Dining out is probably one of the biggest spending categories for many Singaporeans — and fortunately, there’s no shortage of credit cards offering bonus miles for restaurants and eateries.

For the purposes of this post, I’m going to assume that you’re dining at a restaurant in Singapore. If you’re dining overseas, refer to my post on the best cards for overseas spending instead. I also have a separate article for the best cards for food delivery.

What MCC does dining code as?

Restaurants and eateries can code under any of the following MCCs:

| 🍽️ Dining-related MCCs |

||

| MCC | Description | Examples |

| 5811 | Caterers | Eatz, Neo Garden, Stamford Catering |

| 5812 | Restaurants | Crystal Jade, Jumbo Seafood, Paradise Group |

| 5813 | Bars & Nightclubs | Brewerkz, Brotzeit, Harry’s |

| 5814 | Fast Food | Burger King, McDonald’s, KFC |

| 5441 | Candy, Nut, Confectionery Stores | Candy Empire, See’s Candies, TWG |

| 5462 | Bakeries | BreadTalk, Bengawan Solo, Four Leaves |

| 5499 | Misc. Food Stores | Crave, Famous Amos, Grain |

That’s quite a wide range, and it’s not always straightforward. For example, will eating in a hotel restaurant code as a hotel, or a restaurant?

Fortunately, it’s possible to check the MCC before spending through any of the methods below.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

The exact MCC only matters if you’re paying with a card that uses a whitelist policy. If you’re using a card with a blacklist policy, things are much simpler.

| ❓ Whitelist vs Blacklist Policy |

To learn more about the differences between the two, refer to this post. |

In the next section, I’ll cover both whitelist and blacklist options for dining.

What cards should I use for dining?

The best card to use for dining depends on whether you’re making payment in-store at a terminal, or whether the restaurant employs QR code ordering and payment (which is basically an online spending situation).

Payment in-store

| 🍽️ Best Cards for Dining (Payment In-store) |

||

| Card | Earn Rate | Remarks |

Amaze x Citi Rewards Card Amaze x Citi Rewards CardApply |

4 mpd |

Max $1K per s. month. SGD transactions incur a 1% fee Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month* Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd | Min. S$500, max S$1K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd |

Max S$1K per c. month. Must choose Dining as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max S$750 per c. month. Must choose Dining as bonus category Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd |

Max S$600 per c. month. Must use mobile contactless Review |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd |

Min S$1K, max S$1.2K in SGD per s. month. Must use contactless Review |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

2.4 mpd |

No cap. Min S$1K spend on SIA Group in m. year Review |

| C. Month= Calendar Month | S. Month= Statement Month | M. Year= Membership Year *From 1 March 2026, the bonus cap will be reduced to S$1,000 per calendar month, and bonuses removed for in-person spend |

||

For in-store payments at restaurants, the simplest solutions would be to use blacklist cards like the UOB Preferred Platinum Visa, UOB Visa Signature or Amaze +Citi Rewards Card, all of which would earn 4 mpd.

However, given how flexible these bonus caps are, it might be a better idea to conserve them for other transactions, and instead use cards which whitelist the dining category.

In that case, 4 mpd options include the Maybank XL Rewards and HSBC Revolution, or the UOB Lady’s Card and UOB Lady’s Solitaire, provided you choose Dining as the quarterly bonus category. This can be further buffed with an extra 2-6 mpd from the UOB Lady’s Savings Account.

If you’re a very big spender, you might consider the KrisFlyer UOB Credit Card, which offers an uncapped 2.4 mpd provided cardholders spend at least S$1,000 on Singapore Airlines, Scoot or KrisShop in a membership year.

Payment via QR code

| 🍽️ Best Cards for Dining (Payment via QR code) |

||

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd |

Max $1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd |

Max $1K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month* Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd | Min. S$500, max S$1K per c. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd |

Max S$1K per c. month. Must choose Dining as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max S$750 per c. month. Must choose Dining as bonus category Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd |

Max S$600 per c. month Review |

StanChart Journey Card StanChart Journey CardApply |

3 mpd |

Max S$1K per s. month. SGD only Review |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

2.4 mpd |

No cap. Min S$1K spend on SIA Group in m. year Review |

| C. Month= Calendar Month | S. Month= Statement Month | M. Year= Membership Year *From 1 March 2026, the bonus cap will be reduced to S$1,000 per calendar month, and bonuses removed for in-person spend |

||

Many restaurants now use QR-code menus, and some require customers to pay via their phones before submitting orders.

