UOB Lady’s Cardholders can earn 4 mpd on up to S$2,000 of monthly spending on their choice of bonus categories. This includes restaurants, supermarkets, shopping, taxis, air tickets, hotels, and petrol but— here’s the catch — not all at the same time.

That’s because cardholders have to choose which category or categories they’d like to earn bonuses on, a selection that can be rotated every calendar quarter.

It’s a highly personal choice of course, as everyone’s spending patterns will be different. But given the availability of alternatives on the market, certain selections may make more sense than others.

Here’s what you can pick, and what I would pick.

UOB Lady’s Card bonus categories

UOB Lady’s Card UOB Lady’s Card |

|||

| Apply | |||

UOB Lady’s Solitaire UOB Lady’s Solitaire |

|||

| Apply | |||

| Income Req. |

S$30,000 p.a. (Lady’s) |

Points Validity |

2 years |

| S$120,000 p.a. (Solitaire) | |||

| Annual Fee |

S$196.20 (Lady’s-FYF) |

Min. Transfer |

5,000 UNI$ (10,000 miles) |

| S$414.20 (Solitaire-FYF) |

|||

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 0.4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on 1/2 bonus categories | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| Note: A by-invitation-only metal version of the UOB Lady’s Solitaire also exists, with a higher annual fee of S$598.99 and a complimentary airport transfer + six lounge visits per year. Earn rates and bonus caps are the same as the plastic UOB Lady’s Solitaire | |||

UOB Lady’s Card and UOB Lady’s Solitaire Card members will earn 10 UNI$ for every S$5 spent (4 mpd) on:

- UOB Lady’s Card: 1 bonus category, capped at S$1,000 per calendar month

- UOB Lady’s Solitaire Card: 2 bonus categories, capped at S$2,000 per calendar month (the cap is shared between both bonus categories)

| 👍 Extra 2-6 mpd with UOB Lady’s Savings Account |

| From 1 April 2024 to 31 March 2025, UOB Lady’s Cardholders can earn an extra 2-6 mpd on bonus category spending if they have a UOB Lady’s Savings Account. Learn more here. |

Any spending beyond the cap earns just 0.4 mpd, so be careful not to overshoot.

Choosing bonus categories

Cardholders choose their bonus categories via this link, and can change their selection every calendar quarter.

|

| Choose bonus categories |

Selecting bonus categories requires entering your 16-digit card number. Even if you don’t have the physical card yet, you can obtain this from the UOB TMRW app. However, if you were recently approved (<24 hours) the system may throw an error message when registering your bonus categories. Try again after 24 hours.

Some important things to note:

- The first time you choose your bonus categories, they are effective immediately

- Bonus categories can be re-selected every calendar quarter, up till 2359 hours (SGT) the day before the first calendar date of the following calendar quarter

- The bank will take the most recent entry submitted as the bonus category for the following quarter. For example, if you submit ‘Fashion’ on 15 April, then submit ‘Dining’ on 21 June, your bonus category for 1 July to 30 September will be ‘Dining’

- If you do not manually re-select your bonus categories, the choices from the previous quarter will be automatically carried over

- If you upgraded from the Lady’s Card to the Lady’s Solitaire Card, your additional bonus category will only be effective from the following calendar quarter

Which category should you pick?

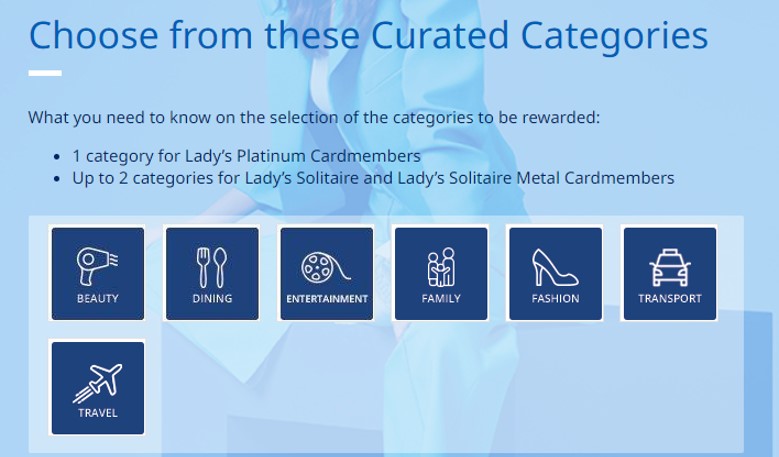

Here’s a rundown of which MCCs are included under each of the seven bonus categories available to UOB Lady’s Cardholders.

