One month ago, I wrote about Instarem’s Amaze card, a unique solution that pairs with your credit cards to give zero FCY fees and 1% cashback, on top of regular credit card rewards.

| 💳 tl;dr: Amaze card |

|

| Sign Up Here |

|

I received my physical Amaze card recently (wait time from application: 2.5 weeks, but you’re likely to face a longer wait now), and have been dutifully field testing it.

The verdict? It’s pretty incredible (I’d have said “Amaz-ing,” but that’d just be lazy writing), doing all it says on the tin and more.

The Amaze converts offline transactions into online ones, with extremely reasonable exchange rates. You also earn credit card rewards as per normal, although that probably won’t last long.

One thing’s for sure- I’m definitely bringing the Amaze with me to Germany for the VTL and using it as my default spending card overseas. 4 mpd with zero FCY fees and 1% cashback? Yes please.

Here’s five things worth highlighting, based on my experience with Amaze so far.

(1) MCCs get passed through, but transaction description changes

I already mentioned this in my previous post, but for the benefit of those just tuning in: yes, transactions made with the Amaze card keep their original MCC.

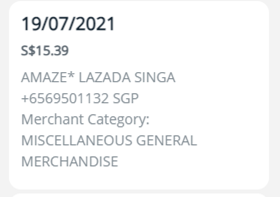

For instance, I used my Amaze card to pay online at Lazada. The transaction came through as MCC 5399: Misc. General Merchandise Stores.

I also tried the Amaze card for an offline transaction at Wildfire Burger, and it came through as MCC 5812: Eating Places & Restaurants

However, the transaction description will have an AMAZE* prefix added to it. This means you won’t be able to stack the Amaze’s 1% cashback with credit card bonuses for specific merchants.

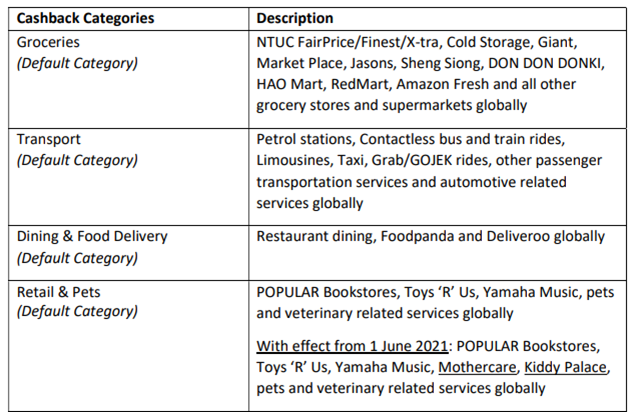

For example, the Maybank Family & Friends Card allows cardholders to earn 8% cashback at their choice of five preferred categories. In the case of retail & pets, spending must be at POPULAR, Toys R Us, Yamaha Music, Mothercare or Kiddy Palace specifically.

If I pair my Amaze with the Maybank Family & Friends Card and spend at POPULAR, I will not earn the 8% cashback (confirmed on HWZ). That’s because Maybank looks at the merchant description rather than the MCC, and the merchant description has now been modified with the Amaze prefix.

tl;dr: if your credit card offers bonuses on certain categories, go right ahead and use Amaze. If your credit card offers bonuses on certain merchants, Amaze won’t work.

(2) Amaze transactions earn 10X with Citi Rewards

I can confirm that pairing Amaze with a Citi Rewards Card works like a charm. Transactions charged through Amaze code as online, which means 10X points (4 mpd) with the Citi Rewards Card.

| ⚠️ Amaze currently supports Mastercards only, so you won’t be able to pair it with your Citi Rewards Card if it’s the Visa version. |

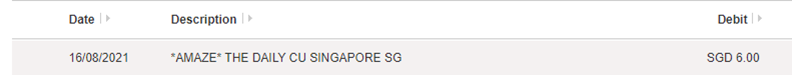

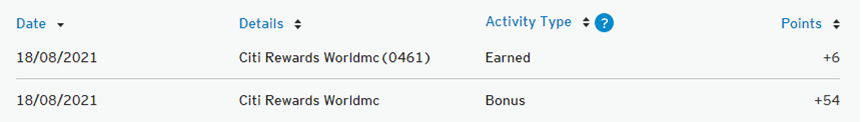

For instance, I used my Amaze at Daily Cut for a S$6 transaction.

