Here’s The MileLion’s review of the American Express Platinum Credit Card, the entry rung of the Platinum hierarchy.

But don’t let that lowly positioning deter you— with all the nerfs to the AMEX Platinum Charge, and the continued neglect of the AMEX Platinum Reserve, this could very well be the new star of the Platinum family.

With perks like Love Dining, a S$200 annual Lifestyle Credit, Comoclub C4 status, and a welcome offer that basically takes 75% off the annual fee, there’s a lot to like here.

AMEX Platinum Credit Card AMEX Platinum Credit Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| With Love Dining & Chillax, a S$200 annual credit, and 75% off the first year’s annual fee, the AMEX Platinum Credit Card could offer the best value in the Platinum lineup. | |

| 👍 The Good | 👎 The Bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: AMEX Platinum Credit Card

|

|||

| Apply | |||

| Income Req. | Not stated* | Points Validity | No expiry |

| Annual Fee | S$327 |

Min. Transfer |

450 MR points (250 miles) |

| Miles with AF | – | Transfer Partners | 11 |

| FCY Fee | 3.25% | Transfer Fee | None |

| Local Earn | 0.69 mpd | Points Pool? | Yes |

| FCY Earn | 0.69 mpd | Lounge Access? | No |

| Special Earn | 3.47 mpd on 10Xcelerator merchants | Airport Limo? | No |

| *AMEX no longer publishes minimum income requirements for any of its cards | |||

| Cardholder Terms and Conditions | |||

The AMEX Platinum Credit Card suffers from something of an identity crisis, because American Express has three different Platinum cards with similar-sounding names.

| Card | Annual Fee | Earn Rate |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

S$327 | 0.69 mpd |

AMEX Platinum Reserve AMEX Platinum Reserve |

S$545 | 0.69 mpd |

AMEX Platinum Charge AMEX Platinum Charge |

S$1,744 | 0.78 mpd |

Don’t mix them up! The AMEX Platinum Credit Card is the entry-level offering, two rungs below the AMEX Platinum Charge and one rung below the AMEX Platinum Reserve. All three cards have very different features and benefits.

How much must I earn to qualify for an AMEX Platinum Credit Card?

American Express no longer publishes any official income requirement for its credit cards, instead stating that all applications are “subject to internal review”.

The last published minimum requirement for the AMEX Platinum Credit Card was S$80,000, but don’t let that deter you. Remember: any income requirement above S$30,000 is essentially arbitrary (it can affect the credit limit granted, but not approval per se), and there are plenty of reports of customers getting approved with incomes closer to the S$30,000 mark.

| 💡 A bit of history… |

|

Speaking of income requirements, the AMEX Platinum Credit Card caused quite a stir when it first launched in Singapore back in 2004.

Up till then, the idea of “platinum” was sacrosanct. Most cards carrying the label had a minimum income requirement of S$100,000, or were by invitation only. But the AMEX Platinum Credit Card halved that to a mere S$50,000- the industry average for a gold card at the time. That led one advertising executive to dismiss it as a “white gold card” that would “taint the appeal of other platinum credit cards among society’s creme de la creme”. AMEX disputed that assessment, of course, saying they expected the average Platinum Credit Card holder to earn close to S$125,000 a year. Eager to dispel notions that it might be a poor man’s platinum, its advertisements marketed it as a heavyweight offering. One showed the card weighing down a man’s suit pocket, another showed the card in a handbag bending a chair out of shape (either that, or someone really needs Jenny Craig). Lifestyle perks included complimentary golf, a Feed at Raffles membership (remember that?), and spa packages. But maybe that executive was right after all, because today, the “platinum” tag is essentially worthless- anyone can get a Visa Platinum debit card without so much as earning a penny. |

How much is the AMEX Platinum Credit Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$327 | First 2 free, S$163.50 for 3rd onwards |

| Subsequent | S$327 | First 2 free, S$163.50 for 3rd onwards |

The AMEX Platinum Credit Card has an annual fee of S$327 for the principal cardholder. The first two supplementary cards are free for life, and the third onwards costs S$163.50.

The first year’s annual fee is non-waivable, but in subsequent years, a waiver may be granted at AMEX’s discretion. However, if the fee is waived, you won’t receive the S$200 annual Lifestyle Credit.

Some cardholders have reported being offered 30,000 Membership Rewards points (equivalent to 16,667 airline miles) for paying the annual fee—a compelling offer, as the value of the points and Lifestyle Credit combined can easily exceed the cost of the fee.

