There’s no sugarcoating the truth: Standard Chartered’s credit card rewards programme is a hot, steaming mess, a labyrinth designed by the devil himself.

“Do Standard Chartered rewards points pool? Why are there two conversion rates? Why can’t I transfer points to KrisFlyer? Why can’t I transfer points to anything other than KrisFlyer?”

These are questions that flood my inbox with alarming regularity, and while it’s frustrating to read the same thing over and over again, the blame lies squarely with Standard Chartered. This bank has one of the most convoluted rewards systems I’ve ever seen, almost as if someone’s KPI was to make things as confusing as possible.

Here’s my best attempt at explaining things.

Two rewards currencies

On the surface, Standard Chartered only has a single rewards currency: 360° Rewards Points.

However, it’s much better if you think of two different currencies, following two different sets of rules:

- 360° Rewards Points earned on SC Visa Infinite (both the regular & Priority Banking version) & Journey

- 360° Rewards Points earned on all other SC cards

| 360° Points (SC Visa Infinite & Journey) |

360° Points (All other SC cards) |

|

| Conversion Fee | S$27 per conversion |

|

| Expiry? | No expiry | Up to 3 years |

| ✈️ For KrisFlyer Conversions |

||

| Conversion Rate |

25,000 pts = 10,000 miles | 34,500 pts. = 10,000 miles |

| Points Pool? |

Yes, but not with all other SC cards | Yes, but not with SC Visa Infinite & Journey |

| ✈️🏨 For All Other Partners | ||

| Conversion Rate |

2,500 -5,000 pts. = 1,000 miles/points | |

| Points Pool? |

Yes | |

First, the easy bits:

- Regardless of which card they’re earned on, all 360° Rewards Points conversions attract a flat fee of S$27 (some SC webpages have not been updated, and still quote the pre-GST hike figure of S$26.75)

- 360° Rewards Points earned on the SC Visa Infinite & Journey do not expire, while 360° Rewards Points earned on all other SC cards are valid for up to three years (“up to” three years, not three years!)

If you’re wondering why the Journey gets special treatment, it’s because it used to be the X Card (remember that?), with a Visa Infinite badge. It was downgraded to Visa Signature when it became the Journey, but StanChart kept the points on the Visa Infinite system to avoid devaluing customer’s past earnings. That at least makes them better than BOC!

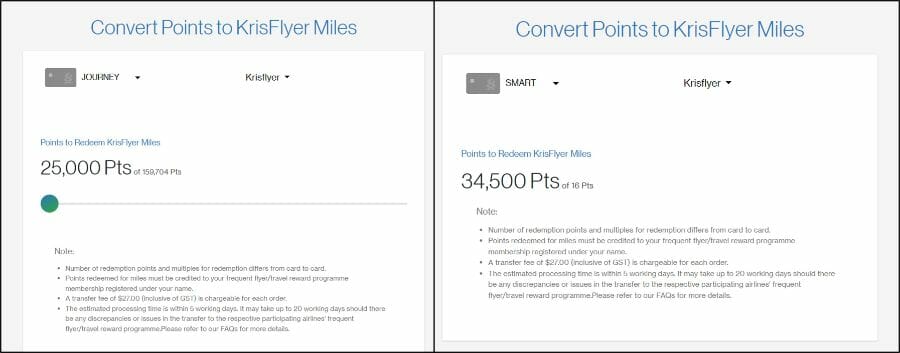

For KrisFlyer conversions

Here’s where it gets more complicated.

