| ⚠️ Update |

|

As per an update to their FAQs, GrabPay no longer supports the following PayNow QRs

This means you can’t use the method below anymore to generate free miles/cashback. |

I’m a big proponent of topping up your CPF Special Account every year to enjoy bonus interest and tax deductions (sorry Han Hui Hui), and now there’s an added incentive to do so.

Not only has CPF increased the maximum tax relief for cash top-ups from S$7,000 to S$8,000 (effective 1 January 2022), they’ve also added PayNow QR as a top-up method.

GrabPay can be used to make PayNow QR payments, and I hope you see where I’m going with this: find a credit card that offers rewards for GrabPay top-ups, and you’re looking at free miles or cashback while saving for your future.

Step 1: Top-up GrabPay account with a rewards-earning card

While the vast majority of credit cards have excluded GrabPay top-ups from earning rewards, there’s still three holdouts I know of.

| 💳 Cards for GrabPay Top-Ups | ||

| Card | Earn Rate | Remarks |

AMEX HighFlyer Card AMEX HighFlyer CardApply |

1.8 mpd | Only for owners of SMEs |

AMEX True Cashback Card AMEX True Cashback CardApply |

1.5% cashback (3% cashback for new cardholders) |

No cap |

UOB Absolute Cashback Card UOB Absolute Cashback CardApply |

1.7% cashback | No cap |

AMEX HighFlyer Card

AMEX HighFlyer Card AMEX HighFlyer Card |

| Apply |

Miles chasers who happen to be SME owners can apply for the AMEX HighFlyer Card, which earns 1.8 mpd on all transactions- GrabPay top-ups included.

If you don’t already have this card, you can earn a S$300 statement credit when you spend at least S$5,000 in the first 3 months (including GrabPay top-ups). To illustrate, someone who tops up his CPF Special Account with the full S$8,000 via GrabPay will receive:

- 14,400 miles (S$8,000 @ 1.8 mpd)

- S$300 statement credit

Later this week, The MileLion will be launching a special acquisition offer featuring an additional S$100 of CapitaVouchers, so hold your fire till then.

AMEX True Cashback Card

AMEX True Cashback Card AMEX True Cashback Card |

| Apply |

The AMEX True Cashback Card earns 1.5% cashback on all transactions, GrabPay top-ups included.

New AMEX True Cashback Card members will earn 3% cashback on the first S$5,000 spent in the first six months (including GrabPay top-ups).

If you do not currently hold any other American Express principal cards (and have not cancelled any in the past 12 months), apply via this link and get a pair of Apple AirPods (3rd generation) or S$160 cash with S$500 spend within 30 days of approval (including GrabPay top-ups).

To illustrate, someone who tops up his CPF Special Account with the full S$8,000 via GrabPay will receive:

- S$150 cashback (3% cashback on first S$5,000)

- S$45 cashback (1.5% cashback on next S$3,000)

- Apple AirPods or S$160 cash (assuming new-to-AMEX)

UOB Absolute Cashback Card

UOB Absolute Cashback Card UOB Absolute Cashback Card |

| Apply |

The UOB Absolute Cashback Card earns 1.7% cashback on all transactions, GrabPay top-ups included.

The first 100 new-to-bank cardmembers who apply for a UOB credit card from 1 January to 28 February 2022 and spend a minimum of S$1,500 within 30 days of approval will receive a S$150 cash credit, but do note that GrabPay top-ups are excluded from eligible spending.

To illustrate, someone who tops up his CPF Special Account with the full S$8,000 via GrabPay will receive:

- S$136 cashback (1.7% cashback on S$8,000)

Step 2: Top-up CPF with GrabPay

Once you’ve topped up your GrabPay account, the next step is to top-up your CPF Special Account.