What sign-up bonus or gifts are available?

AMEX Platinum Credit Card AMEX Platinum Credit Card(Offer Ends: 28 May 25) |

|

| Apply | |

| New & Existing AMEX Customers | |

| Annual Fee | S$327 (must be paid) |

| Spend | S$1,000 |

| Spend Period | 30 days |

| Welcome Bonus | S$250 |

American Express is currently offering a welcome gift of S$250 cashback for new cardholders who spend at least S$1,000 within the first 30 days of approval. This effectively offsets ~75% of the first year’s S$327 annual fee, reducing the cost to just S$77.

This offer is available to both new and existing AMEX cardholders; the only condition is that you must not have cancelled a principal AMEX Platinum Credit Card in the past 12 months. For the avoidance of doubt, you will be eligible for this offer even if you cancelled a principal AMEX Platinum Charge or AMEX Platinum Reserve in the past 12 months, as they are distinct products.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 0.69 mpd | 0.69 mpd | 3.47 mpd on 10Xcelerator merchants |

SGD/FCY Spend

AMEX Platinum Credit Cardholders earn:

- 2 MR points per S$1.60 spent in Singapore Dollars (0.69 mpd)

- 2 MR points per S$1.60 spent in foreign currency (FCY) (0.69 mpd)

These are rather underwhelming rates, given that most general spending cards earn 1.2-1.6 mpd, and you shouldn’t be using this card for day-to-day spend.

All foreign currency transactions are subject to a 3.25% fee, on par with the rest of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

10Xcelerator merchants

|

| AMEX 10Xcelerator |

AMEX Platinum Credit Card cardholders earn 10 MR points per S$1.60 (3.47 mpd) at 10Xcelerator merchants (formerly known as Platinum EXTRA). There is no minimum spend necessary, and no cap on the bonus that can be earned.

10Xcelerator merchants include, among others:

- 1-Group restaurants (1-Atico, Bee’s Knees, Botanico, Monti, Sol & Luna, UNA and more)

- IWC

- Lee Hwa Jewellery

- Miele

- PARKROYAL COLLECTION Pickering

- PARKROYAL COLLECTION Marina Bay

- Samsonite

- Tag Heuer

- The Hour Glass

- Venchi

- Watches of Switzerland

While other cards such as the UOB Preferred Platinum Visa and UOB Visa Signature could earn 4 mpd, the key advantage of the AMEX Platinum Credit Card is the absence of a bonus cap, as well as its wider range of transfer partners.

To learn more about the 10Xcelerator programme, refer to my guide below.

When are MR points credited?

Base and bonus MR points are credited when your transaction posts, which generally takes 1-3 working days.

How are MR points calculated?

Here’s how you can work out the MR points earned on your AMEX Platinum Credit Card.

| Base Points | Divide transaction by 1.6, then round down to the nearest whole number. Multiply by 2 |

| 10Xcelerator |

Divide transaction by 1.6, then round down to the nearest whole number. Multiply by 8 |

This means the minimum spend required to earn miles is S$1.60.

If you’re an Excel geek, here’s the formulas you need to calculate your points:

| Base Points | =ROUNDDOWN(X/1.6,0)*2 |

| 10Xcelerator |

=ROUNDDOWN(X/1.6,0)*8 |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for MR points?

A full list of exclusions can be found in this document, under Section 3: American Express Cards enrolled in the Membership Rewards Programme.

The key exclusions to note are:

- Charitable donations

- Education

- GrabPay top-ups

- Insurance premiums

- Public hospitals

- SimplyGo

- Utilities

CardUp transactions will earn points with the AMEX Platinum Credit Card, though given the 0.69 mpd rate and a 2.6% fee, there are far better options.

What do I need to know about MR points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | Yes | N/A |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 450 MR points (250 miles) |

11 | Instant (KrisFlyer) |

Expiry

MR points earned on the AMEX Platinum Credit Card never expire, so long as the card account remains active.

Pooling

MR points earned across different American Express cards are pooled, but it’s slightly complicated.

If you hold an AMEX Platinum Credit Card and an AMEX Platinum Charge, there are two possibilities.