360° Rewards Points earned on the SC Visa Infinite & Journey:

- Can be converted to KrisFlyer miles at a rate of 25,000 points = 10,000 miles

- Pool among each other

- Do not pool with 360° Rewards Points earned on all other SC cards

360° Rewards Points earned on all other SC cards:

- Can be converted to KrisFlyer miles at a rate of 34,500 points = 10,000 miles

- Pool among each other

- Do not pool with 360° Rewards Points earned on the SC Visa Infinite & Journey

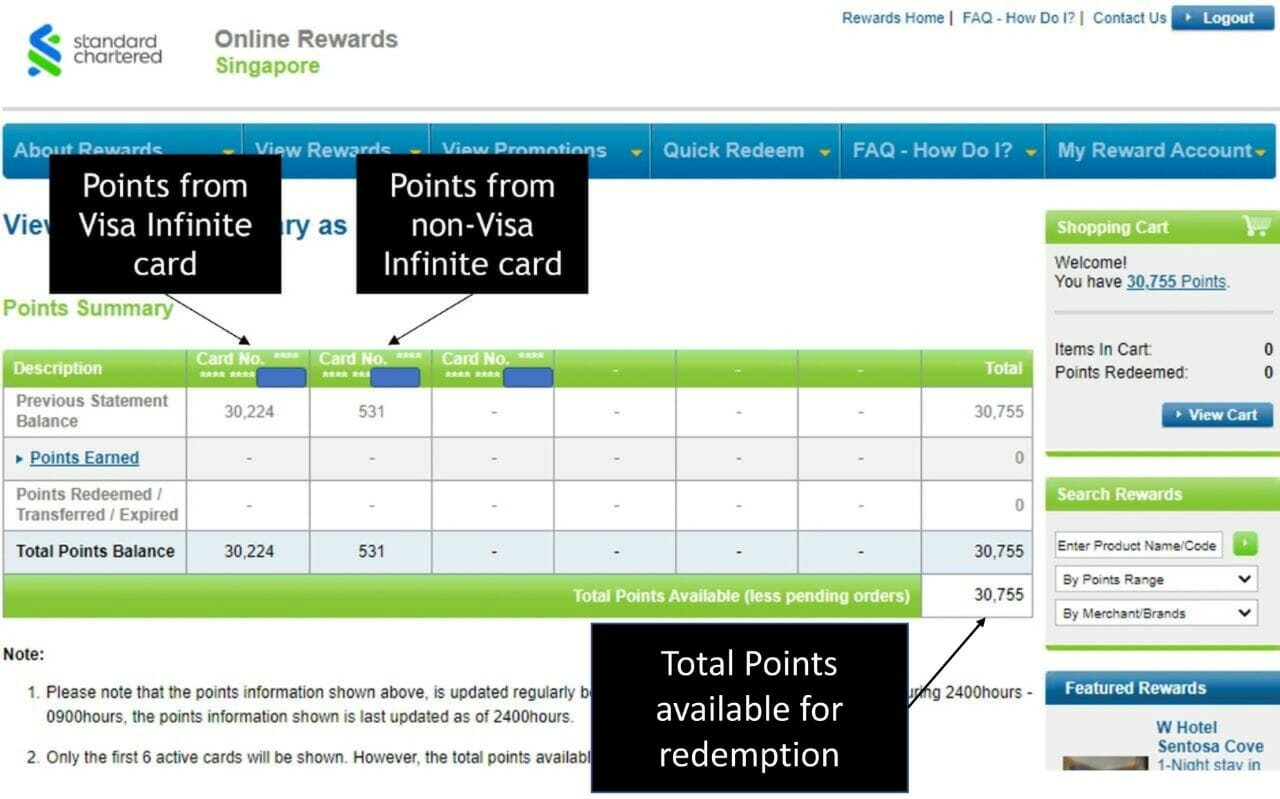

For example, if I have:

- 26,000 points (SC Visa Infinite)

- 24,000 points (SC Journey)

- 34,000 points (SC Rewards+)

- 35,000 points (SC Smart)

I can redeem a total of 50,000 points (Visa Infinite & Journey) for 20,000 KrisFlyer miles, and I can redeem a total of 69,000 points (Rewards+ & Smart) for 20,000 KrisFlyer miles. What I can’t do is pool the SC Visa Infinite and SC Rewards+ points, or SC Journey and SC Smart points.