This is conceptually similar to food delivery, and the main difference for blacklist cards is that you can’t use the UOB Visa Signature anymore, as it does not offer bonuses for online spend (unless that spending is in FCY, in which case the FCY bonus kicks in).

Instead, you can use the DBS Woman’s World Card, which earns 4 mpd on all online transactions capped at S$1,000 per calendar month. Also, there’s no need to pair the Citi Rewards Card with Amaze, because the transaction is already online.

For whitelist cards, the rest of the options are largely similar, though there’s now an additional option in the form of the StanChart Journey Card, which earns 3 mpd on local online dining capped at S$1,000 per statement month.

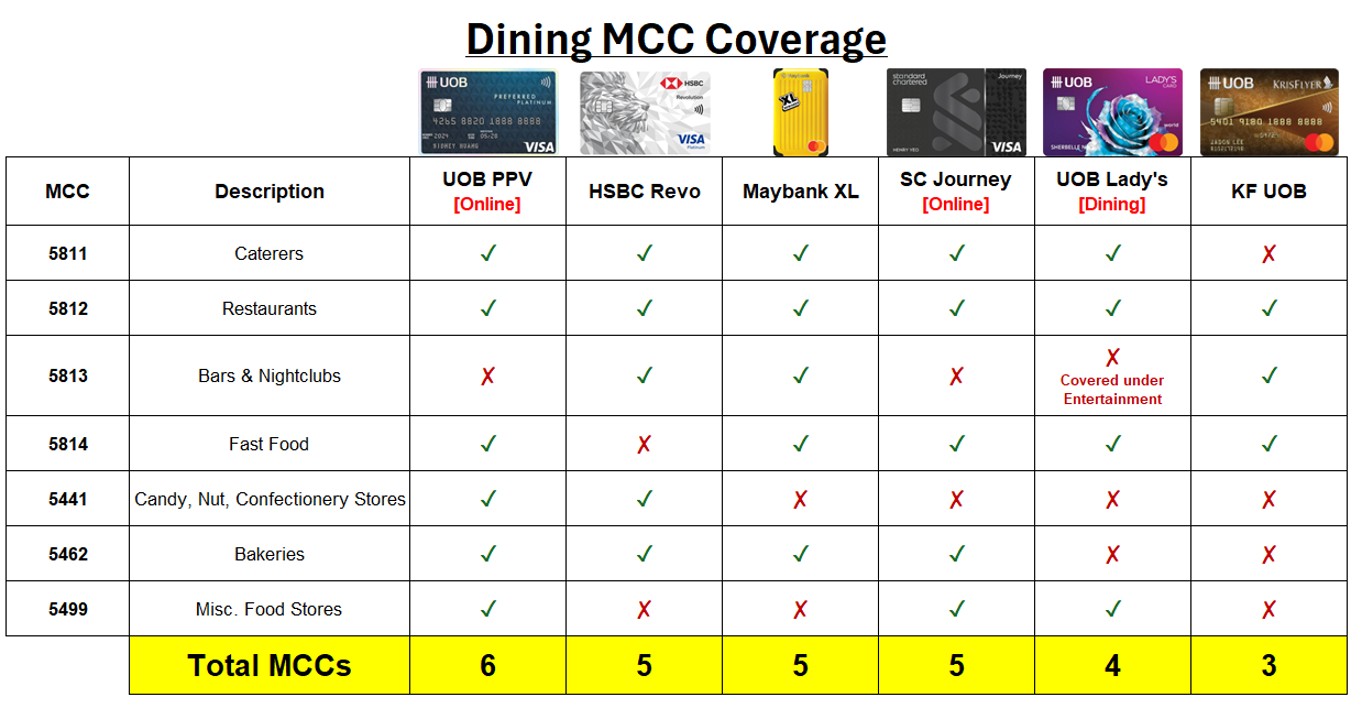

What about MCC coverage?

If you’re using a whitelist card, it’s crucial to check how dining is defined, because different cards cover different MCCs.

For example, the HSBC Revolution does not cover MCC 5814, which is a major omission and a potential gotcha. Even if you don’t care for Burger King, KFC or other junk food, 5814 can be used by non-fast food places like Cafe Nesuto and Baker & Cook. It’s also used by food delivery platforms like Grab and Deliveroo, so be careful!

One more thing: isn’t the UOB Preferred Platinum Visa a blacklist card? It is- if you’re paying offline.

If you’re using the UOB Preferred Platinum Visa for offline, in-person payments, the MCC does not matter. So long as it’s a mobile contactless payment (and assuming, of course, that the MCC is not on the general exclusions list), you’ll earn 4 mpd.