This earned 6 base points (1X) and 54 bonus points (9X) with my Citi Rewards Card, or 24 miles overall. Effective earn rate= 4 mpd.

To reiterate: Amaze turns offline spend into online spend. Why bother with this, when you could just as well use the HSBC Revolution or UOB Preferred Platinum Visa for contactless spending at offline merchants?

Well, the HSBC Revolution (review), while useful, does not earn 4 mpd at every offline merchant; it’s limited to supermarkets, restaurants, hotels and retail stores. Granted, that’s a very wide range, but it’s hardly a universal solution.

The UOB Preferred Platinum Visa (review) caps its 4 mpd at S$1,110 per month, and some folks will burn through that in no time at all.

So pairing the Amaze with a Citi Rewards Card basically gives you another S$1,000 of 4 mpd firepower to play with, and don’t forget, you earn 1% cashback too (with a minimum quarterly spend of S$500).

Do note that regular rewards restrictions still apply, so you won’t earn any Citi rewards points for transactions at the following, even via Amaze:

- Charitable donations

- Educational institutions

- Government services

- Insurance

- Utilities

In other words, there’s no point heading down to make card payment in person (you’d earn 1% cashback from Amaze, but other cards like the UOB Absolute Cashback offer 1.7%).

Also remember that the Citi Rewards card won’t earn 10X for travel transactions, so don’t use it at the check-out counter to pay for staycations.

(3) Amaze transactions *should* earn 10X with the DBS Woman’s World Card

Since transactions code as online, there’s no reason why Amaze transactions shouldn’t also earn 10X points (4 mpd) with the DBS Woman’s World Card. Because of the way in which DBS credits bonus points, I won’t know for sure until next month, but the reports I’ve seen so far are all positive.

This means you can effectively convert another S$2,000 of offline spending into online transactions.

(4) The FCY value proposition is unmatched

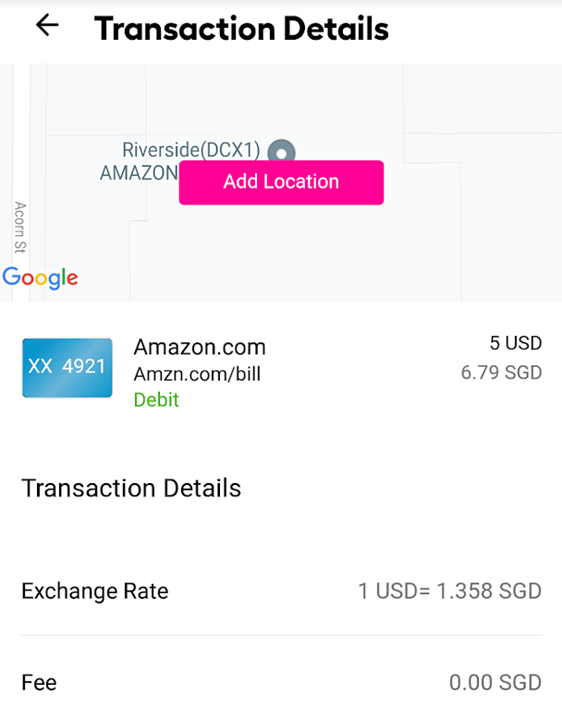

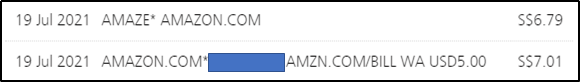

Foreign currency (FCY) transactions made on the Amaze card are converted to SGD at pretty much the mid-market exchange rate. I made a US$5 transaction on Amazon’s USA website; Amaze converted it to S$6.79 (mid-market rate at the time =S$6.81).

I made the exact same transaction on my DBS Woman’s World Card seconds later, and DBS billed me S$7.01, ~3.2% more.

Amaze transactions do not trigger DCC fees, so by making FCY transactions with Amaze, you:

- Avoid the bank’s 2.8-3.5% fee

- Earn 4 mpd (pair it with Citi Rewards/ DBS WWMC)

- Earn 1% cashback

I haven’t done a comparison of the rates with alternatives like YouTrip and Revolut, but I don’t think I need to. Even if Amaze’s rates are slightly inferior, it’s more than offset by the opportunity to earn 4 mpd and 1% cashback.