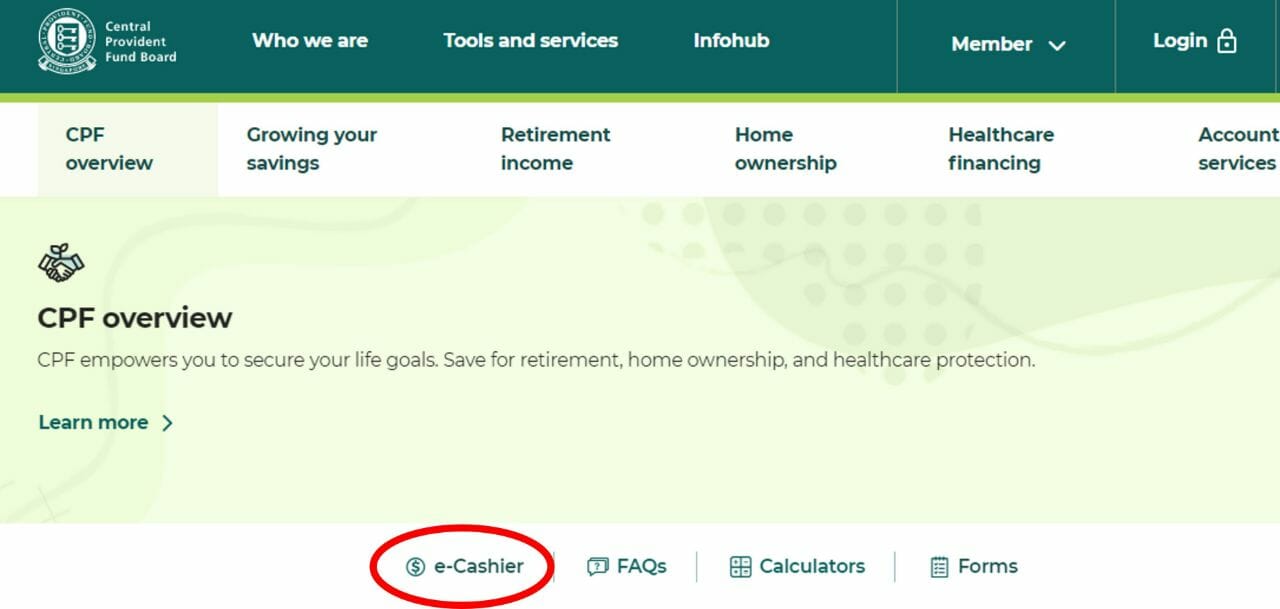

To do this, first login to your CPF account and then navigate to e-Cashier (you can find it by mousing over any of the dropdown menus at the top of the page, e.g. CPF overview).

