From 20-22 October 2021, Citibank is running a 72-hour flash deal for Citi PayAll, with up to S$120 CapitaVouchers for users who set up at least S$2,500 of payments.

This deal can be stacked with other ongoing PayAll offers, such as the 0.5% cashback promotion for Citi Prestige and ULTIMA cards, and the S$120 cashback promotion for recurring payments.

Get up to S$120 CapitaVouchers with Citi PayAll

Citi PayAll customers who set up at least S$2,500 of payments between 12 a.m on 20 October 2021 to 11.59 p.m on 22 October 2021 (with payment due date before 30 November 2021) will receive CapitaVouchers as follows:

| Total Citi PayAll Payments | CapitaVouchers |

| S$2,500 to S$3,999 | S$30 |

| S$4,000 to S$7,999 | S$50 |

| S$8,000 and above | S$120 |

There is no restriction on the type of payment that can be made; all PayAll transactions will count:

| 💰 Citi PayAll: Supported Payments | |

|

|

The miscellaneous category is extremely broad, and pretty much covers any situation where you get an invoice with instructions to make a bank transfer.

Each customer is entitled to a maximum of one gift during the promotion period. This promotion is valid for the following Citi credit cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

- Citi Lazada Card

- Citi Cash Back+ Card

- Citi Cash Back Card

At the risk of repeating myself, your payments must be set up during the promotion period, so if you’ve already got payments in place, you’ll need to cancel and set them up again (since Citi is running so many PayAll promos, make sure the cancellation doesn’t jeopardise your participation in another one!).

For the avoidance of doubt, you can combine multiple payments to meet the minimum spend. However, only the first payment of a recurring payment setup would count towards the calculation.

Citibank provides the following examples:

| ✔️ Qualifies | ||

| Payment | Frequency | Amount |

| School Fees | One-time | S$250 |

| Insurance | One-time | S$250 |

| Rent | Recurring (12 months) | S$2,000 per month |

| Verdict: This customer qualifies for S$30 CapitaVouchers as he has accumulated S$2,500 of PayAll payments. Only the first rental payment of S$2,000 will count towards the calculation of PayAll payments for the promotion. | ||

| ❌ Does Not Qualify | ||

| Payment | Frequency | Amount |

| Insurance | Recurring (12 months) | S$2,000 per month |

| Electricity Bill | One-time | S$250 |

| Verdict: This customer does not qualify as he has only accumulated S$2,250 of PayAll payments. Only the first insurance payment of S$2,000 will count towards the calculation of PayAll payments for the promotion. | ||

Eligible customers will receive a notification via SMS/email with gift redemption details within 12 weeks from the end of the promotion period, i.e. by 14 January 2022.

The full T&C of this offer can be found here.

Stack with Citi’s other PayAll offers

This flash deal is offered on top of Citi PayAll’s other ongoing offers, as detailed below.

Get up to 0.5% cashback on Citi PayAll

From 1 October to 31 December 2021, Citi Prestige and Citi ULTIMA cardholders will enjoy bonus cashback when they set up and charge the following amounts:

| Total Citi PayAll Payments (1 Oct to 31 Dec 21) |

Bonus Cashback |

| S$30,000 to S$59,999 | 0.2% |

| S$60,000 to S$89,999 | 0.3% |

| S$90,000 and above | 0.5% |

The maximum cashback that can be earned is capped at S$600, which works out to a payment cap of S$120,000.

Cashback will be credited to your account within 12 weeks from the end of the promotion period, i.e. by 25 March 2022.

The full T&C of this offer can be found here.

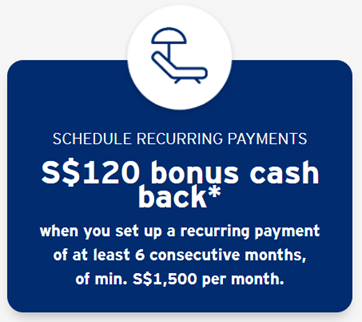

S$120 cashback for recurring payments

Citi PayAll customers who schedule recurring payments of at least six consecutive months and a minimum of S$1,500 per month will receive S$120 cashback.

