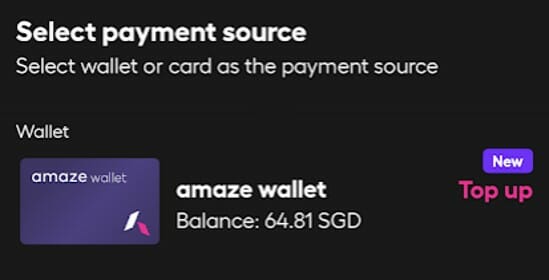

Instarem’s Amaze has long had a wallet feature, where cashback earned was deposited each quarter. Apart from that, however, the wallet wasn’t terribly useful since you couldn’t top it up manually, and it only held SGD. Any foreign currency spending would be converted at the point of transaction at spot rates, making it just another debit card.

But Instarem has been working to add new functionality to the Amaze Wallet, first by enabling ad-hoc top-ups, and now by adding support for foreign currencies.

This means you can now use Amaze either as a credit card passthrough, which earns rewards as usual, or as a multi-currency debit card a la Revolut and YouTrip, which lets you lock in favourable exchange rates for future use.

|

| Apply here |

| Use code 7HK2A2 for 225 bonus InstaPoints |

| 💳 tl;dr: Amaze Card |

|

Amaze wallet adds foreign currency support

In addition to SGD, the Amaze Wallet now supports three foreign currencies:

- Swiss Franc (CHF)

- British Pound (GBP)

- Euro (EUR)

Amaze Cardholders can top up their wallet with SGD, then convert SGD into any supported foreign currency at the current rate offered by Instarem. The foreign currency can subsequently be spent through the Amaze Card, effectively locking in today’s rate for tomorrow’s spend.

For example, I can convert S$100 into €68.82 today, then pay with my Amaze Card in Germany six months in the future (with the funding source switched to Amaze Wallet).

| ❓ What if the wallet balance is insufficient? |

If you run out of the local currency, other available currencies in the wallet will be used in the following order: SGD, EUR, GBP, CHF For example, if I have €68.82 in my Euro wallet but try to buy something that costs €80, the remaining €11.18 will be debited from my SGD wallet at the current rates. Should I have insufficient funds in my wallet, the transaction will fail. Do note that Amaze does not permit the combining of two different payment sources. If my Amaze Wallet balance is insufficient, I cannot use my linked credit card to cover the difference. All payment for a given transaction must come from either the Amaze Wallet (and its assorted currencies), or the linked credit card. |

If this functionality sounds familiar, it’s basically what Revolut and YouTrip already offer, albeit with many more currencies. Amaze will presumably expand currency support in the near future.

| 💱 Supported Currencies | |||

| Amaze | Revolut | YouTrip | |

| AED | ✓ | ||

| AUD | ✓ | ✓ | |

| BGN | ✓ | ||

| CAD | ✓ | ||

| CHF | ✓ | ✓ | ✓ |

| CZK | ✓ | ||

| DKK | ✓ | ||

| EUR | ✓ | ✓ | ✓ |

| GBP | ✓ | ✓ | ✓ |

| HKD | ✓ | ✓ | |

| HUF | ✓ | ||

| ILS | ✓ | ||

| JPY | ✓ | ✓ | |

| MXN | ✓ | ||

| NOK | ✓ | ||

| NZD | ✓ | ✓ | |

| PLN | ✓ | ||

| QAR | ✓ | ||

| RON | ✓ | ||

| SAR | ✓ | ||

| SEK | ✓ | ✓ | |

| THB | ✓ | ||

| TRY | ✓ | ||

| USD | ✓ | ✓ | |

| ZAR | ✓ | ||

Like any other e-wallet facility, the Amaze Wallet has an annual spending limit of S$30,000 per calendar year (spending via a card linked to Amaze does not count towards this limit). Your Amaze Wallet can hold a maximum of S$3,000 at any point in time.

Here’s how paying through the Amaze Wallet (and Revolut or YouTrip for that matter) compare to paying through Amaze + Credit Card.

| Amaze (via credit card) | Amaze Wallet, Revolut, YouTrip | |

| Mechanism | Credit | Debit |

| Lock in exchange rate | No | Yes |

| Earn credit card rewards | Yes | No |

| Annual limit | None | S$30K |

How do Amaze’s rates compare?

Based on my checks, the rates offered by Amaze are largely on par with competitors. Do note these reflect weekend rates; comparing weekday rates may yield a different outcome.

| 💰 Cost of 1 unit of foreign currency | |||

| Amaze | Revolut | YouTrip | |

| CHF | S$1.471 | S$1.472 | S$1.463 |

| EUR | S$1.453 | S$1.456 | S$1.447 |

| GBP | S$1.668 | S$1.672 | S$1.661 |

Also note that these are not the same rates you’ll get when spending via Amaze linked to a credit card. Those remain opaque, and you’ll only know after charging.

Amaze rates typically entail a small markup from Mastercard. It’s higher than before, but still worth using to earn 4 mpd overseas in my opinion.

What about ATM withdrawals?

Amaze has also added the ability to withdraw cash from ATMs, but their fee structure lags behind the competition.

| 💰 ATM Fees | ||

| Amaze | Revolut | YouTrip |

|

|

|

| Limit S$1K daily | Limit €3K daily | Limit S$5K daily |

Revolut offers S$350 of fee-free withdrawals on their free plan and YouTrip has a flat S$5 fee, but Amaze charges 2% of the transaction amount.

Therefore, if you’re looking for fair ATM fees, Revolut would be my first choice, followed by YouTrip and then Amaze a distant third.

What cards should I use with Amaze?

