Back in July 2022, Instarem nerfed its popular Amaze Card by replacing cashback with InstaPoints. Compared to cashback, InstaPoints are much more finnicky- they’re only awarded on foreign currency transactions of at least S$10 and capped at 500 points per transaction.

InstaPoints can be redeemed for cashback, but the introduction of a new rewards currency means expiry and minimum conversion blocks. Basically, the idea is to increase breakage (when points expire or are stuck in an account), thereby lowering the cost of the rewards programme for Instarem.

The InstaPoints redemption catalogue has now gone live, and everything’s pretty much as expected. InstaPoints can be redeemed for cashback at a rate of 2,000 InstaPoints= S$20, and either spent through the Amaze Card or cashed out via GrabPay (more on that later).

|

| Apply here |

| Use code 7HK2A2 for 225 bonus InstaPoints |

| 💳 tl;dr: Amaze Card |

|

InstaPoints redemption catalogue now live

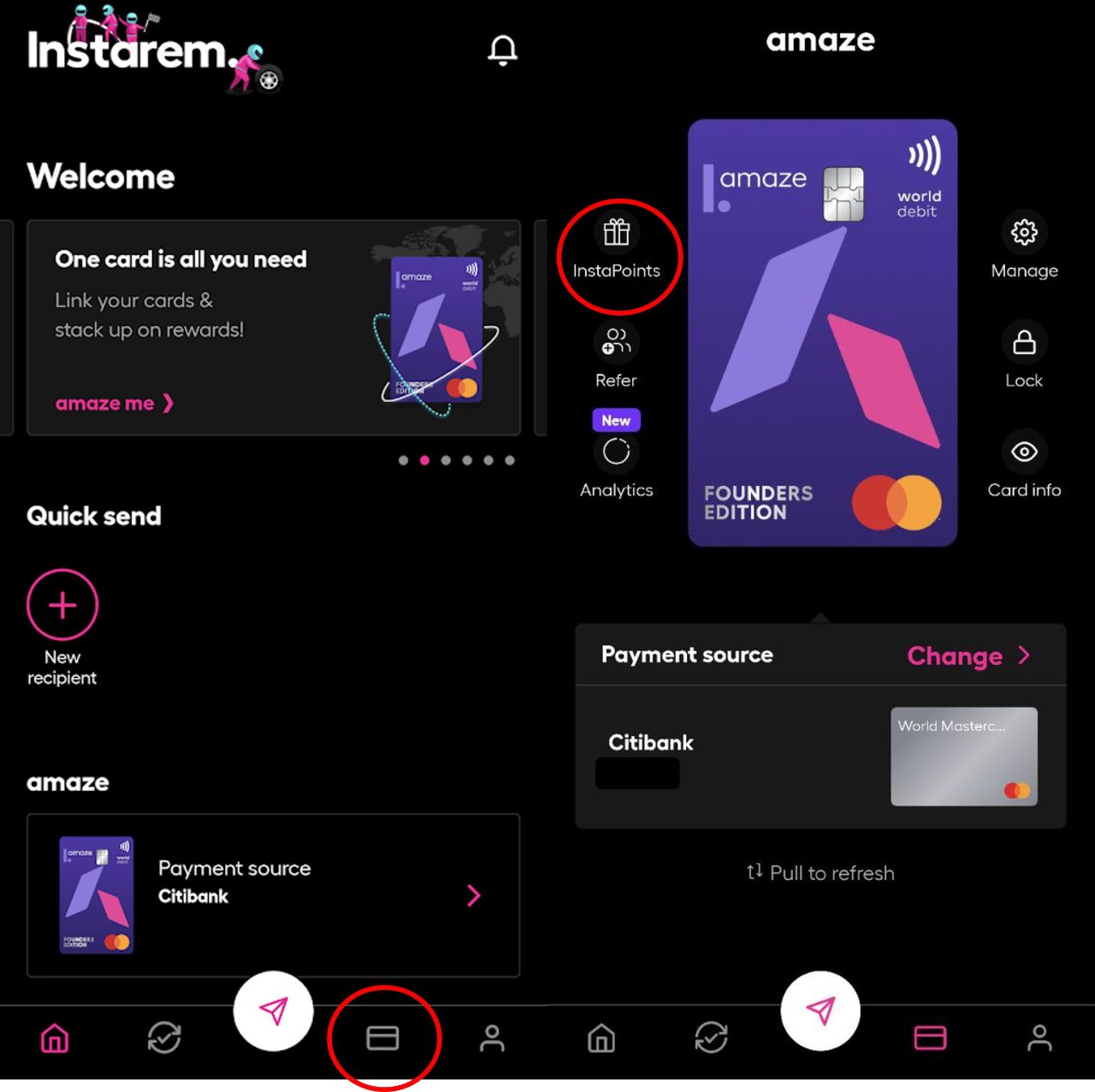

Amaze Cardholders can now cash out their InstaPoints balance via the Instarem app. To find the catalogue, launch the app and tap on the card icon on the bottom > InstaPoints

