Once upon a time, Amaze was a must-have card for any miles chaser: excellent exchange rates, 1% cashback on virtually everything, on top of regular credit card rewards, and use cases that went beyond just overseas spending (iykyk). Demand was so intense that Instarem had trouble shipping out physical cards in time for year-end VTL travel in 2021.

But that party couldn’t last forever, sadly, and the last few years have seen a never-ending parade of devaluations.

|

| 💳 Amaze: A timeline of nerfs |

|

Such a laundry list of nerfs would be enough to torpedo any other product, but it speaks volumes about how good Amaze used to be that even after all this, there’s still cases to be made for using it— just far fewer than before.

Overview: Amaze Card

|

||

| Apply here | ||

| T&Cs | ||

| Use code 7HK2A2 for 225 bonus InstaPoints | ||

| 💳 tl;dr: Amaze Card | ||

|

The Amaze Card is available to anyone with an Instarem account, and has no minimum income requirement nor annual fee.

Applications can be made through the Instarem app (Android | iOS), and a virtual card is issued immediately upon approval.

Physical cards take a bit longer to arrive; it was up to a month during the early days, but should be within a week now.

If you’re waiting for the physical card but want to spend in-store, you can do so by adding the virtual card to your mobile wallet. Google Pay support was added in November 2021, with Apple Pay support added in July 2024.

How does Amaze work?