It’s exactly why I’m packing the Amaze when I head to Munich for the inaugural VTL in early September. There’s no reason to use a credit card, not even the UOB Visa Signature (4 mpd, 3.25% fee on FCY transactions) when you have the Amaze.

(5) Cashback is somewhat restricted

Amaze cardholders who spend at least S$500 per calendar quarter will earn 1% cashback on all transactions, capped at S$100 per calendar quarter. The exceptions list is refreshingly brief. No cashback will be earned on:

- Transactions that have been subjected to refunds and chargebacks;

- Any transactions made by You to top-up other prepaid cards and/or virtual online accounts

such as Grab Wallet; - Any cash withdrawals; and

- Transactions which are below S$5

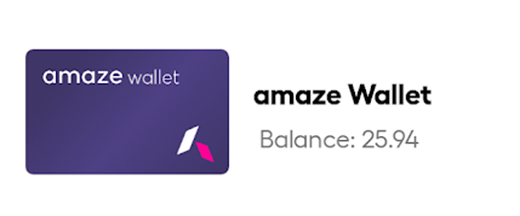

Cashback will be credited by the 25th of the month after the quarter ends, and is deposited into your Amaze Wallet. However, there’s currently no way of withdrawing it to a bank account. In other words, you’ll need to spend it through the Amaze Card.

It is not possible to combine funding sources, which means that if you have a balance of S$25.94 like me, you can only buy something that costs S$25.94 or less. There’s also no mechanism to top-up your wallet further, so it’s difficult to zero-ise your balance.

I tried adding the Amaze Card to my GrabPay wallet, thinking I could top-up GrabPay with Amaze and then cash out the balance (since the Amaze is a debit card), but it failed.

Conclusion

|

||

| Sign Up Here | ||

| T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| N/A | N/A | N/A |

| Earn Rate | ATM Fees | Max Spend |

| 1% cashback | Not supported* | No annual cap; per trxn cap of S$25K |

| *T&Cs state that the Amaze card cannot be used to make cash withdrawals via any ATM inside or outside Singapore. | ||

One final point that didn’t fit into any of the other sections: the virtual Amaze card cannot be added to a mobile wallet like Apple or Google Pay You’ll need the physical Amaze card to really join the party, so I highly recommend ordering one now. This takes less than a minute via the app, but the card delivery may take up to a month.

Let’s not kid ourselves- the banks are already aware of Amaze, and are likely to take a dim view towards Amaze eating their FCY fees while still having to pay out 10X points. This won’t last forever, so make hay while the sun shines.

Fair warning: I’ve not had any reason to refund a transaction yet, so I can’t speak to how efficient that process is. I read a complaint in the comments section of the original post and another one in the Telegram Group (later resolved). Since Amaze inserts another layer into the equation, I can imagine a customer getting bounced between bank, Amaze and merchant- not a fun experience.

If you have more insights, do share them below.

Hi Aaron, does the amaze card need to be paid offline via contactless or the normal chip and signing method avails?

I have been using it exclusively by tapping the physical card. There’s a chip so I suppose you could do Chip too

And that means that paywave is not a requirement for getting the 4mpd + 1% cashback then?

it does not matter what mode you use. which means this card can be a replacement for PPV in situations where paywave not accepted.

A darn shame I don’t have any noteworthy mastercards to use

let’s see how long it would take Citi and DBS to blacklist all Amaze transactions.

if i link 5 cards to it, how will i choose which one to use at merchant?

you select a default one in the app

Yeah that bit me – didn’t swap back to CitiRewards before making a $1000 txn.

It seems the fx rates are better for small transactions. I did a comparison of $50 rates for Revolut, Amaze, Transferwise. Amaze was best. Then I did $500 transactions and Amaze was worst. Still for normal 4mpd forex Amaze is pretty good and offline/online conversion works well.

I’ve been using Amaze for some significant AUD and GBP transactions of late. Note the FX spread varies quite a lot.

AUD ranges from 0.0061 to 0.0084

GBP ranges from 0.0059 to 0.0221 (!)

Is the CRMC still facing issues when awarding the 9X points for online transactions? I am still holding on to CRV and have heard quite a number of bad experiences from users of CRMC having to track transactions regularly.

you don’t have to give up your CRV. I have both the CRV and CRM now.

does citi thank you points from CRV and CRM pool?

No

Is it only can link with MasterCard?

