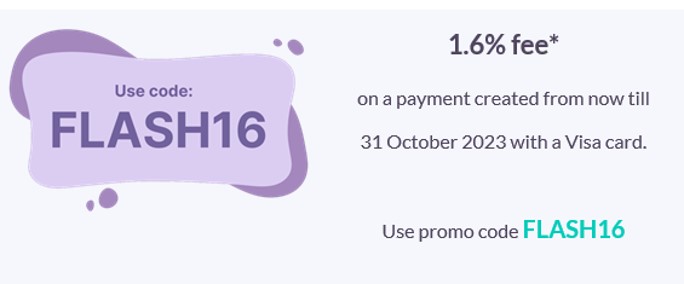

CardUp has launched a new flash deal that offers existing customers a 1.6% fee on a single payment of up to S$10,000 made by 31 October 2023.

This deal is available for Visa cards only, and you could be buying miles for as little as 0.98 cents each, depending on which card you hold.

CardUp 1.6% flash deal

Here’s the key details of CardUp’s 1.6% flash deal for Visa cards:

- Use code FLASH16

- Payments must be scheduled by 31 October 2023 (before 6 p.m SGT), with a due date on or before 3 November 2023. Payments must be scheduled at least three business days in advance of the due date to allow for processing time

- No cap on the overall number of redemptions, but the promo code can only be used once per user

- No minimum spend

- Maximum payment of S$10,000; a 2.6% fee will apply to any part of the payment exceeding S$10,000

- Valid for Singapore-issued Visa cards only

This code is valid for existing CardUp users. If you’re a new user, refer to the offers in the box below.

| ❓ First-time user? |

|

New CardUp users can use the code FLASH15 to enjoy a 1.5% fee on their first payment of up to S$10,000 with a locally-issued Visa card. This code must be used by 31 October 2023 by 6 pm (SGT) for a payment with due date on or before 3 November 2023. Alternatively, you can use the code MILELION to save S$30 off your first transaction with no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%). |

While there’s technically no restriction on the type of payments you can make, you won’t be able to use this code for income tax payments. That’s because the code is only valid from 27-31 October 2023, and CardUp blocks off the last few days of each month in order to ensure payments reach IRAS on time (and avoid double deductions, for those using GIRO arrangements).

Terms & Conditions

The T&Cs of this offer can be found here.

What’s the cost per mile?

Here’s the cost per mile for various Visa cards in Singapore, given their earn rates and a 1.6% admin fee.

| Card | Earn Rate | Cost Per Mile (1.6% fee) |

DBS Insignia DBS Insignia |

1.6 | 0.98 cents |

UOB Reserve UOB Reserve |

1.6 | 0.98 cents |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 0.98 cents |

Citi ULTIMA Citi ULTIMA |

1.6 | 0.98 cents |

DBS Vantage DBS Vantage |

1.5 | 1.05 cents |

SCB VI SCB VI |

1.4* | 1.12 cents |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.12 cents |

UOB VI Metal Card UOB VI Metal Card |

1.4 | 1.12 cents |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.21 cents |

OCBC 90°N Visa OCBC 90°N Visa |

1.3 | 1.21 cents |

DBS Altitude Visa DBS Altitude Visa |

1.3 | 1.21 cents |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 | 1.23 cents |

SCB Journey SCB Journey |

1.2 | 1.31 cents |

Remember: both the amount due and the CardUp fee are eligible to earn miles.

For example, someone who pays a S$1,000 bill via CardUp would pay S$1,016 after fees. If he uses a 1.6 mpd card, he will earn 1,626 miles (ignoring rounding), for which he has paid a fee of S$16. The cost per mile is therefore 0.98 cents each.

That’s a very competitive price to buy miles, though the catch is that the flash deal promo code maxes out at S$10,000.

Citi PayAll alternative

|

| Citi PayAll 1.8 mpd Promo |

CardUp’s eDM takes a not-so-subtle dig at Citi PayAll (“Do you feel frustrated paying 2.2% fees with Citi PayAll?”), but the latter may still be the cheaper option.

From now till 29 February 2024, Citi PayAll is offering a flat 1.8 mpd on Citi PayAll transactions, subject to a minimum aggregate spend of S$8,000 and a cap of S$120,000.

This works out to buying miles at 1.22 cents each, as shown in the table below.

| Card | Earn Rate | Cost Per Mile (@ 2.2% fee) |

Citi ULTIMA Citi ULTIMA |

1.8 mpd (Base: 1.6 mpd Bonus: 0.2 mpd) |

1.22 cents |

Citi Prestige Citi Prestige |

1.8 mpd (Base: 1.3 mpd Bonus: 0.5 mpd) |

1.22 cents |

Citi PremierMiles Citi PremierMiles |

1.8 mpd (Base: 1.2 mpd Bonus: 0.6 mpd) |

1.22 cents |

Citi Rewards Citi Rewards |

1.8 mpd (Base: 0.4 mpd Bonus: 1.4 mpd) |

1.22 cents |

Anyone whose Visa card earns at least 1.3 mpd will be better off using CardUp, but remember that the CardUp offer is single use only, capped at S$10,000. Once you’ve redeemed the flash deal, then the Citi PayAll promotion becomes the best option for the rest of your bills up till 29 February 2024, thanks to its much higher cap.

For more details on this offer, refer to this post.

CardUp guide

I’ve written a separate guide that walks you through the basics of CardUp, together with answers to FAQs regarding rewards and what cards give the lowest-cost miles. You’ll also find a list of ongoing promo codes that can help you save money, so be sure to give it a read.

Conclusion

From now till 31 October 2023, CardUp is offering a 1.6% flash deal for any payment made with a locally-issued Visa card. This reduces the cost per mile to as little as 0.98 cents each, for a single payment of up to S$10,000.

If you have any upcoming bill payments, it might be worth checking whether you can squeeze it into this small window of opportunity.