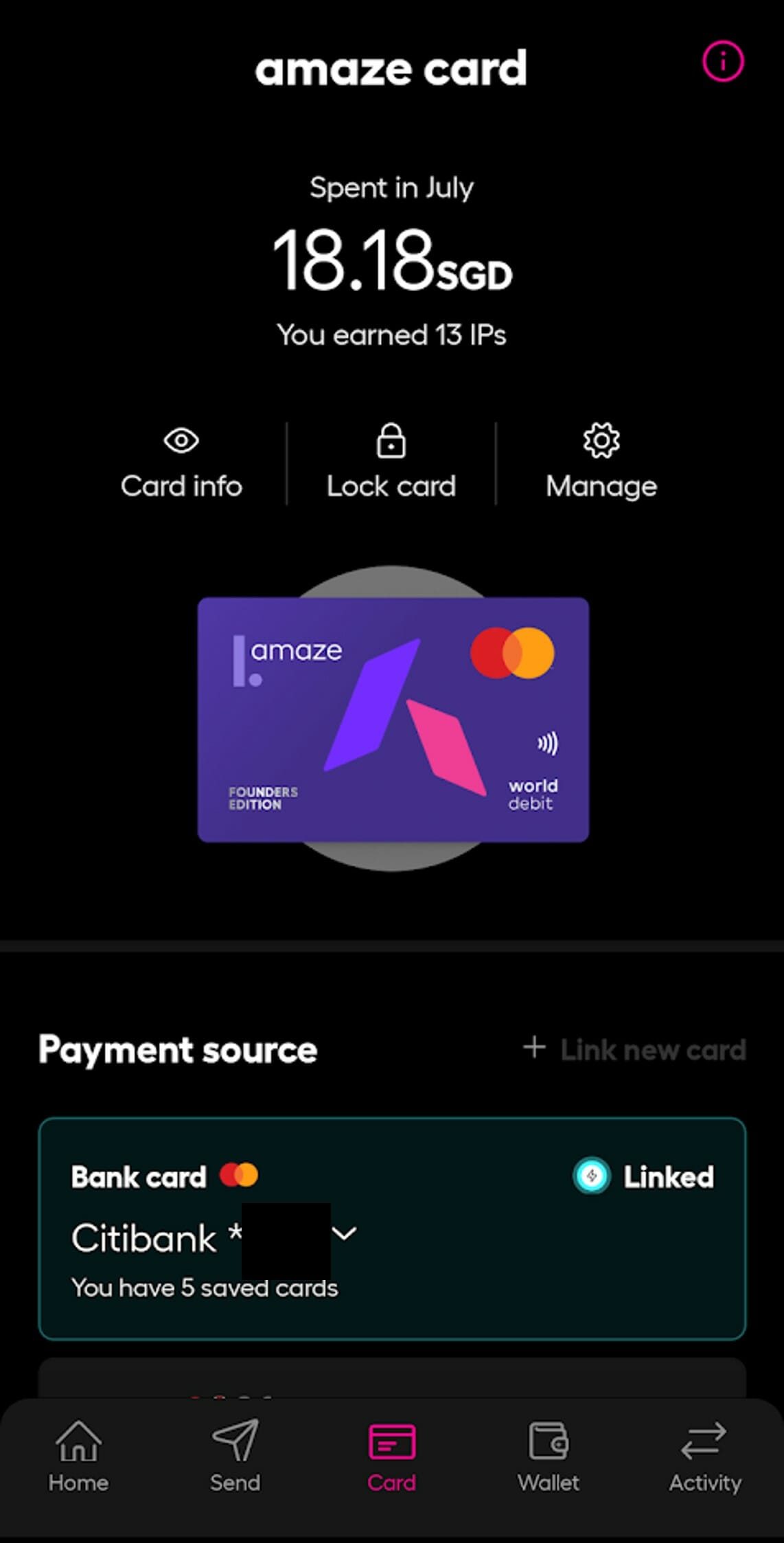

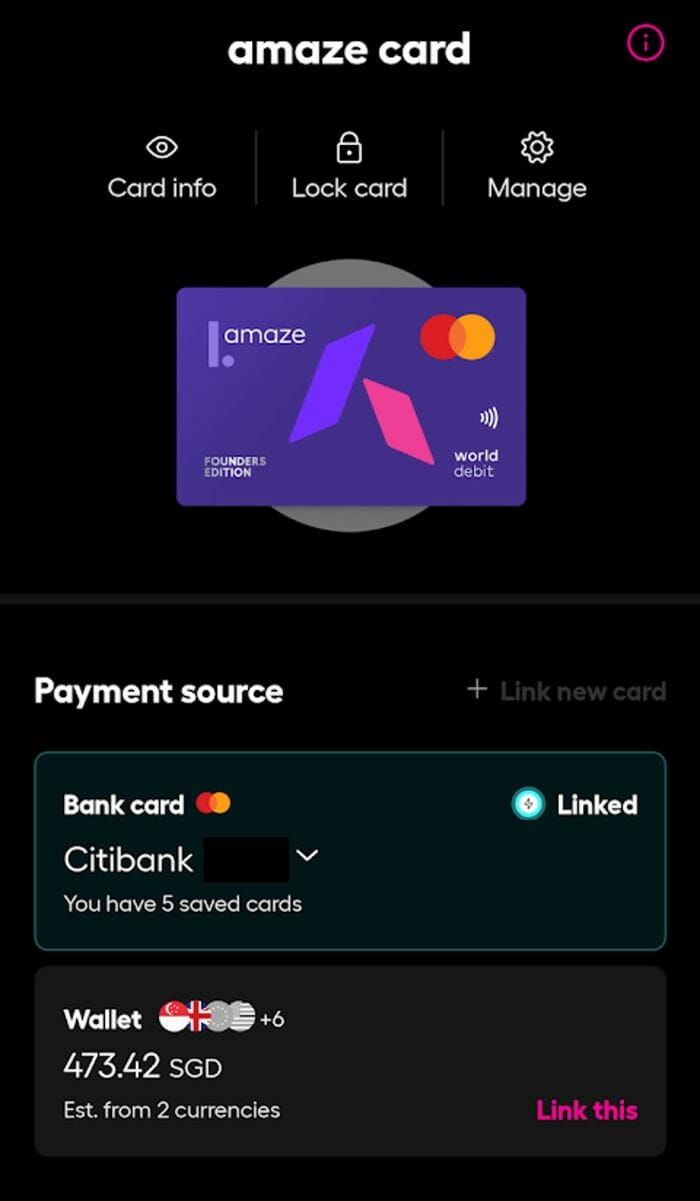

The Amaze Card is a debit card, which is funded by either:

- An Amaze Wallet balance

- A debit or credit card

Most people should be familiar with the concept of a debit card funded by a wallet. However, it can be confusing to think of a debit card funded by another debit card or credit card. Just imagine Amaze as a “passthrough”— whatever you swipe on it gets immediately charged to the underlying debit card or credit card.

Here are the differences between the two funding sources.

| Amaze Wallet | Debit or Credit Card | |

| Conversion rate | More favourable | Less favourable |

| Lock in FX rates | Yes | No |

| Credit card rewards | No | Yes |

| InstaPoints | Yes | No |

| Transaction Limits | Wallet limit: S$15K Annual limit: S$75K |

Based on the linked card |

Do note that you cannot combine two sources in a single transaction. For example, if your payment source is the Amaze Wallet, and the balance is insufficient to cover the cost of a given transaction, the transaction will be declined. You cannot pay for part of your transaction with Amaze Wallet funds, and the rest with a linked debit or credit card.

Amaze Wallet

The Amaze Wallet is conceptually very similar to Revolut or YouTrip, allowing you to buy currencies whenever you believe the rate is favourable, and spend them in the future.

The following currencies are currently supported:

| 💳 Amaze Wallet Supported Currencies | |

|

|

A few points to note:

- A minimum top-up of S$1 is required, beyond which top-ups can be made in increments of just 1 cent

- You can only top-up an Amaze Wallet with PayNow (debit and credit cards used to be accepted, but have since been removed)

- The maximum amount that can be stored in the Amaze Wallet at any time is S$15,000

- The maximum amount that can be transacted through the Amaze Wallet is S$75,000 per calendar year

You do not need to pre-select a currency before spending. Amaze will automatically deduct the relevant currency, and make instant conversions from your other Wallet balances to top-up the difference if needed.

|

Any balance you hold in the relevant transaction currency will automatically be debited first, to minimise your conversion costs (e.g., if you are making a payment in Europe, your EUR balance will be debited by default). If you do not hold any balance in the relevant transaction currency, or the balance you hold in the relevant currency is insufficient, your balance held in other currencies will be debited, starting from your SGD balance, followed by EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR, in this order. If the transaction currency is a currency other than SGD, EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR, your SGD balance will be used to make the payment. If your SGD balance is insufficient, your balance held in other currencies will be converted to SGD to make the payment, in the following order: EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR. -Instarem FAQs |

For example, if I have S$100 and 1,000 JPY in my Amaze Wallet, and I make a transaction that costs 1,500 JPY:

- 1,000 JPY will first be deducted from my JPY balance

- The equivalent of 500 JPY will be converted from my SGD balance and immediately deducted

The exchange rate used for wallet-linked transactions will be better than that for card-linked transactions.

