|

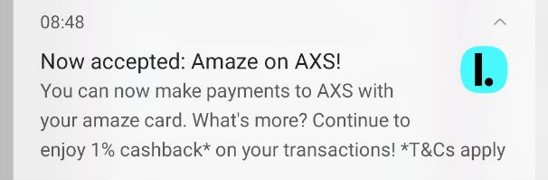

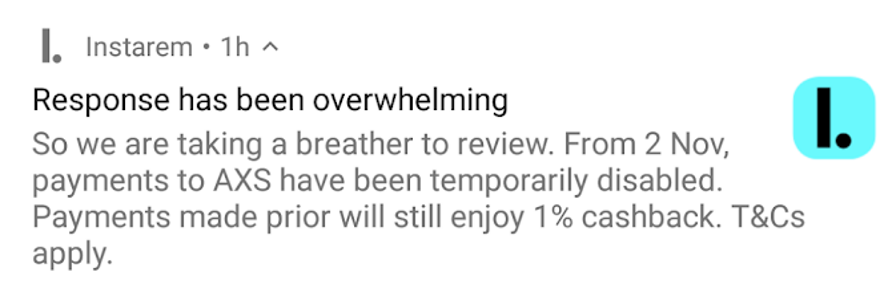

Update: That was fast. Amaze has announced that due to “overwhelming response”, it will be temporarily disabling AXS payments. Any payments made prior to 2 November will still receive 1% cashback.

|

I’ve previously written about the Amaze Card, which is quite simply a phenomenal product. Cardholders can earn 4 mpd on all transactions, with 1% cashback and zero FCY fees. There’s no knowing how long this will last, so enjoy it while you can.

| 💳 tl;dr: Amaze card |

|

| Sign Up Here |

|

When Amaze first launched, it wasn’t possible to use it for AXS transactions. That’s now changed, and it’s getting some people very excited.

Use Amaze for AXS payments

As per a push notification sent via the Instarem app, Amaze is now accepted for AXS transactions. Cardholders will continue to earn 1% cashback as always, although you shouldn’t assume you’ll earn any rewards points from the paired credit card.

Now, in one sense this is no big deal. You could already earn 1.7% cashback on AXS transactions, simply by topping up your GrabPay wallet with a UOB Absolute Cashback Card and paying through the GrabPay Mastercard. Alternatively, you could earn 1.8 mpd, assuming you had an AMEX HighFlyer Card (only available to those who run an SME).

But while the GrabPay Mastercard can’t be used to pay credit card bills, Amaze can. This means you could theoretically pay off S$10,000 of credit card charges and earn S$100 in the process (cashback with Amaze is capped at S$100 per quarter).

I say theoretically, because this assumes that credit card bills actually qualify for 1% cashback with Amaze. I can’t help but be a little skeptical; the push notification for AXS payments alludes to T&Cs applying, but I can’t find anything specific online. And since Amaze cashback is only credited on the 25th of the month after the calendar quarter ends, you’ll only know on 25 January 2022 whether this actually works.

I suppose there’s little to lose- you need to pay those bills, and it costs you nothing to do so via Amaze. In a best case scenario, you get 1% cashback. In a worst case, well, the bill gets paid anyway and there’s no opportunity cost involved.

AXS: Can of worms?

On a side note, I’m quite surprised that Amaze added support for AXS because it tends to open a can of worms.

