Back in 2018, I made the case for why KrisFlyer should switch to an activity-based expiry policy, instead of its current time-based expiry policy.

Under an activity-based system, miles would never expire so long as at least one mile is earned or redeemed within a given period. For example, in a 12-months activity-based expiry policy, earning or redeeming at least one mile would extend the life of your entire balance by a further 12 months.

Obviously, that change hasn’t come to pass, but with COVID-era extensions ending and KrisFlyer miles expiring again from 31 January 2023, I thought it’d be timely to revisit and update the argument, in the hope that someone is listening.

KrisFlyer’s current miles expiry policy

Singapore Airlines currently adopts what’s known as a time-based expiry policy, where miles have a fixed lifespan.

A member’s KrisFlyer miles will expire after three years (or one year for KrisFlyer miles received from contests) at 23:59 hours Singapore time (GMT +08:00 hours) on the last day of the equivalent month in which they were earned.

For example, KrisFlyer miles credited to a member’s KrisFlyer account in July 2017 will expire at 23:59 hours Singapore time (GMT +08:00 hours) on 31 July 2020.

-KrisFlyer T&Cs

All KrisFlyer miles expire three years after they were earned, with the exception of miles won from contests, which expire after one year. All expiry takes place at the end of the month, e.g. miles earned from 1-31 July 2017 all expire on 31 July 2020.

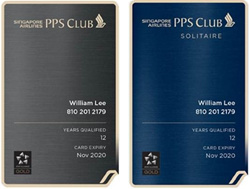

| ❓ PPS Club member? |

|

KrisFlyer miles belonging to Solitaire PPS Club or PPS Club members never expire so long as they maintain their status. Should they subsequently fail to requalify, their KrisFlyer miles will expire three years from the last day of the month they failed to requalify. Do note that this benefit does not apply to supplementary Solitaire PPS Club members. |

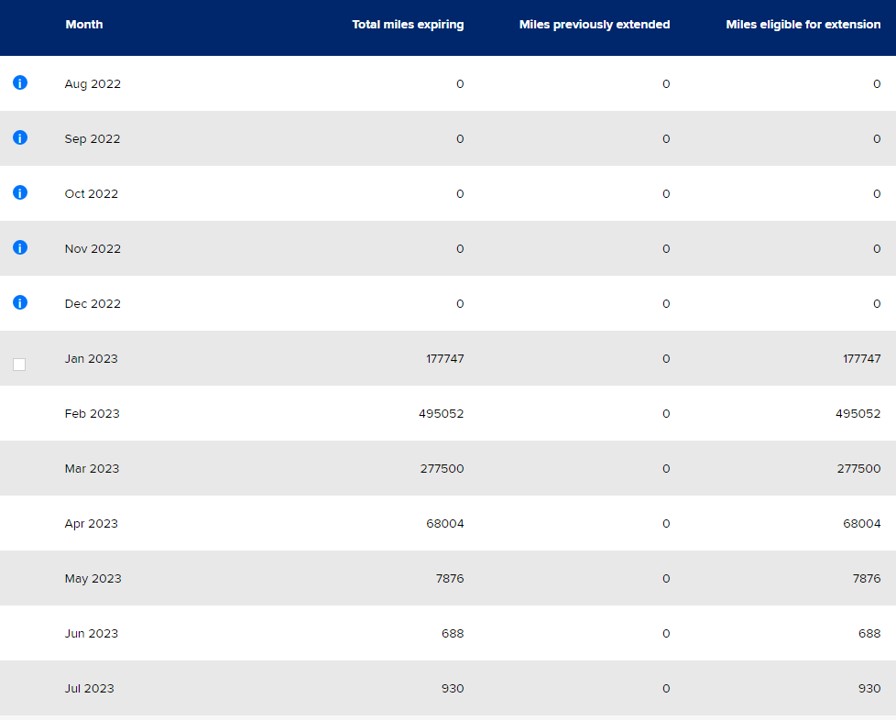

You can see a summary of all miles due to expire in the next 12 months by logging in to your KrisFlyer account and clicking on Miles Validity. When making a redemption, the KrisFlyer miles with the earliest expiry date are always used first.

KrisFlyer members have a one-time option of extending their miles by paying a fee of 1,200 miles or US$12 (~S$17) per 10,000 miles. This grants a 6-month or 12-month extension, depending on tier.

| KrisFlyer | Elite Silver | Elite Gold | |

| Fee per 10,000 miles | 1,200 miles or US$12 | ||

| Extension | 6 mo. | 12 mo. | 12 mo. |

What’s wrong with time-based policies?