I have no idea why Standard Chartered would complicate things like this. Even if you want to give Visa Infinite & Journey cardholders a favourable rate, couldn’t you just build that into the earn side? Why further complicate matters with a two-tiered redemption system?

| 🔎 In case you were wondering… |

|

It used to be the case that all StanChart 360° Rewards Points would pool, regardless of which card they were earned on. Therefore, an SC Smart Card customer could “enhance” the value of his points by applying for an SC Visa Infinite or SC X Card, and tapping the more favourable rate for his pooled balance.

Now that there is no co-mingling of points across the two “currencies”, this is no longer possible. |

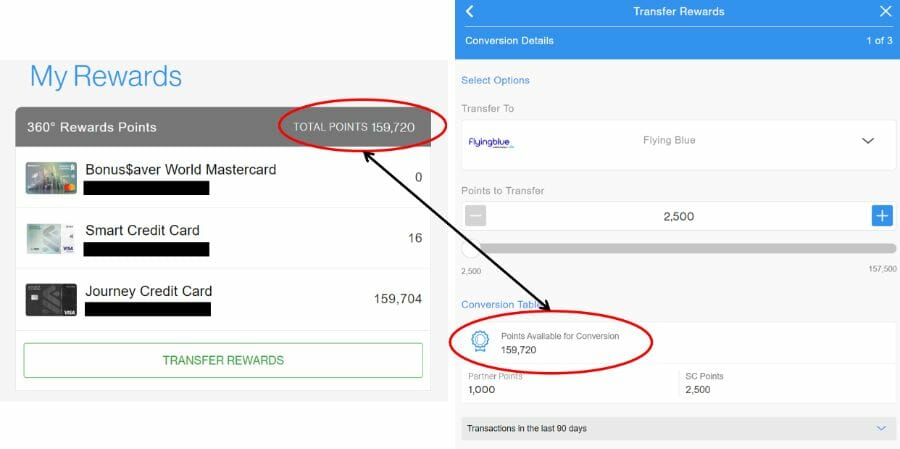

For all other partners

Mercifully, it’s a simpler situation for all other transfer partners.

360° Rewards Points earned on all SC cards:

- Can be converted to nine different airline and hotel programmes at a rate of 2,500-5,000 points =1,000 miles/points, depending on programme

- Pool among each other

As the screenshot below shows, the 16 points on my Smart Card and 159,704 points on my Journey Card are all combined into a single balance of 159,720, which can be redeemed for any airline and hotel programme except KrisFlyer.

Two rewards platforms

But wait, we’re not done yet!