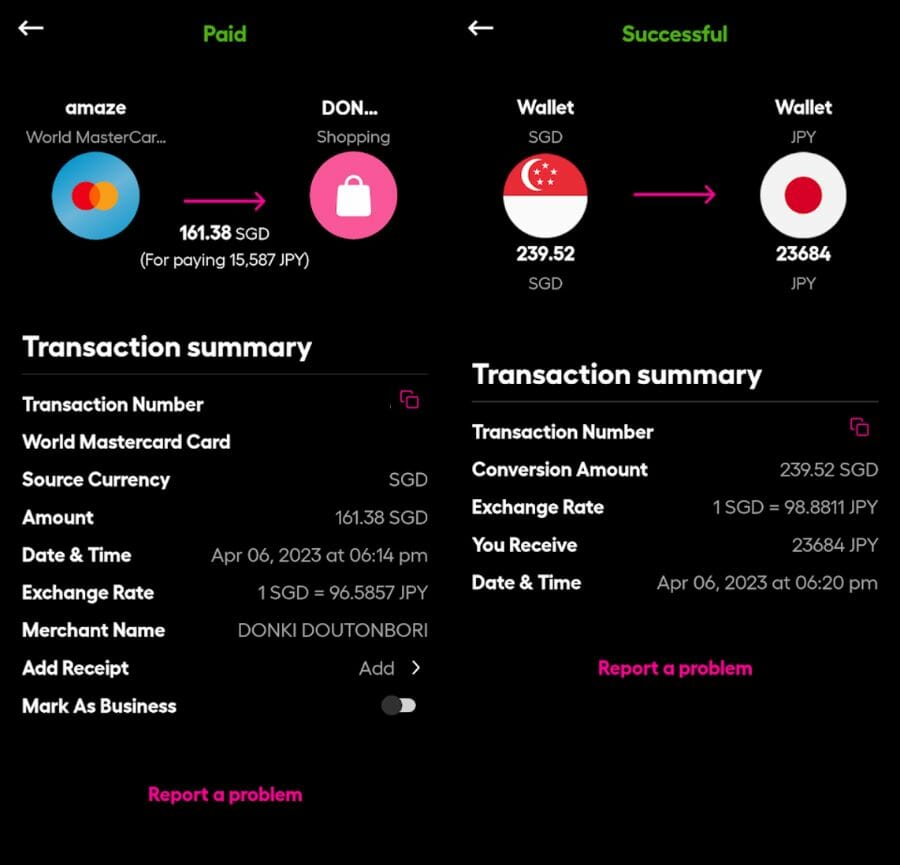

Here’s an example of two transactions, made minutes apart. The one on the left is with a linked credit card, the one on the right is with the Amaze Wallet. Notice how the Amaze Wallet rate (98.8811 JPY) is 2.37% better than the card rate (96.5857 JPY).

Amaze Wallet balances in SGD can be withdrawn to a local bank account.

Debit or Credit Card

Amaze Cardholders can link up to five Singapore-issued Mastercard debit or credit cards, and designate a default card to be charged during a transaction.

Every time a transaction is charged to the Amaze Card linked to a debit or credit card, two things happen:

- Amaze converts any foreign currency (FCY) amounts into Singapore dollars based on its internal exchange rate

- Amaze then charges the Singapore dollar amount to the linked debit or credit card

Basically, transactions are a two-step process, with Amaze acting like a passthrough. At the end of each month, there’s no Amaze bill to pay; instead, you settle any outstanding amounts on the credit card you linked to Amaze (if you linked a debit card, funds will be deducted immediately).

Here are some important things to remember about transactions processed through Amaze.

(1) All transactions are processed online

All Amaze transactions are processed online, which means they will be eligible for the online spending bonus with the Citi Rewards Card (for all online spend except mobile wallet and travel).

For example, a S$100 in-store transaction at a restaurant with Amaze x Citi Rewards would earn 400 miles, based on the online bonus rate of 4 mpd (spending with the Citi Rewards Card alone would earn just 40 miles).

(2) All transactions are charged in SGD

Amaze will convert all FCY transactions into SGD before charging them to the linked card. Therefore, you will earn rewards according to the local spend rate, for cards which offer overseas spending bonuses.

For example, a $100 overseas transaction at a restaurant with Amaze x Citi Prestige would earn 130 miles, based on the local earn rate of 1.3 mpd (spending with the Citi Prestige Card alone would earn 200 miles).

(3) All transactions retain their existing MCC

Amaze does not modify the MCC of a transaction. If you use the Amaze Card at a restaurant, the MCC will code as a restaurant. If you use the Amaze Card at a hotel, the MCC will code as a hotel.

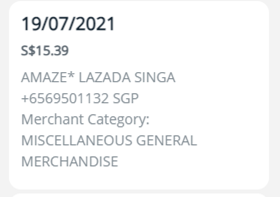

(4) All transactions have an AMAZE* prefix

What Amaze does modify is the transaction description.

For example, here’s how a Lazada transaction looks like when paid with Amaze. Notice how the MCC remains the same, but AMAZE* is added to the transaction description.

This means that if your credit card awards bonuses based on transaction description, pairing it with Amaze will lead to forfeiture of those bonuses. Fortunately, such cards are the minority (e.g. OCBC Rewards for Guardian and Watsons), and most cards award bonuses based on MCC.

Amaze charges a 1% domestic fee

With effect from 10 March 2025, card-linked Amaze transactions in SGD are subject to a 1% domestic fee (with a minimum fee of S$0.50).

Don’t get confused: while all Amaze transactions are ultimately converted into SGD, this fee applies to transactions that were already in SGD when charged. You will not have to pay this fee on transactions that were originally in FCY when charged.

If you could already earn 4 mpd on the same transaction with another card, there’s little reason to pay a 1% fee (unless you really want to earn Citi points), but assuming that’s not possible, then a 1% fee for 4 mpd isn’t the worst deal in the world.

Refer to the article below for more analysis.

What exchange rates does Amaze offer?

Amaze Wallet

You can check the rates Amaze is offering for wallet conversions via the Instarem app.

In general, these rates will be very close to mid-market, with the exception of weekends (where there’s usually a 1% spread) and during periods of high currency volatility. Also, the exchange rate for unsupported currencies will be based on the prevailing Mastercard rate.