Time-based expiry policies have historically been popular with airlines because it enables them to reliably estimate their “breakage rate”, or the number of miles that expire without being redeemed. This all-important figure affects the fair value of miles on the balance sheet, and therefore other investor-relevant metrics like working capital.

The breakage rate also affects the rate at which airlines can recognise revenue arising from the sale of miles, a more complex accounting issue that my bachelor’s degree does not qualify me to explain. All things equal, however, a shorter expiry period increases the likelihood of breakage, reducing the fair value of the outstanding miles.

But if we ignore the accounting side of things, time-based policies have numerous drawbacks.

Confusing for customers

Time-based policies can be confusing for customers, because in the case of frequent flyer programmes the service redeemed is usually not consumed straight away. This then creates a disconnect between miles validity and ticket validity.

To illustrate, consider the following scenario:

- I have 100,000 KrisFlyer miles that expire on 31 March 2023

- On 1 February 2023, I redeem all 100,000 miles for an award ticket that departs on 1 October 2023

- On 1 May 2023, I decide I don’t want to travel, and call up customer service to cancel the ticket. The customer service rep tells me I can’t get any miles back because they expired on 31 March 2023

From the customer’s point of view, this isn’t very intuitive. How can my miles have expired, when they’re attached to a valid ticket? And yet the customer service rep is correct. Your miles expire on a fixed date. You can redeem miles for a ticket that flies after the expiry date, but each mile has a “memory” of when it originally expires, so cancelling an award ticket does not give them fresh validity.

There would be no such confusion if KrisFlyer miles followed an activity-based expiry policy. It would also make tracking on the backend more straightforward, since all miles would adopt the same vintage.

Penalises those saving up for aspirational awards

Time-based expiry policies penalise customers who are saving up for a big award. For instance, a round-trip Business Class ticket to Europe costs 207,000 miles, and even if you optimise your spending and sign-up bonus strategy perfectly, it could still take a while to reach (let’s not even talk about wanting to bring your family!).

If a member is diligently slogging away to get to that magic number, why discourage them from doing so with a hard expiry? An activity-based expiry provides an incentive to save up for aspirational awards, while still giving the airline the freedom to adjust award prices as needed (though hopefully with notice).