| 💳 UOB Lady’s Card Bonus Categories | |

| Category | MCCs |

| 💆 Beauty & Wellness | 5912 Drug Stores & Pharmacies 5977 Cosmetic Stores 7230 Barber & Beauty Shops 7231 Beauty, Barber Shop & Gyms 7297 Massage Parlors 7298 Health & Beauty Spas |

| 🍽️ Dining | 5811 Caterers 5812 Restaurants 5814 Fast Food 5499 Misc. Food Stores |

| 📽️ Entertainment | 5813 Bars, Lounges, Discos, Nightclubs 7832 Motion Picture Theatres 7922 Theatrical Producers, Ticketing Agencies |

| 🛒 Family | 5411 Grocery Stores & Supermarkets 5641 Children’s and infant’s Wear Stores |

| 👗 Fashion | 5311 Department Stores 5611 Men & Boy’s Clothing and Accessories 5621 Women’s Ready to Wear 5631 Women’s Accessories 5651 Family Clothing Stores 5655 Sports Apparel Stores 5661 Shoe Stores 5691 Men’s and Women’s Clothing Stores 5699 Accessory and Apparel Stores 5948 Leather Goods & Luggage Stores |

| 🚕 Transport | 4111 Transportation Suburban & Local Commuter 4121 Taxis and Limos 4789 Transportation Services Not Elsewhere Classified 5541 Petrol Stations 5542 Automated Petrol Stations |

| ✈️ Travel [not explicitly mentioned in T&Cs; refer here for details] |

3000-3299 4511 4582 Airlines 4411 Cruise Liners 4722 Travel Agencies 5309 Duty-free Stores 3500-3999 7011 Hotels |

| Bonus are valid for both local and foreign currency spending, whether online or offline | |

If you’re not certain about the MCC of a specific transaction, here’s three ways of looking it up before spending.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

So how do you go about selecting a bonus category?

Your personal spending patterns

Sorry to be Captain Obvious here, but some categories will be complete non-starters for certain individuals. Someone who prefers staying home won’t get much mileage out of choosing Entertainment as a bonus category, and someone who rarely eats out won’t want to pick Dining.

So your bonus categories should, at a minimum, match the sort of things you normally spend on.

Alternative cards

But just as important to consider are alternatives: if you could already earn bonuses on a particular category with a different card, then choosing it as your bonus category may be duplicative.

| Category | Alternatives |

| 🍽️ Dining |

|

| 👗 Fashion |

|

| ✈️ Travel |

|

| 🛒 Family |

|

| *Excludes MCC 5814 (Fast food, GrabFood, Deliveroo, Foodpanda) from 1 May 24 *No more bonuses on supermarkets from 1 May 24 |

|

Why I say “may” is because there can be good reasons for choosing a bonus category already covered by another card.

The simplest example is that you spend a lot on a particular category, so much so that it busts the cap on other cards. Someone who spends big on restaurants may find the S$1,000 monthly cap on the HSBC Revolution to be insufficient, and supplements it by choosing Dining as his UOB Lady’s Card’s bonus category.

Another reason is that you may want to free up the alternative card’s bonus cap for other categories. For example, I might choose Dining as my UOB Lady’s Card bonus category so I can use the HSBC Revolution for cruises, gym memberships and rental cars.

It’s also important to remember that as whitelist cards, the UOB Lady’s Cards can help to reduce the load on your blacklist cards, and free up their more flexible caps for other purposes. For example, instead of using your DBS Woman’s World Card or Citi Rewards for Grab and gojek rides, you could choose Transport as your bonus category and use the UOB Lady’s Card instead.