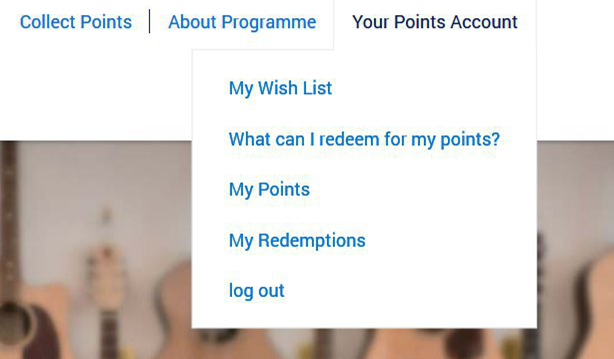

(1) Some people will see their points pooled automatically on the back end. If you’re in this situation, the drop down menu for “Your Points Account” will look like this.

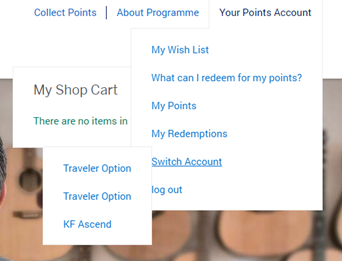

(2) Some people will not see their points pooled on the back end. Instead, they’ll have one points account for their AMEX Platinum Charge, and another points account for their AMEX Platinum Credit Card. If you’re in this situation, the drop down menu for “Your Points Account” will have a “Switch Account” button to toggle between points balances.

In this case, you can call up customer service to get your points manually combined and transferred at the more advantageous 400 MR points = 250 miles rate (see below)

Transfer Partners & fees

American Express has 11 airline and hotel transfer partners, with MR points transferring at the following ratios:

| Programme | Conversion Ratio (MR Points: Partner) |

| 450:250 | |

| 450:250 | |

| 450:250 | |

| 450:250 | |

| 450:250 | |

|

450:250 |

| 450:250 | |

| 450:250 | |

| 450:250 | |

|

1,000:1,000 |

|

1,000:1,250 |

All transfers are free of charge.

If you happen to hold the AMEX Platinum Credit Card and AMEX Platinum Charge at the same time, you can transfer all your MR points to the nine airline partners at a preferential rate of 400 MR points = 250 miles.

Transfer ratios for hotel partners remain the same regardless of card.

Transfer Times

The time taken to transfer points depends on programme. Based on my personal experience:

- KrisFlyer: Instant

- Qantas Frequent Flyer: Instant

- EVA Air Infinity MileageLands: Within 24 hours

- British Airways Executive Club: Within 36 hours

- Asia Miles: Within 48 hours

Other card perks

S$200 annual Lifestyle Credit

|

| Participating Merchants |

Principal AMEX Platinum Credit Cardholders enjoy an annual S$200 Lifestyle credit, which is disbursed as 2x half-yearly S$100 credits:

- Valid from 1 January to 30 June: S$100 credit

- Valid from 1 July to 31 December: S$100 credit

Guide: AMEX Platinum Credit Card S$200 annual lifestyle credit

Annual registration and enrolment is required, and can be done here or on the AMEX Experiences app.

The credit can be used with a minimum spend of S$100 in a single transaction at any participating merchant. For example, a single transaction of S$120 would trigger the credit, but two separate transactions of S$60 would not. Unused credits are not rolled over to the next period, so use it or lose it!

Lifestyle Credits can be spent at any of the following dining and retail outlets.

Dining

| 🍽️ Lifestyle Credit: Restaurant | |

| Hotel Dining | Restaurant Dining |

|

|

Retail

| 👗 Lifestyle Credit: Fashion | |

|

|

| *Also 10Xcelerator partner | |

Remember that Lifestyle Credits are refreshed based on calendar date, which won’t be a perfect overlap with your membership year. So, for example, if your AMEX Platinum Credit Card is approved in April 2025, you’ll get:

- S$100 Lifestyle Credit to spend by 30 June 2025 (issued after registration is complete)

- S$100 Lifestyle Credit to spend by 31 December 2025 (issued on 1 July 2025)

- S$100 Lifestyle Credit to spend by 31 March 2026 (issued on 1 January 2026)

This effectively allows you to use S$300 worth of credits in your first membership year.

| ❓ Why 31 March 2026? |

|

Why must the final S$100 Lifestyle Credit be spent by 31 March 2026? In my example, I’m assuming you don’t renew your card for a second year, so you’ll need to use your Lifestyle Credit by the month prior to renewal, which in this case is March 2026 (using your credits in the month of renewal can be risky, as explained here). |

Comoclub C4 membership

| Comoclub C4 membership |

Both principal and supplementary AMEX Platinum Credit Cardholders are eligible for a complimentary 12-month Comoclub C4 membership.