Penalises those who stayed loyal during COVID

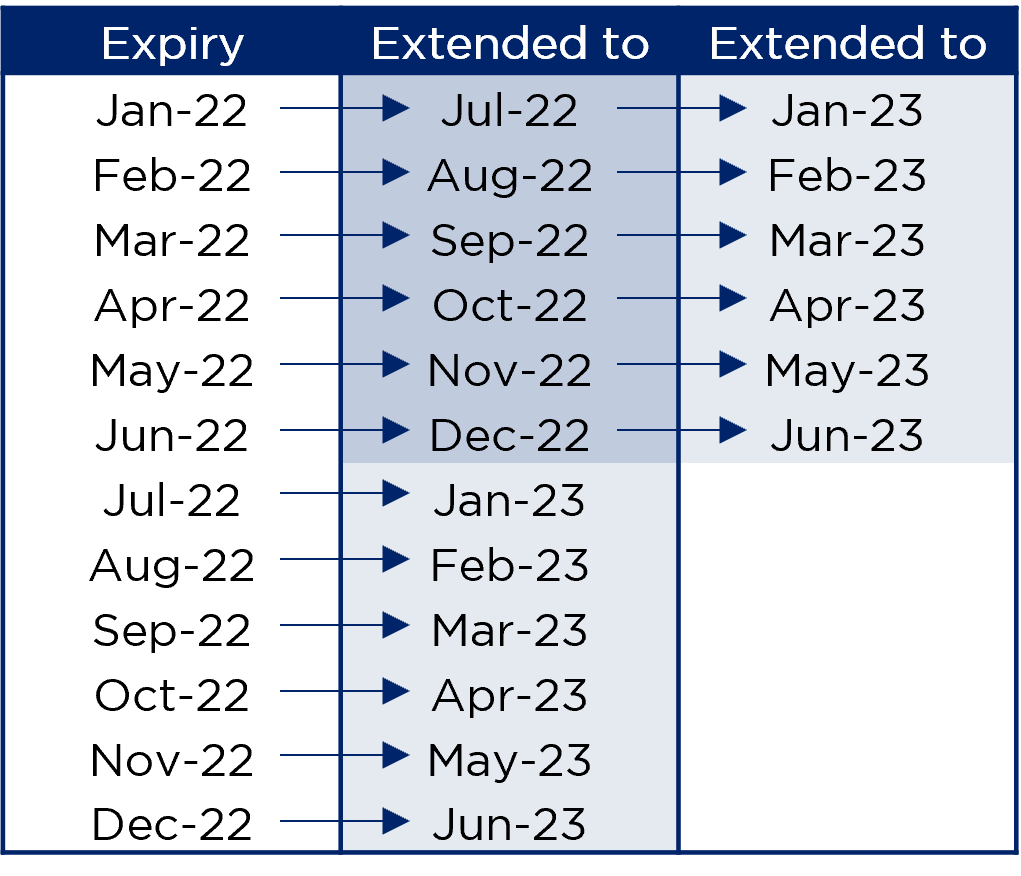

Singapore Airlines, to be fair, has granted extensions to miles expiring during the COVID period- namely April 2020 till December 2022.

|

| KrisFlyer Miles Extension |

But what’s not been addressed is the treatment of miles earned during COVID.

Back in 2020 when COVID was raging, vaccines nowhere in sight and the air travel industry facing an unprecedented apocalypse, you’d need some faith to continue sticking with KrisFlyer and earning those miles month in month out.

That faith hasn’t exactly been repaid. Take the example of miles earned in April 2020. These expire on 30 April 2023, but since VTLs only began in earnest towards the end of 2021, you really only have 1.5 years to use them!

Penalises cobrand cardholders

Singapore Airlines’ cobrand cardholders enjoy automatic miles conversions every month, which saves them the usual S$25 or so conversion fee levied by the banks.

But this is a mixed blessing. Even though you save on conversion fees, automatic conversion means your three-year expiry countdown starts immediately.

Contrast this to someone earning points with a third-party card like the Citi PremierMiles or DBS Altitude. These points don’t expire so long as they’re on the bank side, which gives the cardholder the freedom to decide when he/she wants the three-year countdown to begin.

If a cobrand cardholder is more valuable to the airline, why should he/she be on the losing end when it comes to expiry?

No incentives for frequent interaction

With a time-based expiry policy, there’s nothing I can do (short of paying an extension fee) to extend the life of my miles.

But with activity-based expiry, I have every incentive to regularly interact with KrisFlyer beyond the airplane cabin:

- Using Kris+ for shopping or dining

- Paying with a cobrand credit card

- Earning when staying at a hotel or renting a car

- Converting Esso Smiles or Shell Escape points

- Converting hotel points

- Earning when booking activities with Klook

- Converting CapitaStars or Linkpoints

- Shopping at KrisShop

Each of these activities would extend the life of my entire miles balance, building daily touchpoints with the programme. And isn’t that what loyalty executives want? For customers to be thinking about their programme on a daily basis, even when they’re not flying?

Put it another way: activity-based expiry helps engage the marginal members on the fringes of the programme. The occasional traveller with the odd flight here and there. The guy who used a cobrand card for a while before switching to cashback. The lady who got a couple thousand free miles signing up for a magazine subscription. Miles tend to be an afterthought to this group, who usually have a small balance that ends up expiring or cashed out at poor value.

“Isn’t that good for the airline?” you ask. Not really. In the short term perhaps, but the airline is missing out on the opportunity to bring these members into the fold. Suppose the lady with a couple thousand expiring miles knew that she could extend them by simply signing up for a cobrand card, or giving her membership number when booking a rental car. I imagine she’d be inclined to do that. It’s the theory of loss aversion put into practice- if there’s a simple way she can extend the expiry of her miles, why not?

Moreover, activity-based expiry makes it easier for marginal members to make it to their very first award ticket. And that’s the key threshold that KrisFlyer (or any programme) needs to get them to, since successfully attaining a reward increases customer loyalty and subsequent engagement. It’s just basic motivational theory- when customers realise “hey, this free ticket thing really works”, all of a sudden things get real.

My proposed model

So what would an activity-based expiry policy for KrisFlyer look like, if it were up to me?

KrisFlyer miles will never expire, so long as you earn or redeem at least one mile every 18 months

“Earn or redeem” is an important distinction, because some programmes like Avianca LifeMiles only consider earning activity as valid activity for extending miles. I think that’s unnecessarily harsh, since people who redeem miles are still interacting with your programme.