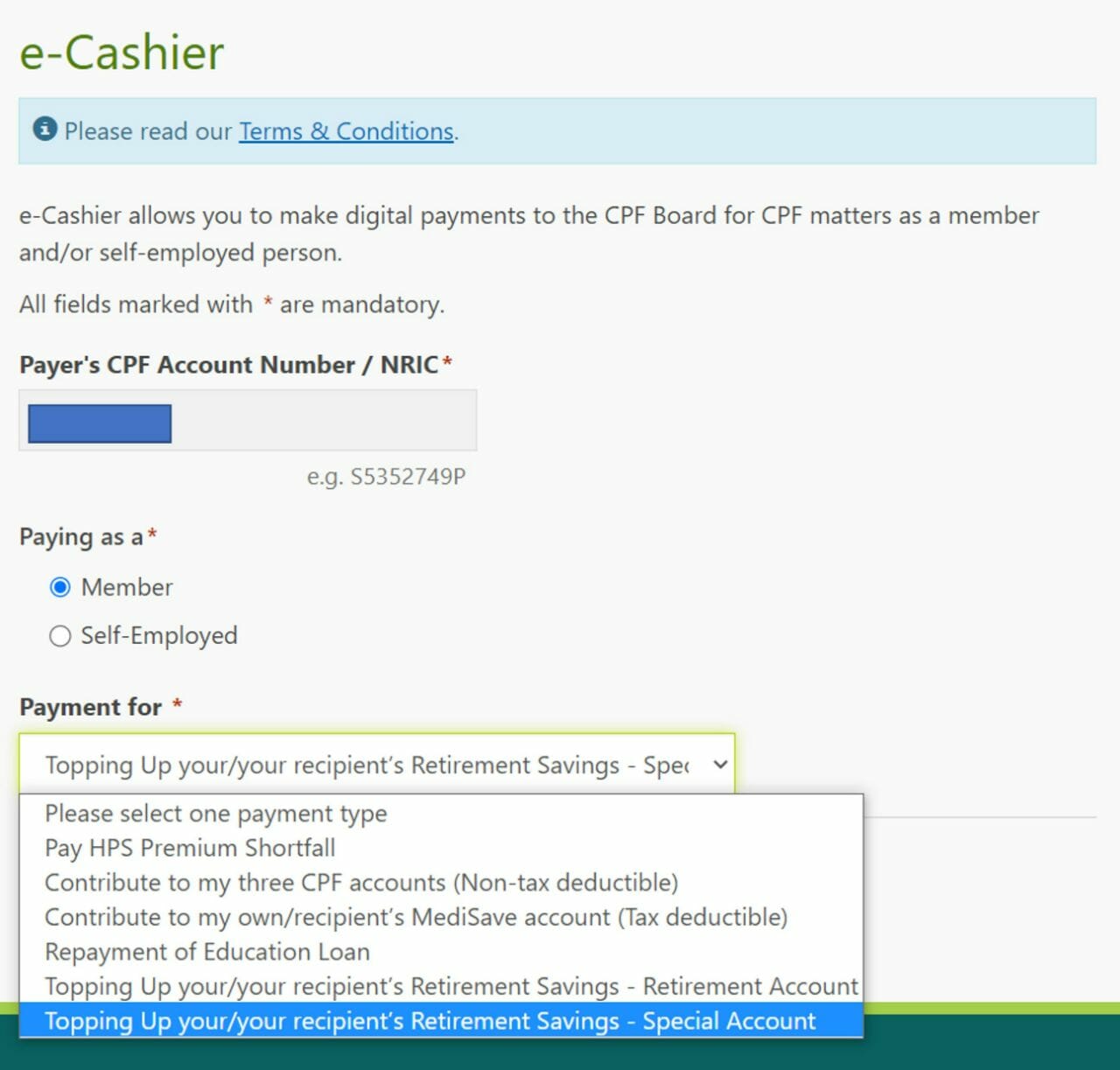

On the next screen the Payer’s NRIC (that’s you) will already be populated if you’re logged in. You’ll need to select whether you’re paying as a member or self-employed (I’m showing how you top up your Special Account, so select “member”), and what the payment is for (select “Topping Up your/your recipient’s Retirement Savings- Special Account”)

