American Express has launched a new welcome offer for the American Express Singapore Airlines Business Credit Card (also known as the AMEX HighFlyer Card) that runs from now till 31 October 2024.

Cardholders who spend at least S$3,000 within the first three months of approval will receive 24,600 bonus HighFlyer points (plus a further 5,400 base HighFlyer points).

Unfortunately, even though the minimum spend has been cut by 50% compared to the previous offer, the bonus has been cut by 57%. This means your payoff ratio (miles divided by minimum spend) has come down, and it’s definitely one of the weaker offers in recent memory.

|

| Apply Here |

| 💳 Key Info: AMEX HighFlyer Card |

|

AMEX HighFlyer Card Sign-Up Bonus

|

| Apply Here |

| T&Cs |

| 👍 No minimum business size required |

|

While the AMEX HighFlyer Card is meant for businesses, there’s no minimum turnover or number of employees required to apply. If you’re running a home business, giving tuition or engaged in some other side hustle, setting up a sole proprietorship or LLC would qualify you to apply. Do note that you must be earning at least S$30,000 per annum to qualify for a card, as per MAS regulations. This need not come from the business itself; for example, I could earn S$30,000 from my day job with Company A, and have a separate side hustle with my own Company B. I can then apply for a HighFlyer Card by virtue of Company B, using Company A’s payslips. |

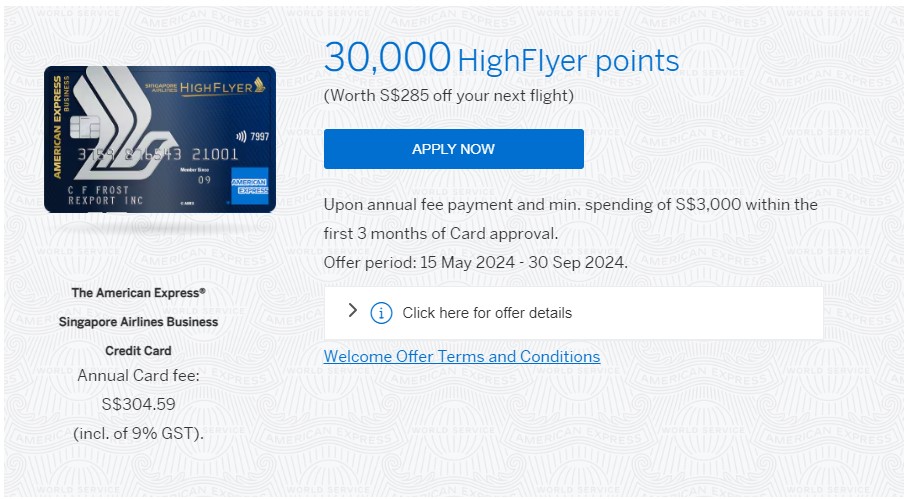

New AMEX HighFlyer Cardholders who apply between 15 May to 31 October 2024 (with approval by 30 November 2024) will receive 24,600 bonus HighFlyer points when they spend S$3,000 within the first 90 calendar days of approval.

This bonus is on top of the regular earn rate of 1.8 HighFlyer points per S$1, so you’ll receive a total of 30,000 HighFlyer points.

As usual, the S$304.59 annual fee must be paid, and there is no requirement that you be new-to-AMEX; the offer applies even if you hold an existing AMEX consumer card. Applicants who have cancelled the AMEX HighFlyer Card previously for the same company are not eligible.

What counts towards eligible spending?

All online and offline retail transactions will count towards the minimum qualifying spend for the welcome offer, with the exclusion of the following:

| ❌ AMEX HighFlyer Card Exclusions |

|

Note in particular that insurance premiums, SPC transactions, GrabPay top-ups, utilities and public hospitals no longer earn points, nor count towards the qualifying spend for sign-up bonuses.

Unfortunately, the AMEX HighFlyer Card no longer works with CardUp, so you won’t be able to use CardUp to meet the minimum spend.

When will the welcome gift be received?

All bonus HighFlyer points will be credited approximately 10 weeks from the date they meet the qualifying spend and pay the annual fee.

How does this offer compare to the previous?

For the sake of comparison, here’s how the current offer compares to the previous one which ended on 14 May 2024.

| 🎁 Welcome Gift: HighFlyer Points | ||

| Previous Offer (Till 14 May 24) |

Current Offer (From 15 May 24) |

|

| Mo. 1-3 | S$6K | S$3K |

| Total Bonus | 57.2K pts | 24.6K pts |

The current offer reduces the minimum spend by 50% (S$6,000 to S$3,000), but the bonus points are cut by 57% (57,200 to 24,600 points). This makes it a relatively weaker offer than before, and if you don’t need the card now, I’d highly recommend waiting for a better offer to come along.

Terms and Conditions

The T&Cs for this offer can be found below. As always, I recommend saving a copy for your personal reference because the links may be subsequently updated for future campaigns.

Overview: AMEX HighFlyer Card

|

|||

| Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$304.59 |

Min. Transfer | N/A |

| FCY Fee | 3.25% | Transfer Fee | None |

| Local Earn | 1.8 mpd | Points Pool? | N/A |

| FCY Earn | 1.8 mpd | Lounge Access? | Yes |

| Special Earn | Up to 8.5 mpd on SIA tickets | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

AMEX HighFlyer Cardmembers earn 1.8 HighFlyer points per S$1 on all local and overseas transactions, and up to 8.5 HighFlyer points per S$1 on Singapore Airlines and Scoot revenue tickets.