Credit or debit card

Whenever you make a foreign currency transaction on a card, you normally incur two kinds of fees:

- An implicit fee arising from the spread between the spot rate and the actual rate used by the card network (e.g. Visa, Mastercard)

- An FCY transaction fee of ~3.25%, imposed by the bank

Amaze does not impose (2), which means the only “fee” you need to be concerned about comes from (1).

First things first: you should not be comparing Amaze rates to spot, unless your alternative was to visit a money changer or use a Revolut or YouTrip type product where the rates can be very close to mid-market.If you want to earn miles on your overseas transactions, then the right rate to compare Amaze to is Mastercard, because that’s what you’d have incurred had you used the credit card directly.

Once upon a time, Amaze rates were almost indistinguishable from Mastercard’s. But at some point in May 2022, those started diverging, and the spread is currently ~2%, depending on day and currency. Amaze rates for card spending, unfortunately, are opaque- you won’t know what rate you get until the transaction is completed.

However, it should be clear that so long as you can earn equivalent rewards on Amaze + credit card versus credit card directly, Amaze is the better choice so long as its spread is less than the bank’s FCY fee.

Unfortunately, it is not possible to check what rate Amaze is offering for card-linked transactions prior to spending.

Earning rewards with Amaze

Amaze transactions will earn either:

- InstaPoints (for wallet-linked transactions)

- Credit card rewards (for card-linked transactions)

It used to be possible to earn InstaPoints on card-linked transactions too, but this was removed in March 2025, making it an either/or situation.

InstaPoints

Earning InstaPoints

Amaze transactions funded by an Amaze Wallet will earn InstaPoints at the following rate.

| Transaction Currency | Amaze Wallet | Debit & Credit Card |

| SGD | 0.5 InstaPoints per S$1 | N/A |

| FCY |

Here are the key points to note:

- InstaPoints can be earned on both SGD and FCY transactions

- A minimum spend of S$10 is required to earn InstaPoints

- There is no cap on how many InstaPoints you can earn in a month

- InstaPoints are credited immediately upon completing the transaction

Redeeming InstaPoints

InstaPoints can be redeemed for a discount off an Instarem funds transfer, or KrisFlyer miles.

| InstaPoints | Reward |

| 100-400 |

S$1.25 to S$5 off an Instarem funds transfer |

| 1,200 | 400 KrisFlyer miles |

Cashback redemption options were removed in March 2025.

It would take S$2,400 of Amaze spending to earn 1,200 InstaPoints, so you can think of this like an earn rate of 0.17 mpd.

InstaPoints expiry

InstaPoints expire 12 months from the date of crediting.

Ineligible transactions

The following transactions do not earn InstaPoints:

- Any transaction in SGD

- Any foreign currency transaction smaller than S$10

- Any transaction with the following MCCs:

| MCC | Description |

| 4111 | Railroads, Transportation Services |

| 4784 | Tolls and Bridge Fees |

| 4900 | Utilities: Electric, Gas, Water, and Sanitary |

| 5047 | Medical, Dental, Ophthalmic and Hospital Equipment and Supplies |

| 5199 | Nondurable Goods (Not elsewhere classified) |

| 5960 | Direct Marketing: Insurance Services |

| 5993 | Cigar Stores and Stands |

| 6012 | Financial Institutions: Merchandise, Services, and debt Repayment |

| 6211 | Security Brokers/Dealers |

| 6300 | Insurance Sales, Underwriting, and Premiums |

| 6513 | Real Estate Agents and Managers: Rentals |

| 6540 | Non-Financial Institutions – Stored Value Card Purchase/Load |

| 7299 | Other Services (Not elsewhere classified) |

| 7349 | Cleaning, Maintenance and Janitorial Services |

| 7523 | Parking Lots, Parking Meters and Garages |

| 8062 | Hospitals |

| 8211 | Elementary and Secondary Schools |

| 8220 | Colleges, Universities, Professional Schools, and Junior Colleges |

| 8241 | Correspondence Schools |

| 8244 | Business and Secretarial Schools |

| 8249 | Vocational and Trade Schools |

| 8299 | Schools and Educational Services |

| 8398 | Charitable Social Service Organisations |

| 8661 | Religious Organisations |

| 8675 | Automobile Associations |

| 8699 | Membership Organisations |

| 9211 | Court Costs, including Alimony and Child Support |

| 9222 | Fines |

| 9223 | Bail and Bond Payments |

| 9311 | Tax Payments |

| 9399 | Government Services |

| 9402 | Postal Services |

The exclusions list more or less matches the ones published by banks, with education, insurance, government payments and hospitals all ineligible.

This means you won’t earn any InstaPoints should you use the Amaze to pay for overseas school fees, visa applications or medical treatment.

Credit card rewards

Amaze transactions are eligible to earn credit card rewards with all banks except:

Do remember that standard exclusion clauses still apply. For example, insurance premiums are an excluded category for Citibank, so pairing the Citi Rewards Card with Amaze does not magically enable you to earn points on insurance payments (remember, the MCC remains the same).

| ❓ Doesn’t Citi exclude Amaze? |

| Citi excludes Amaze* AXS, Amaze *Bus/MRT, and Amaze*TRANSIT from earning rewards. This does not amount to a blanket exclusion on Amaze. It simply means that you won’t earn any points if you make AXS, Bus/MRT or Transit transactions with an Amaze paired with a Citi card. |

So which credit card should you pair with Amaze for the most miles? Sadly, there’s only two good candidates left.

| 💳 Recommended Amaze Pairings |

||

| Card | Earn Rate | Cap |

Citi Rewards Card Citi Rewards CardApply |

4 mpd1 | S$1K per s. month |

OCBC Rewards Card OCBC Rewards CardApply |

4 mpd2 | S$1.1K per c. month |

| 1. All online transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) and in-app mobile wallet (T&Cs) 2. Clothes, bags, shoes and shopping (T&Cs) |

||

Of course, you could still pair Amaze with general spending cards like the Citi PremierMiles Card, HSBC TravelOne Card, or OCBC 90°N Card, provided you feel that receiving the local earn rate with a ~2% fee (what Amaze implicitly charges; see below) is better than receiving the FCY earn rate with a 3.25% fee (what the bank charges if you paid with a “naked” card).