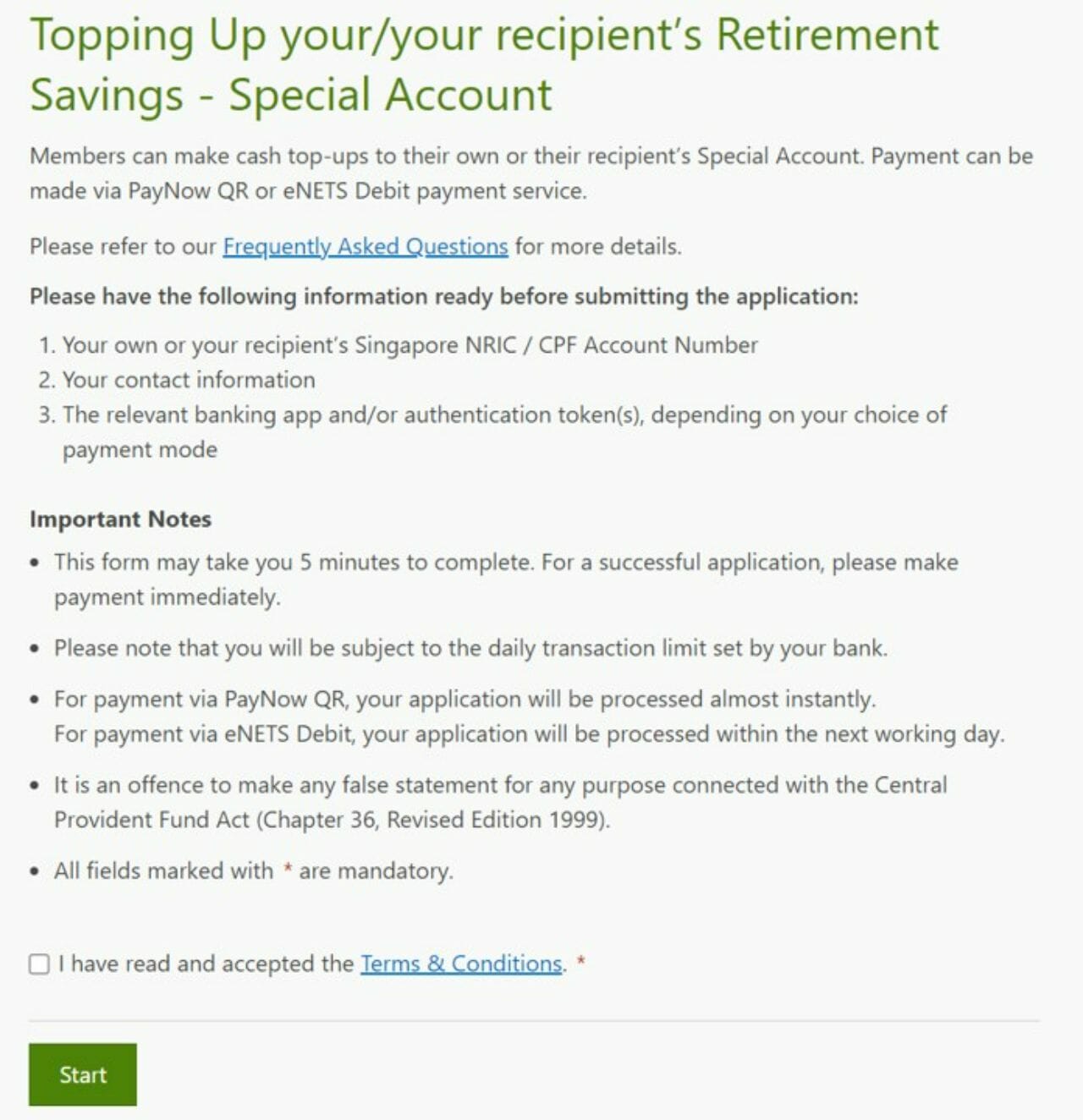

The next screen shows you instructions and a link to T&Cs. Check the box and click “start”

Next, enter the recipient’s CPF account number (basically their NRIC), your contact number, and the relationship of the recipient (can be self, parent, parent-in-law, grandparent, grandparent-in-law, spouse, sibling or others).