This includes year-round discounts at Como shopping and dining outlets, but the real perk are the birthday treats. In your birthday month, you will receive S$130 of vouchers (all of which have no minimum spend):

- S$100 shopping spree at Club21, Kids21 or DSM Singapore

- S$20 dining voucher for Como restaurants

- S$10 voucher for SuperNature and Glow Café

The catch is that Comoclub birthday treats are no longer awarded to members who were fast-tracked after 1 January 2025. If your fast-track was processed before this date, you’ll continue to receive birthday treats without having to meet any spending requirement, but otherwise the ship has sailed.

Love Dining by Platinum

|

| Hotels |

| Restaurants |

Both principal and supplementary AMEX Platinum Credit Card cardholders enjoy Love Dining benefits, with up to 50% off food (not beverages) at more than 30 restaurants and hotels across Singapore.

| 🍽️ AMEX Love Dining Discount | |

| Number of Diners | Discount on Food Bill |

| Card member | 15%* |

| Card member + 1 guest | 50% |

| Card member + 2 guests | 35%^ |

| Card member + 3 guests | 25% |

| Card member + 4-9 guests (hotels) or 4-19 guests (restaurants) | 20% |

| *10% at Fairmont Singapore, Swissotel The Stamford, Paradox Singapore Merchant Court ^33% at Fairmont Singapore, Swissotel The Stamford, Paradox Singapore Merchant Court |

|

The current list of participating restaurants can be found below:

|

|

| 👨🍳 Restaurants (26) | |

|

|

| T&Cs | |

| 🏨 Hotels (50) | |

|

|

| T&Cs | |

| *No Love Dining @ Hotels savings available; cardholders instead enjoy 20% off total bill ^No Love Dining @ Hotels savings available; cardholders instead enjoy 35% off total bill |

|

Each diner must order at least one qualifying food item (usually a main course) to enjoy the discount. Blackout dates apply, namely public holidays and eve of public holidays, plus special occasions like Valentine’s Day.

What I like about Love Dining is that it’s not 1-for-1, it’s 50% off. With 1-for-1, you only get the cheaper item free, and everything else you buy is at the regular price. With 50% off, you save on everything (except drinks)- appetisers, mains, desserts. No more feeling compelled to order a more expensive item because your partner did, and at more upscale restaurants, the savings can easily add up to S$100+ per visit.

For more on the Love Dining programme, refer to my detailed guide below.

Chillax

|

| Chillax |

AMEX Platinum Credit Card cardholders enjoy 1-for-1 drinks and special offers with Chillax at participating bars:

|

|

| 🍸 Participating Bars | |

|

|

Platinum Regional Golf Programme

AMEX Platinum Credit Card members enjoy complimentary green fees at more than 40 golf clubs in Singapore, Cambodia, Indonesia, Malaysia, Philippines, Thailand, and Vietnam.

- Weekday visits require one paying guest (total two players) to enjoy complimentary green fees

- Weekend visits require two paying guests (total three players) to enjoy complimentary green fees

Participating clubs in Singapore include Orchid Country Club, Sembawang Country Club, and Warren Golf & Country Club. A complete list can be found here.

Return guarantee benefit and purchase protection

Items purchased with the AMEX Platinum Credit Card are eligible for complimentary return guarantee benefit and purchase protection.

- Return guarantee: If an eligible item cannot be returned within 90 days of purchase, the insurer will take the item off the cardholder’s hands for a maximum of S$800

- Purchase protection: If an eligible item is stolen or damaged within 90 days of purchase, the insurer will replace or repair it for up to S$10,000

The full T&Cs of this policy can be found here.

Summary Review: AMEX Platinum Credit Card

|

|

| Apply | |

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

The AMEX Platinum Credit Card has a value proposition that’s hard to beat.

The welcome gift alone already offsets 75% of the first year’s annual fee, and with the S$200 Lifestyle credit, you’re already coming out ahead. The Love Dining and Chillax benefits are just the icing on the cake, and can easily save you hundreds of dollars a year.

In fact, with the AMEX Platinum Charge cutting benefits left and right, I’m already planning to downgrade to the AMEX Platinum Credit Card later this year. This allows me to keep enjoying Love Dining and Chillax benefits, while saving significantly on annual fees.

The main weakness of this card are its mediocre earn rates (outside of 10Xcelerator merchants), but no one’s forcing you to use it for day-to-day spending!

So that’s my review of the AMEX Platinum Credit Card. What do you think?

I’ve always found this card useful as it’s really the only option you have at THG for solid earn rates outside of sign on bonuses. They really could be doing better with Love Dining merchants though, the programme is perhaps just 2 or 3 more departures from being shite.