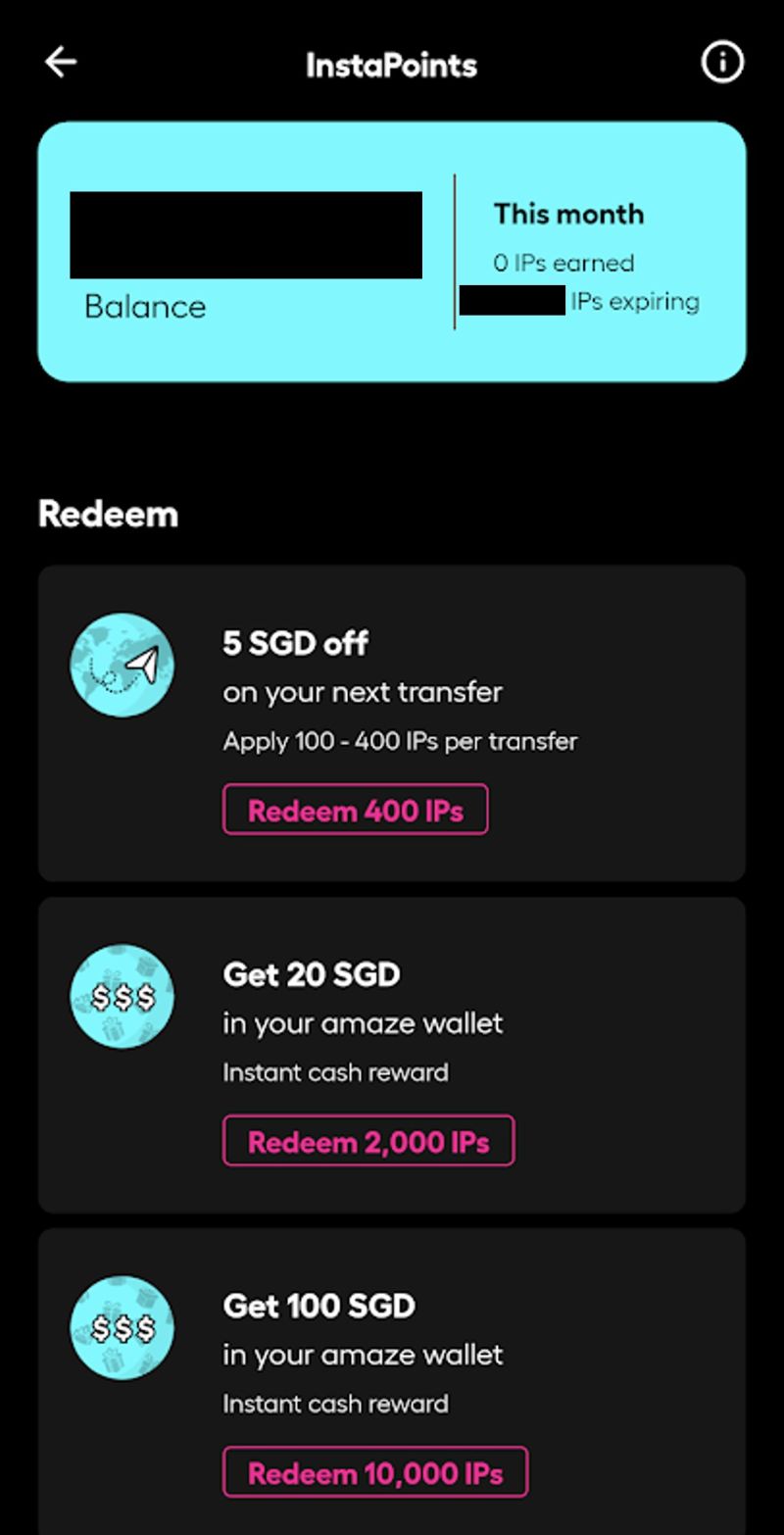

You’ll see a summary of your InstaPoints balance, as well as the various redemption options.