Can link with any credit card.

Can link with any credit card as long as it’s Mastercard.

Any idea how this works if i use to to make recurring bill payment for eg ?

Which card will the recurring bill charge to if i linked 5 cards ?

Whichever card is linked at the time of the transaction will be charged. You can setup multiple cards but can only link one at anytime.

Hi, how can I check if I’m indeed getting the 4mpd for my transactions that I put through Amaze? Or if the bank has blocked the 4mpd earnings as the transaction codes as Amaze?

The cards I’m thinking of linking are the DBS woman’s card, UOB lady’s card and the Citibank rewards card.

It is quite hard to track the points especially for the UOB cards.

Thank you!

https://milelion.com/2019/08/22/how-do-banks-calculate-credit-card-points-specialised-spending/

One question – if paying overseas and/or with foreign currency, you don’t know what exchange rate they will use when posting the transaction, correct? Is there a way to see exchange rates before making a transaction or is it totally black box?

People in the comments mentioned a huge spread and it should be minimum yellow, if not red flag….

Whatever the rates are, it’s still better than using credit card. Add in the 4 mpd and I’m sold. This may not be the product for someone who doesn’t care about miles and just wants the absolute lowest cost fcy transaction- but for miles collectors, it’s fantastic

Would I be able to use this card to transfer money to someone’s bank account overseas? E.g. children studying abroad

Am I able to pair it with GPMC?

i dont think you can link grabpay card

Tested. GPMC not supported.

Thank you Mr Milelion. I saved (not a lot in absolute amount, but I did save and show a middle finger to the banks) in the various USD subscription fees I have to pay every month. Damn. This is good.

it’s not about the money it’s about sending a message…

Anyone facing issue linking the WWMC to the Amaze card?

I managed to link it after closing the app and reopening it.

Anyone has problem adding Amaze card to Apple Wallet?

I tried to add the physical card to ApplePay but got a message that it was not supported.

Amaze card can only be added to google pay currently

After receiving the physical amaze card recently, I tried paying at fairprice and venue beauty with citi reward card tagged as default card. Unfortunately, the system does not reward me with any bonus thankyou points. It seems the transaction is not coded as online when using physical card and it earns only 0.4mpd.

I also noted that favepay transaction no longer earns 4mpds starting the same time I start using the physical amaze card. While the two are not related, I suspect citi has become more stringent in what classified as online transactions.

I’ve used citi rewards mastercard directly at fairprice online and not received bonus points until I complained (a lot) – they said they would award them as a one time exception. I don’t use CRM at fairprice online anymore and it may be a citi issue rather than an Amaze issue but I guess YMMV. I’ll try the amaze card sometime at cold storage and see what happens.

clumsy is right. CRM is a notorious problem child- see here: https://milelion.com/2020/05/20/the-curse-of-the-citi-rewards-mastercard/

Thank, Clumsy and Aaron.

I guess i will avoid using it for fairprice then.

So it’s basically a Russian roulette? Gotta chase them for every single transaction you make?

not “every”. but it’s a card you need to be vigilant with.

Anyone able to confirm if DBS WWC earns 4mpd when link to Amaze card when we do in-store transactions TIA!

yes

Does it still? It seems like that earn rate has been nerfed on my transactions.

Same no more points on DBS WWC

any idea with citibank casback+ mastercard? if I change my insurance premium/singapore power/ geneco bill to it. will i get cashback (either from amaze, or from citibank or both)

Interested to know as well

no rebate from citibank since the mcc remains the same. Should be able to get Amaze 1%

does it work for mrt/bus?

yes

Does this card go well with the OCBC Titanium for big ticket purchases?

Did you try? I’m interested to know as well.

Just tried to add the DBS WWMC but was consistently rejected with the message that the card issuer has rejected the request. Signs of DBS cramping down on this?

Try again in a couple of hours. It will work. You might also notice food delivery payments will keep getting declined. Just call DBS up and tell them to whitelist Amaze + food delivery merchants and everything works perfectly from there. Caveat, DBS will say ok, but if there are any unauthorized transactions from those merchants, it’s on you.

Maybank FF card T&Cs state “… services classified under MCC … ” so its code driven not merchant name with the exception of Popular, ToyRUs and Yamaha Music that’s explicitly called out.