The first payment in the series must happen by 31 December 2021, but the subsequent five can come after 31 December 2021 if you wish. Citi PayAll supports the following recurring payments:

- Education expenses

- Insurance premiums

- Membership

- Misc. payments (e.g. parking, storage, utilities, wedding expenses)

- Rent

| ⚠️ Citi PayAll does not support recurring payments to IRAS. If you have taxes to settle, consider CardUp’s special promo for Milelion readers, which offers a 1.75% fee for a one-time payment of any amount, up to the total tax due |

Eligible customers will receive S$120 cashback in the form of a statement credit within 12 weeks from the end of the promotion period. The T&C of the offer can be found here.

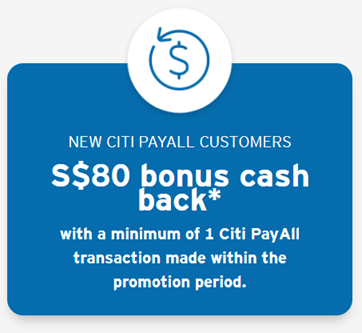

S$80 cashback for new Citi PayAll customers

If you haven’t made a Citi PayAll transaction before, you’ll receive S$80 cashback when you make at least one transaction by 31 December 2021.

There’s no requirement that this be part of a recurring series, although you could obviously set one up and stack it with the S$120 cashback offer described above.

Eligible customers will receive S$80 cashback in the form of a statement credit within 12 weeks from the end of the promotion period. The T&C of the offer can be found here.

Is it worth it?

If you have payments to make, this flash deal helps further offset your expenses.

To illustrate, someone who pays an insurance premium of S$4,000 would pay a fee of S$80 (2%) and receive:

- S$50 CapitaVouchers

- 4,800 miles (assume 1.2 mpd with Citi PremierMiles Card)

- S$80 cashback, if this is his/her first-ever PayAll transaction

The CapitaVouchers alone reduce the fee to S$30, and everything else is just gravy.

Remember, you’re not just buying KrisFlyer miles; Citibank points can be transferred to 10 different frequent flyer programs, including some with great sweet spots like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles. Even the newly-revitalised Qatar Privilege Club might be a good bet.

| 💳 Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Assuming you opt for plain vanilla KrisFlyer miles, here’s the range of value that you get when redeeming them:

| Options for Spending KrisFlyer Miles | ||

| Redemption Option | Value per mile | |

| ✈️ | Award flights | 2-6 cents |

| 🏨 | Shangri-La Golden Circle conversion | 1.1-1.4 cents |

| ✈️ | Pay for flights with miles | 0.95 cents |

| 🚘 | KrisFlyer vRooms | 0.8 cents |

| 🛍️ | KrisShop | 0.8 cents |

| 🏬 | CapitaStar conversion | 0.7 cents |

| 📱 | Kris+ | 0.67 cents |

| 🎡 | Pelago | 0.67 cents |

| ⛽ | Esso Smiles conversion | 0.33- 0.67 cents |

Conclusion

From 20-22 October 2021, Citi PayAll is offering up to S$120 CapitaVouchers on top of its other ongoing promotions, which represents a great opportunity to pay some bills.

Citi PayAll supports a wide variety of payments, including tax, insurance, rent, education, electricity bills, MCST fees, renovation bills and more, so everyone should be able to find some kind of payment to put on the platform.

Is there a fee for set up PayAll?

No setup fee. Just a 2% fee per transaction (e.g. you pay $1,000 via PayAll, Citi charges your card $1,020) but you earn miles.

Can we credit the funds to our own account at another bank and be eligible?

Paragraph 9 of the T&Cs for the “S$120 cashback for recurring payments” offer states:

Are you able to confirm if that offer is stackable with the CapitaVoucher flash deal?

I just tried to setup payall for premium for my AIA Life policy but failed. Do you know if this is a known exclusion?

has anyone received the $120 Capita voucher for this promotion?