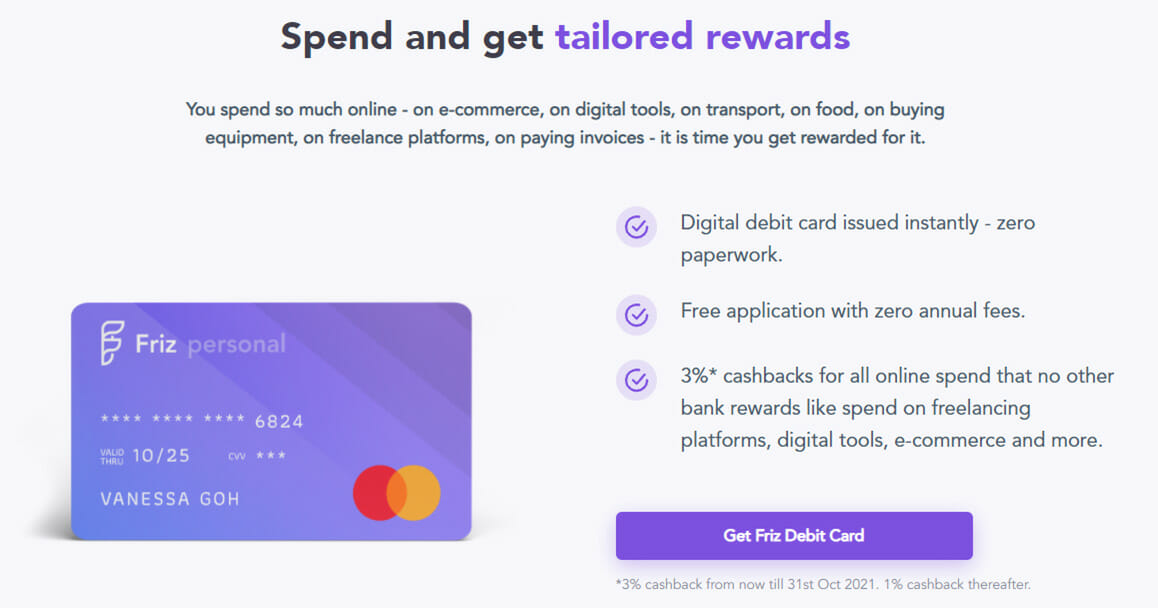

I’m thinking in particular of another recently-launched debit card called Friz. Friz offers 3% cashback on all transactions (until 31 October), and there was initially no exclusion for AXS transactions nor cap on cashback. It didn’t take long for people to start paying their income tax bills, insurance premiums, town council charges etc. en masse (though to my knowledge, it wasn’t possible to use Friz for credit card bill payments).

Alarm bells must have gone off, because Friz belatedly decided to exclude AXS transactions from cashback. They won’t be winning any fans for the way they handled it though, since they (1) made the exclusion retroactive and (2) gave a super lame excuse about how customers had “complained about transaction failures and bad experiences using AXS.” Sure they did.

Anyway, the moral of the story is that adding AXS functionality often creates more problems (for card issuers at least) than it solves. I mean, GrabPay went through its own on again off again relationship with AXS, only restoring functionality a few months ago.

I’m quite happy with Amaze the way it is, though I wonder whether adding AXS functionality may hasten its demise (by getting it on the blacklist of banks). I remember how quick DBS was to add Mileslife to its exclusion list, classifying it alongside CardUp and ipaymy. This made no sense at all since Mileslife wasn’t even a bill payment service, but they did it anyway.

If a similar fate befalls Amaze, that can’t be good.

Conclusion

Amaze can now be used for AXS transactions, although there’s very little reason to do so when you can earn better rebates through a combination of the UOB Absolute Cashback Card and GrabPay.

I think people are more excited about the possibility of earning 1% cashback on credit card bill payments, but I’m skeptical as to whether that will actually happen. And even if it does, I don’t think that’s necessarily a good thing for the long-term value proposition of Amaze.

Scb supersalary debit card paid axs cc bills for years, looks like amaze will be the successor

Does supersalary still work?

Nope. Supersalary no more 1% for AXS

Unfortunately I think this one will be nerfed faster than light. That debit card trick survived for many years because not many people had one or knew about it.

I repeat what Traz has said, SCB debit card 1% has been excluded from AXS since last year for your info.

I dont think many people have the Amaze card. They might all be frantically applying right now. But it will take some time till it reaches scale. So make hay while the sun shines 🙂

Have others been able to get their amaze card? Mine constantly says it’s reserved but nothing happens

Yea Ive been waiting for weeks now. I’m not sure if the wait is worth the hype.

really worried this axs functionality will raise unnecessary attention to Amaze card esp you can now use CC to pay CC bills so technically you can just keep rolling over your CC bills ?

or imagine paying your citi cc bills via axs using amaze and then link amaze to the same citi card effectively extending your cc bills ?

Nice. You even get free $100 every quarter for your efforts.

That’s the exact thing that killed Grab with AXS

Grab was quite popular already and many cards had been sent out. How many people have Amaze cards? I think it is just not the same scale. People must be applying for the card frantically now. But it takes time for the card to arrive so we do have a small window of opportunity to remain under the radar.

I’m guessing AXS will probably be forced us to add Amaze as a “credit card” like GPMC so it will automatically exclude CC payments on their system.

that is most logical action to close this ‘loophole’

Until then may hay while the sun shines 🙂

Wondering how does one utilise the amaze cash back accumulated in the app? So far it’s not clear I think…

Will it be tagged as cash advance and incur fees on the cc side?

