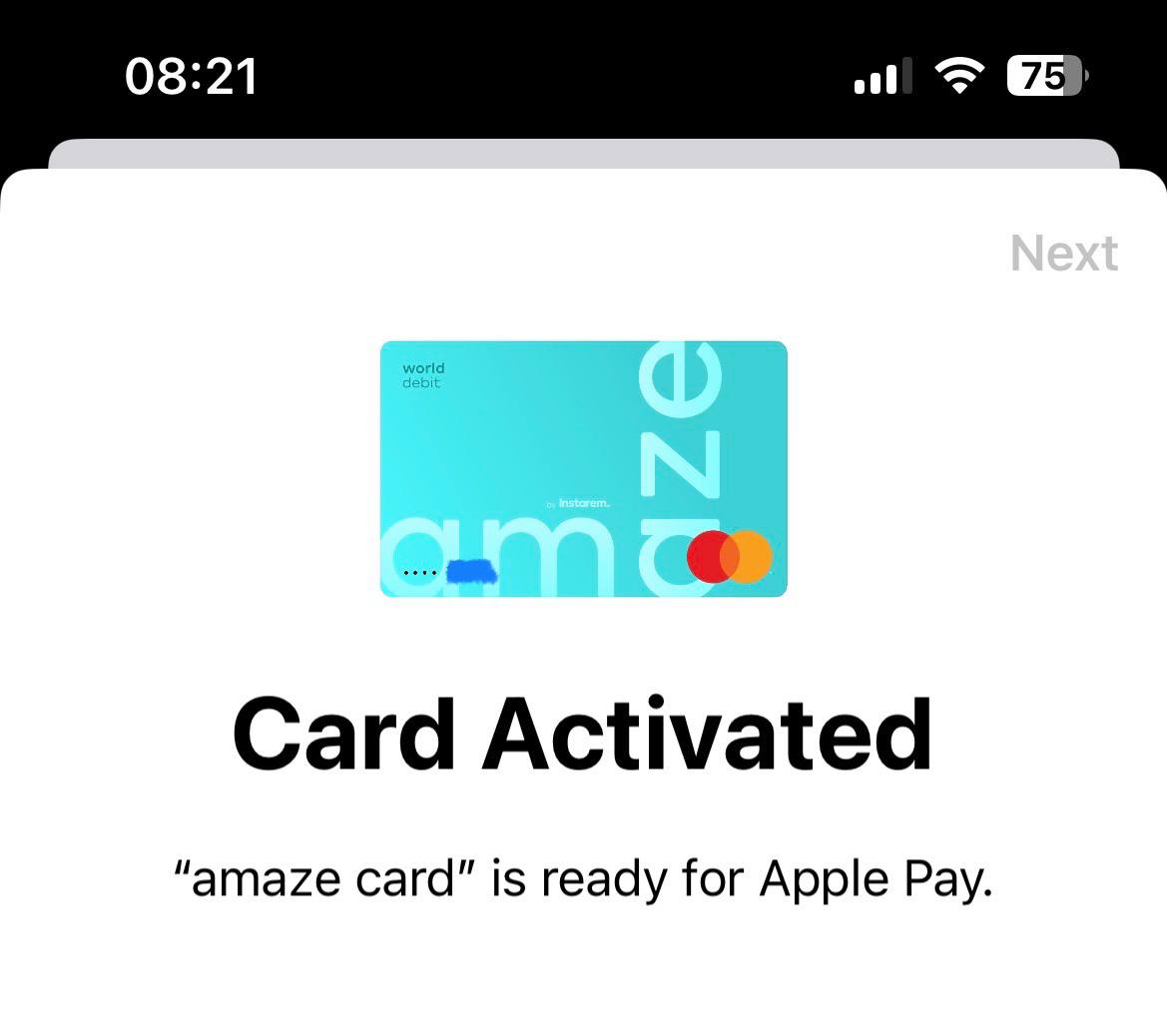

While Amaze Cardholders have been able to use their cards with Google Pay since November 2021, Apple Pay users have had to be a lot more patient. Aside from a brief moment of excitement in July 2023 when support was added for a day (which turned out to be a badly-sandboxed test), it’s been all quiet on the iOS front.

