OCBC 90°N, OCBC Premier Visa Infinite and OCBC VOYAGE Cardholders may have received invitations from the bank for a so-called “annual service fee option”, which allows them to top-up their annual fee in exchange for extra miles.

This isn’t exactly a new feature; it’s been around for quite a while. I’ve simply never bothered to write about it because it seemed so obvious to me that it was a bad deal.

But based on the volume of emails I get, it’s apparently not so obvious to other people, and so for the sake of this group, let’s take a closer look at this option.

OCBC annual service fee option

The annual service fee options for OCBC 90°N, OCBC Premier Visa Infinite and OCBC VOYAGE Cardholders differ between cards, but some rules remain constant:

- Only principal cardholders can opt to take advantage of the annual fee option

- The service fee upgrade is on top of the card’s usual annual fee. You will still receive the regular 10,000 miles (OCBC 90°N) or 15,000 miles (OCBC VOYAGE) for paying the usual annual fee

- Miles from the annual fee option will be credited within 13-15 working days (OCBC Premier Visa Infinite, OCBC VOYAGE) or 14 working days (OCBC 90N Card)

- No refunds of any fee upgrades will be entertained

OCBC 90°N Card

OCBC 90°N Card OCBC 90°N CardT&Cs |

||

| Upgrade Fee | Miles | Cost Per Mile |

| S$545 | 22,000 90°N Miles | 2.48¢ |

OCBC 90°N Cardholders (both Mastercard and Visa) who pay the upgrade fee of S$545 will receive an extra 22,000 miles (awarded in the form of 90°N Miles).

This works out to 2.48 cents per mile.

OCBC VOYAGE & Premier Visa Infinite

OCBC VOYAGE (all versions) OCBC VOYAGE (all versions)  OCBC Premier Visa Infinite OCBC Premier Visa InfiniteT&Cs |

||

| Upgrade Fee | Miles | Cost Per Mile |

| S$3,270 | 150,000 VOYAGE Miles 375,000 OCBC$ |

2.18¢ |

| S$10,200 | 500,000 VOYAGE Miles 1,250,000 OCBC$ |

2.04¢ |

OCBC VOYAGE (all versions) and OCBC Premier Visa Infinite Cardholders can pay an upgrade fee of S$3,270 for an extra 150,000 miles (awarded in the form of 150,000 VOYAGE Miles or 375,000 OCBC$). This works out to 2.18 cents per mile.

Alternatively, they can pay an upgrade fee of S$10,200 for an extra 500,000 miles (awarded in the form of 500,000 VOYAGE Miles or 1,250,000 OCBC$). This works out to 2.04 cents per mile.

| 💳 Limited-time bonus |

|

From 15 July to 31 August 2024, OCBC is upsizing the number of miles received for OCBC Premier Visa Infinite and OCBC VOYAGE Cardholders. The S$3,270 service fee will grant 155,000 VOYAGE Miles/387,500 OCBC$, while the S$10,200 service fee will grant 510,000 VOYAGE Miles/1,275,000 OCBC$, reducing the cost per mile to 2.11 cents and 2 cents respectively. The bonus will be automatically granted to any cardholder who opts to exercise the annual service fee upgrade option during this period. |

Is this a good deal?

In so many words, no.

Paying 2.04 to 2.48 cents per mile, in the market we’re in, is just way too much. If you need extra miles, you can buy them for so much less through bill payment platforms like CardUp, where you can pay rent, insurance premiums, income tax, condo MCST fees, school fees and more with your credit card in exchange for an admin fee.

|

| Save S$30 off your first-ever CardUp transaction with code MILELION, no minimum spend required. This code is valid for Visa and Mastercard payments only |

The exact cost per mile depends on which credit card you have and what promotions are currently ongoing, but I guarantee you the figure will be lower than what OCBC is asking for.