As a reminder, only Mastercard credit or debit cards can currently be paired with Amaze.

Ever since DBS nerfed Amaze transactions back in June, I’ve been pairing Amaze with following cards:

| Earn Rate | Cap | |

Citi Rewards Card Citi Rewards Card | 4 mpd1 | S$1K per s. month |

UOB Lady’s Card UOB Lady’s Card | 4 mpd2 | S$1K per c. month |

UOB Lady’s Solitaire UOB Lady’s Solitaire | 4 mpd3 | S$3K per c. month |

OCBC Titanium Rewards OCBC Titanium Rewards | 4 mpd4 | S$13.3K per m. year |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | 3 mpd5 | None |

| 1. All transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc) (T&Cs) 2. Pick 1: Beauty & wellness, dining, entertainment, family, fashion, transport (T&Cs) 3. Pick 2: Beauty & wellness, dining, entertainment, family, fashion, transport (T&Cs) 4. Clothes, bags, shoes and shopping (T&Cs) 5. Dining, shopping, travel, transport. Must spend at least S$800 on SIA Group transactions in a membership year (T&Cs) | ||

The Citi Rewards Card remains the most fuss-free option, offering 4 mpd on the first S$1,000 per statement month except on travel-related transactions.

Once that’s maxed out, I switch to the UOB Lady’s Solitaire Card (not available to men, but I use The MileLioness’), with dining and fashion as the two bonus categories. This is good for another S$3,000 worth of 4 mpd.

If I’m making a big ticket shopping purchase like a computer or other electronics, I’ll use the OCBC Titanium Rewards and take advantage of its 4mpd annual cap of S$13,335.

The KrisFlyer UOB Credit Card is more of an afterthought for me, but could still be useful for those who want a no-cap option.

Cashing out an Amaze Wallet balance

Instarem does not currently offer a cash out option for Amaze Wallet balances, but a simple workaround exists.

- Top up a GrabPay account using the Amaze Card (don’t forget to switch the payment source to Amaze Wallet before you do!)

- Withdraw the balance to a bank account

Remember: Amaze is considered a debit card, so any funds topped up from Amaze can be transferred to a bank account (unlike funds originating from a credit card).

Each GrabPay top-up must be at least S$10 and in whole dollars (i.e. no cents), but an easy way to zero out your Amaze Wallet is to top it up further with a card, then cash out the whole amount.

For example, suppose I have S$8.29 in my Amaze Wallet. This is insufficient for a GrabPay top-up, but I can:

- Top-up S$21.71 using my credit card (Amaze requires a minimum top-up of S$20)

- Use the S$30 Amaze Wallet balance to top-up GrabPay

- Cash out S$30 from GrabPay to my bank account

For avoidance of doubt, Amaze Wallet top-ups code as MCC 6540 (POI Funding Transactions), and will not earn rewards with any card in Singapore.

Conclusion

Amaze now offers a multi-currency debit card, just like Revolut and YouTrip. This gives customers the option to lock in a favourable rate for use in the future. Alternatively, they can continue to use their credit card as the funding source, in order to earn credit card rewards while enjoying competitive exchange rates.

Would you use Amaze as a Revolut/YouTrip substitute?

Hi, what is the point of pairing solitaire or titanium card with amaze when those card by itself already earn u those benefits you mentioned

For overseas spending. To avoid the FCY fee.

For overseas spend, so that you won’t incur the foreign currency transaction fee by the bank, but at the same time earn points as you would if u had spent locally.

Unless there was a massive move in the exchange rates (like recently when the GBP had a big drop before recovering), I don’t see the point. You might as well just charge at the time of the transaction to the linked credit card and get the benefits that brings. If you are really smart enough to predict exchange rate movements, and can make money from that, I am sure you will be achieving that by other means than moving $2k or $3k to an Amaze wallet.

Agree! I prefer not to have a wallet as there will be small amounts of money left over after the trip. That’s why I still prefer Amaze over Youtrip although the conversion rate may not be as good as Youtrip.

Locking money up in these wallets these days is the dumbest thing you can do these days. Interest rates are sky high and time value of money is sky high as well. If you want to speculate on directionality there are far better ways to do it.

Why compare Revolut rates on the weekend when you know they’ll be worse? During the week they are better than Amaze and for the currencies I use better than Youtrip. Revolut clearly states they charge a 1% markup on the weekend. Seems disingenuous even with the disclaimer.

Because I wrote the article on a weekend.

Hello! Is it true that offline transactions charged to Amaze become online transactions for the underlying credit/debit card? I’ve tried multiple times —linking to my UOB KFCC— but UOB didn’t give me 3mpd for my in-store Amaze shopping transactions at Cartier Tokyo and Paris. The bank insisted these would be awarded 1.2mpd just like any other regular spend while online shopping should have been eligible for 3mpd. The customer service agent didn’t mention anything about the bonus 1.8mpd at all. UOB KFCC’s own t&c states: Online shopping includes card transactions made at fashion websites that sells clothes, shoes, jewellery, accessories… Read more »

Did you spend at least 500sgd on SIA transactions? Also, bonus miles i.e. the remaining 1.2 mpd only gets posted 2 months after the end of the membership year.

Yes, I’ve long exceeded the min. spend on SIA transactions. I called the bank to ask how many miles the transactions would earn; they replied me with the calculation method but overall gist is it’s still 1.2mpd. The customer service agents didn’t mention anything about the transactions earning bonus 1.8mpd :/

I go for WISE instead. Very established than major competitors. You even have US and EURO bank account number which let you received funds in US and EURO. So, a no thank you for the the unamused Amaze.