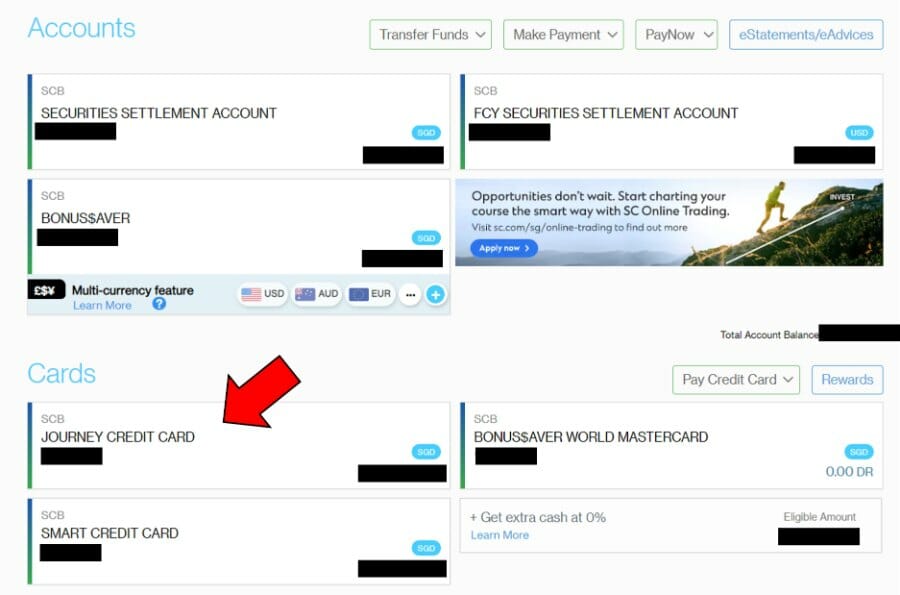

Now that you understand how the two currencies work, you need to learn about Standard Chartered’s two different rewards platforms:

| 🖥️ Desktop | 📱Mobile App | |

| SC 360° Rewards (for KrisFlyer) |

✓ | ✓* |

| SC EasyRewards (for all other partners) |

✓ | |

| *Via in-app browser | ||

| 📱 SC EasyRewards on Mobile App |

|

While Standard Chartered’s official documentation suggests that SC EasyRewards can be accessed through the SC Mobile app, this is no longer true. The latest version of the SC Mobile app has removed the EasyRewards functionality. Tapping the “Rewards” button in the app simply opens the SC 360° Rewards page in the in-app browser. Don’t take it from me- just read the rash of 1-2 star reviews ever since the app was updated. Terrible UI, random in-app advertisements, non-intuitive menus…who dreamed this up? |

Since EasyRewards is not available on the mobile app, I’ll show you how to navigate to both portals from your desktop computer.

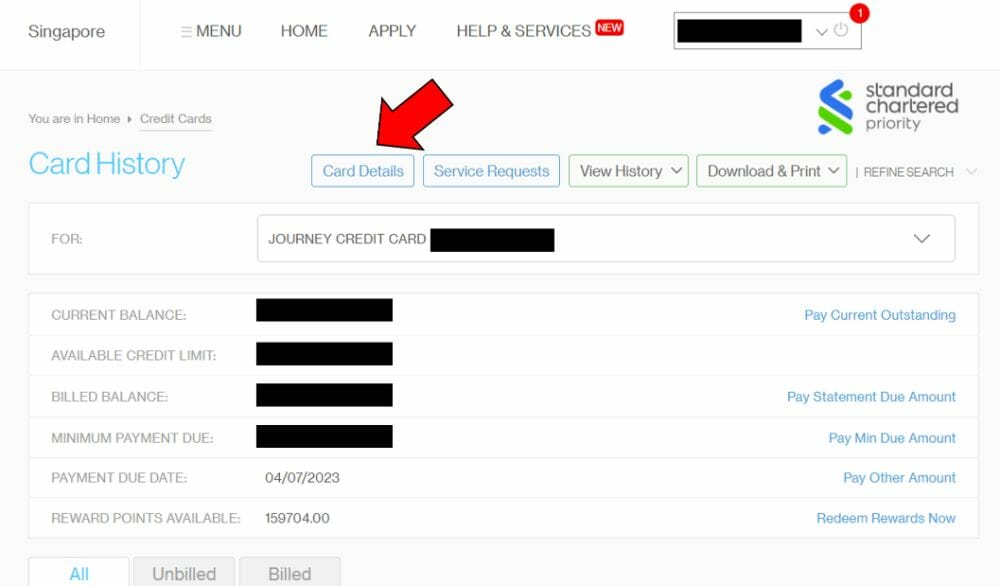

First, login to internet banking and click on your credit card.

Next, click on the ‘Card Details’ button.