For additional information on how this works, I highly recommend reading the post below.

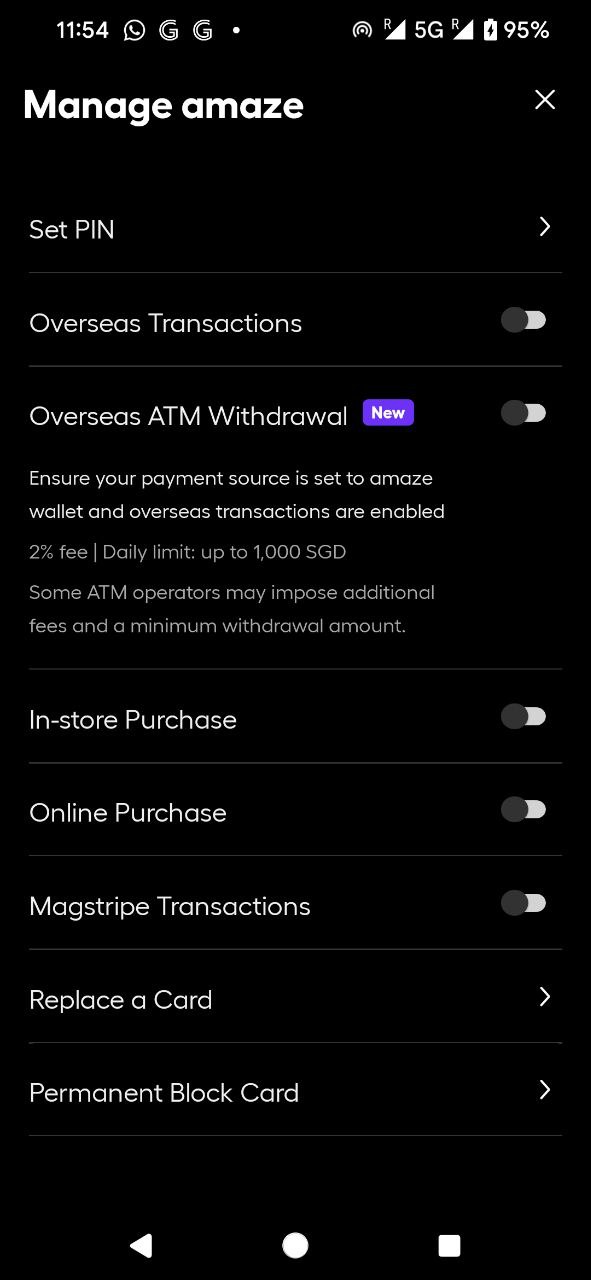

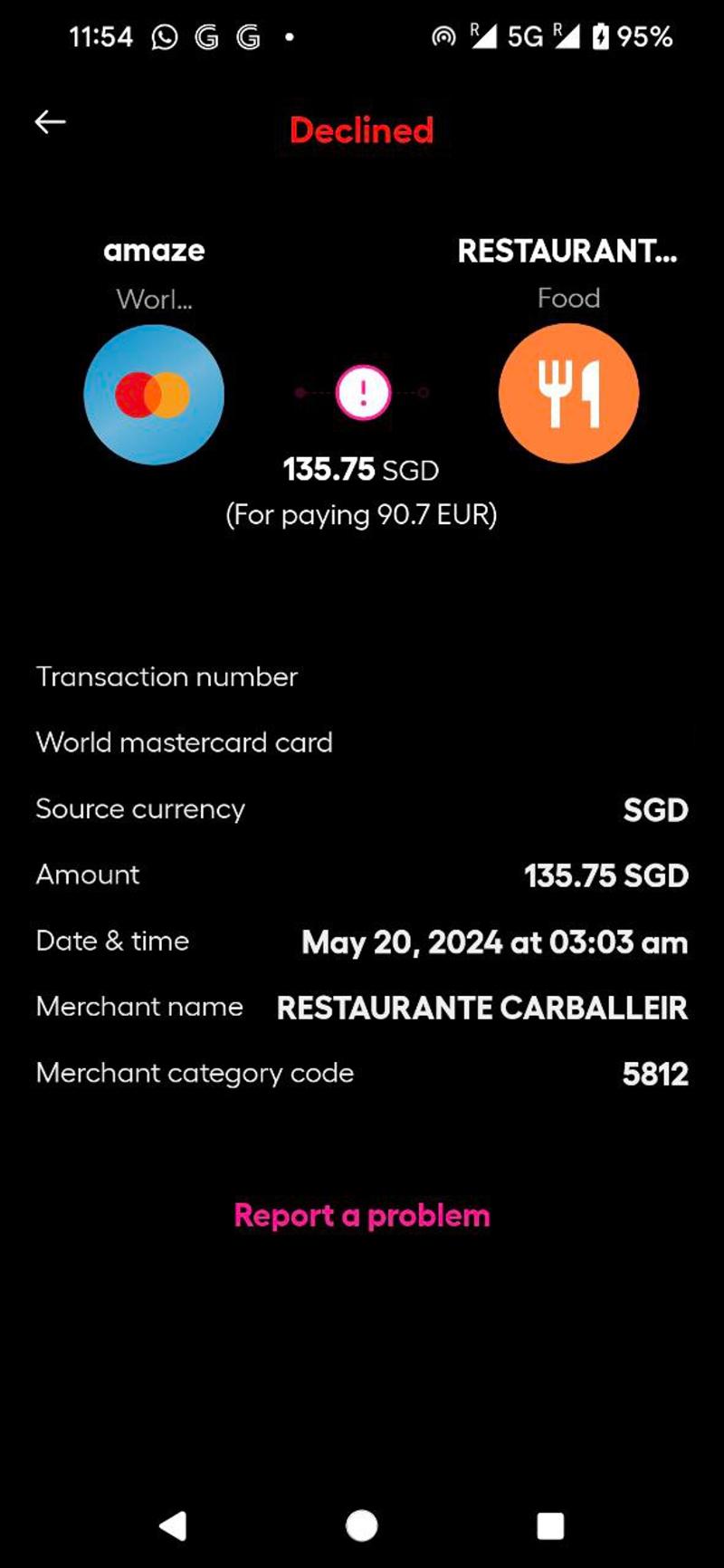

Use Instarem app to check MCCs

The Instarem app provides an easy way of checking MCCs even without spending.

All you need to do is open the Instarem app > Card > Manage > Disable in-store purchase, online-purchase, overseas transactions, magstripe transactions.

Then attempt to make a transaction. It will fail, obviously, but you can then visit the Activity tab and see what the MCC would have been had it gone through. You can then select the correct card to pair with Amaze accordingly.

Alternatively, you can also link Amaze to a wallet, and so long as the charged amount is more than the wallet balance, the transaction will fail. You can then check the MCC under the Activity tab.

Conclusion

|

||

| Apply here | ||

| T&Cs | ||

| Use code 7HK2A2 for 225 bonus InstaPoints |

Amaze is nowhere as amazing as before, but it still has a couple of use cases:

- For card-linked spend: Turning offline transactions into online ones to trigger online spending bonuses with the Citi Rewards Card

- For wallet-linked spend: Earning KrisFlyer miles (via InstaPoints) while enjoying similar rates to Revolut/YouTrip

Personally, whenever I have FCY spending, my go-to option is Amaze paired with the Citi Rewards Card, which earns 4 mpd (so long as the transaction isn’t travel-related) and reduces the FX fee to just 2%. Less frequently, I might opt for Amaze with the OCBC Rewards Card, but only if the merchant’s MCC is on OCBC’s whitelist.

Beyond that, however, my main use case for Amaze is to check MCCs. I generally don’t find it worthwhile to make wallet-linked spend, barring the occasional promotion, and I have many alternatives for earning 4 mpd on local spending without the need for a 1% fee.

So the Amaze party isn’t quite dead yet- though who knows this time next year?

I’d hope this card could be the morning call for banks who charge 3+% for foreign currency transaction to finally wake up

Just wondering if this would work out for OCBC TR card as well (for all the incl categories):

Local spend: 4mpd + 1%

FCY spend: 4mpd + 1% – FCY Fees

In theory it should but only for the whitelisted MCC, as you mentioned.

Banks are gonna exclude AMAZE* from earning points real soon like they did YOUTRIP*.

