When getting their first miles card, many people instinctively look for a credit card where the points never expire.

To be fair, that’s a perfectly reasonable concern. Saving up for your first big redemption can take time, and there’s nothing worse than being so close to the finish line only to realise some of the points you earned earlier have expired!

Even though I don’t think expiring points should be that big a concern (I’ll explain why later), let’s deal with the question at hand first.

| 💳 Credit Card FAQs |

| Managing Points |

| Conversions |

| Calculations |

How long are credit card points valid for?

Here’s a summary of expiry policies by bank, keeping in mind that some banks may have more than one rewards currency.

| 💸 Points Expiry Policy |

||

| Bank | Currency | Expiry |

|

Membership Rewards | No expiry |

| Rewards Points | 12-24 months | |

|

Citi Miles | No expiry |

| ThankYou Points | Up to 5 years1 | |

| DBS Points | 1 year2 | |

| Rewards Points | 37 months | |

| TREATS | 1 year3 | |

| OCBC$ | 2 years | |

| 90°N Miles | No expiry | |

| VOYAGE Miles | No expiry | |

| 360° Rewards Points | Up to 3 years4 | |

| UNI$ | 2 years | |

| 1. ThankYou Points earned on the Citi Prestige Card and Citi ULTIMA Card do not expire 2. DBS Points earned on the DBS Altitude Card, DBS Insignia Card and DBS Treasures AMEX do not expire; DBS Points earned on the DBS Vantage Card are valid for three years 3. TREATS Points earned by Rewards Infinite members do not expire 4. 360° Rewards Points earned by StanChart Beyond Card, StanChart Journey Card, StanChart Visa Infinite and StanChart Priority Visa Infinite do not expire |

||

But that’s not the whole story! Where it gets confusing is that even within the same bank, the same points earned on different cards may have different expiry policies.

For example, DBS Points earned on the Woman’s World Card expire after one year, but DBS Points earned on the Altitude cards never expire. Similarly, ThankYou points earned on the Citi Rewards Card are valid for up to five years, but ThankYou points earned on the Citi Prestige Card never expire.

So in addition to the general rules above, it’s helpful to set out which specific cards earn non-expiring points:

| 💳 Cards With Non-Expiring Points | ||

| Card | Local Earn | FCY Earn |

StanChart Beyond Card StanChart Beyond CardApply |

1.5-2 mpd1 | 3-4 mpd2 |

StanChart Visa Infinite Card StanChart Visa Infinite CardApply |

1.4 mpd3 |

3 mpd3 |

Maybank Visa Infinite Card Maybank Visa Infinite CardApply |

1.2 mpd | 3.2 mpd4 |

OCBC VOYAGE Card OCBC VOYAGE Card(Premier, PPC, BOS) Apply |

1.6 mpd | 2.3 mpd |

DBS Treasures AMEX DBS Treasures AMEXApply |

1.2 mpd | 2.4 mpd |

OCBC VOYAGE Card OCBC VOYAGE CardApply |

1.3 mpd |

2.2 mpd |

DBS Altitude Card DBS Altitude CardApply |

1.3 mpd | 2.2 mpd |

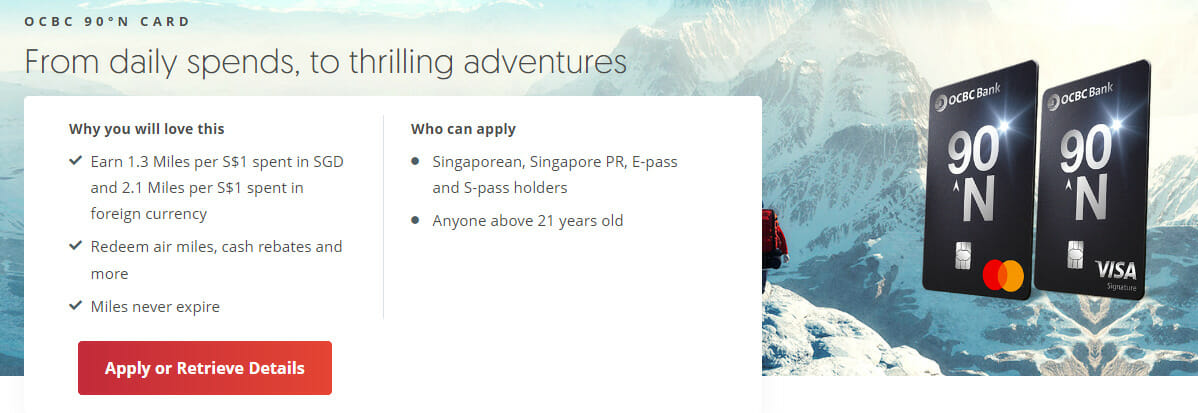

OCBC 90°N Card OCBC 90°N CardApply |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles CardApply |

1.2 mpd | 2.2 mpd |

Citi Prestige Card Citi Prestige CardApply |

1.3 mpd | 2 mpd |

Stanchart Journey Card Stanchart Journey CardApply |

1.2 mpd | 2 mpd |

StanChart Priority Visa Infinite Card StanChart Priority Visa Infinite CardApply |

1 mpd | 1 mpd |

AMEX Platinum Charge AMEX Platinum ChargeApply |

0.78 mpd | 0.78 mpd |

AMEX Platinum Reserve AMEX Platinum ReserveApply |

0.69 mpd | 0.69 mpd |

AMEX Platinum Credit Card AMEX Platinum Credit CardApply |

0.69 mpd | 0.69 mpd |

Maybank World Mastercard Maybank World MastercardApply |

0.4 mpd | 3.2 mpd5 |

| 1. 1.5 mpd for regular customers, 2 mpd for Priority Banking and Priority Private 2. 3 mpd for regular customers, 3.5 mpd for Priority Banking, 4 mpd for Priority Private 3. With a minimum spend of S$2,000 per statement month, otherwise 1 mpd for both 4. With a minimum spend of S$4,000 per calendar month, otherwise 2 mpd 5. With a minimum spend of S$4,000 per calendar month; 2.8 mpd with a minimum spend of S$800 per calendar month, otherwise 0.4 mpd |

||

Are non-expiring points really that important?