“18 months” is half the duration of the current three years, but it’s a well-accepted trade-off that activity-based schemes will have shorter validities than time-based schemes. Moreover, given the abundant ways of earning KrisFlyer miles for those of us in Singapore, I might even be willing to accept a period as short as 12-15 months. Frankly speaking, if you can’t earn or redeem at least one KrisFlyer mile in that period, chances are you’re not really engaged with the programme to begin with.

At the same time, I realise it may not be as easy for members based outside of Singapore to earn KrisFlyer miles, since they don’t have access to Kris+ and since KrisFlyer Spree is now out of business. That said, they should still have the option of credit card or hotel points transfers, or making at least one KrisFlyer redemption a year.

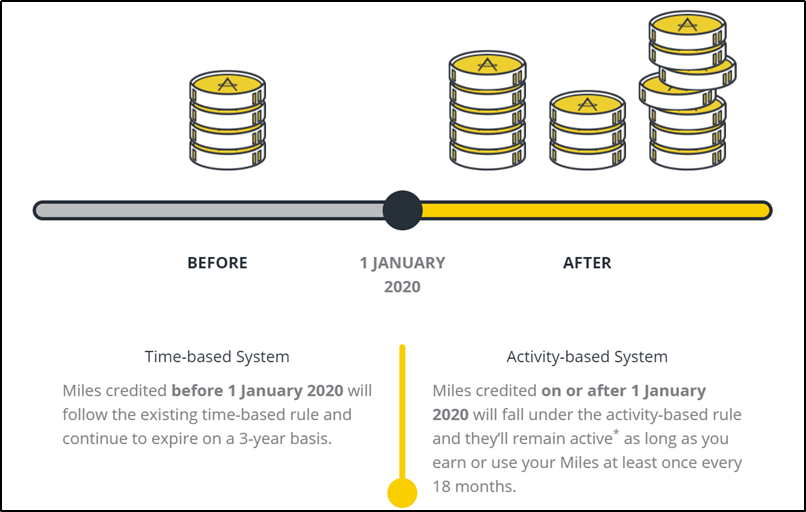

I would also hope that if KrisFlyer goes activity-based, they don’t do it the way Asia Miles did. In January 2020, Cathay Pacific changed the Asia Miles expiry policy such that miles would not expire so long as there was account activity in an 18-month period.

However, the way they did so left a lot to be desired. Basically, Asia Miles adopted a hybrid regime, where miles earned before 1 January 2020 would follow the old time-based rules, while miles earned from 1 January 2020 would follow the new activity-based rules. That added further complication, and the fact that Cathay’s run so many campaigns offering members the chance to convert time-based miles into activity-based miles means they could have just done that from the outset (i.e. it’s not a technical limitation).

Conclusion

KrisFlyer adopting an activity-based expiry policy would make so much sense for both customers and the airline. I can’t think of any real downsides, other than lower breakage- which may not be a bad thing insofar as it lets you generate incremental revenue from higher engagement elsewhere.

There hasn’t been any indication that Singapore Airlines is planning to move in this direction, but we can always hope.

What do you think of an activity-based expiry policy for KrisFlyer?

they are probably afraid of hoarders… members with millions of miles in their accounts…

But ultimately Sia controls the value of those miles… so at the flick of a switch they can adjust the liability as needed? Within limits of course, but I think the incentive against hoarding is the possibility of devaluation

TIGONG BAI POPI BAI. Devaluate one more time by Jan. Unwind it

Opps! 🤭 Are you talking about me! Nearly 2 million miles but I find it extremely difficult to redeem any premium seats. There are only so much SQ experiences l can redeem.

You got my vote! Activity-based expiration is a much better system than the rigid 3-year expiration policy that is currently used.

I’m pretty sure the P&L for activity based expiration isn’t as profitable as time based expiration. Not everything that’s good from a customer’s POV is good for the airline’s bottom line.

Agree…and not to sound selfish, but if it goes to an activity based model, that will increase the likelihood of people eventually being able to accumulate the required number of miles to redeem tickets.

And we all know how tough it is already to redeem saver first/suites tickets as it is

the counterpoint to this would be that greater day-to-day engagement can be beneficial to the airline’s bottom line too. for example- imagine if Kris+ adoption picked up because people want to extend the life of their balances.

I guess the real question is, “to what end”

As some others have commented in the Krisshopper post, this just causes miles deflation.

I for one feel that SQ has to balance the fine line of making redemptions seemingly accessible, but yet out of reach for most.

To me at least, there’s no point making aspirational first/suites redemption available to people who have to save miles for decades…sorry I know…I sound self-serving, but there’s a reason why there are only 4 seats on a 777 or 6 on a 380. The ratios speak for themselves.