” For avoidance of doubt, any transaction charged under Default Categories or Selected Categories (as defined below) (as the case may be) merchants that are not classified under the MCCs stated herein or not otherwise stated herein shall not be eligible for cashback under the Cashback Programme”

thanks- i’ve made that more clear.

Aaron, did you get 4mpd on your dbs woman’s card? Will be help to have this Data point. Thanks!

yes got 4mpd

Hi all,

Does anyone try using Amaze as a debit card to pay off credit card bills via AXS?

I was able to do so first time round, but subsequent month, AXS came back to say it rejects my amaze card details.

Any. Idea why is it so ?

Thanks.

Hi Aaron, can you please confirm if the 4 miles per dollar applies to the dbs woman’s World card? Thanks!

I have just checked on a previous transaction that I had made on my AMAZE card tagged to OCBC TR. As I didn’t get my additional 9X points the following month, I had called to check. Surprisingly, the CSO actually checked and told me that the transaction was tagged with MCC 5734 – Computer Software Stores (I think other online payment services maybe tagged to this code to). Doesn’t this go against the notion of the tagging of the same MCC code as per the store/service you have purchased from? [P.S. It was a purchase from LV store] May switch… Read more »

HWZ has many reports of people not getting 10x OCBC$ for purchases made directly at LV store with OCBC TR. I don’t think this has anything to do with Amaze changing the MCC but that LV store has a MCC which OCBC excludes.

Thanks Bubbles.

True. I think had positive experiences before when using OCBC TR card on its own. And actually the CSO did mention one of my latest transactions @ LV (using AMAZE x OCBC TR), after the previous one, was tagged under MCC5948 Leather Goods, which falls outside of OCBC TR TnCs.

However, my question still stands on what was a MC5734 shown for a previous transaction with the AMAZE card.

If we pair Amaze with a 90N that gives 2.1mpd on overseas spend, and use the amaze card overseas, does ocbc still recognize the spend as overseas ?

nope. it’s billed in SGD.

Hi, I tried using the Amaze card with my Citi Rewards card last week on Jan 6. The points have come in for the Rewards card but no bonus ones (9x points) show up. How soon can I expect to see the bonus points? If they’re missing, how do I chase for those points? Or has Citi decided that Amaze transactions do not count as online spend?

Still can’t add Amaze to apple pay. And using the physical car you don’t get the maximum benefits.

what are the additional benefits of adding to apple pay besides for more convenience ?

Can anyone please share if DBS WWMC still gives 4mpd when linked to Amaze? I m thinking of using Amaze (linked with DBS WWMC) to pay overseas hotel in the hotel when I travel next month.

Hi Samantha, linked WWMC but do not see the additional points coming thru. Have you booked your hotel? And if so, which card used

It appears that UOB has nerfed rewards for Amaze transactions.

“With effect from 1 March 2022, please be informed that transactions with transaction descriptions “TRANSIT*” and “AMAZE* TRANSIT*” will be excluded from the awarding of UNI$, cashback and KrisFlyer miles.”

https://www.uob.com.sg/personal/cards/rewards/redeem-points.page

Nervously looking at Citi and DBS now.

Does that mean only transit? What if I use the UOB lady’s card for dining?

It only affects transit

I managed to add it to my Google pay tho

https://milelion.com/2021/11/10/amaze-adds-google-pay-support-use-virtual-card-at-brick-and-mortar-stores/

Hi,

can I check if I link the UOB krisflyer card will I get 3 miles for instore apparels purchases as from what I know the amaze transaction are being converted to “online”

Hi,

can I check if I link the UOB krisflyer card will I get 3 miles for instore apparels purchases as from what I know the amaze transaction are being converted to “online”

Effective 1 Mar 2022, UOB will no longer credit miles to transactions from Amaze.

https://www.uob.com.sg/assets/pdfs/kf_credit_card_full_tnc.pdf?s_cid=pfs:sg:paid:sea:go:na:tx:na:001506:010121-evergreen:na:cvp_cashback:pc-go&vid=purpleclick_google

hi Aaron, how do you check the MCC description for the transaction as you mentioned above? Thanks.

hello! Does that mean that if I use my amaze card (linked withCiti Cashback card) on dining overseas, I will still be eligible for my 6% cashback? While if I use my amaze card on petrol overseas, my citibank cashback won’t be recognised since its merchant specific (esso & shell)?