Although it’s nice to earn points that don’t expire, I don’t believe this should be your key criteria for choosing a card.

There are two reasons for this:

- You have more time than you think to redeem your points

- You shouldn’t be holding on to points so long that expiry becomes an issue

You have more time than you think to redeem your points

Most credit cards in Singapore earn points that are valid for at least 2 years. After that, you can transfer them to KrisFlyer where they’re valid for a further 3 years.

| 💳 Exception: DBS Woman’s World Card |

| Points earned on the DBS Woman’s World Card expire after 1 year. That’s annoying, but the ability to earn 4 mpd on S$1.5K of online spending each month makes me willing to pay the additional transfer fees necessitated by the short expiry period. |

Therefore, in most cases, you have at least 5 years to save up for your desired redemption. If you’re not able to accumulate enough miles in that period for at least one award flight, it suggests that:

- you’re not optimising your miles collection strategy

- your miles goal is too ambitious relative to your spending (e.g. trying to redeem for too many people, or in too high a cabin)

- your absolute spending levels are too low (but before you write off the miles game as only for big spenders, consider whether you’re truly optimising your miles collection in the first place)

You shouldn’t be holding on to points indefinitely

Non-expiring points can be a bad thing, if they encourage you to hold them indefinitely without any clear redemption plan. The longer you hold your points, the more vulnerable you are to devaluations.

Take KrisFlyer, for example. Historically, KrisFlyer devalued every 4-5 years. However, recent events suggest that the gap between successive devaluations has shortened to 2-3 years.

Saving up your miles for retirement might have been viable in the early days of frequent flyer programmes, but it’s unthinkable today. Given how airlines are handing out miles for everything from opening a credit card to buying flowers, the pace of devaluations is only likely to accelerate in the future.

To put it another way, miles are amazing, but they’re the worst investment to hold. They don’t earn interest, they’re not protected by deposit insurance, and they can only be devalued. Earn and burn, not earn and hold!

But what about transfer fees?

It’s certainly true that non-expiring points help minimise transfer fees, because there’s no pressure to cash them out before you’re ready. For example, if you hold a DBS Woman’s World Card, you’ll have to transfer points at least once every 12 months, or else forfeit them.

| 💰 Points Conversion Fees by Bank |

||

| Issuer | Per Conversion | Annual Option |

|

S$201 | N/A |

|

S$30 | N/A |

| S$27.252 | N/A | |

| S$27.253 | S$43.604 | |

| Free | N/A | |

| S$27.25 | N/A | |

| S$25 | N/A | |

| S$27.25 | N/A | |

| S$255 | S$506 | |

| 1. Waived for all Platinum and Centurion Card 2. Waived for Citi ULTIMA Card 3. Waived for DBS Insignia Card 4. Automatic conversions in blocks of 500 DBS points (1,000 miles) each quarter. Additional ad-hoc redemptions can be done for free 5. Waived for UOB Reserve, UOB Visa Infinite Metal, UOB Visa Infinite and UOB Privilege Banking Card 6. Automatic conversions in blocks of UNI$2,500 (5,000 miles) each month for balances above UNI$15,000. Additional ad-hoc redemptions cost S$25 each |

||

While transfer fees are annoying and you should be doing all you can to minimise them, I feel they’re ultimately insignificant in the grand scheme of things. To put it another way: I wouldn’t actively avoid the DBS Woman’s World Card or the UOB Preferred Platinum Visa just because they earn points with 1-2 years expiry. The opportunity cost of foregone miles far outweighs any additional transfer fees.

Conclusion

The validity of credit card points in Singapore ranges from one year to evergreen, and while non-expiring points are a bonus, it ultimately isn’t that big a factor in my decision whether or not to get a particular card.

So my advice is not to get too hung up about this. Pick cards on the basis of their earn rates and transfer partners, and with the right accumulation strategy, you’ll be earning and burning points so fast that expiry won’t even be an issue.

Hi, still a noob in the mile games. Do we have to transfer the moment we hit the tier? For example, dbs points – I have 5000 enough for 10k miles, do I transfer now or at which point is ideal to transfer into krisflyer account? Thanks!

No, you can hold until you need to transfer/DBS points going to expire but in blocks of 5K.

Thanks!

Hi Aaron. i’m holding citibank premier miles cc. my initial plan is to slowly and steadily accumulate 280,000 miles so that i could plan a honeymoon to New York with my wife-to-be (2-way Biz class). That will means my wife and i need to spend about $187,000 in order to achieve that (assume average 1.5mpd earn). Hope to achieve that in 5 years time; that will mean spending about $3100 per month. However, seeing your article about the devaluations prompted me to have a second thought on my Plan. I thought traveling in Biz class for 20 hours is a… Read more »

dude- you should NOT be earning miles at a 1.5 mpd rate. if you are, you’re doing it wrong. there are many ways to earn a much higher weighted average with sign up bonuses and specialised spending cards. have a read of this and you’ll be able to accelerate your miles collection.

hi,

Earn miles that never expire!

DBS Points earned on your DBS Altitude Card do not expire.

DBS Altitude Card – Miles Credit Card for Air Travel | DBS Singapore

I have two Amex cards earning Membership Rewards points. If I cancel one of them will I lose all the points tied to it? Or will they be pooled together to the Amex card that I will still be subscribing to?