The MileLioness and I each have a UOB Lady’s Solitaire Card, and our bonus categories are:

- Mine: Travel + Family

- Hers: Transport + Dining

We each have a UOB Lady’s Savings Account with S$10,000 inside for an extra 2 mpd, and the combined monthly 6 mpd cap of S$4,000 (S$2,000 per card) works quite well for us.

Her bonus categories cover our day-to-day petrol, Grab/gojek rides, food delivery and eating out. My bonus categories cover groceries (though if it’s Cold Storage or Giant I’m more inclined to use the DBS yuu Card), as well as hotels and air tickets when we travel (with Amaze where applicable for better FCY rates).

I personally don’t see the value in Entertainment, or Beauty & Wellness, unless perhaps you happen to be buying a big ticket spa package that quarter.

Conclusion

The UOB Lady’s Cards are extremely versatile tools because of their shapeshifting ability to be different things at different times. It can be a dining card this quarter and a shopping card the next, or perhaps a travel card should you be going on vacation.

If your income allows for it, you should aim to get the Solitaire version to enjoy a higher 4 mpd cap of S$2,000 instead of S$1,000 on the base version, and if you have some spare cash, parking S$10,000 in a UOB Lady’s Savings Account for an extra 2 mpd might not be the worst idea either.

UOB Lady’s Card cardholders: What bonus categories do you choose and why?

Does Amaze + UOB lady’s earn 4mpd on travel? Travel category doesn’t seem

MCC tagged, but instead by merchant name?

Is paying the annual fee worth it for the lady’s solitaire? I think I can hit the min. Reqs but without bonus miles or lounge access I’m not sure if the annual fee is worth paying at all?

Annual fee can be waived easily

For Solitaire? Are you sure?

Previous reports of repetitive annual fee waivers for Solitaire despite low monthly spends but YMMV

Hi Aaron, I use amex platinum charge card for most of my expenses including Air tickets. I only use other cards like UOB krisflyer card if the merchant don’t take amex or due to promotion. Will you recommend I should switch to UOB lady solitaire or continue using UOB krisflyer if my daily expenses are groceries and dining for miles earning purposes? For online expenses, I am using DBS women world card. I dont have a lady card now. Thank you!

If my wife gets the card, can she transfer the bank points/miles to my (husband’s) Krisflyer acct?

No.

Does anyone know how strict the annual income requirement on the Solitaire card is?

Will the travel category include booking through OTAs like Agoda or Expedia?

it looks like UOB’s started to nerf *Amaze pairing related transactions which started to appear in PPV and VS T&Cs but oddly not updated for Lady’s card. Anyone else noticed ?

I have the UOB ladies solitaire card and am not a fan. One of the categories I selected is “beauty and wellness” but hardly any of the transactions I make in this category qualify for the bonus points. I think beauty-related merchants somehow often use unrelated MCC that are not covered by the rather limited MCC codes UOB’s categories include. So the card is quite useless in this category. Safer to use a card with high general spend ratio. Also, it is extremely hard to verify UOB’s MCC as the online chat is laughably bad. It can’t give you MCC… Read more »

Hello. Does anyone know if Amazon Fresh purchases count as Grocery purchases (ie with MCC 5411)?

Does the travel category covers transactions not made through third party sites like Agoda, Booking, Expedia etc?

If I have the uob solitaire paired with amaze card, would I earn 4mpd on overseas dining ?

does the family catergory include amazon prime?

I mean Amazon Fresh

does wellness include fitness boutique studios such as pilates or barre studios?

Hi Aaron, if cap for bonus is by statement month, is it by transaction date or post date of transaction?

https://milelion.com/2022/08/14/review-uob-ladys-card-ladys-solitaire/

Is there anyway to check which category I’ve chosen, other than calling in to CS?

Nope. Gotta call.

do supplementary card spending also earn points that accrue together with main cardholder?

How can I check which 2 categories I selected? Thanks.

For grab, if it is a transport transaction vs a food delivery transaction, it will be 2 different mcc category?

grab food and grab transport have different MCC

Great article! Does transport cover petrol top up at the gas station?