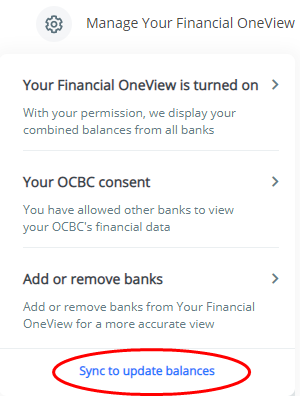

All data updates must be manually triggered

Second, all data updates must be manually triggered. Suppose it’s now 5 January 2021 and I want to know how my account balances looked as of 31 December 2020 (as mentioned in the previous point, bank account information is only shown as at the end of the previous month). I’ll need to request that balances be synced again.

This involves being redirected to SingPass and once again providing consent for information to be shared. You won’t need to provide OTPs for each individual bank, however, thank goodness- there’s just one button to click.

Not all accounts are listed

Third, the accounts listing is not comprehensive. If you use Standard Chartered to trade equities, like I do, you won’t see your balance (only the amounts in your securities settlement accounts). Likewise, DBS PayLah balances don’t appear either.

On the plus side, the system shows both individual and joint accounts without any issues.

A few other miscellaneous issues I noted:

- It strikes me as odd that IRAS lists your assessable income, but not your outstanding tax amount. Given that SGFinDex is meant to display your overall assets and liabilities, it’d be much more useful if they showed how much you still owed the taxman.

- There’s no way to export the information to a CSV file

Is it safe to use SGFinDex?

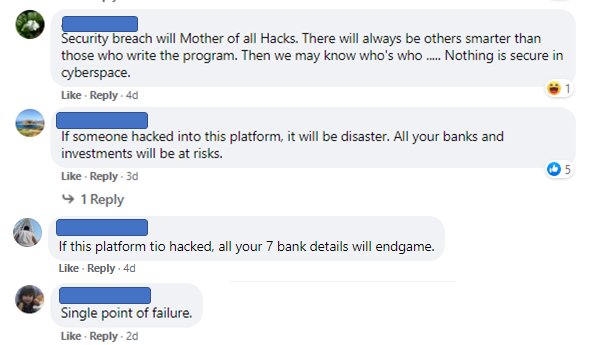

If the Straits Times Facebook comments are anything to go by (they’re not), there’s a lot of concern about the security implications of having all your accounts in one place.

Rest assured, most of them are unfounded.

First of all, SGFinDex is read-only. If you’re logged into an OCBC ibanking account, for example, you won’t be able to make transactions on your DBS/HSBC account even though you can see your balances. This means that if a given bank account is compromised, the damage the hacker can do is limited to that particular bank- no different from the status quo.

Second, there’s a further level of verification required every time you want to update your account balances. As mentioned earlier, you’ll need to login to SingPass and grant permission for data sharing each time.

So I wouldn’t lose any sleep about the way SGFinDex is set up, at least when it comes to security.

Standard Chartered launch campaign- free S$5

It looks like Standard Chartered will be running a SGFinDex launch campaign from 7 December 2020. The T&C aren’t officially live, but you can find a cached version on Google.

The first 30,000 participants to do the following will receive S$5 cashback credited to their Standard Chartered bank account:

- login via Standard Chartered Mobile App or Standard Chartered Online Banking

- register for SGFinDex;

- link Standard Chartered data to SGFinDex;

- link another financial institution’s data to SGFinDex; and

- refresh and update your data which is published on SGFinDex.

Remember, this starts from 7 December 2020, so don’t jump the gun yet if you want to explore SGFinDex via Standard Chartered.

Conclusion

Those of you playing the miles game will probably have several credit cards across different banks, and SGFinDex makes it that much easier to track your spending. I highly doubt that rewards balances will ever get similar treatment though, although AwardWallet does a valiant (if imperfect) job of doing that.

SGFinDex still has ways to go, but all the pieces are there. It’s my hope that the rollout will eventually incorporate other financial institutions, roboinvestors and insurance companies.

What do you make of SGFinDex?

Next thing we need is to allow interbank withdrawal.. I remember in Japan where I can be a customer of “Bank A” but I can still draw money from “Bank B”

What’s the fee? It is always possible to do that, but at what costs.

we don’t even have a common ATM platform here (well, there’s atm5 but it’s not a universal solution), which would minimize a lot of waste. no need to have 6 different ATMs lined up next to each other.

It does not really require a shared ATM or even an ATM card. Just ride on PayNow QR to withdraw money from any ATMs in the network of PayNow which are all the banks in SG?

I wasn’t aware of this. I was under the impression it’s only possible within your own bank, eg ocbc lets you withdraw cash with payanyone, but only at ocbc machines

That’s what’s currently available. To enable PayNow QR withdraw is not that difficult as the infrastructure is already there. But there is no will to push it. Someone has to pay the cost but nobody wants to pay.

Is this a plug for SoCash?

SoCash operates in the same space, but with a network of merchants and non-bank atm operators. I am talking about bank atm operators.

Actually,

I was referring to

1) POSB user who wants to draw money from OCBC atm. (Not possible

2) ATM5 is still not seamless

The infrastructure and technology is there. The banks can do it in very short time. But they could not agree on the cost of access to ATMs from other banks.

If there is a push, socash concept will replace atm

Not going to happen as much as the banks want to eliminate its ATM costs. For one, the banks are still major cash providers and cash collectors for MAS to provide new notes and remove old notes from circulation. Completely removing ATMs for a bank can backfire as bank depositors have minimum expectation that they can at least withdraw their money from the bank ATMs.

Not having ATMs can also help banks prevent bank runs if anything happens suddenly. so if anything, its a pros and cons situation.

But yeah… whats new. Fees. everything in sg is just $$ even at the cost of convenience to their CUSTOMERS.

Aaron please can you write about what bank account you use, like Standard Chartered priority or DBS Treasures etc. Thank you

i use SC priority but it’s really because of the no min. commission on equities trading. I also keep a few accounts across dbs/ocbc etc, but since interest rates are so low now it doesn’t really matter. most of my short term funds are in places like singlife, gigantiq, dash easyearn.

have you consider trading in lower risk stocks or index based funds rather putting your money in singlife, gigantiq, dash easyearn?

Yup, i have some exposure to that. singlife/gigantiq etc are purely for very short term liquidity.

Even if SGFinDex is read only, the information (balances, account numbers) a hacker steals can be put to harm’s use, in the wrong hands. That’s why you redacted yours. Don’t ever discount what a hacker can do.

How to connect my bitcoin account on Gemini

Even if it is not hacked, you are willingly sharing the information with the bank. What make you think the bank is not making use of it. Is there any clause that stop the bank to use th data?

Read the TnCs. The only reason the big banks join the scheme and even provide rewards is to know your total worth for a year. Remember you grant the bank 365 days permission to pull your account information from other banks.

Can you point out the clause please? I will not want to use sgfindex if this is true. Q: I have consented for my data in Bank A and Bank B to be shared through SGFinDex with my selected financial planning application/website. Does that mean that all other participating financial planning applications/websites will now automatically have my data? Answer No, other participating financial planning applications/websites will not be able to retrieve your data without your consent. A participating financial planning application/website will need to obtain your consent each time to retrieve your data after you log in to the application/website.… Read more »

The one you granted permission has the permission for 365 days. If you did not grant, of course not able to pull.

I am not looking at individual POV. Think of what the banks gain.

Don’t recommend using this at all. Your transaction and spending data is very valuable information. Allowing any single entity to have a fuller picture of your financial situation will lead to easier discrimination of outliers.