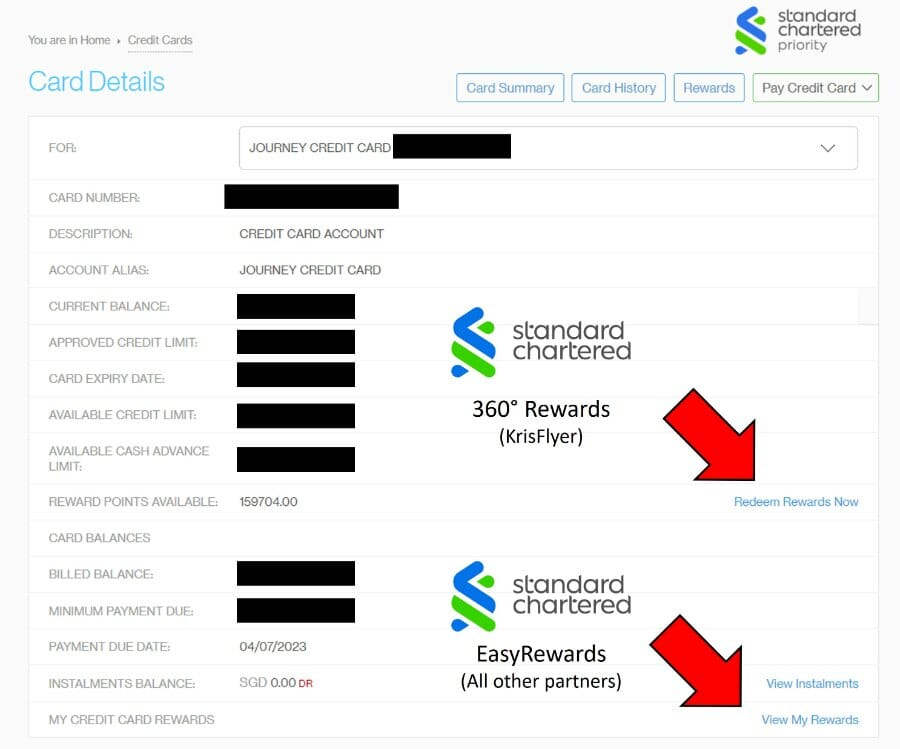

This expands the interface, showing you two options:

- Redeem Rewards Now (which brings you to SC 360° Rewards)

- View My Rewards (which brings you to SC EasyRewards)

At the risk of sounding like a broken record, this is needlessly confusing. If you must use two different rewards portals, why not modify the labels so it’s clearer what’s found where?

It’s because of this that so many customers go away thinking that StanChart no longer offers conversions to KrisFlyer (because they end up on the EasyRewards portal), or that StanChart no longer offers anything but KrisFlyer (because they end up on the 360° Rewards portal).