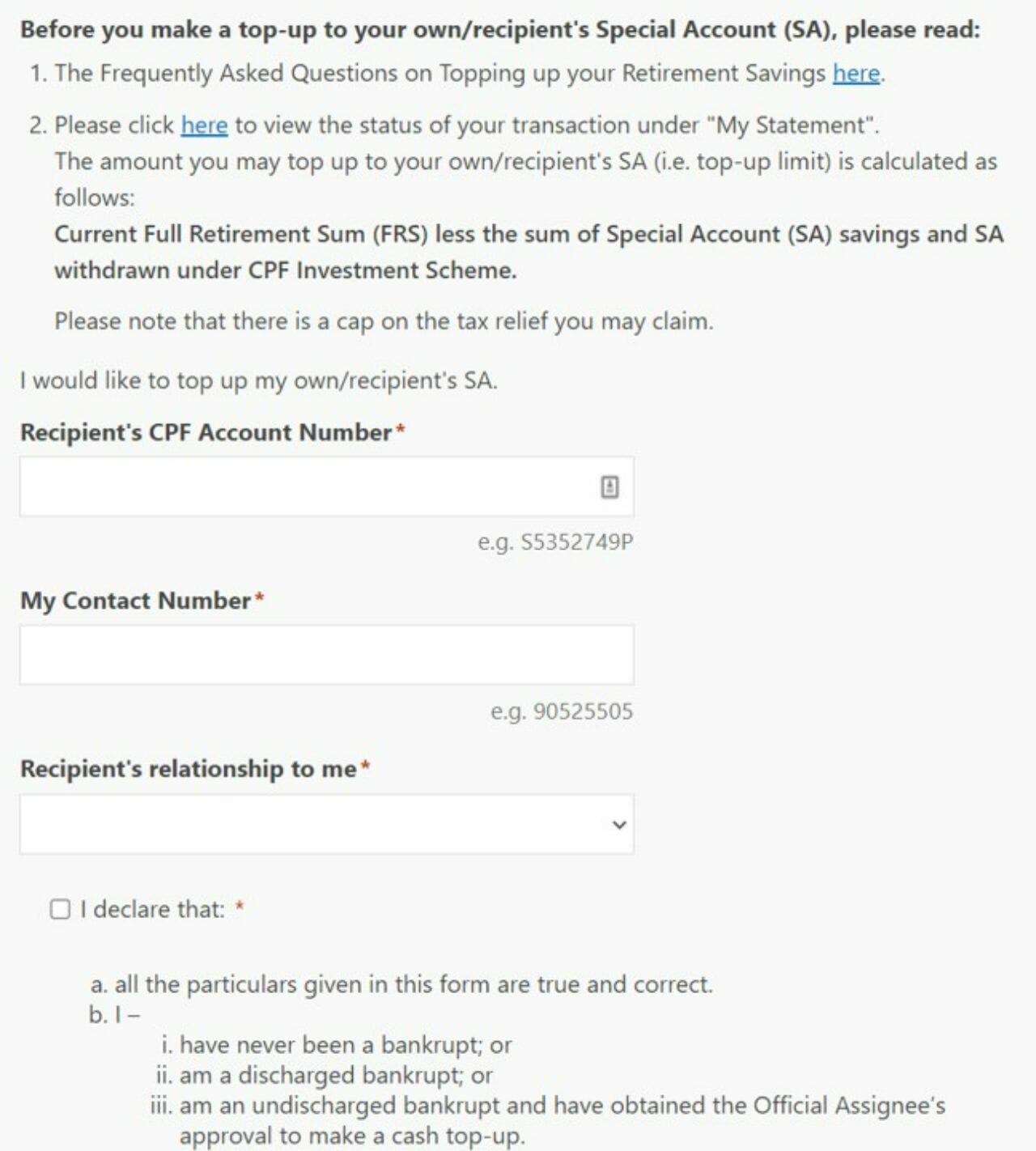

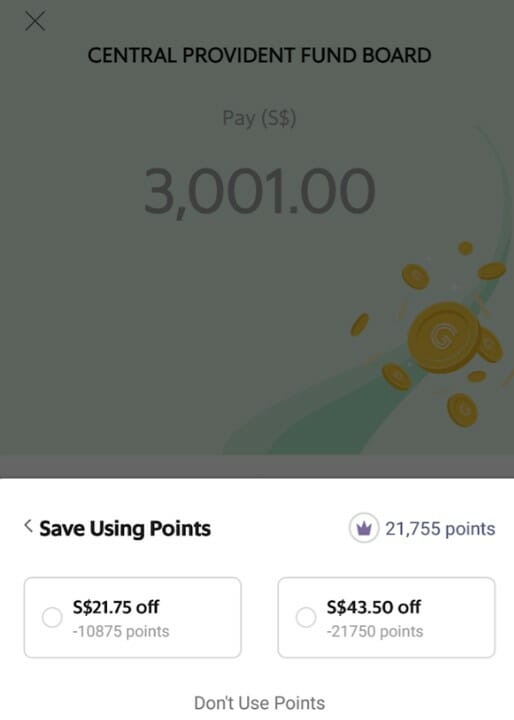

Scroll down and enter the amount your wish to top-up, keeping in mind the single transaction limit for GrabPay is S$5,000.

There’ll be one more screen to confirm the details, after which you’ll be asked to select a method of payment. Click on the PayNow icon, then “make payment”.