But last week, Amaze started dropping hints that this would soon change, and as of this morning Amaze Cards can now be added to Apple Pay. This brings added convenience and opens workarounds for miles collectors.

Amaze adds support for Apple Pay

Amaze users can now add their cards to their Apple Pay wallet and use it to make payments with an iPhone or Apple Watch app.

The most obvious benefit is having one less card to carry in your pocket, but it goes far beyond that.

Digitisation opens up the possibility of your card being in two places at the same time. For example, sometimes when I’m travelling with The MileLioness, I have to pass her my physical Amaze Card so she can make a purchase (yes, she never got around to getting one for herself.). Now, I can simply digitise it onto her wallet and keep the card with me.

On top of this, there’s two more benefits I can think of.

No more waiting for a physical Amaze Card

If you haven’t received your physical Amaze Card yet, or have lost your card and need a replacement, Apple Pay support allows you to continue making payments at brick-and-mortar merchants where contactless payments are allowed.

All you need to do is add the virtual Amaze Card to your Apple Pay wallet, then tap your phone to pay.

Kris+ workaround

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

Kris+ requires users to pay via Apple or Google Pay, and even though the transaction codes as online, Citi Rewards Cardholders won’t earn 4 mpd because of Citi’s exclusion of in-app mobile payments.

However, a simple workaround is to pair the Citi Rewards Card with Amaze, then use your Amaze Card with Apple or Google Pay. This then allows you to earn 4 mpd on your spending, capped at S$1,000 per statement month

I’ve used Kris+ as an example, but the same benefit applies for any app which insists on customers using Apple or Google Pay for checkout. Too bad XNAP isn’t alive to see this!

Conclusion

|

||

| Apply here | ||

| Full Review | ||

| Use code 7HK2A2 for 225 bonus InstaPoints | ||

| 💳 tl;dr: Amaze Card | ||

|

Amaze has finally added support for Apple Pay, which is good news for anyone who didn’t have the common sense to just switch to Android years ago.

Not only will you be able to use the Amaze for in-store transactions before the physical card shows up in the mail, you’ll also be able to circumvent the Citi Rewards Card’s restrictions on in-app mobile payments.

Any other use cases for Amaze on Apple Pay?

just in time for the holiday season!

Great news!

On a side note, as you mention XNAP. I emailed their team a month ago to enquire about the existence of XNAP. Here’s an excerpt of their reply “The app has been temporarily suspended and removed from various app stores due to the completion of our Proof of Concept (POC) phase. We are pleased to announce that during the 12-month POC period, we observed substantial growth in XNAP app usage, highlighting strong interest in our platform. Our team is now working on further enhancements, and we will be relaunching the app later this year in collaboration with our partners, featuring… Read more »

Im hopeful but im not holding my breath.

They know that this is something people want but I don’t think they will continue to keep footing the cost of credit card transaction fees.

Maybe they are not footing the cc fees; instead, the merchants are?

thanks for that update. i wouldn’t bet on it happening but well…

great news

Thank you for this great piece of news Aaron.

Hi, I made a transaction via Amaze which the vendor reversed as it’s the wrong amount and vendor charged again. But Amaze insisted that once the first transaction is charged, it will eat into the limit for the insta points. So although the insta points were reversed when the transaction was reversed, I did not earned any insta points when the vendor charged the correct price. I wouldnt have charge the second time with my Amaze card if I know this kind of practice. Thought to share since it’s not commonly known.

Anyone having problems with amaze card on Apple pay? Was working at the start but past few days my payments have been getting declined. Tapping physical card seems to be working fine. Anyone has the same experience?

im having the same issue. did u manage to fix it?