No. I pay my POSB everyday card bill using the same card, the payment is Amaze AXS payment, category is utilities.

Did you pay on Friday? So the transaction got posted on Saturday?

Do you have the exact 4 digit MCC code for the transaction?

We should all hope that Amaze won’t suffer the same fate as Curve has in the UK: https://www.headforpoints.com/2021/10/01/creation-cancel-credit-cards-used-with-curve-card/

Amaze raising its head above the parapet with manufactured spend is a nailed-on way to get the card killed.

They don’t really care tbh. They just want your spending data and going all out to trigger all kinds of spending is extremely worth it for them

We should all hope that Amaze customers won’t suffer same fate as Curve customers.

I don’t need my cards cancelled and accounts closed. I didn’t even do any MS. That 1% cash back may have got very expensive.

I dont think cards and accounts will get cancelled. We are not doing anything illegal. But I wonder how will this get nerfed. Maybe the card companies are going ban Amaze i.e. I see that is the only way, because if you continue to allow Amaze, even if you dont give out points, you will still have people doing balance transfer from one bank to another bank for free and the only way to prevent it would be for the card company to ban Amaze. Since the tie up with AXS is with Amaze and it has nothing to do… Read more »

It will be a blanket ban on rewards for AMAZE* transactions. Like some banks did for PAYPAL*. Who knows if it will be retroactive? Balance transfer will cost NIUM $100 per quarter. The banks have every right to cancel cards and close accounts if they don’t want you as a customer – don’t cycle your credit limit. This card will be dead soon and most probably Amaze/NIUM won’t honor the January cashback.

yeah as tempting as it may be, better dont do funny things like cycling your credit limit or keep rolling your cc debt via this loophole.

I have a 10k balance on my UOB credit card. If I pay it off using DBS credit card, would it be called cycling credit limit? If I do it back and forth a few times will that be considered as pushing it too far? I just want to know what is reasonable here?

Just for reference, my amaze card is linked to my DBS woman’s World card; I was confirmed by the DBS support team that the below Amaze expenses were not eligible to bonus points:

– Hotel booked on booking.com (while it is a genuine online expense)

– Restaurant in Europe (so it was not “converted” to an online expense).

So just 1mdp for the above…

What is their explanation for not classifying your booking.com spending as online spending?

They simply told me this kind of transactions doesn’t flow in the eligible category but they are happy to adjust it manually…if I provide proofs I indeed booked my hotels with my DBS woman’s world card (which is not the case).

I still saved on FX fees, got 1% cashback…and 1mpd. Still a good card, but less amazing

You got 0.4mpd!?

Sorry, yeah that’s actually what I meant; 0.4mpd on all my bookings !

Oh no! I just bought an iPhone on the apple online store using amaze+dbs wwmc. I hope it works or that’ll be a painful 1k

Anyone tried using Citi cashback plus for cc payment? Any cashback?

Isnt it too early to know? This facility opened up only on Friday. Cashbacks are given at the end of the statement month I guess.

I just tried to pay my UOB card via the same UOB card linked to AXS, it failed after I entered the OTP.

I tried linking another UOB card and paying UOB card 1 with UOB card 2, that also failed with same error “Unable to process transaction, please try again” I think they have disabled paying credit cards via the amaze card already. So it lasted just 1 day?

No. It lasted from last Friday to yesterday. 3 days

Yeah, so how much hay did people make while the sun was shining? Everyone very quiet today 🙂

Still fishing for social validation and Internet points? Maybe there is a lesson to be learned. “Silence is golden”. What is the first rule of MS club? Maybe that’s the reason you’ll never be in MS club.

So you move all your chatter from HWZ to Milelion? Why bother? Do you win Internet points by making all these posts? This is why people keep MS to themselves. Sharing is not caring. Publicly stating that you are trying to pay a CC with the same CC so you can get rewards which is specifically against your UOB card membership agreement is foolish.

The loophole is now closed already. I dont think it is because of me, come on, I dont think I am that impactful. Otherwise the people incharge must be really dumb that they need someone like me to come and post here for them to find out.

It’s milelion. Not you

Yea precisely. Couldnt agree more. It’s stupid for milelion to even post this shit

I’m sorry, I’m a lonely man with no friends. My only hobby is to post hacks for the whole world to know and to show off how smart I am

banks closed to loophole because I shared on the internet? I don’t give a shit

I tried to use the Amaze card to pay insurance through AXS today but the payment was unsuccessful a few times. Not sure if it is limited to only some payment options within AXS.