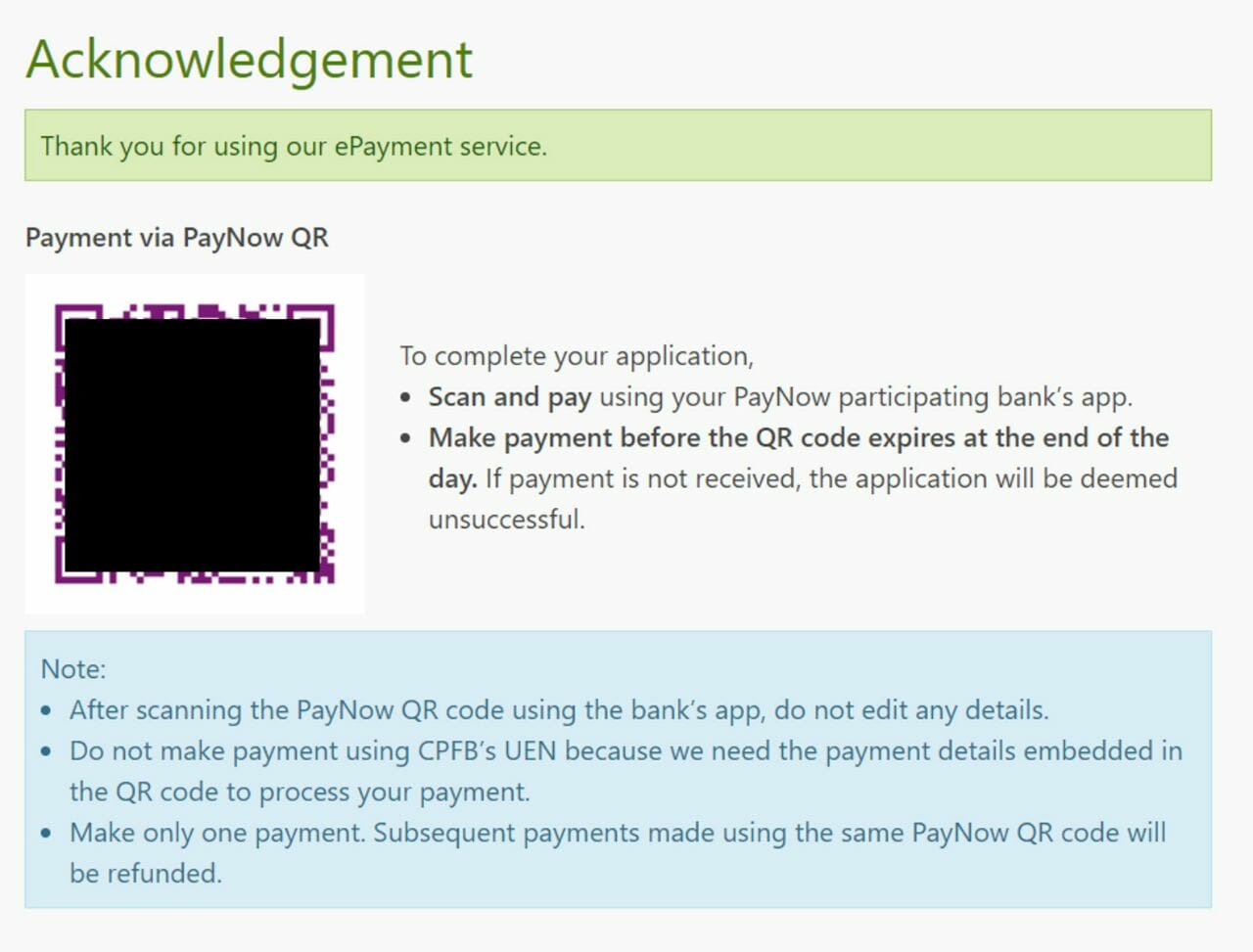

And there you go! A PayNow QR code, which you can scan and pay using your Grab app.

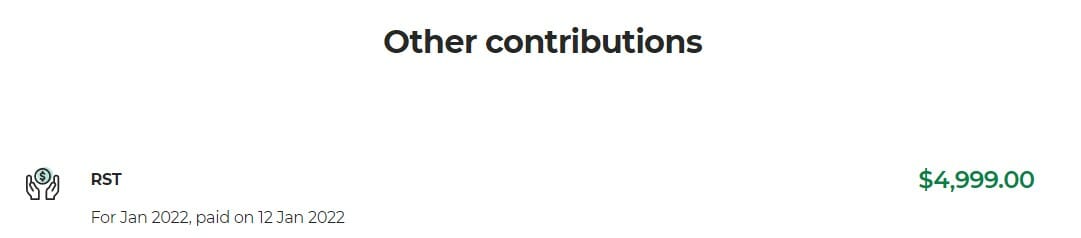

Once the transaction is done, you’ll see the top-up reflected immediately in your account.

A few points to note:

- There’s no issue with using Person A’s GrabPay account to top-up Person B’s CPF account

- If you want to top-up the full S$8,000, you’ll need to do it over multiple transactions because the single transaction limit for GrabPay is S$5,000

- GrabPay has a S$30,000 annual transaction limit, which resets on 1 January annually

- You won’t earn any GrabRewards points for transactions to the CPF Board. But, somewhat amusingly, you can use GrabRewards points to offset the cost of your transaction (albeit at a mediocre 0.2 cents/point rate)

- Topping up CPF does not count towards the GrabPay Power Up challenge

- Don’t forget, you can enjoy a further S$8,000 tax relief (S$16,000 total) for topping up the CPF accounts of your loved ones, defined as parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings

I’ve shown how to top-up a CPF Special Account, but you could just as well make voluntary contributions as a member or self-employed individual via PayNow QR as well. Just keep in mind the CPF annual limit of S$37,740- if you exceed the CPF annual limit, any excess top-ups will be refunded without interest.

Conclusion

Balances in your CPF Special Account earn an attractive 4% p.a interest, risk free. I’m certainly not going to pass that up, especially when I can generate some free miles or cashback in the process.