I only have this card in hope they’ll give me upgrade to plat charge

I have this card for the sole reason of Love Dining offer with free 1st year subscription.

Not exactly free with POEMS T&C for the promotion.

POEMS Account Holders will need to purchase a total transaction value of SGD 1.25 million in wholesale bonds or 5 transactions in multiples of SGD 250,000 in nominal value of the traded wholesale bond through a single POEMS Account to enjoy the Annual Fee rebate of SGD1,600 (exclusive of GST).

Do note that you would have to pay for the annual fee first (SGD 1,712 inclusive of GST) and Phillip Securities Pte Ltd (PSPL) will rebate SGD 1,600 (exclusive of GST) to your POEMS Account once the criteria are met.

This refers to the Amex platinum charge. This article is on the Amex platinum credit card

I see, thanks for the clarification!

Hi, has anybody used the Hotel Room upgrade vouchers before? They don’t specify how much of an upgrade we get from it, so I’m curious if it bumps up our room class by 1 or if they’re generous enough to go all the way.

Thanks!

Will the Comoclub C4 benefits become useless if you already hold the Amex Platinum Charge Card (which gives you C5 benefits)? I assume one cannot double dip?

you can’t have more than one comoclub membership, so yes it’s duplicative

Is it possible to create 2 accounts if I have 2 emails, 2 phone numbers? I already hold the plat charge which gives me c5 :+

If I own the amex krisflyer card but never had an amex platinum card, do I classify as a new or existing member?

I’m holding this card for the sole reason of it ensuring that I don’t need to pay the AF on my other AMEX cards. And no, I don’t pay the AF on this card either.

Does the lifestyle credit registration really take the quoted 8-10 weeks to process?

Yes, it does. I called in and they verified that they need the time to validate that annual fee has been paid. At least for me, they couldn’t expedite the processing, so I’ve lost out on one cycle of the credit.

It would be helpful if Aaron could mention that in the post, i.e. try to get the card more than 3 months from the end of the half-year (i.e. Jan-Mar or Jun-Aug) so that you don’t run the risk of losing the benefit due to processing time.

My card was approved in end May, I was just told I can only have $200 lifestyle credits from Jun-Dec 2023 and Jan-July 2024. I asked what if my card was approved in April 2023 instead, and if that would mean it would be 3 cycles for me. The CSO said no. The 3rd $100 would only be credited after the annual fee is paid in April.

I was told the same by Amex CSO, that lifestyle credits are the same at $200 per year for all cardholders regardless when the card was approved. This is unlike what milelion has stated of 3 x $100 lifestyle credits.

all I’ll say to this is that CSOs can be wrong!

Hi Aaron,

I read in the internet that the conversion from MR to Krisflyer miles is 1:1. However, you wrote 450:250. Am i missing something? Thanks to clarify.

yes, you are certainly missing something.

Is this card metal or plastic?

Plastic lol

Good to also note that the sign-up bonus MR points is only credited in about 6-8 weeks from point of spend, i.e. if you’re signing up and spending within the first 30 days, you’ll get your MR points only in the 3rd billing cycle. That’s based on what the customer service just shared, since I didn’t see it credited after the 2nd statement.

Just want to add that for the lifestyle credit cycle it takes 4-8 weeks (initial registration at the site) and if you really want to expedite it, you will have to pay the annual fee before they will send the enrollment link. One tip would be try to change the billing cycle to as close to the current date as possible so that you can pay the annual fee as soon as possible. Another pitfall is that at least for me the annual fee payment seem to not show up in the 1st statement, and after checking with chat, they… Read more »

Does the free hotel stay credit in calender year or card renewal year?

So for 1st year, is it possible to double dip the free hotel stay? Thanks

The card used to be good but it’s a big waste of money now. ALL $1200 statement credits are worthless. I do not appreciate how every single benefit of this card is now fake. Airline Credit: The flights can nearly aways be purchased more cheaply with 3rd party sites/promos. No flights to Singapore are covered, so even though I took 30 flights in the last year, I did not even come close to meeting the minimum spend. Spa Credit: The listed SPAs already have promos that will allow you to enjoy lower prices anyway, and you can get very good… Read more »

Does the play card also have a free extra a/c card for the principal like the plat charge card?

As of 26 June 2025: There’s minimum spending of S$1,000 to received $200 and $150 for new/existing customers respectively and this article is posted on May 24, 2025 but is not stated; thus with this in mind, will you still recommend ? Isit still visible?