So does this works for example topping up my crypto account using this method to save on the transaction fee?

I attempted to top up into binance. It was rejected

Does it convert the insurance premiums into miles earned if i link up the miles card to the AMAZE?

I am wondering the same for my uob one card cashback as well

You can’t even link Visa cards to it now.

Afaik from hwz forum, no. The cc receives the same MCC as though U used it directly to pay so they will get the insurance MCC, thus no rewards. But I guess U get the 1% cashback…?

Does it converts my insurance premiums to be eligible for uob one 5% cashback + amaze 1% cashback?

people need to learn to read the article better. if the mcc is passed through, then it will still code as insurance. does insurance earn cashback with uob one?

SCB Unlimited ==> Amaze ==> AXS. Wonder will get 1.5% + 1%? Or at least 1%?

AXS doesn’t take Amaze.

Hi! Burning qns before I sign up using your code: does AMAZE card earn us 1% cashback for charges made on AXS mobile stations? (I.e Using Amaze card to pay insurance premiums on AXS mobile)

It’s answered above – AXS doesn’t take Amaze. But you can use UOB Absolute to top up GPMC and pay via AXS to earn 1.7%.

WWMC ==> Amaze ==> online spend. Does it earn 4mpd on WWMC?

For now maybe yes… so try it yourself.

Till Banks decided to exclude the transactions start with AMAZE*

Use cases are pretty limited. Only Mastercard can be linked. MCC exclusions still apply. Forex rates are pretty good compared to banks but Instarem’s rates for normal transfers are worse than Transferwise. How long until banks nerf this? Hopefully get a few months but it’s not earth shattering.

i’d say the ability to stack 1% cashback on top of 4 mpd is a good enough perk for me- not to mention the possibility of turning offline into online spend

I hope it lives longer than GrabPay top-ups since this time we won’t have people calling up Citi or DBS asking if GrabPay top-ups qualify for 4mpd.

Worse? Instarem has better rates than Transferwise from SGD to MYR for starters.

I’m waiting for amaze to accept amex so I can pay insurance with amaze + UOB Absolute Cashback

Sign up process doesn’t work (to be precise the ID verification), both manual verification and via Singapass, tried on 3 devices and on 2 internet connections. Never managed to get through it due to (varying) error messages appearing at some point. Basically impossible to become a customer. Lousy.