It’s just a shame this didn’t happen back in the day when the Citi Rewards Visa offered 4 mpd on GrabPay top-ups…

Thank you! MUACK MUACK

Does it meant that we could use the same method to top up the Medisave too ?

i haven’t checked that out, but so long as PayNow QR is accepted, why not?

Yes – all types of CPF top-ups can be done via PayNowQR, including Medisave.

Thanks, guys!

Hi Aaron,

1. It appears the Amex High Flyer card’s $300 statement benefit offer ended on 31 Dec 2021. See https://www.americanexpress.com/sg/credit-cards/singapore-airlines-business-card/

Do you know if this will be extended?

2. Does one need to have a business registration to sign up for this High Flyer card?

3. Is the statement benefit applicable to existing AMEX principal card holders?

If all the above checks out, look forward to your Milelion offer later this week!

Thanks!

1. AMEX has confirmed with me that it’s been extended to 28 feb 2022 already, don’t know why they’re so slow updating their website. (and if you read T&C, you’ll see 28 feb is reflected alr: https://www.americanexpress.com/en-sg/business/small-business/singapore-airlines-business-credit-card/terms-and-conditions/index.html)

2. yes, ACRA

3. yes.

Thanks!

If any help, setting up a Sole Proprietorship only costs $20 annually, is registered with ACRA so you get an ACRA registered licence number and profile. I understand some members successfully registered for HiFlyer using SP.

Even with SP, still need to submit 2 years of income data right?

Can use personal Income Tax Notice of Assessment? They do have a requirement on income. Any one with Sole Proprietorship can confirm?

What about the business address?

1.7% cashback regardless of amount? I believe we can earn up till the max cpf vc limit of 37,740 right?

I don’t think so. Your grab wallet only has a limit of 30k

Am i considered new to amex if i hold uob absolute?

yup.

are existing highflyer card holders without any amex personal card considered new to amex?

yup

“if you exceed the CPF annual limit, any excess top-ups will be refunded without interest”……hmmmm….hmmm…..

if top up using grab, where will the refunds be credited to ?

albeit at a mediocre 0.2 cents/point rate)

is there a better use for this? Regardless where and how the usage, the rate is always 0.2c/pt right?

you can redeem during grabrewards flash sales when the value can go up to around 0.3 cents mark.

anybody have problems reloading the grab card for $5000, spending the $5k (in this case topping up CPF) and when you try reloading another $3k to the grab card, it doesn’t allow your credit card transaction to go through. No problem on credit card side. Also face this problem when doing for >$5k insurance. Has grab solve this issue other than “trying a few hours later or the next day”? Anyone face this same issue? Thanks

https://help.grab.com/passenger/en-sg/360027487871-Are-there-any-transaction-limits

Hi Aaron, “The first 100 new-to-bank cardmembers who apply for a UOB credit card from 1 January to 28 February 2022 and spend a minimum of S$1,500 within 30 days of approval will receive a S$150 cash credit, but do note that GrabPay top-ups are excluded from eligible spending.”

just to confirm, we will still get 1.7% rebate but just that we don’t qualify for the promo?

GrabPay’s Scan & Pay does not have a remarks field for users to enter important information like the reference or account number.

Do ensure that the QR code you are scanning is a uniquely generated one which has your account information embedded in it and not a generic QR Code for the organisation’s bank account. I paid my NUSS membership fees without checking and now they don’t know who made the payment. And now NUSS hasn’t been following-up with my calls and e-mails 🙁

Not an issue for CPF top-ups, thankfully.

Hello. Saw your post. When are you expecting to release the link for the Capitaland vouchers for Amex high flyer card? I’m intending to apply. Thanks!

probably next week, stay tuned.

“Later this week, The MileLion will be launching a special acquisition offer featuring an additional S$100 of CapitaVouchers, so hold your fire till then.”

Is the offer coming yet? Thanks

grabpay to e-cashier paynow QR code didn’t work for me.

Apparently grab mentioned this on their website?

https://help.grab.com/passenger/en-sg/4409920359449

yeah looks like a new addition. RIP.

Does AXS machine using Grabpay /Grabpay Master Card still work for CPF Topup and IRAS income tax?

I just tried on 1st Dec 2022, GRAB APP saysThis PayNow QR code is not supported by Grab – 🙁

Hi,

Can we use cardup and link a credit card to top up cpf?