If you’re using the UOB Preferred Platinum Visa for online payments, such as QR code ordering, the MCC does matter, and only whitelisted MCCs will earn 4 mpd.

What if I want to pay with Kris+?

|

| S$5 for new Kris+ Users |

| Get S$5 when you sign-up with code W644363 and make your first transaction |

Kris+ is a great way of racking up additional miles on dining, on top of what you earn from your credit cards. There’s a few hundred dining partners offering an extra 1-9 mpd, and it doesn’t cost you anything extra to use.

In general, Kris+ preserves the MCC of the merchant, so if you’re at a restaurant, you should use the same card you’d otherwise use for dining.

For a guide to the best cards to pair with Kris+, refer to the article below.

Other options for dining

Here are two more cards that are worth a mention when we talk about dining, though I decided not to feature them in the tables above because their appeal is rather niche.

StanChart Beyond Card

The StanChart Beyond Card offers cardholders an uncapped 8 mpd on overseas dining, with no minimum spend necessary.

This sounds incredible, but the catch is that it’s for Priority Private customers only. This requires you to have a minimum AUM of S$1.5M with the bank, so safe to say it won’t be for everyone.

Dining is defined as MCCs 5811, 5812, 5813 and 5814.

StanChart Smart Card

The StanChart Smart Card offers cardholders up to 9.28 mpd on fast food, streaming, public transport and EV charging.

| Card Spend (per statement month) |

Bonus Categories | Non-Bonus Categories |

| Less than S$800 |

1.6 pts/S$1 0.5% 0.46 mpd |

1.6 pts/S$1 0.5% 0.46 mpd |

| S$800 to S$1,499 | 25.6 pts/S$1 8% 7.42 mpd |

1.6 pts/S$1 0.5% 0.46 mpd |

| S$1,500 or more | 32 pts/S$1 10% 9.28 mpd |

3.2 pts/S$1 1% 0.93 mpd |

Fast food is not defined by MCC, but rather covers the following specific chains:

- Burger King

- Domino’s Pizza

- KFC

- McDonald’s

- Pizza Hut

- Starbucks

- Subway

- The Coffee Bean & Tea Leaf

- Toast Box

- Ya Kun Kaya Toast

An uncapped 9.28 mpd would be amazing, but that minimum spend is going to be an issue. Unless you can somehow spend at least S$1,500 in a month on fast food, streaming, public transport and EV charging, you’ll have to make up the difference with non-bonus spend that is rewarded at a much lower rate.

A lower tier of 7.42 mpd is available with a minimum spend of S$800, but even that is a significant amount of spending to hit on bonus categories alone. If you’re eating that much junk food, you might want to get a credit card that offers bonuses on hospital bills too!

Other ways of saving on dining

While this article is meant to focus on miles earning, here’s a quick reminder that there are credit cards which offer special dining privileges that can take a bite out of the bill:

- AMEX Platinum Charge, Platinum Reserve and Platinum Credit Card members have access to the Love Dining programme, which offers up to 50% off food at selected hotels and restaurants

- AMEX HighFlyer Card, DBS Vantage Card and StanChart Beyond Card (Priority Private only) members get a complimentary ALL Accor+ Explorer membership, which offers up to 30% off food at participating hotels

- All HSBC Card members get a complimentary copy of The Entertainer with HSBC, which has numerous 1-for-1 dining offers

Alternatively, $120K cards like the Citi Prestige and OCBC VOYAGE sometimes offer special discounted dining experiences. These are very popular and are usually booked up within minutes, so you’ll need a bit of luck to get them.

Conclusion

Dining out is one category that banks are happy to reward, as seen from the wide variety of cards offering bonuses.

If you’re using a whitelist card to pay, however, you’ll want to be careful about MCC because each bank defines dining differently. The simplest approach is to use a blacklist card, but it might be better to save those bonus caps for other categories of spending instead.

Most restaurants now allow ordering via a QR code and may also integrate the payment into the ordering process. In this case, this would count as online transaction and would be suitable for cards such as DBS Women’s World Mastercard.

Not necessarily. From personal experience, I have seen Dining MCCs such as 5814 being assigned for such QR payment. But yes, using MCC agnostic cards like DBS WWMC would be safer

I think you missed out HSBC Premier Mastercard which is 5%+1% and with a very high cap?

How long does it take for the UOB Lady’s Solitaire to be approved? Applied a week+ back and still pending approval. Sent a query email to UOB but no response.

Thanks

are bubble tea stores generally under Misc. Food Stores?