Even if the ability to earn rewards via bank cards get nerfed, I’ll still prefer this card over something like YouTrip since there will be no orphan values left behind in the card. Although I might still hold on to my Revolut for the ability to withdraw cash overseas.

this is a good point- the orphan value bit. i still have $50 sitting in my revolut which i haven’t got around to utilizing

You can withdraw Revolut value free of charge to a Singapore bank account. Done it many times.

Bear is correct. Just link your Singapore bank account to Revolut. You can then transfer to and from your Revolut wallet FOC. Also, your Revolut card can be used for public transport so there are ways to use up that money without travelling.

Thank you! Was under the impression that since I topped up with a credit card I wouldn’t be able to withdraw in cash

I think if you make a habit of doing credit card topups and then withdrawals to your local bank account you’ll have problems – but the occasional withdrawal of small amounts left over from credit card topups seems to be ok.

Can use amaze to pay cardup/ ipaymy?

You really need to learn to read the article again, it’s written in plain and simple English after all.

This is a blog, we only read the title and the details we ask questions and spoonfed. what wrong?

There’s actually a reason why Aaron didn’t answer your question……. Perhaps some reflections.

I think you didn’t know how a blog works.

also, you know everything? never need to ask?

so you can read? you said you read the title? why dont you continue to read the article? if you used the time spent on the comments section on the main article instead, you could have finished the article and gotten you answer.

LOL

LOL

i love it when keyboard warriors try and act smart and be so proud of knowing everything

“couldnt care less” but you replied!

LOL

called you out and WON

keyboard warrior 1, can care more 0!

Aaron… when you did the Amazon transaction with Amaze, did it require individual OTP to be inputted, or was it only required when you first linked the card?

Only when first linking

It sounds awesome, but after three tries via SingPass, each of which getting me only a “Something went wrong – Got it” message, maybe I won’t link my payment methods with these people.

applied and waiting for the card to be delivered.

i dont have any useful mastercard on hand so have to add the posb everyday card first and tried to add ICBC global travel card afterwards, but fails every time (even swith from iphone to android) at the 3D verification stage (icbc’s problem).

The Instarem app doesn’t like rooted phones 🙁

Same goes to fintech/banking apps.

I am not from the credit card industry, but I would be curious about the security implications of routing transactions via the Amaze card. Card issuers have certain safeguards against credit card fraud by blocking suspicious transactions or sending alerts, for example. It’s not clear to me if any of these safeguards would be compromised by making the payment using the Amaze card. Would it be harder to dispute Amaze transactions with your issuing bank? Would the responsibility of blocking suspicious transactions now fall on Amaze (just like with PayPal)? How well will Amaze handle disputes or complaints about fraudulent… Read more »

is like using paypal. same concept.

As per DBS CSO, its highly likely that Amaze transaction may not earn bonus points with WWMC because there was no OTP 🙁

However CSO did mention to hold on till next month till bonus points are out.

I have remained discreet and ambiguous about Amaze- so just mentioned made an online payment through a different way.

@aaron any ideas?

It does earn 10x with citi rewards, which also requires transactions to be online. So I don’t think it will be a problem…

Hi Aaron

Ok. Managed to sign up using your referral code.

I’ve spent like $3000+ via instarem and referred one person, but i haven’t been credited any points yet – anyone got any points yet?

it’s been over a week.

actually, you’re not alone. i don’t see a single point in my account either, and i’ve certainly got at least one referral by now.

hi guys, i think its credited quarterly?

cashback is, but referrals should be instant (?)

anyway just checked my account again and I do see a few have credited, with dates from late july. maybe needs a few days

Deleted and started a new comment instead

Hi Aaron, do you know if cards from the other multi-currency accounts like TransferWise/Revolut can be linked to the Amaze card?

If it works for say Revolut, you could stack 1% + 1% cashback on transactions (Revolut Metal provides 1% cashback)

Hi aaron,

You mentioned that this card is considered a debit card but i wonder if it can work with merchants that accept NETS only ?

I.e. we plug this into their nets machine, key in the pin and charge it to our credit card.

If yes, i think there might be some use case for it too

no, the card does not support nets

Nets has nothing to do with it

I think HSBC already closed this loophole starting 2 Aug by introducing Everyday+ program of additional 1% cashback which excludes PayPal-like transactions.

They have very bad tech implementation. They will send you the email that you transaction was declined because of system error but balance already deducted from your cc and if you reach them then they will say oh sorry balance was already approved from our backend. We send you wrong email. Can you please check with the merchant.. so they expect customer to do here and there because of their errors. They will hold your money for 14days even though trx was declined and reverted. Maybe try to order and cancel any order from your cc you’ll see your amount… Read more »

I’ll suggest to not to use Amaze for any big transactions or for the merchant where you can’t contact to get refund because Amaze can approve the trx which was declined at merchant. So, if you can’t go to the merchant place again then maybe you’ll not able to settle your amount. For 1% of cashback maybe you’ll lose the whole principal amount 😟 I’ve faced this incident and decided to close my amaze account. If you add your cc then they will not allow to delete it even though there is an option but it will gives you error.… Read more »

oh dear thats scary!

Been using it for big transactions and haven’t faced that issue. That said in the event of disputes you can actually file for a claim with Mastercard’s liability protection under those circumstances.

https://www.mastercard.com.sg/en-sg/personal/get-support/safety-and-security/liability-protection.html

Yeah all these fintech deals feel like picking up pennies in front of a steam roller. Risk/reward isn’t great and people get blaise until they lose all their money and find out they are actually unsecured creditors with zero protection.

anyone get referral points or cashback yet? over a month wait for me – nothing

Is it possible to add GPMC into Amaze as one of the 5 cards, and earn GrabRewards that way?