I highly doubt kris+ can break even , let alone be a highly profitable programme for SQ. Krisshop is probably the most profitable airline auxiliary business outside of krisflyer. Heck, GrabPay is not even profitable despite its scale!

Even a behemoth like AmEx derives barely half its revenue from MDR (notwithstanding they charge the highest MDR amongst card schemes) and has to rely on fees and interest income to make up for the other half.

It’s wishful thinking, Aaron, to propose that a vehicle like kris+ would add anything to SQ’s bottom line regardless of greater day-to-day engagement or not.

The real counter point is that SIA can do whatever they want and it’ll not affect them. Demand far exceeds supply and they have no real competition. Kris+ is useless overseas and more of a I have program. Overseas clients don’t save miles they squirrel away in bank until they need them and if they are loyal they pay cash. Rich clients couldn’t care about miles. SIA priority has always been on paying premium customers and those flying in Economy should be lucky they have a kris bird logo on their ticket. Talking to SIA would have limited success. If… Read more »

But the people who have trouble keeping their 40,000 kf miles alive will likely be spending $20-$30 on kris+, which is nothing in the grander scheme of things compared to keeping the PPS club happy which are spending $25,000 a year to subsidize economy rates for everyone else.

It’s simple really, they want people to obtain PPS status if they wants the no expiry benefits. Also SIA is trying to keep the amount of miles in circulation that are from credit card points in checked by using this 36 months validity rule. Its better this way, otherwise those hoarders will force SIA to devalue the award chart much more regulary and this in turn will hurt the real flyers(basically those that earns miles organically)

Amen

That should be way. Else where is the loyalty to Singapore Airlines. You can bring your membership somewhere else.

Exactly, this makes so much more sense to actually reward the loyal customers who are dole-ing out cash for premium seats.

Just to make it worse I have 500000 miles threatening to expire early 2023 and every flight I try to redeem was full. How dare SQ threaten to expire miles but not allow us to use them? (FYI Ive tired every star alliance partner sydney to Vancouver) for 6 months via any city. So it’s not a peak time, instead it seems the star alliance system seems broken, but no one at SQ can confirm this. Till 2019 was sussessfully using miles on this route for 5 plus years);

Just book 1yr out

And your point being? Why don’t you go look ahead 1 yr for another destination.

There are alot of things I want too, like a saver redemption suites to London as well as a Rolls Cullinan

Worse case, transfer them to Kris+ can buy food.

Just spend SGD$25,000. You will be absolutely fine bro

What SIA needs is a total management overhaul, the way the company thinks, act and progress is often 2 to 3 steps behind the industry’s best and they are just living the legacy of JY Pillay.

Amen. But I guess the same can be said for many of our companies in SG

Wait till you take Qatar / Emirates or any other airlines then talk lah. Talk so much

I second that. I changed my loyalty to another airline 5 years ago to enjoy ‘sweet spots’ on their redemption rates and on commercial rates while booking my outbound flights from Europe instead of from Singapore, but I am now reverting all that back to SQ. My flights with the other airline got cancelled up to 5 times over a 1-year period and up to 1 month before the departure day, online troubleshooting never worked and neither was taking no action, as the itinerary was shown as disrupted. Further, customer agents were not able to rebook me straight away in… Read more »

In over 2 decades of flying having accrued and consumed several millions miles, I have never come even close to having a single mile expire. And that includes over the Covid period. Personally, I think it is a mute point – most especially as you can leave miles on non-expiry credit cards so easily until you want to use them. Anyone who has miles about to expire, needs a course on basic management !

moot point

Moo point

AGREED. Be loyal and be rewarded. Else the rest can move their airlines miles somewhere else. Just remember once you moved your business, your home ground is Singapore, you stand a lot more to lose.

Maybe Singapore Airlines should only open First Class Suites Award Saver Tickets to their premium clients on PPS Solitaire and not supplementary card member. And PPS Club Member for First Class Advantage like Air France. This is a better idea too

With how difficult it already is to redeem miles, I think the program needs to be more exclusive instead of inclusive if anything.

Agree! They should prioritise in Status!

true, as someone struggling to find a flight with 3 x F tickets using cash, i can’t say i support opening up more F to saver redemptions…

They need to start to exclude earnings with some foreign cards like in the UAA though with that revenue stream they would be mad to do so.

Totally agree with activity based as all my other points memberships use activity based and it provides me certainty that I can toil towards a goal and my points will still be there to spend.