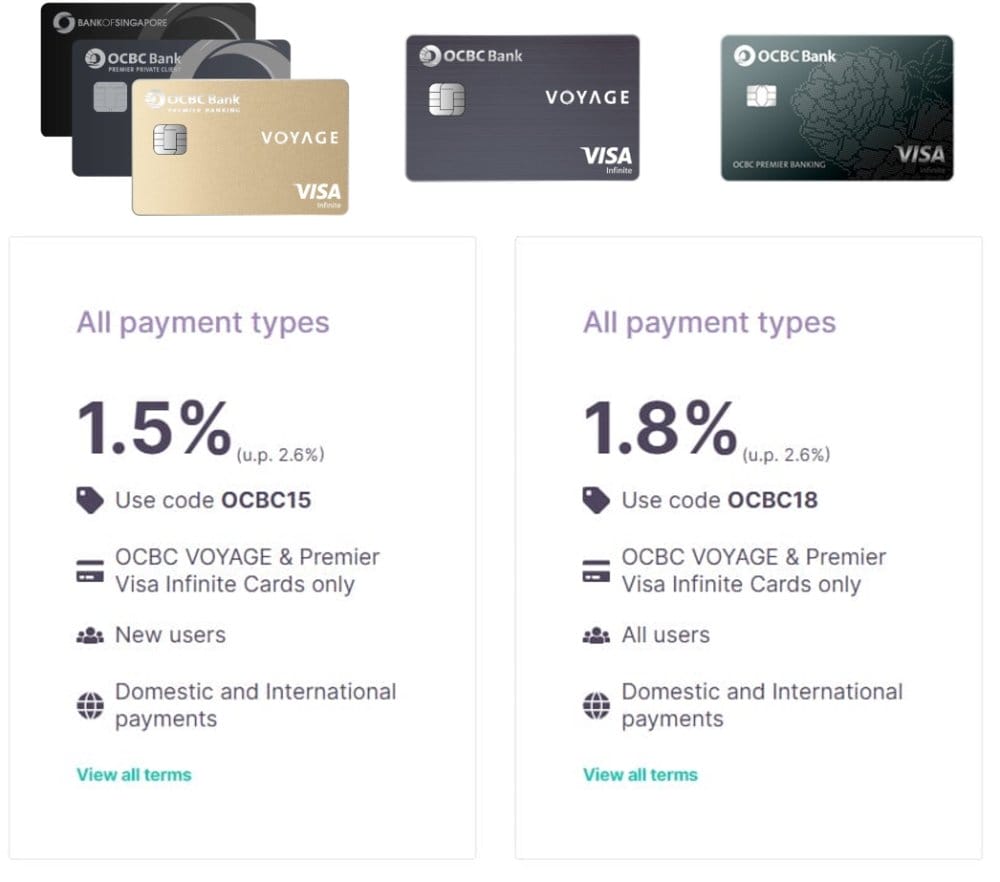

For example, CardUp is now offering OCBC Premier Visa Infinite and VOYAGE Cardholders an admin fee of 1.5% (new customers) or 1.8% (existing customers)

- With a 1.5% fee, your cost per mile ranges from 0.92 to 1.15 cents

- With a 1.8% fee, your cost per mile ranges from 1.11 to 1.38 cents

Either way, it’s much cheaper than the annual service fee option, and keep in mind the 1.8% admin fee can be used as many times as you wish up till 31 December 2024.