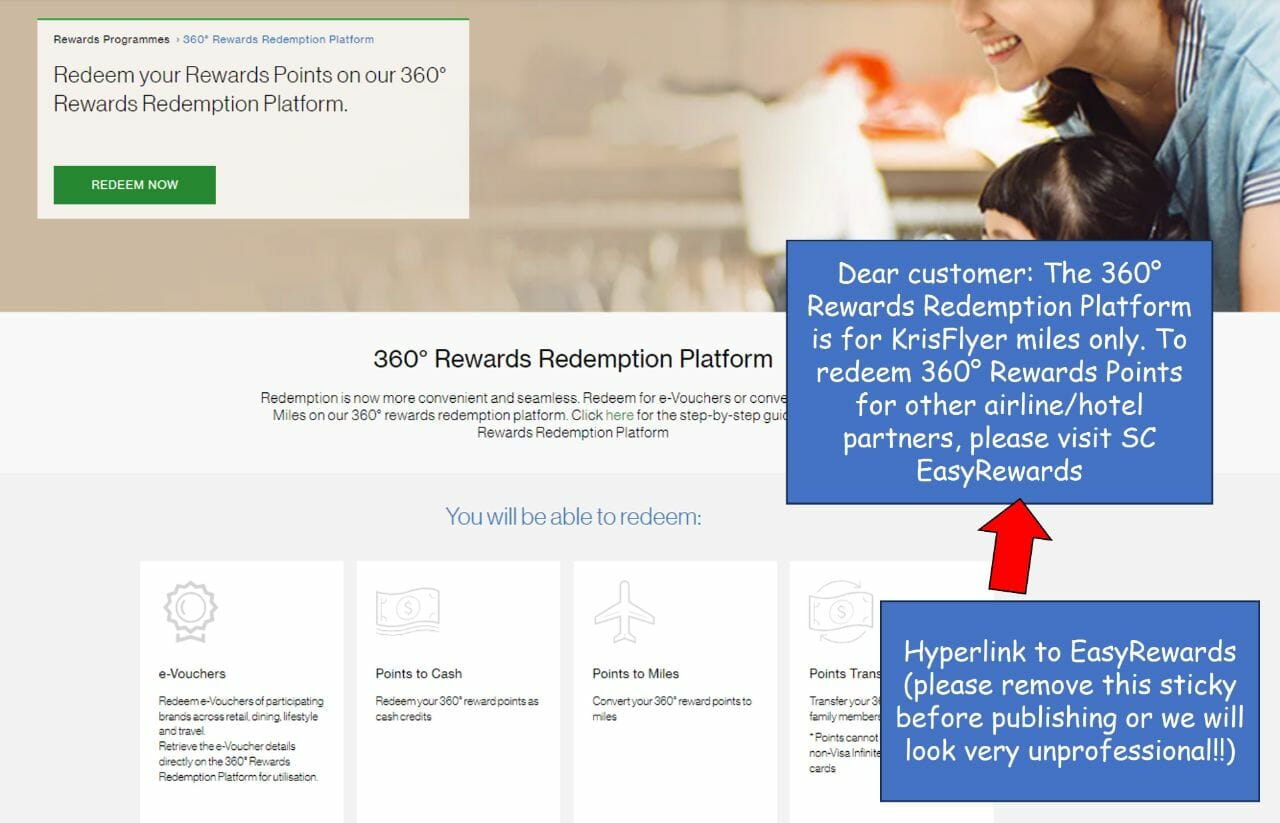

SC 360° Rewards

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| Visa Infinite & Journey | All others | |

|

25,000 : 10,000 | 34,500 : 10,000 |

As we covered previously, the 360° Rewards portal is for redeeming KrisFlyer miles only. The conversion rate depends on what type of SC card you hold.