InstaPoints can be redeemed for cashback in the following denominations (you’ll only see the S$100 and S$500 denominations if you have sufficient points).

| InstaPoints | Cashback |

| 2,000 | S$20 |

| 10,000 | S$100 |

| 50,000 | S$500 |

| You’ll also see a 400 InstaPoints = S$5 option, but that’s not cashback. Instead, it’s a discount voucher for your next Instarem FX transfer | |

The minimum conversion block is 2,000 InstaPoints (S$20), so anything smaller than that becomes an orphan balance.

A few things to note:

- All InstaPoints cashback redemptions will be credited to your Amaze Wallet instantly

- The maximum balance you can hold in your Amaze Wallet is S$3,000

- There is no limit on the number of InstaPoint redemptions you can make

With the launch of these redemption options, Instarem will be implementing a new InstaPoints expiry policy:

- Points earned before 1 October 2022 expire six months after date of crediting

- Points earned from 1 October 2022 expire 12 months after date of crediting

InstaPoints will not be earned on any transaction that is in SGD, smaller than S$10, or under the exclusion list. InstaPoints earned from Amaze Card spending will be awarded on the 15th of the following month after each calendar quarter.

| Spend Period | InstaPoints Credited |

| 1 Jan to 31 Mar | 15 Apr |

| 1 Apr to 30 Jun | 15 Jul |

| 1 Jul to 30 Sep | 15 Oct |

| 1 Oct to 31 Dec | 15 Jan |

How do I cash out an Amaze wallet balance?

Instarem does not currently offer a cash out option for Amaze Wallet balances, but a simple workaround exists.

- Top up a GrabPay account using the Amaze Card (don’t forget to switch the payment source to Amaze Wallet before you do!)

- Withdraw the balance to a bank account

Remember: Amaze is considered a debit card, so any funds topped up from Amaze can be transferred to a bank account (unlike funds originating from a credit card).

Each GrabPay top-up must be at least S$10 and in whole dollars (i.e. no cents), but an easy way to zero out your Amaze Wallet is to top it up further with a card, then cash out the whole amount.

For example, suppose I have S$8.29 in my Amaze Wallet. This is insufficient for a GrabPay top-up, but I can:

- Top-up S$21.71 using my credit card (Amaze requires a minimum top-up of S$20)

- Use the S$30 Amaze Wallet balance to top-up GrabPay

- Cash out S$30 from GrabPay to my bank account

For avoidance of doubt, Amaze Wallet top-ups code as MCC 6540 (POI Funding Transactions), and will not earn rewards with any card in Singapore.

Conclusion

|

||

| Apply here | ||

| Use code 7HK2A2 for 225 bonus InstaPoints |

InstaPoints earned through the Amaze Card can now be converted into cashback and cashed out to a bank account via GrabPay. There is a minimum conversion block of 2,000 InstaPoints (S$20), however, which makes this system decidedly inferior to the previous cashback scheme. You’ll also need to monitor your InstaPoints for expiry.

I recently updated my review of the Amaze Card in light of all the new developments; be sure to check it out below.

hi, has the minimum spend of S$500 per quarter required to earn cashback been scrapped? Trying to keep up with the changes…

I just tested the card and the mark up is higher than youbiz now.

I tie this card to my citibank credit card.

USDSGD 1.408

When I charge USD100 they charging me 143.56 which is over 2% higher.

No help given by customer service who claim this is the best rate.

Just beware when using the card.

you should not be comparing this card to youtrip, since youtrip does not let you earn miles. you should be comparing the rate to another miles earning card

The FX margin spread which is 2% is already above what revolute and youtrip charge.

I am not sure is there any change in the policy amaze but certainly the spread is not 0.5% anymore as indicated in the post.

You can give it a test while I am waiting for amaze to clarify but the reply they give is simply that the best dynamic rate they have.

i have not tested with UOB mile cards but I think this fx rate is decided by amaze and not bank itself.

After I redeemed Instarem points for S$60, I top-up my GrabPay with Amaze Wallet. Thereafter I changed the default back to credit card, I noted S$0.60 has been charged as Amaze fee to my credit card.

I was told below , this article needs to update to reflect this.

“current transaction fees on select merchants like GrabPay, prepaid cards, and other e-wallet top-ups, is reduced to 1% (with a minimum fee of 0.50 SGD) and are chargeable with amaze linked to a card as well as the wallet.”