This consists of 2.5 HighFlyer points per S$1 from the AMEX HighFlyer Card itself, and a further 6 HighFlyer points per S$1 broken down into:

- The usual 5 HighFlyer points per S$1 awarded to all HighFlyer members

- A bonus 1 HighFlyer point per S$1 awarded to HighFlyer members with the AMEX HighFlyer Card

Note that these 6 HighFlyer points per S$1 are not awarded on tickets issued in the V or K booking classes (Economy Lite). Tickets issued in the Q or N booking classes (Economy Value) will only be eligible for 50% accrual of HighFlyer points. HighFlyer points are not earned on award redemptions, so if you’re using the AMEX HighFlyer Card to pay for taxes and surcharges on award tickets, you’ll earn just 2.5 mpd.

| ✈️ What is HighFlyer? |

|

HighFlyer is Singapore Airlines’ loyalty program for SMEs. The program is free to join and does not require any minimum spend commitment; all you need to sign up is an ACRA business registration number. Companies can redeem HighFlyer points at a rate of 1,050 HighFlyer points= S$10, or convert them to KrisFlyer miles for nominated employees at a rate of 1 HighFlyer point= 1 KrisFlyer mile. HighFlyer points are valid for 3 years. |

In July 2024, Singapore Airlines lifted many of the restrictions on converting HighFlyer points to miles:

- Each HighFlyer account can now be linked any number of KrisFlyer accounts (though if you wish to add more than 15, you need to contact customer service)

- Each selected KrisFlyer account may receive a maximum of 100,000 KrisFlyer miles converted from HighFlyer points per calendar year, regardless of which HighFlyer accounts the points are converted from

- There is no more overall cap on how many KrisFlyer miles can be converted from HighFlyer points

Purchases of Singapore Airlines tickets will enjoy 0% interest for six months, and other purchases get up to 51 days of interest-free credit. Employees who purchase tickets with the card will still be entitled to accrue miles for personal use, based on the fare class purchased.

In terms of personal benefits, cardholders enjoy:

- Two complimentary visits to Priority Pass lounges per year

- A complimentary Accor Plus Explorer membership, which includes one free stay every year and up to 50% off dining

- Hertz Gold status with 10% off best available rates and one class upgrades

- A fast track to KrisFlyer Elite Gold status with S$15,000 or more spent on Singapore Airlines, Scoot or KrisShop transactions in the first year of card membership

- Complimentary travel insurance when travel tickets are bought with the card

AMEX HighFlyer Card members will also enjoy the following spending bonuses:

- First year only: 5,000 HighFlyer points for S$500 spent on Singapore Airlines, Scoot or KrisShop transactions

- Every year: 15,000 HighFlyer points for S$10,000 spent on Singapore Airlines, Scoot or KrisShop transactions

Complimentary Accor Plus Membership

One of the highlights of the AMEX HighFlyer Card is the free Accor Plus Explorer membership, which includes one complimentary hotel night each year at participating hotels in Singapore and across Asia Pacific.

Members also get access to the periodic Red Hot Rooms sale, which can be a good opportunity to book cheap staycation or overseas hotel rates.

The other big draw of an Accor Plus membership are the dining discounts. The discount structure works like this:

- 25% off dining: 1 member only

- 50% off dining: 1 member and 1 guest

- 33% off dining: 1 member and 2 guests

- 25% off dining: 1 member and 3 guests

- 15% off drinks in Asia

Some examples of participating Accor Plus restaurants in Singapore include Prego, Mikuni and Asian Market Cafe at the Fairmont, SKAI, The Stamford Brasserie, CLOVE, at Swissotel and The Cliff and Kwee Zeen at the Sofitel Sentosa Resort.

For those who have already received their AMEX HighFlyer Card, here’s how to go about activating your Accor Plus membership.

What can you do with HighFlyer points?

In addition to KrisFlyer miles redemptions, HighFlyer points can also be used for the following options.

| Item | Cost |

12-month KrisFlyer Elite Gold membership 12-month KrisFlyer Elite Gold membership |

125,000 points |

LoungeKey pass LoungeKey pass |

8,000 points |

S$50 KrisShop voucher S$50 KrisShop voucher |

6,250 points |

S$10 off SIA tickets or S$10 Scoot voucher S$10 off SIA tickets or S$10 Scoot voucher |

1,050 points |

| Award chart | |

SIA Academy courses SIA Academy courses |

Not stated |

You can read the full details about each redemption option below.

Conclusion

The AMEX HighFlyer Card’s latest welcome offer awards 24,600 bonus HighFlyer points with a minimum spend of S$3,000, but it’s a comparatively weaker offer than the one we saw previously. If you’re able to wait, I think it’s worth seeing if a more competitive offer comes along in the future.

If you’re new to the HighFlyer card, be sure to check out my repository of articles covering how to make the most of your membership.

https://www.americanexpress.com/en-sg/business/business-card/sia-campaign/?sourcecode=A0000HEUUX&cpid=100540079

This is a better offer that ends on 29th May.

thanks for flagging- will make a note in the post.

https://www.americanexpress.com/content/dam/amex/en-sg/business/small-business/singapore-airlines-business-credit-card/campaign-tncs/SBS_Card_Singapore_Airlines_Exclusive_Campaign_TnCs.pdf

Better offer than ends 31 Jul (extra 10k pts with $500 spend in first month)