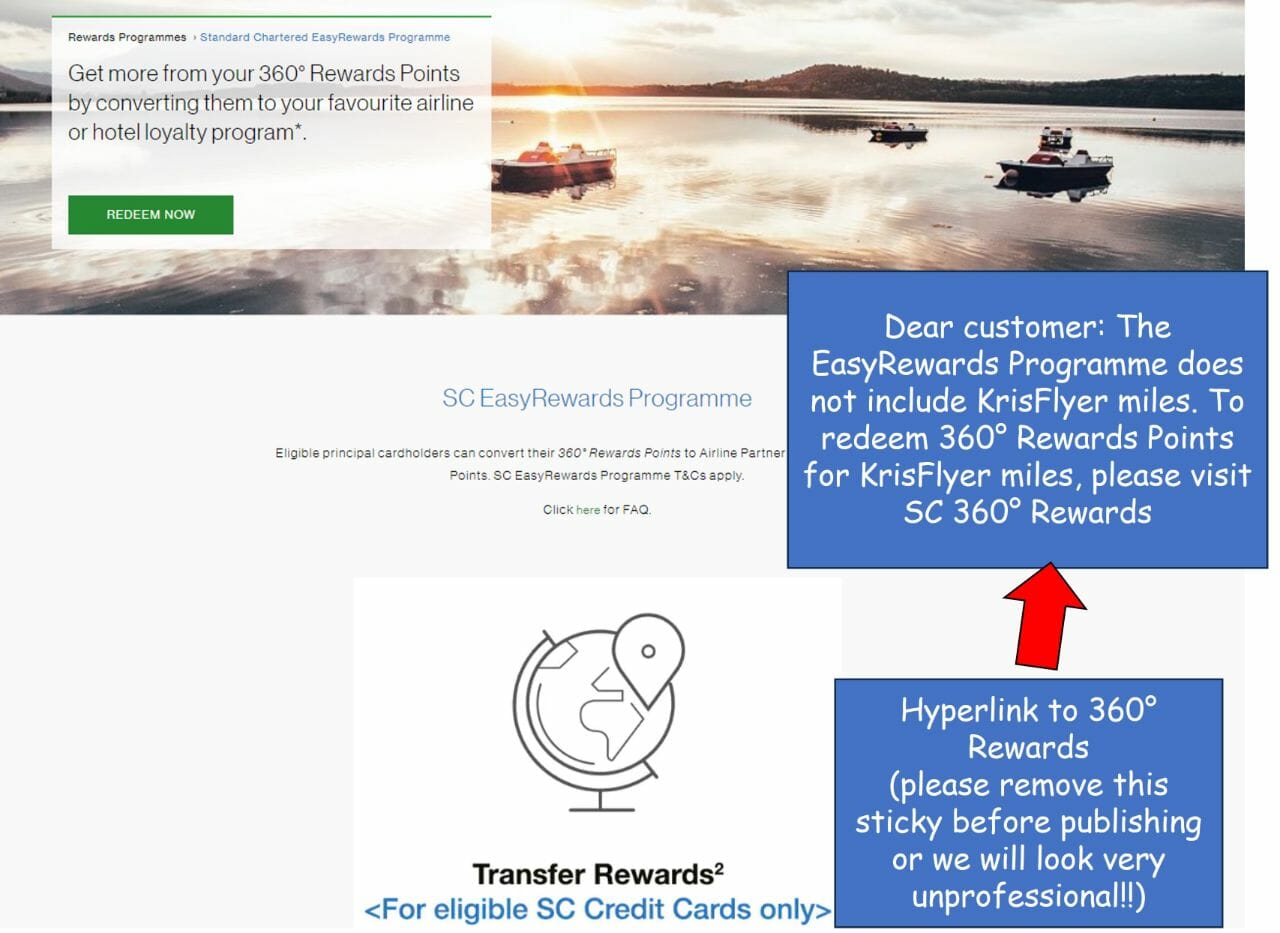

SC EasyRewards

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 3,000 : 1,000 |

||

| 3,500 : 1,000 |

||

| 3,500 : 1,000 |

||

|

3,500 : 1,000 |

|

| 5,000 : 1,000 |

||

All other airline and hotel loyalty programmes can be found on the SC EasyRewards portal, where all SC cards follow the same conversion rates for a given programme.

Conclusion

Standard Chartered’s rewards system is a thing of beauty. Not content to have two identically-named-but-actually-different points currencies, the bank also splits its transfer partners across two different portals.

Even if your IT setup or other contractual issues prevents you from displaying KrisFlyer on the same portal as the other loyalty programmes (for context, KrisFlyer was a legacy SC rewards partner, while the other programmes were brought onboard through Ascenda Loyalty), how hard would it be to add a simple text-based note explaining things?

Look, I’ve even done it for you.

On the SC 360° Rewards landing page:

On the EasyRewards landing page:

You’re welcome; the invoice is in the post.

Thanks for the article Aaron. I recently tried to cancel my X/Journey card with Stan Chart. I was told I would risk losing the miles earned on that card (not much, maybe 5000 miles) — and then asked how to redeem from the pooled 360 rewards (mixed in with Visa Infinite) to redeem first the X/Journey miles. SCB rep had no idea — although reading the fine print, it seems that once pooled into the 360 Rewards world, Visa Infinite and X/Journey miles are indistinguishable … so cancelling the Journey card (but keeping my Visa Infinite) should not result in… Read more »