Zzz

Transfer to Kris+ and eat some Firewood Pizza

SIA is simply quite outdated and slow lah…

Then join another airline. Mai kpkb.

Singapore Airlines. I am sure you are listening. You took billions from us and gave nothing back in return. Everyone was expecting you to use the pandemic downtime to improve. Nothing happened. The KF program is stale as ever when many have moved on. The menu in the premium cabins is still the same old. Maybe can change it up a little. The competition is becoming stronger. Charging 15k for a seat requires some refinement.

If you paid 15k for a seat you have no reason to look at KF perks.

Maybe you should switch airlines to American Airlines, Cathay Pacific or Qatar and Join Avios or One World. Or take an Emirates business Cathay Business or Q Suites. Mai complain and complain. Look at their Business Class and First Menu before you start complaining. Name me an airlines with selection of BTC

Ai Pi Ai Qing Ai Ah Go Li, market a lot. fly with Jetstar

I agree with you completely. I understand the pride and love we all have for our national carrier. But the fact is that SQ has fallen behind. ASIDE from suites…the rest of the classes are just…meh.

Other airlines have business class with doors. Many have improved catering. Ground services including limo for first class passengers. What does SQ provide?

No warm towels in first or business.

Catering has gotten worse. BTC TBH, only appealing out of select stations.

Don’t get me wrong I love SQ…but they really need to up their game

Sure SQ improving benefits everyone, I don’t think it is as bad as some may make it sound. We can’t just cherry pick each element and compare it to the best for that element, need to look at it as a whole. The Private Room is top of the line, the soft product being the crew is among the best. Agreed some routes could improve in-flight catering, but I’m sure such is a thing other airlines also suffer from as its more a logistics challenge than an intention to have less food variety on certain routes. That said, the menu… Read more »

Agreed with you BOB! You are definitely BOB the Builder! Can we fix it

Don’t get me wrong. What does Qatar, Emirates provide? You are just being biased. Are you a Premium Passenger. If you think we are meh then look at the rest of the airlines. Have you really set on it? Haha. Don’t get me wrong. The services in Qatar, Emirates, American, United, JAL, ANA are way worse. I fly every other 3-4 days more than our SQ Cabin crew. So before you comment, I think you look at a more holistic view. Open your door and close your door on business class sure? Fallen behind cause of a door is just… Read more »

Apple to Apple comparison bro. You need a competitor analysis

Sigh PPSwor, I fly a lot and in Suites/First or Business’s exclusively.

That’s why I say what I say.

SQ is aging, and not in a good way.

Tahan abit more for the 777X. I really don’t want to fly any 767 / 787-9 / A320Neo or A330. My preference is still the 737-8MAX / 787-10 / A350 / 777-300ER though is abit dated / A380.

SIA’s business class is pretty average to be honest. Not bad but there is no wow factor which separates it from other premium airlines.SIA’s economy class is downright horrible and has fallen behind its competitors. The catering is just pathetic and there are no post take-off drinks, snacks, starter, appetizer.SIA is now the worst full service carrier operating the SIN-TPE and SIN-NRT route. Other arilines like Starlux, EVA,ANA, JAL and even China Arilines are much better.

JAL is a joke. Classic joke. No offence to the Japanese. Sky Suites 787 lol. I dread their flight very often. So is ANA. I taken their long haul during pandemic via Tokyo to JFK. Is far cry from our Business Class Cabin on A380. To each of their preference. Currently on flight SQ878, there’s pre drinks. Eva lately I took a flight from TPE – HKG, it is definitely a classic joke as well. I think the airlines listed is classic joke. No offence. Still a far cry from our cabin. StarLux I haven’t taken before, no intention to… Read more »

PPSwor, u sound like u prefer a huge seat.

Tbh I have always preferred the reverse herring bone config over SQs shove my feet into a corner approach.

Call me spoilt but even Swiss 777 Biz class provides a better hard product than SQ.

Even Uniteds polaris biz is better

I guess to each his own.

The only reason why I’m commenting is just that SQ is losing its competitive advantage.

And we care, hence we comment

Polaris and Swiss Air lol. To each of your own. Haha. Think the edge will only come 2025. Try to look at Lufthansa squeezing their business and first on the round surface in the next 2 years then we comment. Polaris no comments. I take the lie flat seat across LA to NY / SF to NY / NY to Vegas but the seat TENG TENG. Bua butter also cannot sleep properly.

The current CEO has to go lah. He is only concerned about cost-cutting and charging exorbitant airfares. SIA was excellent when Chew Choon Seng was the CEO.