Tried, it doesnt work with GPMC

Linked the physical Amaze card to DBS Womens World but transactions do not qualify for 10x points

Darned

I have 800 plus points now on my instarem. What do I do with it?

Just saw this in my email :(.

As of April 1, 2022, amaze cashback on SGD currency purchases will be updated to 0.5% while the cashback on non-SGD currency purchases will remain 1%.

hi Aaron

how did you get details on merchant category for your transactions? if already mentioned elsewhere, appreciate if you can direct me there

https://milelion.com/2019/04/18/dbs-virtual-assistant-now-provides-mccs-and-rewards-points-per-transaction/

If paired with UOB PRVI Miles, do you think we can get the ongoing 4.4 miles per dollar promotion for overseas charges? I think it can be a good use of Amaze if that’s possible.

No. Two things. The Amaze txn is coded as online which is excluded by UOB. The Amaze txn is charged in SGD which is excluded by UOB. You have to physically use the UOB PRVI card at overseas payment terminals and not use DCC.

Then how come the article asks to pair Amaze with UOB Lady’s Card? I assume this is also excluded by UOB. And it would have convert the spend to an online transaction which will not earn 4mpd if that is the case.

FX rates aren’t as good as before! Yep, you can say that again. I am in New Zealand at the moment and the FX rate seems to be 3% now, no different to any other card. With the SGD/NZD rate at around 0.844 right now, and a transaction going through at 0.8701, I have stopped using the card in NZ.

FX fees for Amaze are closer to 2% now, as of Sep 2022

i just did some USD transactions and it was closer to 0.5% over the MC rate.

As a DP, just used in Melbourne today and Amaze charged 2.51%

when you say 2.51%, are you comparing to spot rate or mastercard rate? that’s the key question. the correct rate should be mastercard.

I just charged 15 mins ago for 2 Australia visa fees of AUD 20. First was using Amaze paired with Citi Rewards. It translated to S$18.26. This is 4% fx charge over google rate 17.56. Then for the 2nd visa fee, I charged directly to Citi rewards, the pending transaction shows $18.08, though not final until posted, but it does show much lower than Amaze.

Looks enticing enough still. But I’m still unclear how using Amaze will earn the 4 mpd. I’m using Maybank PremierWorld MasterCard

https://www.uob.com.sg/assets/pdfs/kf_credit_card_full_tnc.pdf

section 1.11

UOB KF nerfed amaze ?

I see on the uob ladies card that no points are awarded for transactions with AMAZE*TRANSIT. Does this exclude all amaze transactions or is this only for transit/transport related transactions using amaze?

Just the transit-related ones.

Hi MileLion and guys, just wanted to check, if I link 2 different cards to my Amaze and I transact overseas, and I wish to claim VAT refund back to credit card, will the VAT refunds go back to my respective credit cards linked to my Amaze card?

Cheeers!

Hi, if I pair Citi rewards to amaze card. Will I get 4 mpd for overseas expenditure? Is this considered travel related expenditure since amaze convert it to online transaction?

Hi everyone – sorry if this has been covered elsewhere, but if I use the Amaze card on Singapore public transport paired with the Citibank rewards card, would I still get 4mpd from Citibank (as it is “online” spend) or would this be excluded? Thanks in advance!

I just used it in Europe (France and Italy). Amaze charged rates which were all more than 2% away from the market rate. There is no point using it overseas any more.

Hi – for overseas remittance (i.e. sending money to a personal bank account outside of Singapore), can I a.) remit using my Amaze credit card (paired with CitiRewards) and b.) will it give me points for Citi? Thanks in advance!

Will we get 4mpd for paying condo MCST via AXS?

Not sure if it’s just me, but the spread that I was just charged was around 1.2% over the Mastercard rate. (USD to SGD)

Anyone with similar experience?

Just returned from Malaysia, the exchange rate almost the same as the Mastercard rate, with the DBS already excluded amaze for the reward points, it is silly to link the card.

I spent about 5500 RM for the hotel, and got 500 instarem point. (no DBS points), It would be better paying direct with the DBS Master card

Tell me one good reason to use the card if anyone has 🙂

Hi, i am unable to add this card into apple pay. anyone have the same issue?

Me too

Does this mean that for dental, i will still get 4mpd with Citi Rewards? Am confused with the instapoints paragraph

Amaze has changed, I have been charged more than 2% off Mastercard rates recently. And when I inform instaram of this they simply shrug it off and say they are offering competitive rates.

it’s a scam so pls be careful

I can understand the party winding-down. Afterall Amaze needs to make money at the end-of-the-day, and it was so good in the early days I can’t see how they could have been making money then. What “gets” me the most, is when the latest round of nurf’s come out, and they treat all their customer like total idiots, with a covering email saying something along the lines of “we have made these change to increase benefits to you so you have the best travel card”. This really annoys me. Why can’t they be honest? Do they thing we are stupid?… Read more »

I’m still confused by the discussion of using spot or Mastercard exchange rates. You are correct that if you are choosing between using a Mastercard credit card with Amaze versus without Amaze, then you compare against the Mastercard exchange rate. But if you are comparing whether to use a Mastercard credit card with Amaze versus using cash (Amaze wallet or Wise, Revolut or YouTrip), then shouldn’t you be comparing everything to spot rate? If the Amaze card and Amaze wallet exchange rate is different, then there is a difference and not everything compares back to Mastercard exchange rates. This is… Read more »

I wonder if it will ever end.

Does citi need amaze more than them

Does amaze need citi more than them?

These are important questions