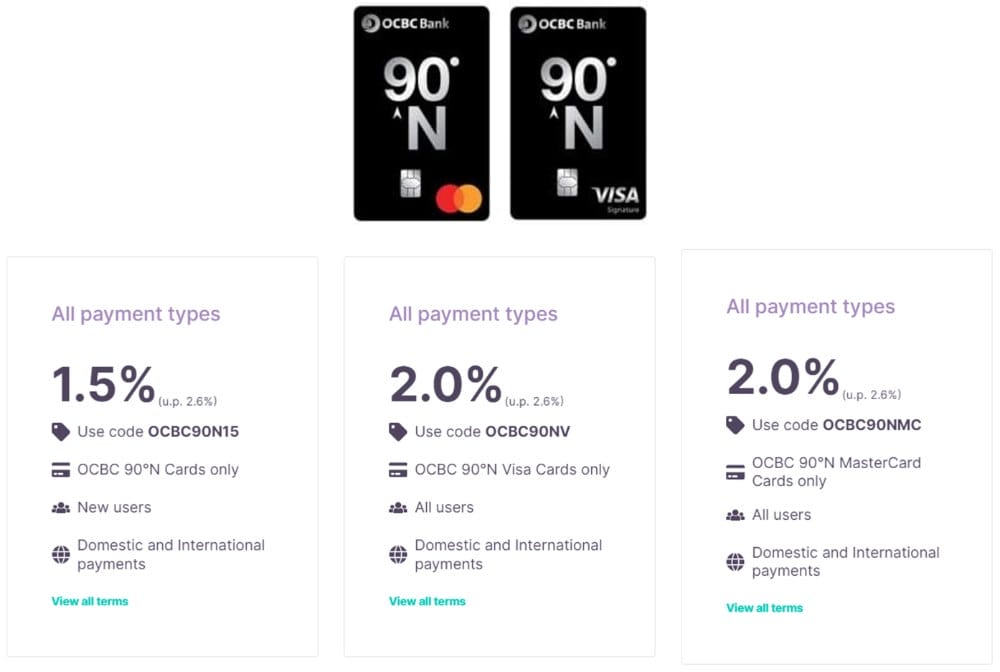

Likewise, if you’re an OCBC 90°N Cardholder, you have the option of an admin fee of 1.5% (new customers) or 2% (existing customers)

- With a 1.5% fee, your cost per mile is 1.14 cents

- With a 2% fee, your cost per mile ranges is 1.51 cents

The miles will be credited as soon as your CardUp transaction posts.

Extended: Discounted CardUp fees for OCBC cardholders starting from 1.5%

Besides, CardUp isn’t the only game in town. There are other bill payment platforms you can consider too, as summarised in the table below.

| Platform | Admin Fee Earn Rate |

CPM |

| 2.5% 1-1.6 mpd |

1.52-2.44¢ | |

| 1.5-2.6% 1-1.6 mpd |

0.92-2.53¢ | |

| 2.6% 1.2-1.6 mpd^ |

1.63-2.17¢ | |

| 1.9-1.95% 1 mpd |

1.9-1.95¢ | |

|

1.9% 1-1.4 mpd |

1.36-1.90¢ |

| 1.7-2.2% 1 mpd |

1.70-2.20¢ | |

| *Not to be confused with AXS Pay Any Bill, which is not a reliable way of earning miles ^Upsized to 1.6-2 mpd till 31 July 2024, details here |

||

And even if you don’t have any bills to pay (lucky you), there exist “no questions asked” options like the UOB Payment Facility, which will sell you as many miles as you want from 1.7-2.2 cents onwards.

Assuming you’re in a position to get an OCBC VOYAGE Card, you should also be able to get a UOB Visa Infinite Metal Card, which lands you at a 2 cents per mile figure. That’s still not great, mind you, but it’s lower than what OCBC is asking for, and you can buy in the exact quantity you require.

For more options, refer to the article below.

In fact, you might not even need to pay out of pocket. There are many quick and instant ways of earning the extra miles you need to top-up your KrisFlyer account, such as shopping at a Kris+ merchant or buying something from KrisShop.

So it’s just very hard to see any scenario where you’d take the OCBC option, when KrisFlyer miles are available elsewhere for less.

But what about OCBC’s transfer partner variety?

Hold up, you say. Why are you only talking about KrisFlyer miles? Doesn’t OCBC have eight other airline and hotel transfer partners, and couldn’t some of those points be worth more?

| 👍 No more “forced conversions” |

| In the past, the annual service fee option would automatically transfer the credited points to KrisFlyer, but that policy appears to no longer exist. In other words, you can choose to send those points to a different loyalty programme, if you so wish. |

Yes, but here’s the problem: OCBC’s transfer ratios to non-KrisFlyer programmes are very poor. With the exception of AirFrance-KLM Flying Blue, every other airline programme has a haircut of 10-30% compared to the KrisFlyer ratio. The hotel programme rates are likewise poor value.

Transfer Partners Transfer Partners |

||

| 90°N Miles & VOYAGE Miles | OCBC$ | |

| 1:1 (VOYAGE) |

25,000 : 10,000 |

|

| 1,000 : 1,000 (90°N) | ||

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 750 | 10,000 : 2,900 | |

| 1,000 : 700 | 10,000 : 2,800 | |

| 1,000 : 500 | 10,000 : 2,000 | |

| All ratios expressed as OCBC points : partner miles/points |

||

So even if, for example, you considered 1 Asia Mile to be worth more than 1 KrisFlyer mile, OCBC’s transfer ratio means your cost per mile is effectively increased by 33%, resulting in a minimum cost per mile of 2.72 cents!

Therefore, OCBC’s transfer partner variety counts for very little here, simply because the transfer ratios are fundamentally unattractive.

Conclusion

While there’s certainly a case to be made for buying miles, there’s no case for buying them at the price that OCBC is asking for.

If you’re really in need of miles, you could buy them for much less through bill payment platforms, or earn them quickly through Kris+ merchants. Therefore, OCBC’s inflated prices are only for the truly lazy (or uninformed), and you should do yourself a favour and ignore these messages the next time they come round.

Thanks Aaron. What about keeping the miles as voyage miles which can then be used for revenue tickets? Is that a good deal?

that depends what value you get per voyage mile. last i heard it was 1.72 cents each. you do the math.

The math changes a bit if you are PPS/TPPS and would have flown Business / First anyway and award flights aren’t available or available only for 1-2 people in a 4 person itinerary. Admittedly a corner use case but it preserves optionality that cannot be just expressed in cpm terms. I wouldn’t do this every year but maybe consider it based on travel plans for the said year.

don’t understand what you mean here. are you saying that if you regularly fly J/F then your value per mile is naturally higher and you’d be willing to pay more? but even so wouldn’t you want the cheaper miles from bill payment options instead?

I suppose I wasn’t clear enough. For a family of 4, getting award flights isn’t always easy even with a miles balance that allows for it. For the last few trips I ended up buying 1 or 2 revenue fares anyway, which wasn’t too bad since it helped with the PPS qualification. Having a bank of voyage miles offers optionality since tickets are technically revenue ones from SQ’s perspective. One still has to check if outright payment on SQ ends up cheaper than the cpm via VM, especially after the devaluation. Earlier, this upgrade offer was for KFmiles not VM… Read more »

Thanks Aaron. The value of a VM is still 1.72 cents as i just checked on OCBC Travel.

And thanks Nobody. You hit the nail on the head. Especially on F when there is sometimes only one award seat and it would not bode well for marital harmony for the better half to fly J 🙂

You forgot to consider one key aspect: credit line. Yes, there are cheaper “cents per mile” options as you’ve pointed, but the biggest limiting factor to these options is the individual’s credit line and how much services you can tap on to “buy” miles. Even if you have a $60K credit line and have that much expenses to pay via Cardup etc in one go, the total miles that can possibly be earned is 72K miles @ your average 1.2 mpd. This is the biggest limiting factor for the man on the street credit card holder… only those in the… Read more »

But credit limit should not be a limiting factor (at least not for cardup, I know Citi payall has a hard cap of 95pc) since you can effectively prepay your account balance to increase the amount you can transact on. So it’s not really a restriction as such. and if you’re in a position to own an ocbc voyage card, then you earn at least $120k, which means there’s no regulatory limit on the credit limit that can be granted. we need to be careful not to conflate the 2 scenarios- the “man in the street” would not be in… Read more »

I think we can agree to disagree. Credit limit is a limiting factor in my view. Banks always have credit rules in place where lines are assigned at their discretion based on considerations such as one’s other borrowing obligations and unsecured line assignments (Singaporeans hold avg 5-6 cards across at least 2 issuers), and with that the probability of one drawing down on all unsecured lines and going bad. While most customers here would pay on time & in full, there is no telling when one could turn from transactor to revolver. After all, any spend on a credit card… Read more »